Decoding the Flicker: Mastering Candle Chart Patterns in Technical Evaluation

Associated Articles: Decoding the Flicker: Mastering Candle Chart Patterns in Technical Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Flicker: Mastering Candle Chart Patterns in Technical Evaluation. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Flicker: Mastering Candle Chart Patterns in Technical Evaluation

Candle charts, with their visually intuitive illustration of worth motion, have grow to be a cornerstone of technical evaluation. Not like bar charts, candles vividly show the open, excessive, low, and shut costs of an asset inside a selected time interval, offering a richer narrative of market sentiment and potential future worth actions. Understanding candle chart patterns is essential for merchants searching for to determine potential entry and exit factors, handle threat, and in the end, enhance their buying and selling efficiency. This text delves deep into the world of candle chart patterns, exploring their formation, interpretation, and sensible software.

Understanding the Anatomy of a Candle:

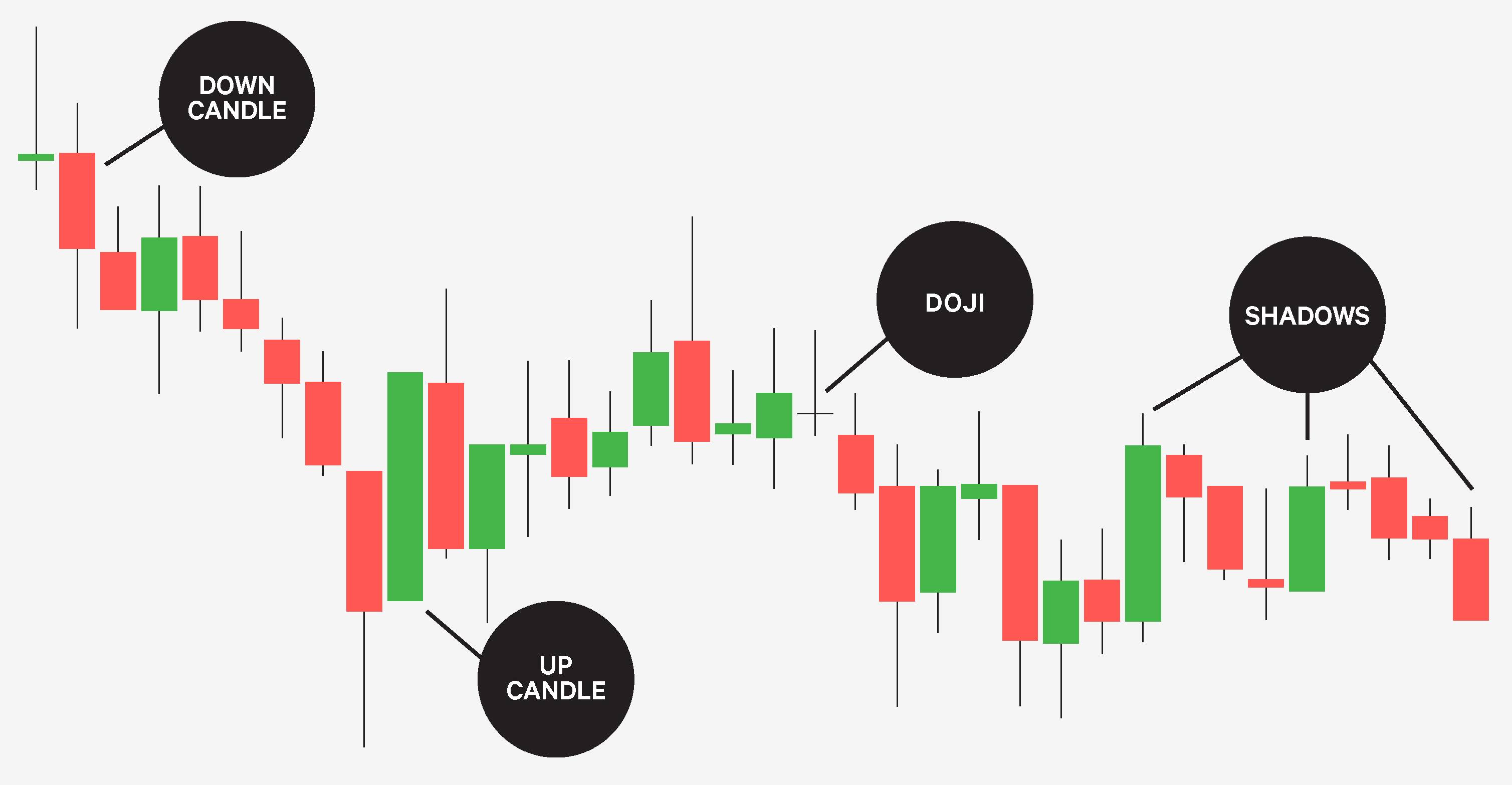

Earlier than diving into particular patterns, let’s refresh our understanding of candle elements:

-

Physique: The oblong portion of the candle represents the value distinction between the open and shut. A inexperienced (or white) physique signifies a closing worth larger than the opening worth (bullish), whereas a pink (or black) physique signifies a closing worth decrease than the opening worth (bearish). The longer the physique, the stronger the bullish or bearish stress.

-

Wicks (Shadows): The skinny traces extending above and under the physique characterize the excessive and low costs of the interval. Lengthy wicks counsel indecision or rejection at these worth ranges. Quick or absent wicks point out robust directional momentum.

Classifying Candle Chart Patterns:

Candle patterns are broadly categorized into two fundamental teams:

-

Reversal Patterns: These patterns sign a possible change within the prevailing pattern. They sometimes seem on the finish of an uptrend (bearish reversal) or a downtrend (bullish reversal).

