Decoding the Doji: A Complete Information to This Highly effective Chart Sample

Associated Articles: Decoding the Doji: A Complete Information to This Highly effective Chart Sample

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Doji: A Complete Information to This Highly effective Chart Sample. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the Doji: A Complete Information to This Highly effective Chart Sample

The world of technical evaluation is stuffed with a wealthy tapestry of chart patterns, every whispering potential insights into future value actions. Amongst these, the Doji candlestick sample stands out for its distinctive visible simplicity and infrequently profound implications. Whereas seemingly insignificant at first look, understanding the nuances of the Doji and its numerous varieties can considerably improve a dealer’s potential to anticipate market reversals and capitalize on worthwhile alternatives. This text delves deep into the world of Doji candlesticks, exploring their formation, interpretation, and sensible functions inside totally different buying and selling contexts.

Understanding the Doji’s Anatomy:

A Doji candlestick is characterised by its near-equal opening and shutting costs. Visually, this interprets to a candlestick with a small or virtually non-existent physique, usually capped by lengthy higher and decrease shadows (wicks). The minimal physique signifies indecision available in the market, a battle between patrons and sellers leading to a near-standoff. The size of the shadows gives additional clues concerning the depth of this wrestle.

Key Kinds of Doji Candlesticks:

Whereas the core attribute of a Doji – equal open and shut – stays constant, a number of variations exist, every carrying delicate but necessary distinctions of their interpretation:

-

Headstone Doji: This incorporates a lengthy higher shadow and a really quick or non-existent decrease shadow. It suggests sturdy promoting stress all through the buying and selling interval, with patrons unable to push the value considerably greater regardless of an preliminary try. This usually foreshadows a bearish reversal.

-

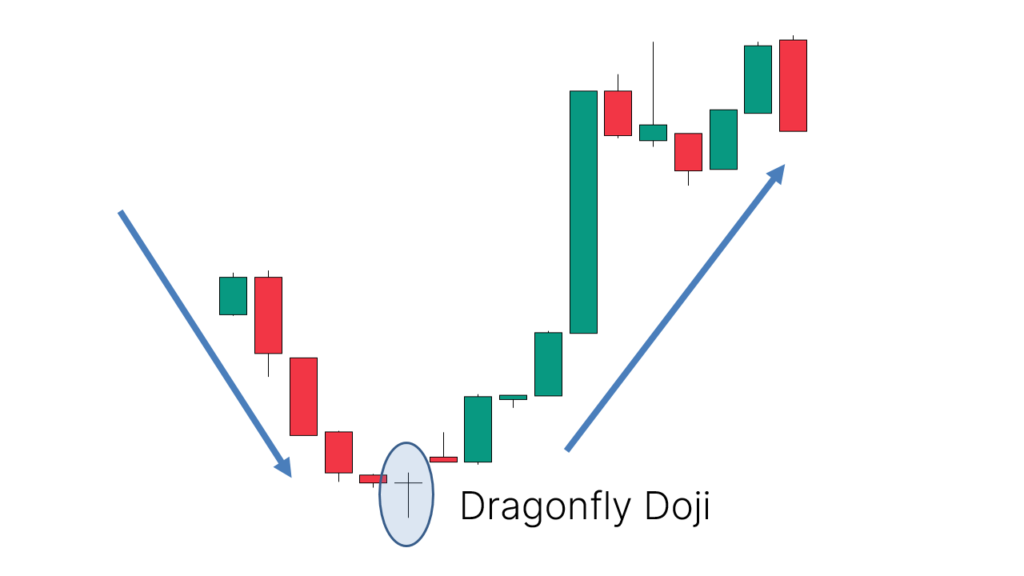

Dragonfly Doji: The inverse of the Headstone Doji, this sample exhibits a protracted decrease shadow and a really quick or no higher shadow. It signifies sturdy shopping for stress overcoming preliminary promoting, hinting at a possible bullish reversal.

-

Lengthy-Legged Doji: This Doji shows important higher and decrease shadows, indicating substantial value volatility and indecision. The lengthy shadows spotlight the extraordinary wrestle between patrons and sellers, with neither facet gaining a decisive benefit. This sample usually precedes a powerful transfer in both path, making it essential to think about the encircling context.

