Decoding the Dow Jones Market Chart: A Complete Information

Associated Articles: Decoding the Dow Jones Market Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Dow Jones Market Chart: A Complete Information. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Dow Jones Market Chart: A Complete Information

The Dow Jones Industrial Common (DJIA), typically merely referred to as the "Dow," is arguably essentially the most recognizable inventory market index globally. Its each day fluctuations, charted graphically, present a snapshot of the general well being and sentiment of the US financial system. Understanding how one can interpret the Dow Jones market chart is essential for traders of all ranges, from seasoned professionals to these simply beginning their funding journey. This text will delve into the intricacies of the Dow chart, exploring its elements, widespread charting strategies, and the insights it gives.

Understanding the Dow Jones Industrial Common:

Earlier than diving into chart evaluation, it is important to grasp what the Dow represents. It is a price-weighted common of 30 giant, publicly owned corporations based mostly in the US. These corporations characterize a various vary of sectors, together with expertise, finance, client items, and industrials. The choice course of for these corporations is rigorous, aiming to replicate the broader US financial system and its main sectors. Crucially, the price-weighted nature of the index implies that higher-priced shares have a larger affect on the general index worth in comparison with lower-priced ones. This differs from market-cap-weighted indices just like the S&P 500, the place bigger corporations by market capitalization maintain extra weight.

Studying the Dow Jones Market Chart: Fundamental Components:

A typical Dow Jones market chart shows the index’s worth over a selected interval, normally introduced as a line graph. Key components embrace:

- X-axis (Horizontal): Represents time, sometimes starting from days, weeks, months, or years relying on the chart’s timeframe.

- Y-axis (Vertical): Represents the Dow Jones index worth at a selected cut-off date.

- Value Line: A steady line connecting the closing costs of the Dow for every interval on the X-axis. This line kinds the first visible illustration of the index’s efficiency.

- Candlesticks (Elective): Some charts make the most of candlestick patterns, the place every "candle" represents a single interval (e.g., a day). The physique of the candle exhibits the vary between the opening and shutting costs, whereas the "wicks" (traces extending above and under the physique) point out the excessive and low costs for that interval. Candlesticks provide a richer visible illustration of value motion.

- Shifting Averages (Elective): These are traces plotted on the chart that characterize the common value over a selected interval (e.g., 50-day transferring common, 200-day transferring common). Shifting averages clean out value fluctuations and assist determine developments.

- Quantity (Elective): Some charts embrace a separate graph displaying buying and selling quantity, which represents the variety of shares traded throughout every interval. Excessive quantity typically accompanies important value actions.

- Indicators (Elective): Technical analysts typically incorporate further indicators onto the chart, resembling Relative Energy Index (RSI), MACD (Shifting Common Convergence Divergence), Bollinger Bands, and others. These indicators present alerts about potential value reversals, momentum, and overbought/oversold circumstances.

Deciphering Chart Patterns:

The Dow Jones market chart can reveal varied patterns that skilled merchants use to foretell future value actions. Some widespread patterns embrace:

