Decoding the Ethereum Worth Chart: A Deep Dive into Market Dynamics

Associated Articles: Decoding the Ethereum Worth Chart: A Deep Dive into Market Dynamics

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Ethereum Worth Chart: A Deep Dive into Market Dynamics. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Ethereum Worth Chart: A Deep Dive into Market Dynamics

Ethereum, the second-largest cryptocurrency by market capitalization, boasts a value chart that is as charming as it’s complicated. Not like easier property with predictable trajectories, Ethereum’s value is a dynamic reflection of technological developments, regulatory landscapes, market sentiment, and macroeconomic circumstances. Understanding its value chart requires extra than simply glancing on the traces; it calls for a nuanced strategy that considers numerous influencing components and analytical instruments. This text delves into the intricacies of the Ethereum value chart, exploring its historic tendencies, key value actions, and the components driving its volatility.

Historic Overview: From Humble Beginnings to Market Large

Ethereum’s journey started in 2015 with an preliminary coin providing (ICO) value of just below $1. The early years noticed intervals of serious progress interspersed with substantial corrections, reflecting the nascent nature of the cryptocurrency market and the inherent dangers related to rising applied sciences. The chart throughout this era shows a unstable, upward trending sample, punctuated by sharp drops and intervals of consolidation. This volatility stemmed from components akin to restricted adoption, regulatory uncertainty, and the inherent speculative nature of the cryptocurrency house.

The 2017 bull market noticed Ethereum’s value explode, reaching an all-time excessive (ATH) exceeding $1,400. This surge was fueled by growing curiosity in decentralized functions (dApps), preliminary coin choices (ICOs) constructed on the Ethereum blockchain, and broader enthusiasm for cryptocurrencies. The chart throughout this era showcases a steep parabolic rise, indicative of a speculative bubble. The next crash in 2018, nonetheless, highlighted the fragility of such speedy progress, with the value plummeting to under $100. This decline mirrored a correction available in the market, a waning of ICO fervor, and rising regulatory scrutiny.

The interval following the 2018 crash noticed a gradual restoration, punctuated by intervals of consolidation and additional progress. The chart from 2019 to 2020 reveals a extra mature market, with much less dramatic value swings. This relative stability stemmed from elevated institutional curiosity, developments in Ethereum’s underlying know-how (just like the shift in the direction of proof-of-stake), and a rising understanding of its potential functions past simply hypothesis.

The 2020-2021 bull market noticed one other important value surge, pushing Ethereum’s value to a brand new ATH above $4,800. This rally was pushed by a number of components, together with the rising adoption of decentralized finance (DeFi) functions, the growing reputation of non-fungible tokens (NFTs), and the broader macroeconomic atmosphere characterised by low rates of interest and elevated liquidity. The chart throughout this era exhibits a powerful upward development, although not as parabolic because the 2017 bull run, suggesting a extra sustainable progress trajectory. Nonetheless, the next correction in 2022 demonstrated that even mature markets are topic to important value fluctuations.

Key Worth Actions and Their Drivers:

Analyzing particular value actions on the Ethereum chart reveals beneficial insights into market dynamics. For instance:

-

The "ICO Increase" (2017): The sharp value enhance was straight correlated with the explosion of ICOs on the Ethereum blockchain. Buyers flocked to the platform, driving up demand and pushing the value larger. The next crash mirrored the bursting of this ICO bubble and the belief that many tasks have been unsustainable.

-

The "DeFi Summer season" (2020): The surge in DeFi exercise led to a big enhance in Ethereum’s value. The rising reputation of decentralized lending, borrowing, and buying and selling platforms elevated demand for ETH, as it is the native token of the Ethereum community.

-

The NFT Increase (2021): The explosion of the NFT market fueled one other value surge. ETH turned the dominant forex for purchasing and promoting NFTs, driving additional demand and value appreciation.

-

The "Merge" (2022): The extremely anticipated transition from proof-of-work to proof-of-stake (the "Merge") considerably impacted the value. Whereas the value initially reacted positively, the general macroeconomic circumstances and the crypto winter overshadowed the long-term optimistic impacts of the Merge.

Analyzing the Chart: Technical Indicators and Elementary Elements

Successfully deciphering the Ethereum value chart requires a multi-faceted strategy that mixes technical evaluation with basic evaluation.

