Decoding the GBP/USD Change Fee Chart: A Two-Decade Journey and Future Outlook

Associated Articles: Decoding the GBP/USD Change Fee Chart: A Two-Decade Journey and Future Outlook

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the GBP/USD Change Fee Chart: A Two-Decade Journey and Future Outlook. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the GBP/USD Change Fee Chart: A Two-Decade Journey and Future Outlook

The GBP/USD trade charge, a cornerstone of worldwide finance, displays the relative worth of the British pound sterling (GBP) towards the USA greenback (USD). Charting its motion over time supplies invaluable insights into the interaction of financial, political, and social elements influencing each the UK and US economies. This text delves right into a complete evaluation of the GBP/USD trade charge chart, inspecting key traits, historic occasions, and potential future eventualities. We’ll discover the elements driving fluctuations, offering a framework for understanding this dynamic relationship and its implications for traders, companies, and people.

A Historic Perspective: The GBP/USD from 2000 Onwards

The start of the twenty first century noticed the GBP/USD buying and selling inside a comparatively slender vary, fluctuating across the 1.40-1.80 mark. The early 2000s witnessed intervals of relative stability, punctuated by minor shifts pushed by elements corresponding to rate of interest differentials between the Financial institution of England (BoE) and the Federal Reserve (Fed), and world financial development patterns. The robust US greenback within the early a part of the last decade, fueled by strong financial development and comparatively excessive rates of interest, stored the GBP/USD comparatively subdued.

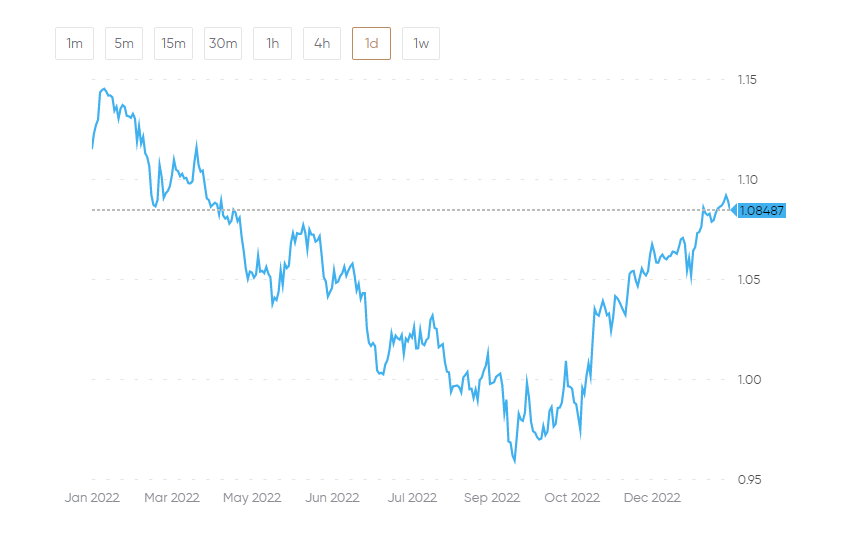

Nevertheless, the interval following the worldwide monetary disaster of 2008 marked a major turning level. The disaster triggered a pointy decline within the GBP/USD, falling to lows under 1.35 in early 2009. This drop mirrored a confluence of things: the worldwide recession, the UK’s publicity to the monetary disaster by way of its banking sector, and the numerous fiscal stimulus measures carried out by the UK authorities. The next restoration was gradual, with the pound regaining some floor as the worldwide financial system began to get better.

The interval between 2010 and 2015 noticed a comparatively steady, albeit fluctuating, GBP/USD trade charge. Throughout this time, the pound’s worth was influenced by a mix of things, together with:

- Financial coverage variations: Divergences in financial coverage between the BoE and the Fed performed a major function. Durations of quantitative easing (QE) within the UK tended to weaken the pound relative to the greenback, whereas intervals of tighter financial coverage within the US had the other impact.

- Financial development differentials: Relative financial development between the UK and the US additionally performed a vital function. Durations of stronger UK financial development tended to assist the pound, whereas intervals of slower development or financial uncertainty had the other impact.

- Geopolitical occasions: International geopolitical occasions, such because the Eurozone debt disaster and varied world conflicts, impacted each currencies and influenced the GBP/USD trade charge.

The Brexit Referendum and its Aftermath:

The 2016 Brexit referendum marked a watershed second for the GBP/USD. The sudden vote to depart the European Union triggered a direct and dramatic fall within the pound’s worth, with the GBP/USD plummeting to lows under 1.20 – its lowest degree in a long time. This sharp decline mirrored issues in regards to the financial implications of Brexit, together with potential disruptions to commerce, funding, and the UK’s total financial prospects.

The post-Brexit interval has been characterised by important volatility within the GBP/USD trade charge. The uncertainty surrounding the phrases of Brexit, the continuing negotiations with the EU, and the UK’s evolving financial relationship with the remainder of the world have all contributed to this volatility. Durations of constructive Brexit information or elevated certainty tended to assist the pound, whereas unfavorable information or elevated uncertainty had the other impact.