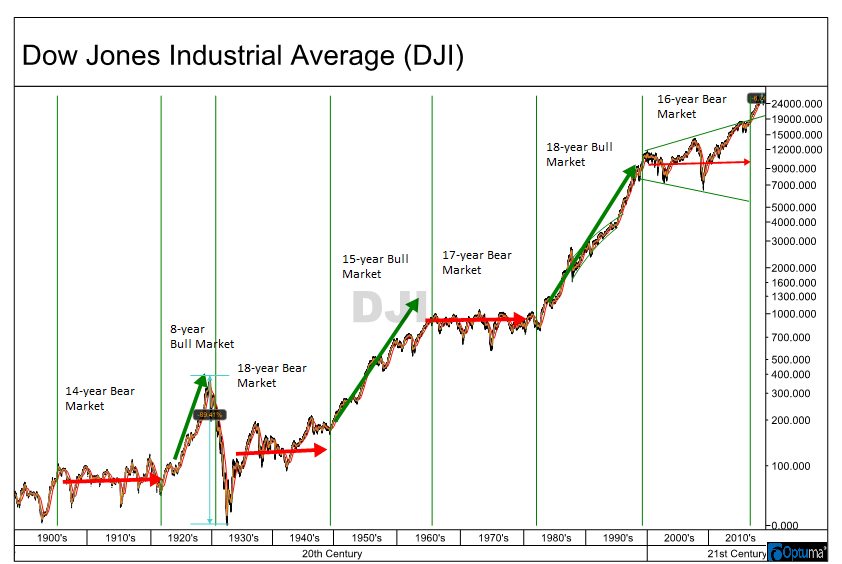

- Uptrend: A sequence of upper highs and better lows, indicating a bullish market.

- Downtrend: A sequence of decrease highs and decrease lows, indicating a bearish market.

- Assist and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt via. Assist ranges act as a ground, whereas resistance ranges act as a ceiling. Breakouts above resistance or under assist can sign important value actions.

- Head and Shoulders Sample: A bearish reversal sample characterised by three peaks, with the center peak (the "head") being the best.

- Double Prime/Backside: A sample indicating a possible reversal, the place the worth reaches an analogous excessive (double high) or low (double backside) twice earlier than reversing.

- Triangles: Consolidation patterns the place the worth fluctuates inside a narrowing vary, typically previous a breakout in both route.

- Flags and Pennants: Quick-term consolidation patterns that usually seem throughout a robust pattern, suggesting a brief pause earlier than the pattern resumes.

Timeframes and Chart Evaluation:

The timeframe of the chart considerably influences its interpretation. Quick-term charts (e.g., each day, hourly) give attention to short-term value fluctuations and are sometimes used for day buying and selling or swing buying and selling. Lengthy-term charts (e.g., weekly, month-to-month, yearly) present a broader perspective, helpful for figuring out main developments and long-term funding methods. Completely different timeframes can reveal completely different patterns and insights. A sample that seems important on a each day chart is perhaps insignificant on a month-to-month chart.

The Significance of Context:

Whereas chart evaluation is a strong device, it is essential to think about the broader financial and political context when deciphering the Dow Jones market chart. Geopolitical occasions, financial information releases (e.g., GDP, inflation), rate of interest modifications, and company-specific information can all considerably affect the index’s efficiency. A seemingly bearish chart sample is perhaps overridden by constructive financial information, and vice versa.

Technical vs. Basic Evaluation:

Chart evaluation, also referred to as technical evaluation, focuses solely on the worth and quantity information of the Dow Jones index. It enhances basic evaluation, which entails inspecting the underlying monetary well being and prospects of the 30 constituent corporations. A complete funding technique sometimes incorporates each technical and basic evaluation to make knowledgeable selections.

Limitations of Chart Evaluation:

It is necessary to acknowledge the constraints of chart evaluation. Previous efficiency just isn’t essentially indicative of future outcomes. Chart patterns might be subjective, and completely different analysts may interpret the identical sample otherwise. Moreover, relying solely on chart evaluation with out contemplating basic elements can result in inaccurate predictions and doubtlessly important losses.

Instruments and Assets for Chart Evaluation:

Quite a few on-line platforms and software program purposes present entry to Dow Jones market charts and technical evaluation instruments. Many brokerage corporations provide charting instruments as a part of their providers. Fashionable platforms embrace TradingView, Yahoo Finance, Google Finance, and Bloomberg Terminal (for skilled customers).

Conclusion:

The Dow Jones market chart is a worthwhile device for understanding the general well being and sentiment of the US inventory market. By studying to interpret its varied components, patterns, and indicators, traders can achieve worthwhile insights into potential value actions. Nonetheless, it is essential to keep in mind that chart evaluation is only one piece of the puzzle. A profitable funding technique requires a holistic strategy that includes basic evaluation, threat administration, and an intensive understanding of the broader financial panorama. Steady studying and follow are key to mastering the artwork of deciphering the Dow Jones market chart and making knowledgeable funding selections.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Dow Jones Market Chart: A Complete Information. We admire your consideration to our article. See you in our subsequent article!