Technical Evaluation: Technical analysts make the most of numerous indicators to foretell future value actions. These embrace:

- Shifting Averages: These easy out value fluctuations and assist determine tendencies. The 50-day and 200-day shifting averages are generally used.

- Relative Energy Index (RSI): This measures the magnitude of latest value adjustments to guage overbought or oversold circumstances.

- MACD (Shifting Common Convergence Divergence): This indicator identifies adjustments in momentum by evaluating two shifting averages.

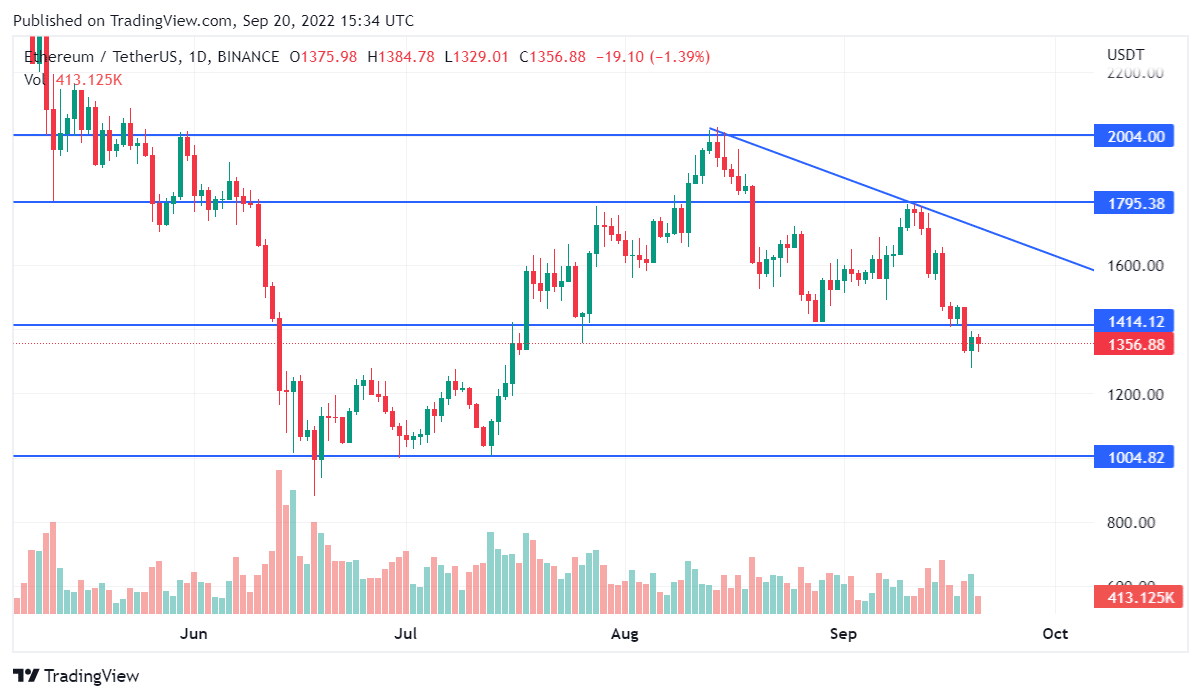

- Assist and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by, offering potential entry and exit factors.

Elementary Evaluation: Elementary evaluation focuses on the underlying worth of Ethereum and its community. Key components to think about embrace:

