Decoding the Fannie Mae 30-12 months Mortgage Fee Chart: A Complete Information

Associated Articles: Decoding the Fannie Mae 30-12 months Mortgage Fee Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Fannie Mae 30-12 months Mortgage Fee Chart: A Complete Information. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Fannie Mae 30-12 months Mortgage Fee Chart: A Complete Information

The 30-year fixed-rate mortgage is the cornerstone of the American dream of homeownership. Understanding its rates of interest, notably these tracked by Fannie Mae, is essential for potential homebuyers and seasoned buyers alike. This text delves deep into the intricacies of the Fannie Mae 30-year mortgage fee chart, exploring its historic context, influencing elements, find out how to interpret the information, and its implications for the housing market.

Fannie Mae’s Function within the Mortgage Market:

Fannie Mae (Federal Nationwide Mortgage Affiliation) is not a lender itself; it is a government-sponsored enterprise (GSE) that performs a significant function within the secondary mortgage market. Lenders originate mortgages, after which promote lots of them to Fannie Mae. This course of offers lenders with capital to originate extra loans, guaranteeing a gradual stream of funds into the housing market. By buying mortgages, Fannie Mae standardizes them and packages them into securities, that are then bought to buyers. This liquidity is important for protecting mortgage charges aggressive and accessible to a wider vary of debtors. Whereas Fannie Mae would not instantly set rates of interest, its actions and insurance policies considerably affect them. Monitoring its reported charges offers a priceless benchmark for the general market.

Understanding the Fannie Mae 30-12 months Mortgage Fee Chart:

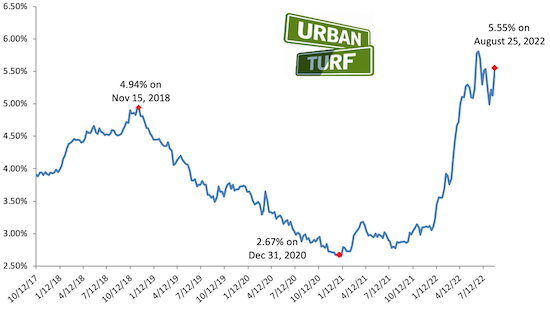

The Fannie Mae 30-year mortgage fee chart, sometimes obtainable on varied monetary web sites and publications, presents a historic overview of common rates of interest for 30-year fixed-rate mortgages. These charges are often introduced as weekly or month-to-month averages, providing a transparent image of fee traits over time. The chart typically consists of extra knowledge factors, comparable to:

- Common Fee: The common rate of interest throughout all 30-year fixed-rate mortgages bought by Fannie Mae in the course of the specified interval.

- Fee Vary: The minimal and most charges noticed in the course of the interval, illustrating the variability in charges supplied by completely different lenders.

- Historic Context: Many charts present a long-term perspective, permitting for comparability of present charges with these from earlier years or a long time.

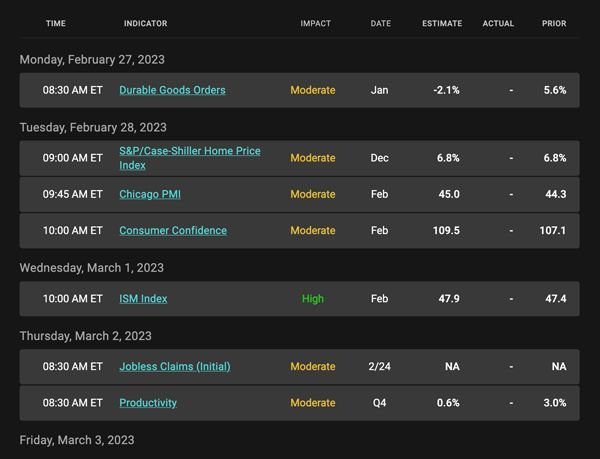

- Financial Indicators: Some charts would possibly incorporate associated financial knowledge, comparable to inflation charges, unemployment figures, and the Federal Funds Fee, to spotlight potential correlations.