-

4-Value Doji: This can be a rarer variant the place the open, excessive, low, and shut costs are all equivalent. It represents excessive indecision and is usually a sturdy sign of an impending pattern reversal.

-

Impartial Doji: This can be a normal Doji with comparatively quick higher and decrease shadows. It signifies indecision however with out the sturdy directional stress instructed by the opposite variations. Its interpretation depends closely on the broader market context.

Deciphering Doji Candlesticks:

The importance of a Doji candle is never remoted. Its true which means emerges when thought of throughout the broader context of the value chart. A number of components affect its interpretation:

-

Pattern: A Doji showing on the high of an uptrend is commonly thought of a bearish sign, suggesting potential exhaustion of the bullish momentum. Conversely, a Doji on the backside of a downtrend might sign a bullish reversal.

-

Quantity: Low quantity accompanying a Doji weakens its significance. A high-volume Doji, nonetheless, amplifies its significance, suggesting a big shift in market sentiment.

-

Help and Resistance: A Doji shaped close to a key help or resistance degree carries higher weight. A Doji at help breaking beneath the help degree confirms a bearish reversal, whereas a Doji at resistance breaking above confirms a bullish reversal.

-

Affirmation: It is hardly ever advisable to solely depend on a single Doji candle for buying and selling selections. Affirmation from different technical indicators or candlestick patterns strengthens the sign. For instance, a bearish engulfing sample following a Headstone Doji reinforces the bearish outlook.

-

Timeframe: The timeframe of the chart additionally issues. A Doji on a day by day chart holds extra significance than one on a 5-minute chart.

Buying and selling Methods with Doji Candlesticks:

Doji patterns are beneficial instruments for figuring out potential reversal factors, however they need to be built-in right into a broader buying and selling technique. Listed here are some frequent approaches:

-

Reversal Buying and selling: Establish a Doji at a big excessive or low, coupled with different bearish or bullish alerts (like quantity modifications, shifting common crossovers, or RSI divergence). This is usually a setup for a brief or lengthy place, respectively.

-

Affirmation Buying and selling: Anticipate affirmation earlier than getting into a commerce. Search for a follow-through candle after the Doji that confirms the reversal. For instance, a bearish candle after a Doji at a excessive suggests a bearish reversal is underway.

-

Vary Buying and selling: Doji candles showing inside a well-defined buying and selling vary can sign continuation of the range-bound value motion. This may be a chance for range-bound buying and selling methods like scalping or utilizing choices.

-

Mixture with different Indicators: Mix Doji evaluation with different technical indicators like MACD, RSI, or Bollinger Bands to boost the accuracy of your predictions. As an example, a Doji showing close to an overbought RSI degree might recommend a bearish reversal.

Dangers and Limitations:

Whereas Doji patterns may be beneficial, it is essential to acknowledge their limitations:

-

False Indicators: Doji patterns can sometimes produce false alerts. Market noise can result in the formation of Doji candles with none important value reversal.

-

Context is Key: The interpretation of a Doji relies upon closely on the broader market context. Ignoring the general pattern and different technical indicators can result in inaccurate predictions.

-

Affirmation is Essential: Relying solely on a Doji for buying and selling selections is dangerous. At all times search affirmation from different indicators or value motion earlier than getting into a commerce.

Conclusion:

The Doji candlestick sample, whereas seemingly easy, presents a robust instrument for technical analysts. Understanding its numerous varieties, deciphering its significance throughout the broader market context, and mixing it with different analytical methods can considerably improve a dealer’s potential to establish potential pattern reversals and capitalize on worthwhile buying and selling alternatives. Nevertheless, keep in mind that no single indicator gives foolproof predictions. A disciplined method, threat administration, and a radical understanding of market dynamics are important for profitable buying and selling utilizing Doji candlesticks. Steady studying and adaptation are key to mastering this beneficial facet of technical evaluation. By diligently finding out charts, practising sample recognition, and rigorously testing buying and selling methods, merchants can unlock the potential of the Doji and considerably enhance their buying and selling efficiency. Bear in mind to at all times backtest your methods and alter your method primarily based in your findings. The journey to mastering technical evaluation is ongoing, and the Doji is only one piece of a bigger, fascinating puzzle.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Doji: A Complete Information to This Highly effective Chart Sample. We hope you discover this text informative and helpful. See you in our subsequent article!