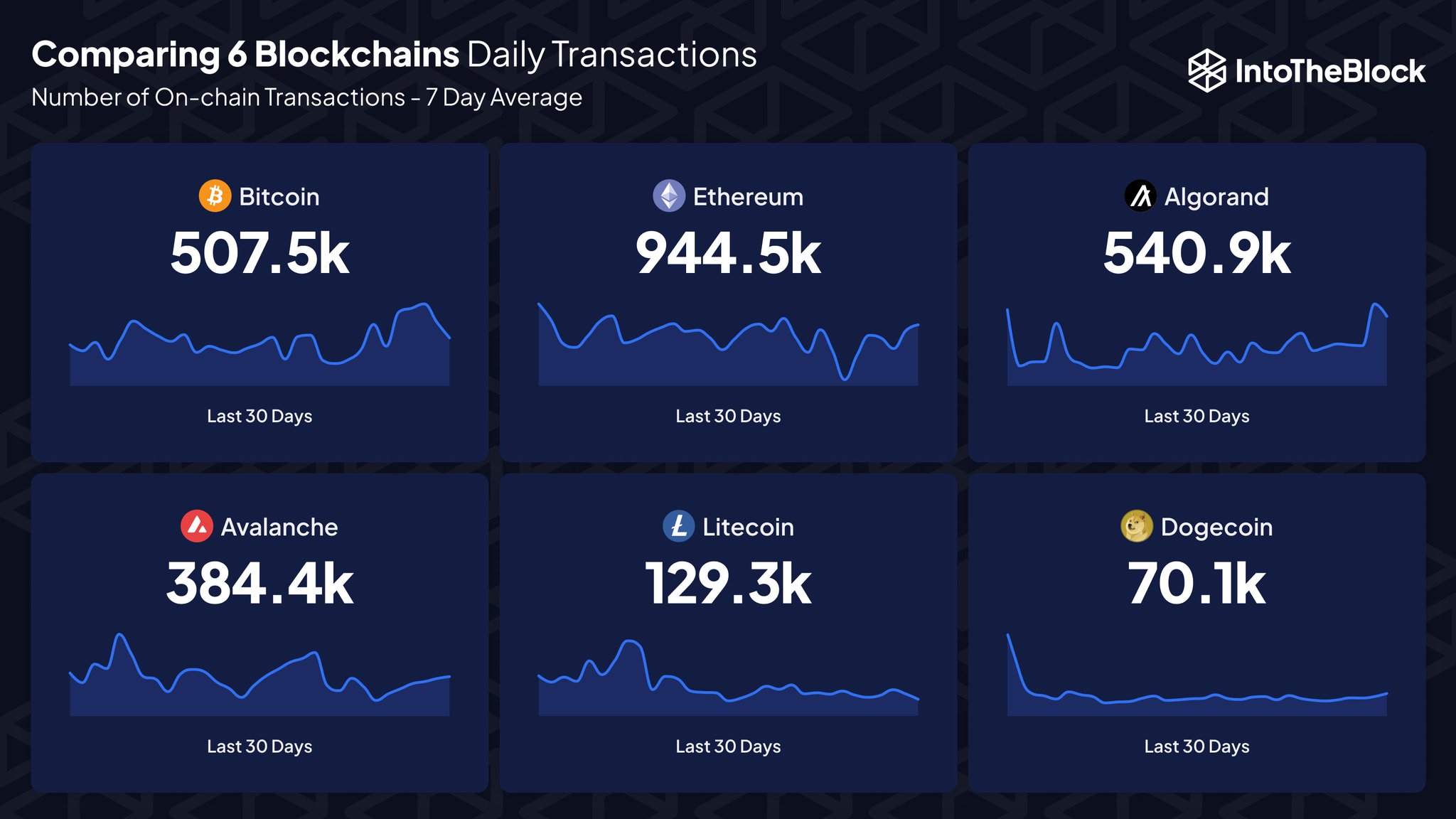

- Community Exercise: The variety of transactions, energetic addresses, and fuel charges present insights into the general well being and utilization of the community.

- Growth Exercise: The tempo of growth, the variety of builders contributing to the platform, and the discharge of latest options all affect the long-term potential of Ethereum.

- Regulatory Panorama: Modifications in rules can considerably affect the value. Optimistic regulatory developments are inclined to assist the value, whereas unfavorable developments can result in declines.

- Macroeconomic Situations: Broader financial components, akin to inflation, rates of interest, and general market sentiment, can considerably affect the value of cryptocurrencies, together with Ethereum.

Conclusion: Navigating the Complexity of the Ethereum Worth Chart

The Ethereum value chart is a posh tapestry woven from technological developments, market sentiment, regulatory developments, and macroeconomic forces. Understanding its nuances requires a complete strategy that comes with each technical and basic evaluation. Whereas predicting future value actions with certainty is unimaginable, a radical understanding of those components permits buyers to make extra knowledgeable choices and navigate the volatility inherent within the cryptocurrency market. Steady studying, staying up to date on the most recent developments, and using a diversified funding technique are essential for fulfillment within the dynamic world of Ethereum and cryptocurrency buying and selling. The chart itself is barely a software; its efficient use hinges on a complete understanding of the forces shaping the asset’s worth. Keep in mind to all the time conduct thorough analysis and contemplate your individual danger tolerance earlier than making any funding choices.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Ethereum Worth Chart: A Deep Dive into Market Dynamics. We hope you discover this text informative and useful. See you in our subsequent article!