Decoding the Foreign exchange Crude Oil Reside Chart: A Complete Information

Associated Articles: Decoding the Foreign exchange Crude Oil Reside Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Foreign exchange Crude Oil Reside Chart: A Complete Information. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the Foreign exchange Crude Oil Reside Chart: A Complete Information

The foreign exchange market, a worldwide decentralized market for exchanging currencies, presents a various vary of devices for buying and selling. Amongst these, crude oil stands out as a extremely unstable and influential commodity, instantly impacting international economies and providing substantial revenue potential – but in addition vital danger. Understanding the foreign exchange crude oil reside chart is essential for navigating this advanced market efficiently. This text delves deep into decoding this dynamic chart, highlighting key indicators, buying and selling methods, and danger administration strategies.

Understanding the Fundamentals: Crude Oil and the Foreign exchange Market

Crude oil, the unrefined petroleum extracted from the earth, is a basic commodity driving international power consumption. Its worth fluctuates based mostly on a mess of things, making it a compelling asset for merchants. These elements embrace:

- Geopolitical Occasions: Political instability in oil-producing areas, sanctions, wars, and worldwide relations considerably affect provide and, consequently, worth.

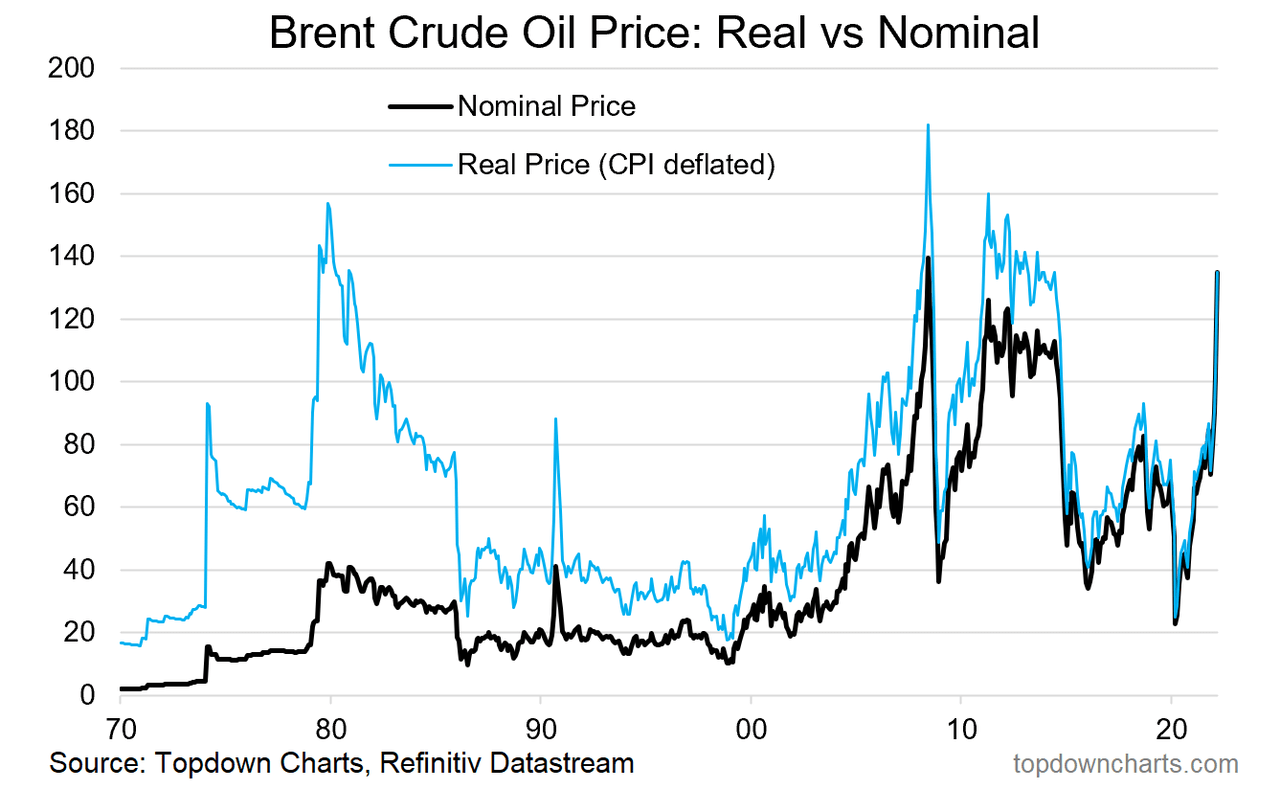

- Provide and Demand: World demand pushed by industrial exercise, transportation, and heating, coupled with OPEC manufacturing quotas and surprising disruptions (e.g., pure disasters, refinery outages), instantly impression worth.

