Decoding the G to HKD Chart: A Complete Information to the Ghanaian Cedi and Hong Kong Greenback Trade Price

Associated Articles: Decoding the G to HKD Chart: A Complete Information to the Ghanaian Cedi and Hong Kong Greenback Trade Price

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the G to HKD Chart: A Complete Information to the Ghanaian Cedi and Hong Kong Greenback Trade Price. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the G to HKD Chart: A Complete Information to the Ghanaian Cedi and Hong Kong Greenback Trade Price

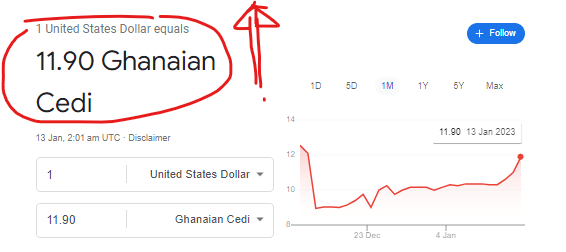

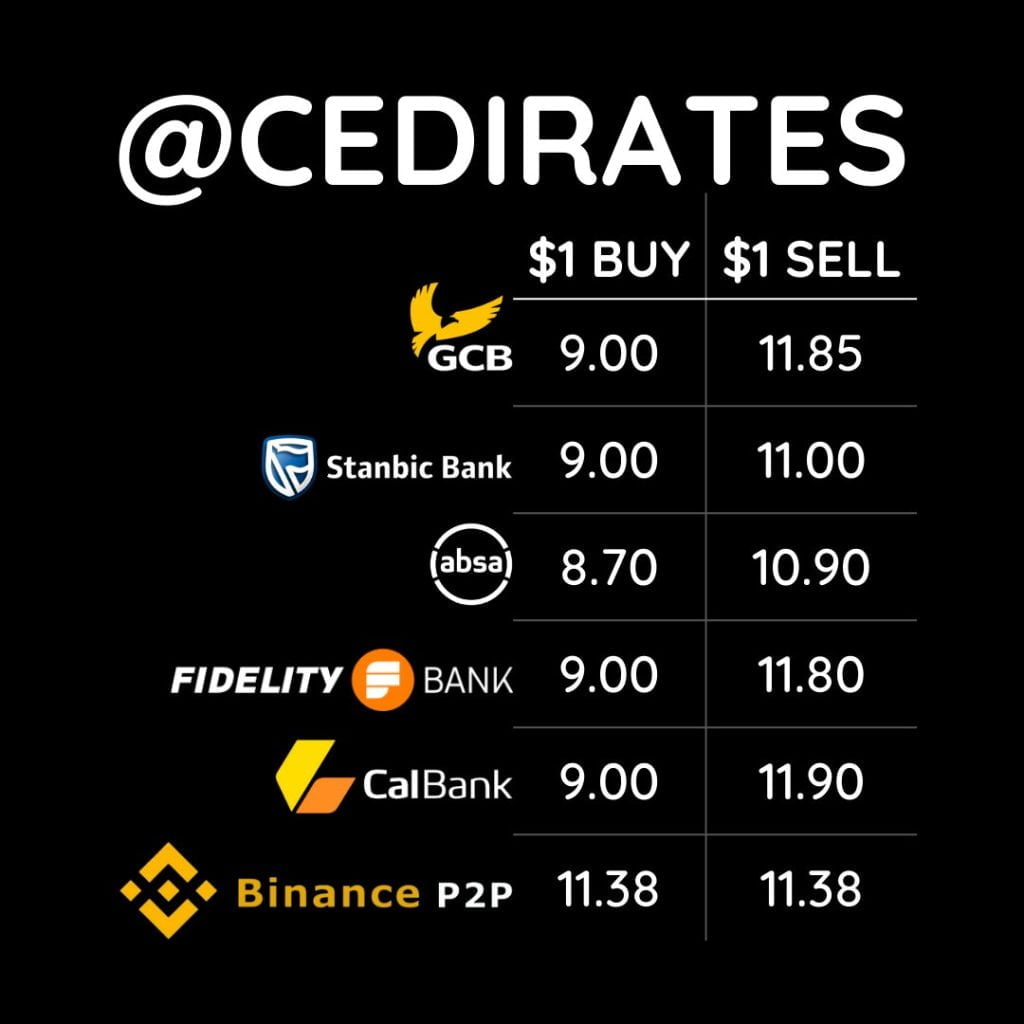

The Ghanaian Cedi (GHS) and the Hong Kong Greenback (HKD) are currencies working in vastly totally different financial landscapes. Understanding the fluctuations between these two currencies requires navigating international financial tendencies, regional political stability, and the precise financial insurance policies of Ghana and Hong Kong. This text supplies a complete overview of the GHS/HKD change fee, exploring its historic efficiency, influencing elements, and forecasting challenges. We’ll delve into tips on how to interpret a GHS to HKD chart, establish potential buying and selling alternatives, and focus on the dangers concerned.

Historic Perspective: A Have a look at the GHS/HKD Chart’s Trajectory

Tracing the GHS/HKD change fee over time reveals a fancy image. The Ghanaian Cedi, traditionally susceptible to volatility, has skilled durations of great depreciation towards main currencies, together with the HKD. This volatility stems from varied elements, together with:

-

Ghana’s Financial Dependence: Ghana’s economic system is closely reliant on commodity exports, primarily gold, cocoa, and oil. Fluctuations in international commodity costs straight influence the Cedi’s worth. When commodity costs fall, the Cedi tends to weaken towards stronger currencies just like the HKD.

-

Inflationary Pressures: Excessive inflation charges in Ghana have persistently eroded the buying energy of the Cedi. This makes it much less enticing to international buyers and contributes to its depreciation towards secure currencies just like the HKD, which advantages from Hong Kong’s comparatively low inflation.

-