Current Traits and Elements Influencing the GBP/USD:

Lately, the GBP/USD trade charge has been influenced by a fancy interaction of things, together with:

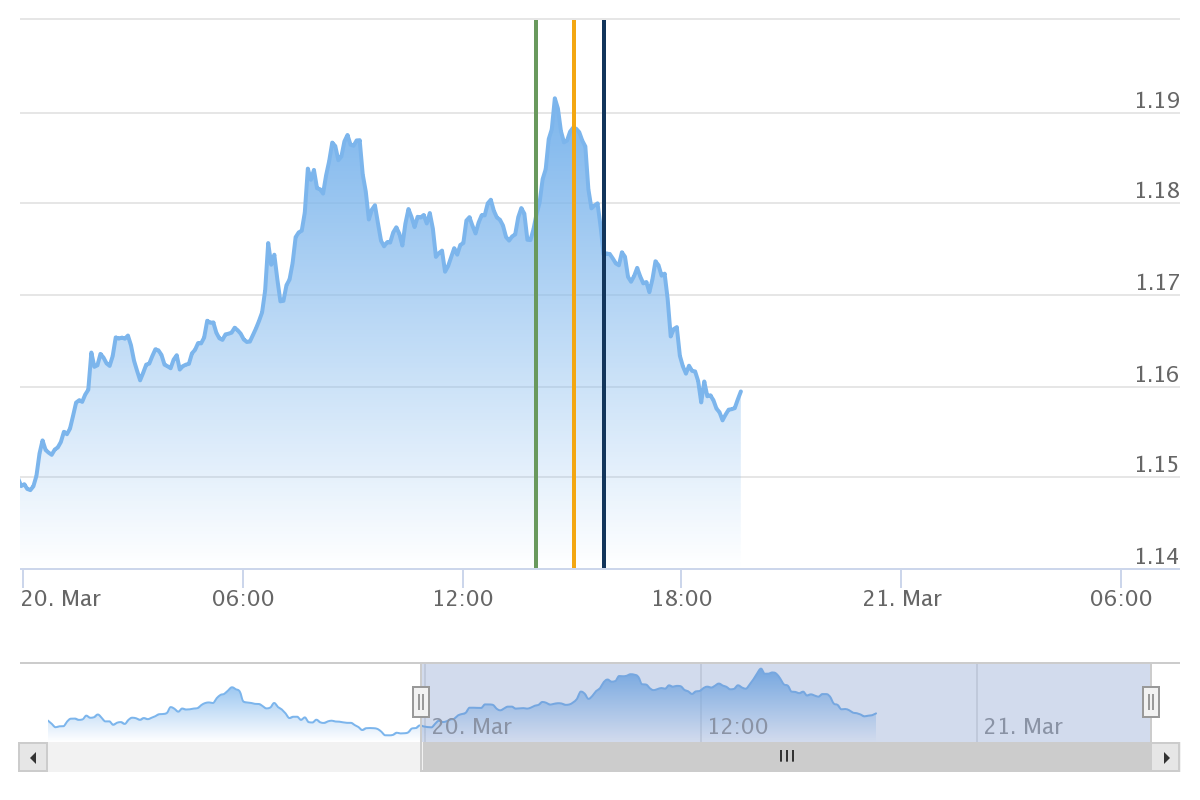

- Inflation and Curiosity Charges: The numerous inflationary pressures skilled globally, significantly within the UK and US, have led to aggressive rate of interest hikes by each the BoE and the Fed. The relative tempo and magnitude of those hikes have considerably impacted the GBP/USD. Durations the place the BoE hikes extra aggressively than the Fed have tended to strengthen the pound, and vice versa.

- Vitality Costs: The volatility in world power costs, significantly following the Russian invasion of Ukraine, has had a major impression on each the UK and US economies, influencing the GBP/USD. Greater power costs are inclined to put downward strain on each economies, impacting the relative power of their currencies.

- International Financial Development: The worldwide financial outlook continues to affect the GBP/USD. Durations of robust world development are inclined to assist each currencies, whereas intervals of slower development or recessionary fears are inclined to put downward strain on each.

- Political Stability: Political stability in each the UK and the US performs a vital function. Durations of political uncertainty or instability are inclined to weaken the respective currencies, impacting the GBP/USD.

- Market Sentiment: Market sentiment, reflecting investor confidence and threat urge for food, performs a major function in influencing the GBP/USD. Durations of elevated threat aversion are inclined to weaken each currencies, whereas intervals of elevated threat urge for food are inclined to strengthen them.