-

Continuation Patterns: These patterns counsel that the prevailing pattern is more likely to proceed. They typically seem in periods of consolidation or sideways motion inside a bigger pattern.

Key Reversal Patterns:

-

Hammer: A bullish reversal sample characterised by a small physique close to the low of the interval and a protracted decrease wick, a minimum of twice the size of the physique. The lengthy decrease wick suggests patrons stepped in to forestall additional worth decline, indicating potential upward momentum. Affirmation is commonly sought by means of subsequent bullish candles.

-

Inverted Hammer: A bearish reversal sample, mirroring the hammer however with a protracted higher wick and a small physique close to the excessive. It signifies sellers’ dominance, as they pushed costs down regardless of preliminary shopping for stress. Subsequent bearish candles verify the sample.

-

Hanging Man: Much like the hammer, however showing on the finish of an uptrend. The lengthy decrease wick suggests a possible pattern reversal, however its bearish implications are stronger than the hammer attributable to its context inside an uptrend. Affirmation is essential earlier than coming into a brief place.

-

Capturing Star: The bearish counterpart of the hanging man, showing on the finish of a downtrend. It encompasses a small physique close to the excessive of the interval and a protracted higher wick, signaling potential rejection of upper costs. Affirmation is important earlier than contemplating a protracted place.

-

Engulfing Sample: A strong reversal sample consisting of two candles. A bullish engulfing sample entails a small bearish candle adopted by a bigger bullish candle that utterly engulfs the earlier candle’s physique. This means patrons have overpowered sellers. A bearish engulfing sample is the other, with a big bearish candle engulfing a previous small bullish candle.

-

Piercing Sample: A bullish reversal sample just like the engulfing sample, however with a barely completely different configuration. A big bearish candle is adopted by a bullish candle that closes a minimum of midway up the bearish candle’s physique. It suggests a possible shift in momentum.

-

Darkish Cloud Cowl: A bearish reversal sample showing on the finish of an uptrend. A big bullish candle is adopted by a bearish candle that opens above the earlier candle’s shut and closes under its midpoint. This alerts a possible weakening of the uptrend.

Key Continuation Patterns:

-

Doji: A impartial candle with the open and shut costs being just about similar. It signifies indecision out there and might seem inside each uptrends and downtrends. Dojis aren’t reversal patterns in themselves however typically precede vital worth actions. A number of dojis in a row can strengthen the sign.

-

Spinning High: Much like a doji however with a small physique and comparatively lengthy higher and decrease wicks. It signifies indecision and hesitation, suggesting a possible pause earlier than the pattern continues.

-

Three White Troopers: A bullish continuation sample consisting of three consecutive bullish candles, every opening larger and shutting larger than the earlier one. This sample signifies robust shopping for stress and a possible continuation of the uptrend.

-

Three Black Crows: The bearish counterpart of the three white troopers. It consists of three consecutive bearish candles, every opening decrease and shutting decrease than the earlier one. This sample alerts robust promoting stress and suggests a possible continuation of the downtrend.

-

Morning Star: A bullish reversal sample typically showing after a downtrend. It consists of three candles: a bearish candle, a small physique (doji or spinning high), and a bullish candle that closes considerably larger than the day prior to this’s shut. The small physique represents a pause within the downtrend earlier than the bullish candle confirms the reversal.

-

Night Star: The bearish counterpart of the morning star. It alerts a possible bearish reversal on the finish of an uptrend, consisting of a bullish candle, a small physique, and a bearish candle that closes considerably decrease than the day prior to this’s shut.

Affirmation and Danger Administration:

Whereas candle patterns present priceless insights, relying solely on them is dangerous. Affirmation is essential earlier than coming into a commerce. This will contain:

-

Quantity Evaluation: Excessive quantity accompanying a candle sample strengthens its significance. Low quantity suggests weak conviction and should invalidate the sample.

-

Technical Indicators: Combining candle patterns with different technical indicators, equivalent to shifting averages, RSI, or MACD, can enhance accuracy and filter out false alerts.

-

Value Motion Affirmation: Search for worth motion confirming the sample’s implications. For instance, a breakout above resistance after a bullish reversal sample confirms the sample’s validity.

-

Assist and Resistance Ranges: Observe how the sample interacts with key assist and resistance ranges. A breakout above resistance or a breakdown under assist strengthens the sample’s predictive energy.

Sensible Software and Concerns:

Candle chart patterns are highly effective instruments, however their effectiveness is determined by correct software and threat administration.

-

Timeframe Issues: The importance of a candle sample varies relying on the timeframe. A sample that’s vital on a each day chart could also be much less so on a 5-minute chart.

-

Context is Key: Think about the broader market context and the asset’s particular traits earlier than decoding candle patterns.

-

Keep away from Over-Buying and selling: Do not bounce into trades based mostly solely on candle patterns. Use them along side different analytical instruments and a well-defined buying and selling plan.

-

Follow and Endurance: Mastering candle chart patterns requires time, follow, and endurance. Backtesting your methods is important to refine your method and enhance your understanding of those patterns.

Conclusion:

Candle chart patterns provide a wealthy and nuanced option to analyze worth motion and anticipate potential market actions. By understanding their formation, interpretation, and limitations, merchants can considerably enhance their means to determine high-probability buying and selling alternatives. Nevertheless, do not forget that no sample ensures success. Combining candle chart evaluation with different technical indicators, elementary evaluation, and sturdy threat administration methods is essential for attaining constant buying and selling success. Steady studying and follow are important for mastering this priceless ability and navigating the dynamic world of monetary markets.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the Flicker: Mastering Candle Chart Patterns in Technical Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!