Political and Financial Stability: Political instability or uncertainty in Ghana can result in capital flight and a subsequent weakening of the Cedi. Conversely, Hong Kong’s political and financial stability, backed by its robust ties to China, contributes to the HKD’s relative power.

-

Financial Coverage Selections: The Financial institution of Ghana’s financial coverage choices play an important function in managing the Cedi’s worth. Rate of interest changes, interventions within the international change market, and different coverage measures can affect the GHS/HKD change fee. Nonetheless, the effectiveness of those measures is commonly constrained by exterior elements.

Inspecting a historic GHS/HKD chart will reveal durations of each appreciation and depreciation for the Cedi. Whereas the HKD has typically maintained relative stability, the Cedi’s fluctuations have created alternatives and dangers for merchants and companies concerned in cross-border transactions between Ghana and Hong Kong. Analyzing historic tendencies, alongside understanding the underlying financial and political elements, is essential for knowledgeable decision-making.

Components Influencing the GHS/HKD Trade Price

Quite a few elements contribute to the every day actions noticed on a GHS/HKD chart. These elements might be broadly categorized as:

-

International Financial Situations: International financial progress, recessionary durations, and shifts in investor sentiment considerably influence foreign money markets. A world financial slowdown can negatively have an effect on demand for Ghanaian exports, resulting in Cedi depreciation. Conversely, robust international progress can increase demand and strengthen the Cedi.

-

Curiosity Price Differentials: The distinction between rates of interest in Ghana and Hong Kong influences capital flows. Increased rates of interest in Ghana can appeal to international funding, probably strengthening the Cedi. Nonetheless, this impact might be offset by different elements, reminiscent of inflation and political danger.

-

Commodity Costs: As talked about earlier, fluctuations in international commodity costs, significantly gold, cocoa, and oil, have a direct influence on the Ghanaian economic system and the Cedi’s worth. A surge in commodity costs can strengthen the Cedi, whereas a decline can weaken it.