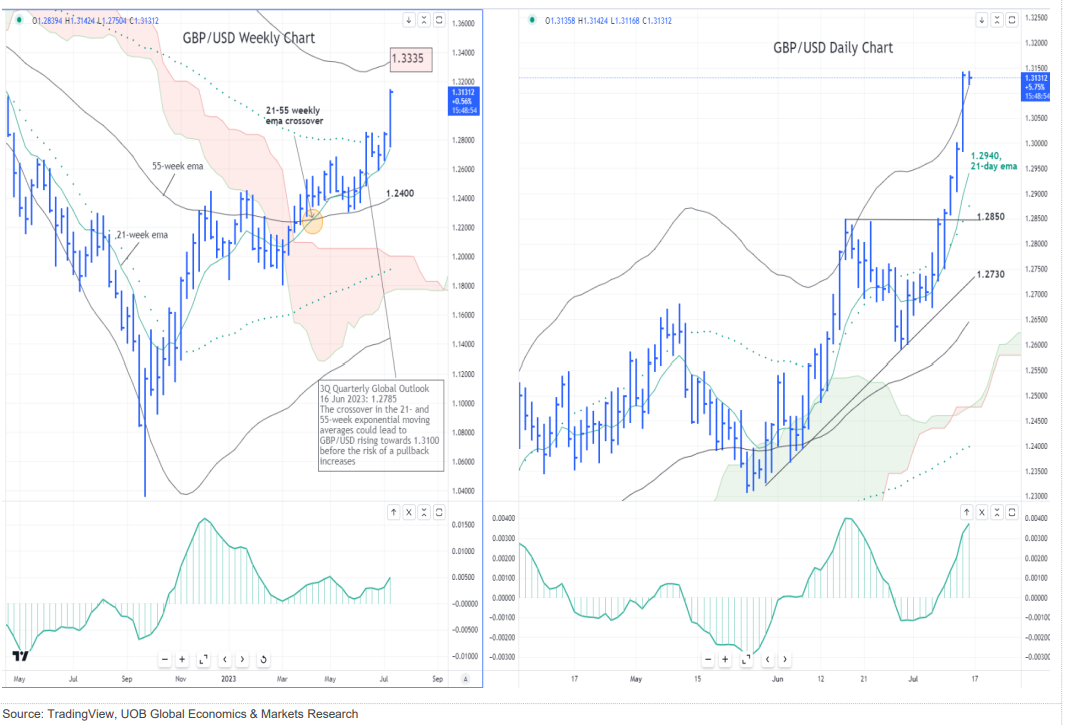

Analyzing the GBP/USD Chart: Technical and Elementary Evaluation

Analyzing the GBP/USD chart requires a mix of technical and elementary evaluation. Technical evaluation entails finding out value charts and figuring out patterns to foretell future value actions. This contains inspecting indicators corresponding to shifting averages, assist and resistance ranges, and candlestick patterns.

Elementary evaluation, however, focuses on the underlying financial and political elements influencing the trade charge. This entails inspecting macroeconomic knowledge corresponding to GDP development, inflation charges, rates of interest, present account balances, and political developments.

By combining technical and elementary evaluation, merchants and traders can develop a extra complete understanding of the GBP/USD trade charge and make extra knowledgeable buying and selling selections.

Future Outlook: Predicting the GBP/USD Change Fee

Predicting future actions within the GBP/USD trade charge is inherently difficult as a result of multitude of things concerned. Nevertheless, a number of key elements are more likely to proceed shaping the trade charge within the coming years:

- The UK’s post-Brexit financial trajectory: The long-term financial penalties of Brexit will proceed to play a major function. The UK’s capability to forge new commerce offers, entice funding, and preserve financial stability shall be essential in figuring out the pound’s worth.

- International financial development: The tempo of worldwide financial development will proceed to affect the GBP/USD. A robust world financial system is more likely to assist each currencies, whereas a weaker world financial system might put downward strain on each.

- Financial coverage divergence: The divergence in financial coverage between the BoE and the Fed will proceed to be a key issue. The relative tempo and magnitude of rate of interest hikes will considerably impression the GBP/USD.

- Geopolitical dangers: International geopolitical occasions will proceed to affect the trade charge. Elevated geopolitical uncertainty is more likely to weaken each currencies.

Conclusion:

The GBP/USD trade charge chart supplies a wealthy tapestry of financial and political occasions over the previous 20 years. Understanding the historic traits, the impression of great occasions like the worldwide monetary disaster and Brexit, and the interaction of varied financial and political elements is essential for navigating the complexities of this vital foreign money pair. Whereas predicting the longer term is inconceivable, by rigorously analyzing each technical and elementary indicators, traders and companies can develop a extra knowledgeable perspective on potential future actions within the GBP/USD trade charge and make strategic selections accordingly. Steady monitoring of financial knowledge, political developments, and market sentiment is crucial for staying forward of the curve on this dynamic and ever-evolving market.

Closure

Thus, we hope this text has supplied useful insights into Decoding the GBP/USD Change Fee Chart: A Two-Decade Journey and Future Outlook. We respect your consideration to our article. See you in our subsequent article!