Decoding the International Gold Worth Chart: A Complete Information

Associated Articles: Decoding the International Gold Worth Chart: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the International Gold Worth Chart: A Complete Information. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the International Gold Worth Chart: A Complete Information

Gold, a timeless image of wealth, stability, and luxurious, has captivated humanity for millennia. Its worth, nonetheless, is much from static. Fluctuating always primarily based on a posh interaction of financial, geopolitical, and market forces, understanding the worldwide gold worth chart is essential for traders, companies, and anybody within the treasured metallic’s trajectory. This text delves deep into the elements influencing gold costs, deciphering the chart’s actions, and providing insights into predicting future tendencies.

Understanding the Chart’s Anatomy:

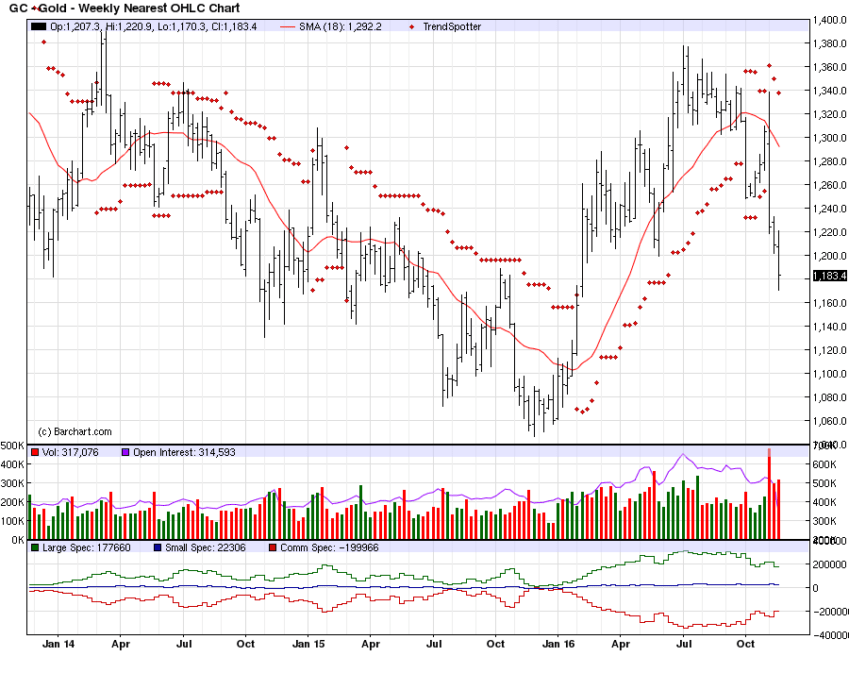

Earlier than we dive into the intricacies of worth actions, it is important to know how a typical gold worth chart is offered. Most charts show the value of gold (often expressed in US {dollars} per troy ounce) over a selected interval, starting from minutes to a long time. Widespread chart sorts embrace:

- Line charts: These present the value’s development over time, revealing tendencies and patterns.

- Candlestick charts: These supply a extra detailed view, incorporating opening, closing, excessive, and low costs for a selected interval (e.g., every day, hourly). The "physique" of the candle represents the value vary between the open and shut, whereas the "wicks" present the excessive and low costs. Inexperienced or white candles sometimes point out a worth improve, whereas crimson or black candles point out a lower.

- Bar charts: Much like candlestick charts, bar charts show the excessive, low, open, and shut costs for a given interval utilizing vertical bars.

Most charts additionally embrace further options akin to:

- Shifting averages: These clean out worth fluctuations, highlighting underlying tendencies. Widespread transferring averages embrace 50-day, 100-day, and 200-day averages.

- Technical indicators: These use mathematical formulation to investigate worth patterns and predict future actions. Examples embrace Relative Energy Index (RSI), Shifting Common Convergence Divergence (MACD), and Bollinger Bands.

- Quantity indicators: These present the buying and selling quantity for a given interval, providing insights into market sentiment and the power of worth actions.

Elements Influencing International Gold Costs:

The worth of gold is a dynamic entity, influenced by a mess of things:

-

US Greenback Energy: Gold is priced in US {dollars}. A stronger greenback typically results in decrease gold costs, because it turns into dearer for holders of different currencies to purchase gold. Conversely, a weaker greenback sometimes boosts gold costs.

