Decoding the GBP/EUR Chart: A Deep Dive into the British Pound and Euro Alternate Price

Associated Articles: Decoding the GBP/EUR Chart: A Deep Dive into the British Pound and Euro Alternate Price

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the GBP/EUR Chart: A Deep Dive into the British Pound and Euro Alternate Price. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the GBP/EUR Chart: A Deep Dive into the British Pound and Euro Alternate Price

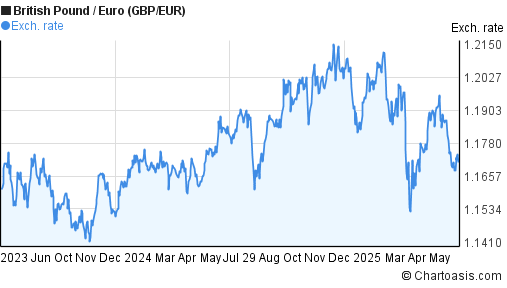

The GBP/EUR chart, depicting the trade charge between the British Pound (GBP) and the Euro (EUR), is a dynamic reflection of the advanced interaction of financial, political, and social elements affecting each the UK and the Eurozone. Understanding its fluctuations is essential for companies participating in cross-border commerce, buyers making currency-related selections, and anybody within the financial well being of those two main European gamers. This text delves into the important thing drivers influencing the GBP/EUR trade charge, explores frequent chart patterns, and offers insights into forecasting methods and threat administration methods.

Basic Components Driving GBP/EUR Actions:

The GBP/EUR trade charge is not decided by random likelihood. As a substitute, it is a continually shifting equilibrium influenced by a large number of elementary elements. These will be broadly categorized as:

-

Financial Information: That is arguably essentially the most vital driver. Key financial indicators launched by each the UK and the Eurozone considerably influence the trade charge. These embrace:

- Gross Home Product (GDP) development: Stronger-than-expected GDP development within the UK relative to the Eurozone sometimes strengthens the GBP. Conversely, weaker UK development in comparison with the Eurozone places downward stress on the Pound.

- Inflation charges: Increased-than-expected inflation within the UK can weaken the GBP, because it erodes buying energy. Conversely, comparatively decrease inflation within the UK in comparison with the Eurozone may strengthen the Pound. Central financial institution responses to inflation are additionally essential.

- Rates of interest: Increased rates of interest within the UK in comparison with the Eurozone have a tendency to draw international funding, growing demand for the GBP and strengthening its worth. Conversely, decrease UK rates of interest can weaken the Pound. The Financial institution of England’s (BoE) and the European Central Financial institution’s (ECB) financial coverage selections are intently watched.

- Unemployment charges: Decrease unemployment charges usually sign a stronger financial system, boosting the forex.

- Commerce balances: A optimistic commerce stability (exports exceeding imports) tends to strengthen a forex, whereas a unfavourable commerce stability weakens it.

- Authorities debt ranges: Excessive ranges of presidency debt can increase considerations a couple of nation’s fiscal stability, probably weakening its forex.

-

Political Components: Political stability and uncertainty play a major function. Main political occasions, comparable to elections, Brexit-related developments, or shifts in authorities coverage, could cause vital volatility within the GBP/EUR trade charge. Political threat premiums are sometimes priced into the trade charge, reflecting the perceived uncertainty.

-

Market Sentiment: Investor and market sentiment considerably influences the GBP/EUR trade charge. Intervals of optimism in regards to the UK or pessimism in regards to the Eurozone are inclined to strengthen the GBP. Conversely, unfavourable sentiment in the direction of the UK or optimistic sentiment in the direction of the Eurozone can weaken the Pound. This sentiment is usually mirrored in market information and analyst commentary.

-

Geopolitical Occasions: International occasions, comparable to wars, pandemics, or main worldwide crises, can influence each the UK and the Eurozone economies, influencing the trade charge. These occasions can introduce vital uncertainty and volatility.

Chart Patterns and Technical Evaluation:

Technical evaluation, which includes learning worth charts and historic knowledge to determine patterns and predict future worth actions, is a vital software for understanding the GBP/EUR trade charge. Some frequent chart patterns embrace:

- Trendlines: Figuring out upward or downward sloping trendlines may help predict the path of the trade charge. Breakouts from these trendlines typically sign vital worth actions.

- Help and Resistance Ranges: These are worth ranges the place the trade charge has traditionally struggled to interrupt by way of. Help ranges characterize potential shopping for alternatives, whereas resistance ranges characterize potential promoting alternatives.

- Transferring Averages: These easy out worth fluctuations and may help determine the general development. Crossovers between completely different transferring averages can generate buying and selling alerts.

- Candlestick Patterns: These present visible representations of worth actions over a particular interval, revealing details about shopping for and promoting stress. Particular candlestick patterns, comparable to hammers, capturing stars, and engulfing patterns, can point out potential reversals or continuations of traits.

- Oscillators: These indicators measure the momentum of worth actions, serving to to determine overbought or oversold situations. Frequent oscillators embrace the Relative Power Index (RSI) and the Stochastic Oscillator.

Forecasting and Danger Administration:

Forecasting the GBP/EUR trade charge is inherently difficult, because it relies on a large number of interconnected elements. Whereas no methodology ensures accuracy, combining elementary and technical evaluation can enhance forecasting accuracy. This includes:

- Basic Evaluation: Analyzing financial indicators, political occasions, and market sentiment to evaluate the underlying forces driving the trade charge.

- Technical Evaluation: Utilizing chart patterns and technical indicators to determine potential buying and selling alternatives and predict short-term worth actions.

- Situation Planning: Growing a number of eventualities based mostly on completely different assumptions about future occasions, permitting for flexibility in response to sudden developments.

Efficient threat administration is essential when buying and selling or investing within the GBP/EUR trade charge. Methods embrace:

- Diversification: Spreading investments throughout completely different belongings to scale back the influence of opposed actions within the GBP/EUR trade charge.

- Cease-Loss Orders: Setting predetermined worth ranges at which a commerce can be robotically closed to restrict potential losses.

- Hedging: Utilizing monetary devices, comparable to futures contracts or choices, to guard towards opposed trade charge actions.

- Place Sizing: Managing the dimensions of trades to restrict potential losses.

Conclusion:

The GBP/EUR chart is a posh and dynamic illustration of the financial and political relationship between the UK and the Eurozone. Understanding the elemental elements driving its fluctuations, using technical evaluation instruments, and using efficient threat administration methods are essential for navigating this market efficiently. Steady monitoring of financial knowledge, political developments, and market sentiment is important for knowledgeable decision-making. Whereas forecasting the longer term is inconceivable with certainty, a well-informed method combining elementary and technical evaluation, coupled with prudent threat administration, can considerably improve the probabilities of attaining optimistic outcomes within the GBP/EUR trade charge market. Bear in mind to at all times conduct thorough analysis and seek the advice of with monetary professionals earlier than making any funding selections.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the GBP/EUR Chart: A Deep Dive into the British Pound and Euro Alternate Price. We recognize your consideration to our article. See you in our subsequent article!