- Financial Development: Sturdy international financial development usually interprets to elevated oil demand, pushing costs upward. Conversely, financial slowdowns result in decrease demand and doubtlessly decrease costs.

- Forex Fluctuations: Since crude oil is priced primarily in US {dollars}, the worth of the greenback towards different currencies instantly impacts the price of oil for patrons utilizing totally different currencies. A stronger greenback makes oil costlier for worldwide patrons, doubtlessly decreasing demand.

- Hypothesis and Investor Sentiment: Market sentiment, pushed by information, evaluation, and hypothesis, closely influences oil costs. Massive-scale shopping for or promoting by institutional buyers can set off vital worth swings.

- Technological Developments: Developments in renewable power sources and power effectivity applied sciences can impression long-term oil demand.

These elements create a dynamic and unpredictable atmosphere, mirrored within the continually altering foreign exchange crude oil reside chart. Merchants use this chart to research worth actions, determine tendencies, and make knowledgeable buying and selling selections.

Decoding the Foreign exchange Crude Oil Reside Chart: Key Components

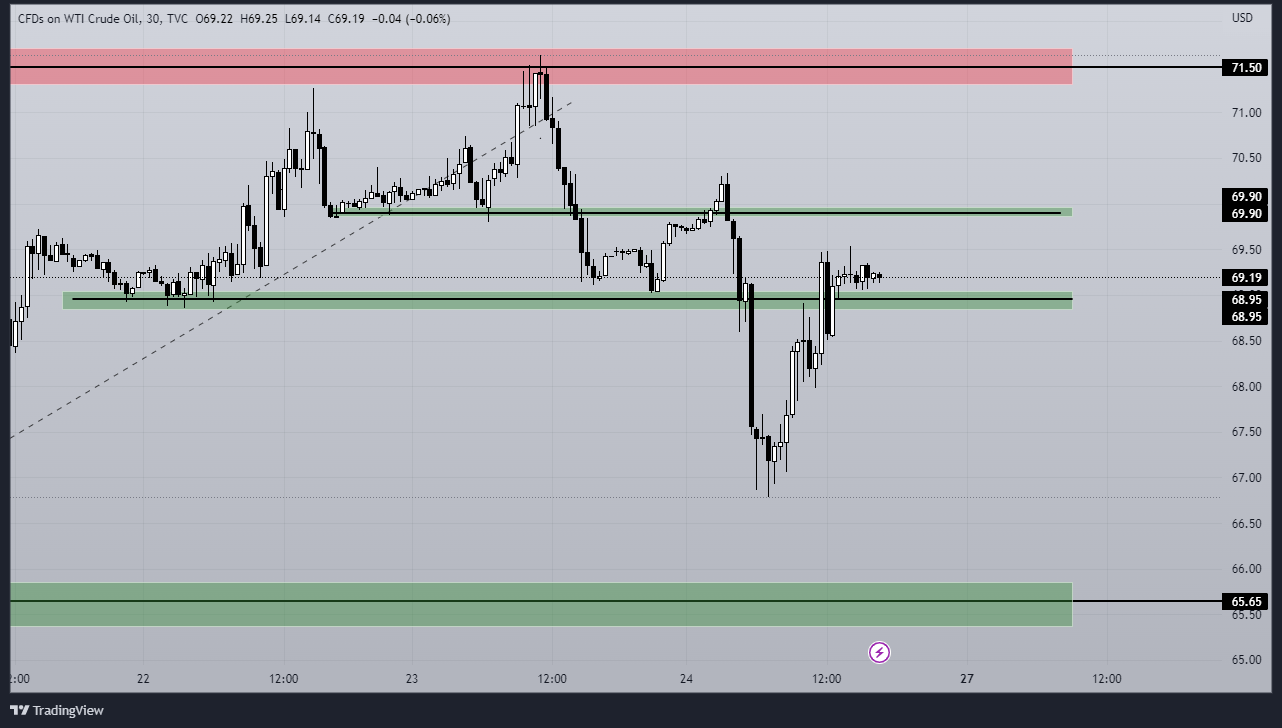

A typical foreign exchange crude oil reside chart shows worth actions over a selected timeframe (e.g., minutes, hours, days, weeks). Key components to grasp embrace:

- Worth Axis (Y-axis): Reveals the value of crude oil in US {dollars} per barrel (e.g., $70/barrel, $80/barrel).

