Decoding the Enigma: Chart Patterns, Accuracy, and the Actuality of Technical Evaluation

Associated Articles: Decoding the Enigma: Chart Patterns, Accuracy, and the Actuality of Technical Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Enigma: Chart Patterns, Accuracy, and the Actuality of Technical Evaluation. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Enigma: Chart Patterns, Accuracy, and the Actuality of Technical Evaluation

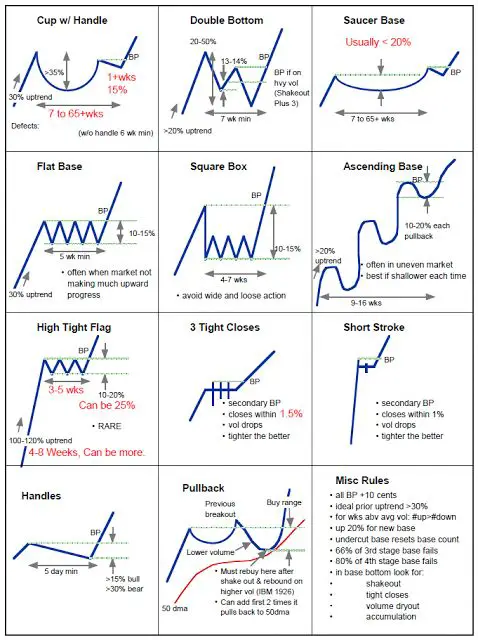

Chart patterns, these visually identifiable formations on value charts, are a cornerstone of technical evaluation. Merchants and traders alike pore over head and shoulders, triangles, flags, and numerous different patterns, searching for to foretell future value actions. Nonetheless, the accuracy of those patterns stays a hotly debated subject, with claims starting from near-infallibility to finish uselessness. This text delves into the complexities of chart sample recognition, exploring their strengths, weaknesses, and the components that affect their predictive energy.

The Attract of Chart Patterns:

The basic enchantment of chart patterns lies of their simplicity and intuitive nature. They supply a visible illustration of market sentiment and potential value motion, providing merchants a framework for making knowledgeable selections. Many patterns are based mostly on established rules of provide and demand, suggesting that repetitive value conduct could be recognized and exploited. For instance, a head and shoulders sample typically signifies a bearish reversal, as the value constantly fails to interrupt above resistance ranges, finally resulting in a decline. Equally, bullish flags and pennants recommend a continuation of an current uptrend after a short lived interval of consolidation.

The perceived objectivity of chart patterns is one other key benefit. Not like basic evaluation, which depends on subjective interpretations of financial information and firm efficiency, chart patterns supply a seemingly goal evaluation of value conduct. This obvious objectivity, nonetheless, is a major supply of each energy and weak point. Whereas the patterns themselves are visually clear, their interpretation and the next buying and selling selections are inherently subjective.

Elements Influencing Accuracy:

The accuracy of chart patterns is much from constant. A number of components considerably impression their predictive energy:

-

Sample Affirmation: A single chart sample hardly ever offers enough proof for a buying and selling determination. Affirmation from different technical indicators, corresponding to transferring averages, RSI, or MACD, is essential. Moreover, affirmation from basic evaluation can strengthen the buying and selling sign. A bullish sample confirmed by optimistic earnings stories or sturdy trade tendencies considerably will increase the chance of a profitable commerce.

-

Sample Definition and Subjectivity: The exact definition of a chart sample could be ambiguous. What constitutes a "head" in a head and shoulders sample, or the exact angle of a flag, is usually open to interpretation. This subjectivity permits for affirmation bias, the place merchants would possibly selectively interpret patterns to suit their pre-existing biases. Clear, well-defined parameters and constant software are important to mitigate this threat.

-

Timeframe: The timeframe used to investigate the chart considerably impacts sample accuracy. Patterns recognized on a each day chart could not maintain true on an hourly chart, and vice versa. Merchants should choose a timeframe related to their buying and selling technique and threat tolerance. A protracted-term investor would possibly concentrate on weekly or month-to-month charts, whereas a day dealer would possibly analyze minute-by-minute value motion.

-

Market Circumstances: The effectiveness of chart patterns can differ drastically relying on market situations. In risky markets, patterns could break down rapidly, rendering them much less dependable. Conversely, in comparatively secure markets, patterns could develop extra clearly and supply extra predictable outcomes. Understanding the prevailing market sentiment and volatility is essential for deciphering chart patterns precisely.

-

Sample Dimension and Quantity: The dimensions and quantity accompanying a sample can affect its reliability. Bigger patterns with vital quantity are usually extra vital and have the next likelihood of success. Small, low-volume patterns could also be much less dependable and simply disrupted by minor market fluctuations.

-

False Breakouts: One of many largest challenges with chart patterns is the incidence of false breakouts. A sample would possibly look like forming, solely to interrupt down unexpectedly, resulting in vital losses for merchants who entered positions based mostly on the anticipated breakout. Cautious threat administration and using stop-loss orders are important to mitigate the danger of false breakouts.

Statistical Evaluation and Backtesting:

Quite a few research have tried to statistically assess the accuracy of chart patterns. The outcomes have been blended, with some research suggesting a modest predictive energy, whereas others discover little proof of serious accuracy. The inconsistency of those findings typically stems from variations in methodology, sample definition, and information choice.

Backtesting, a vital component of validating buying and selling methods, can present insights into the historic efficiency of chart patterns. Nonetheless, backtesting itself will not be with out limitations. Over-optimization, the place a method is fine-tuned to suit previous information, can result in overly optimistic outcomes that fail to carry up in reside buying and selling. Sturdy backtesting methodologies, together with out-of-sample testing and consideration of transaction prices, are important for acquiring significant outcomes.

Integrating Chart Patterns right into a Broader Technique:

Whereas chart patterns alone shouldn’t be the only real foundation for buying and selling selections, they could be a helpful element of a broader, well-defined buying and selling technique. Combining chart patterns with different technical indicators, basic evaluation, and threat administration methods can considerably enhance the general accuracy and success price.

For instance, a dealer would possibly use a transferring common crossover as affirmation for a bullish triangle sample, including additional weight to the buying and selling sign. Equally, basic evaluation can present context for a chart sample, serving to to find out whether or not the sample displays a real shift in market sentiment or a short lived anomaly.

Conclusion:

The accuracy of chart patterns will not be a binary sure or no. Their predictive energy is influenced by a mess of things, together with sample affirmation, definition, timeframe, market situations, and the dealer’s talent and expertise. Whereas chart patterns generally is a helpful software for merchants, they need to by no means be relied upon in isolation. A holistic method, integrating chart patterns with different analytical methods and strong threat administration, is essential for maximizing the potential advantages whereas mitigating the dangers related to this type of technical evaluation. The last word success relies upon not simply on recognizing the sample, however on understanding its context, confirming its validity, and managing threat successfully. The enigma of chart sample accuracy stays a problem, however with cautious software and a nuanced understanding, merchants can harness their potential to reinforce their buying and selling selections.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Enigma: Chart Patterns, Accuracy, and the Actuality of Technical Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!