-

Geopolitical Occasions: Political instability in Ghana or broader regional conflicts can negatively influence investor confidence and result in Cedi depreciation. Conversely, constructive geopolitical developments can increase investor sentiment and strengthen the Cedi.

-

Authorities Insurance policies: Authorities insurance policies in each Ghana and Hong Kong affect their respective currencies. Fiscal and financial insurance policies, commerce agreements, and regulatory adjustments can all have a bearing on the GHS/HKD change fee.

-

Market Hypothesis: Foreign money markets are vulnerable to hypothesis, with merchants anticipating future actions and performing accordingly. This will result in short-term volatility within the GHS/HKD change fee, no matter underlying financial fundamentals.

Deciphering the GHS/HKD Chart: Technical Evaluation and Basic Evaluation

Analyzing a GHS/HKD chart includes using each technical and basic evaluation:

-

Technical Evaluation: This method focuses on chart patterns, indicators, and historic worth actions to foretell future worth tendencies. Technical analysts search for help and resistance ranges, development traces, and different indicators to establish potential buying and selling alternatives. Nonetheless, technical evaluation is just not all the time dependable, significantly in risky markets just like the GHS/HKD pair.

-

Basic Evaluation: This method includes analyzing the underlying financial and political elements affecting the Ghanaian and Hong Kong economies. Basic analysts take into account elements like inflation charges, rates of interest, authorities debt, and political stability to evaluate the long-term outlook for the GHS/HKD change fee. A powerful understanding of basic elements is essential for making knowledgeable long-term funding choices.

Buying and selling the GHS/HKD Pair: Alternatives and Dangers

Buying and selling the GHS/HKD pair can provide alternatives for revenue, but it surely additionally carries important dangers. The excessive volatility of the Cedi makes it a difficult foreign money to commerce. Merchants want to pay attention to the next:

-

Volatility Danger: The GHS/HKD change fee is susceptible to important fluctuations, which may result in substantial losses if not managed correctly. Danger administration methods, reminiscent of stop-loss orders, are essential.

-

Liquidity Danger: The GHS/HKD pair will not be as liquid as main foreign money pairs, that means it could be tough to purchase or promote on the desired worth, particularly in periods of excessive volatility.

-

Political and Financial Danger: Political instability in Ghana or financial shocks can considerably influence the Cedi’s worth, resulting in sudden losses.

-

Foreign money Hypothesis Danger: Speculative buying and selling can exacerbate volatility, making it much more difficult to foretell worth actions.

Profitable buying and selling within the GHS/HKD pair requires a mixture of technical and basic evaluation, danger administration methods, and a deep understanding of the underlying financial and political elements affecting each Ghana and Hong Kong.

Forecasting Challenges: The Issue of Predicting the GHS/HKD Trade Price

Predicting the long run motion of the GHS/HKD change fee is inherently difficult because of the quite a few elements influencing it. Whereas technical and basic evaluation can present insights, they aren’t foolproof. Sudden occasions, reminiscent of political upheavals or international financial shocks, can considerably influence the change fee, rendering even essentially the most refined forecasts inaccurate.

Conclusion:

The GHS/HKD change fee is a dynamic and sophisticated relationship influenced by a large number of things. Understanding these elements, deciphering the GHS/HKD chart utilizing each technical and basic evaluation, and using sound danger administration methods are essential for anybody concerned in transactions or investments involving these two currencies. Whereas the HKD affords relative stability, the Cedi’s inherent volatility necessitates a cautious and knowledgeable method. Steady monitoring of financial indicators, political developments, and international market tendencies is crucial for navigating the intricacies of the GHS/HKD change fee and making knowledgeable choices.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the G to HKD Chart: A Complete Information to the Ghanaian Cedi and Hong Kong Greenback Trade Price. We hope you discover this text informative and useful. See you in our subsequent article!