- Time Axis (X-axis): Shows the time interval lined by the chart, starting from a couple of minutes to a number of years.

- Candlesticks or Line Charts: Most charts use candlestick patterns or line graphs to visually characterize worth actions. Candlesticks present the opening, closing, excessive, and low costs for a selected interval, whereas line charts merely join closing costs.

- Shifting Averages: These are calculated averages of costs over a selected interval (e.g., 50-day shifting common, 200-day shifting common). They assist easy out worth fluctuations and determine tendencies. Crossovers between totally different shifting averages can sign potential purchase or promote alternatives.

- Technical Indicators: A big selection of technical indicators (e.g., Relative Energy Index (RSI), MACD, Bollinger Bands) present further insights into worth momentum, overbought/oversold situations, and potential development reversals. These indicators are sometimes overlaid on the value chart.

- Quantity: Buying and selling quantity signifies the variety of contracts traded throughout a selected interval. Excessive quantity typically accompanies vital worth actions, confirming the power of a development. Low quantity can counsel a weak development or potential reversal.

- Assist and Resistance Ranges: These are worth ranges the place the value has traditionally struggled to interrupt by way of. Assist ranges characterize worth flooring, whereas resistance ranges characterize worth ceilings. Breaks above resistance or under help can sign vital worth actions.

Buying and selling Methods for Foreign exchange Crude Oil

A number of buying and selling methods could be employed when utilizing the foreign exchange crude oil reside chart:

- Pattern Following: This technique includes figuring out and buying and selling within the path of established tendencies. Shifting averages and different trend-following indicators are essential for this method.

- Imply Reversion: This technique assumes that costs will ultimately revert to their common. Indicators like RSI and Bollinger Bands are sometimes used to determine overbought or oversold situations, signaling potential reversals.

- Scalping: This includes taking small earnings from short-term worth fluctuations. It requires shut monitoring of the chart and fast execution of trades.

- Swing Buying and selling: This technique goals to seize earnings from worth swings over just a few days or perhaps weeks. It requires figuring out potential help and resistance ranges and monitoring key indicators.

- Information Buying and selling: This includes reacting to vital information occasions that impression oil costs. Geopolitical occasions, financial knowledge releases, and OPEC bulletins can set off substantial worth swings.

Danger Administration in Foreign exchange Crude Oil Buying and selling

Buying and selling crude oil carries vital danger because of its volatility. Efficient danger administration is paramount:

- Place Sizing: By no means danger greater than a small proportion of your buying and selling capital on any single commerce. This limits potential losses and protects your total account stability.

- Cease-Loss Orders: These routinely exit a commerce if the value strikes towards you, limiting potential losses. Inserting stop-loss orders is essential for managing danger.

- Take-Revenue Orders: These routinely exit a commerce when a predetermined revenue goal is reached, securing earnings.

- Diversification: Do not put all of your eggs in a single basket. Diversify your buying and selling portfolio throughout totally different property to cut back total danger.

- Backtesting: Earlier than implementing any buying and selling technique, backtest it utilizing historic knowledge to evaluate its efficiency and determine potential weaknesses.

- Emotional Self-discipline: Keep away from impulsive buying and selling selections based mostly on worry or greed. Follow your buying and selling plan and keep away from chasing losses.

Conclusion: Mastering the Foreign exchange Crude Oil Reside Chart

The foreign exchange crude oil reside chart presents a dynamic and difficult buying and selling atmosphere. By understanding the basic elements driving oil costs, decoding chart components, using efficient buying and selling methods, and implementing strong danger administration strategies, merchants can enhance their probabilities of success. Nonetheless, it is essential to do not forget that buying and selling includes inherent danger, and losses are attainable. Steady studying, follow, and self-discipline are important for navigating this advanced market and attaining long-term profitability. Bear in mind to at all times search skilled monetary recommendation earlier than participating in foreign currency trading. This text offers data for academic functions solely and shouldn’t be thought of monetary recommendation.

Closure

Thus, we hope this text has offered precious insights into Decoding the Foreign exchange Crude Oil Reside Chart: A Complete Information. We admire your consideration to our article. See you in our subsequent article!