Elements Influencing Fannie Mae 30-12 months Mortgage Charges:

A number of interconnected elements contribute to the fluctuations noticed within the Fannie Mae 30-year mortgage fee chart:

-

Federal Reserve Coverage: The Federal Reserve (the Fed) is the central financial institution of america. Its financial coverage, primarily by way of changes to the federal funds fee (the goal fee banks cost one another for in a single day loans), considerably impacts mortgage charges. Larger federal funds charges usually result in increased mortgage charges, and vice versa. The Fed’s actions intention to manage inflation and keep financial stability.

-

Inflation: Excessive inflation erodes the buying energy of cash, prompting the Fed to boost rates of interest to chill down the economic system. This, in flip, impacts mortgage charges. Conversely, low inflation would possibly result in decrease mortgage charges.

-

Financial Progress: Sturdy financial development typically interprets to elevated demand for housing and consequently increased mortgage charges. Conversely, weak financial development can depress demand and decrease charges.

-

Authorities Laws: Adjustments in authorities rules regarding the mortgage business can affect lending practices and consequently have an effect on mortgage charges. For instance, stricter lending requirements would possibly cut back the provision of mortgages and probably enhance charges.

-

Investor Sentiment: The general sentiment of buyers within the mortgage-backed securities market performs an important function. Optimistic investor sentiment can result in elevated demand and decrease charges, whereas adverse sentiment can have the other impact.

-

Provide and Demand of Mortgages: The stability between the provision of accessible mortgages and the demand from homebuyers instantly impacts rates of interest. Excessive demand with restricted provide sometimes drives charges increased.

-

International Financial Circumstances: Worldwide financial occasions, comparable to world monetary crises or geopolitical instability, may influence investor confidence and affect mortgage charges within the US.

Decoding the Fannie Mae 30-12 months Mortgage Fee Chart:

Analyzing the Fannie Mae 30-year mortgage fee chart requires understanding a number of key elements:

-

Traits: Search for upward or downward traits within the charges over time. A sustained upward development suggests a tightening of the credit score market, whereas a downward development signifies a loosening.

-

Volatility: Observe the diploma of fluctuation in charges. Excessive volatility signifies a much less steady market, probably reflecting uncertainty within the economic system.

-

Comparability with Historic Knowledge: Examine present charges with these from earlier years to gauge their relative place. This offers context and helps assess whether or not present charges are excessive, low, or common in comparison with historic norms.

-

Correlation with Financial Indicators: Analyze the chart along side different financial indicators to establish potential correlations and higher perceive the underlying elements driving fee modifications.

Implications for the Housing Market:

The Fannie Mae 30-year mortgage fee chart is a robust instrument for understanding the housing market’s well being. Decrease mortgage charges usually stimulate demand, resulting in elevated residence gross sales and probably increased residence costs. Conversely, increased mortgage charges can settle down the market, decreasing demand and probably inflicting worth changes.

The Way forward for Fannie Mae 30-12 months Mortgage Charges:

Predicting future mortgage charges is inherently difficult, given the complicated interaction of financial and political elements. Nonetheless, by intently monitoring the Fannie Mae 30-year mortgage fee chart alongside related financial indicators and information, potential homebuyers and buyers can achieve priceless insights into potential future traits. This info is essential for making knowledgeable selections about residence purchases, refinancing, and different funding methods.

Conclusion:

The Fannie Mae 30-year mortgage fee chart serves as a significant barometer of the US housing market’s well being and a key indicator for understanding the forces shaping borrowing prices. By understanding the elements that affect these charges and find out how to interpret the chart’s knowledge, people can navigate the complexities of the mortgage market and make well-informed selections that align with their monetary targets. Repeatedly reviewing this chart, coupled with broader financial evaluation, is important for anybody concerned in or impacted by the housing market. Bear in mind, nonetheless, that these charges signify averages, and particular person charges supplied by lenders will range primarily based on elements like credit score rating, down fee, and loan-to-value ratio. All the time seek the advice of with a professional mortgage skilled for personalised recommendation.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Fannie Mae 30-12 months Mortgage Fee Chart: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!