-

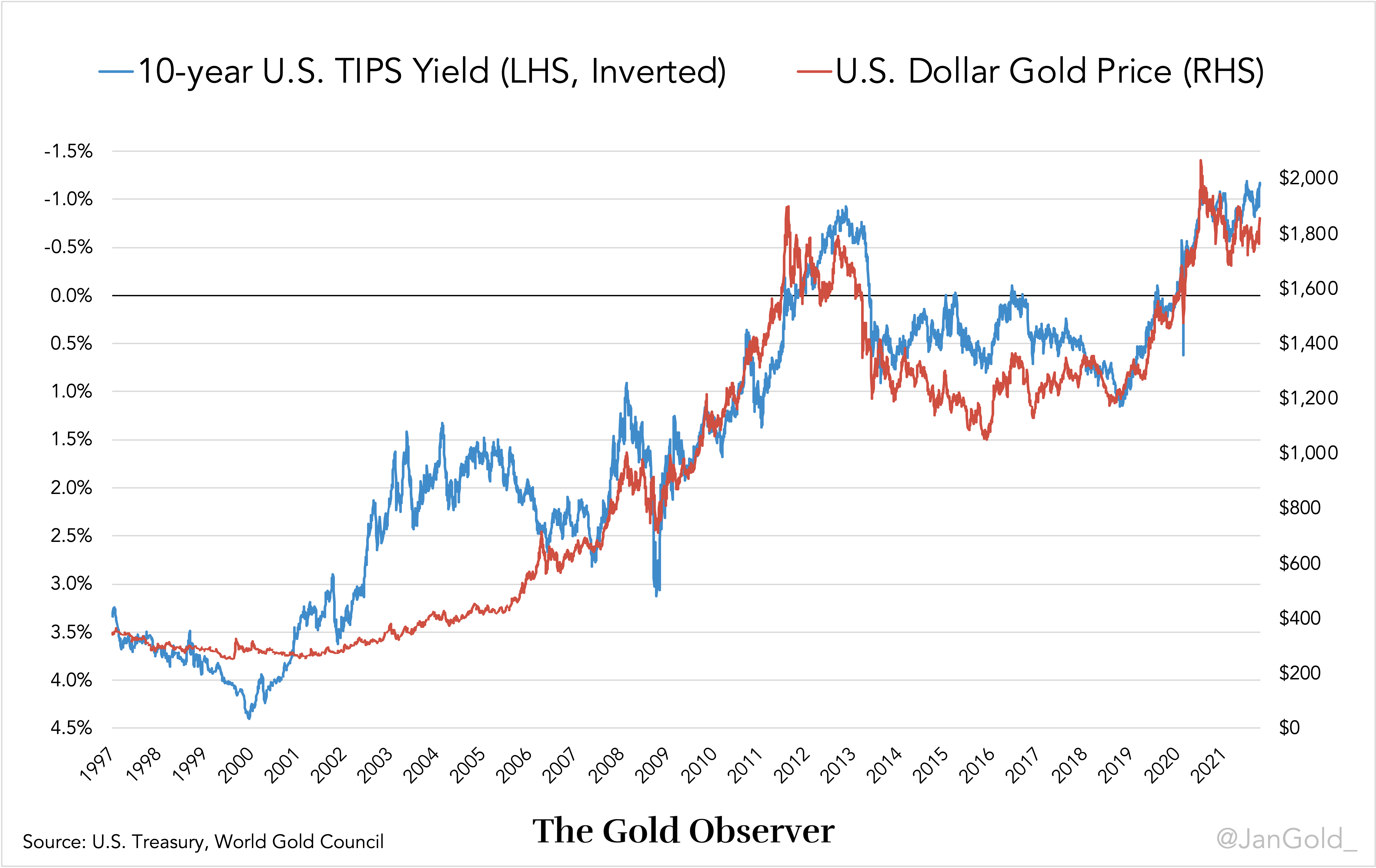

Curiosity Charges: Greater rates of interest make holding non-interest-bearing property like gold much less engaging. Buyers could shift their funds in the direction of interest-bearing investments, placing downward stress on gold costs. Decrease rates of interest, then again, can enhance gold’s enchantment.

-

Inflation: Gold is usually thought-about a hedge towards inflation. In periods of excessive inflation, when the buying energy of fiat currencies declines, traders typically flock to gold as a retailer of worth, driving up its worth.

-

Geopolitical Uncertainty: International political instability, wars, and terrorist assaults typically set off a "flight to security," with traders in search of refuge in gold’s perceived safe-haven standing. This elevated demand pushes gold costs greater.

-

Provide and Demand: Like every commodity, gold’s worth is influenced by the interaction of provide and demand. Elevated mining manufacturing can put downward stress on costs, whereas robust demand from traders, jewelers, and central banks can drive costs up.

-

Central Financial institution Exercise: Central banks play a major position within the gold market. Their shopping for or promoting of gold can considerably influence costs. As an illustration, large-scale purchases by central banks in rising economies can create upward stress.

-

Funding Demand: The demand for gold as an funding automobile is an important driver of its worth. Alternate-traded funds (ETFs) backed by bodily gold considerably affect market dynamics. Investor sentiment, influenced by financial forecasts and market tendencies, performs a pivotal position.

-

Industrial Demand: Gold’s use in electronics and different industries contributes to its demand. Technological developments and industrial progress can have an effect on gold’s worth.

-

Forex Devaluation: When a rustic’s forex devalues considerably, traders typically flip to gold as a safer various, resulting in elevated demand and better costs.

Decoding the Chart’s Actions:

Analyzing the gold worth chart requires cautious consideration of the elements talked about above. As an illustration, a pointy upward spike would possibly point out a flight to security pushed by geopolitical occasions, whereas a gradual decline might replicate rising rates of interest. Figuring out tendencies and patterns requires a mixture of technical evaluation (utilizing chart patterns and indicators) and basic evaluation (contemplating financial and geopolitical elements).

Predicting Future Developments:

Predicting future gold costs is inherently difficult, given the advanced interaction of things. Nevertheless, by rigorously analyzing the chart, contemplating financial indicators, and monitoring geopolitical developments, one can kind educated estimations. Lengthy-term forecasts typically contain contemplating elements like international financial progress, inflation charges, and central financial institution insurance policies. Brief-term predictions would possibly give attention to technical evaluation and market sentiment.

Conclusion:

The worldwide gold worth chart is a dynamic illustration of a posh market. Understanding the elements influencing its actions, deciphering chart patterns, and making use of each technical and basic evaluation are essential for navigating this market successfully. Whereas predicting future worth actions with certainty is not possible, a radical understanding of the underlying dynamics empowers knowledgeable decision-making for traders and companies alike. Constantly monitoring the chart, alongside financial information and geopolitical developments, stays important for staying abreast of the ever-evolving gold market. Bear in mind to seek the advice of with monetary professionals earlier than making any funding selections associated to gold. This text supplies basic data and shouldn’t be thought-about monetary recommendation.

:max_bytes(150000):strip_icc()/Goldchart-997cf958e5b941a79e319b82a078283f.jpg)

Closure

Thus, we hope this text has supplied useful insights into Decoding the International Gold Worth Chart: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!