Decoding the Gold Worth Chart on TradingView: A Complete Information for Merchants

Associated Articles: Decoding the Gold Worth Chart on TradingView: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Gold Worth Chart on TradingView: A Complete Information for Merchants. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Gold Worth Chart on TradingView: A Complete Information for Merchants

Gold, a timeless haven asset, has captivated buyers for millennia. Its worth, nevertheless, is something however static, fluctuating primarily based on a posh interaction of financial components, geopolitical occasions, and market sentiment. Understanding these actions is essential for anybody trying to commerce gold, and TradingView, with its complete charting instruments and analytical capabilities, presents a useful platform for this objective. This text delves deep into deciphering the gold worth chart on TradingView, exploring varied technical indicators, basic evaluation concerns, and threat administration methods.

Understanding the Gold Worth Chart on TradingView:

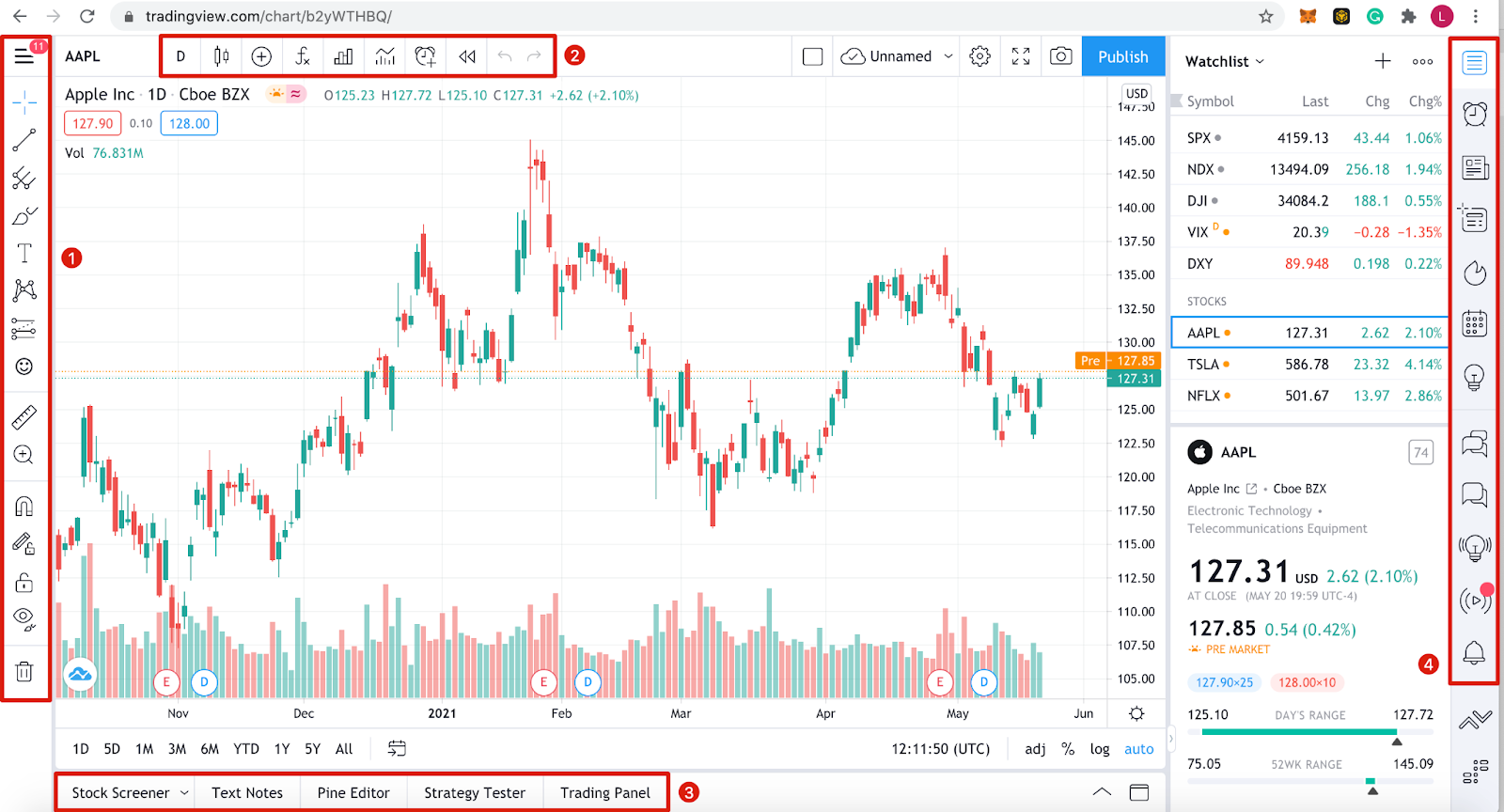

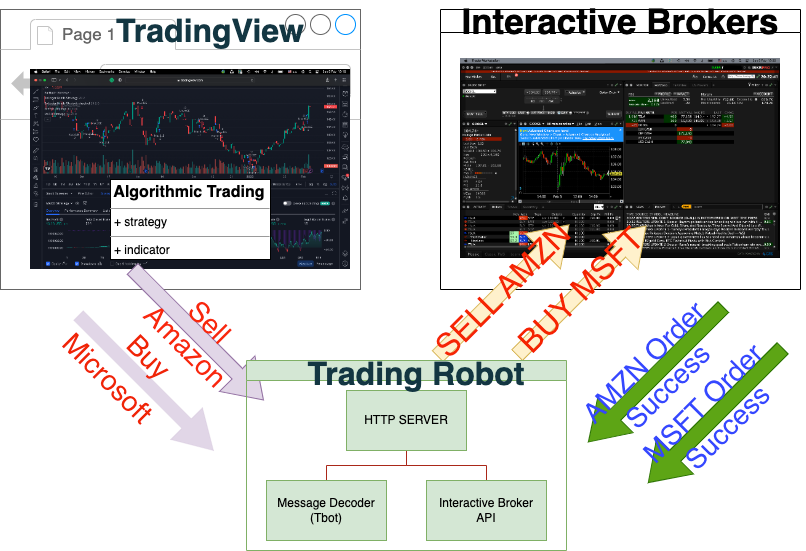

TradingView supplies a user-friendly interface for accessing real-time gold worth information from varied sources. You possibly can select from completely different chart varieties (candlestick, bar, line), timeframes (from intraday to month-to-month), and overlay varied technical indicators to achieve a holistic view of the market. The platform’s energy lies in its means to mix worth motion with analytical instruments, empowering merchants to make knowledgeable choices.

Key Components of the Gold Worth Chart:

- Worth Axis (Y-axis): Represents the value of gold, usually expressed in US {dollars} per troy ounce.

- Time Axis (X-axis): Shows the time interval, starting from seconds to years, relying on the chosen timeframe.

- Candlesticks/Bars: Visible representations of worth actions inside a particular time interval. The physique of the candlestick reveals the opening and shutting costs, whereas the wicks characterize the excessive and low costs. Bullish candles (inexperienced/white) point out a closing worth greater than the opening worth, whereas bearish candles (crimson/black) point out the alternative.

- Shifting Averages (MA): Smoothened variations of the value information, serving to to determine tendencies and potential help/resistance ranges. Frequent MAs embody Easy Shifting Common (SMA), Exponential Shifting Common (EMA), and Weighted Shifting Common (WMA). The 20, 50, 100, and 200-day MAs are regularly used.

- Relative Energy Index (RSI): A momentum oscillator that measures the magnitude of latest worth adjustments to guage overbought and oversold circumstances. Readings above 70 usually counsel overbought circumstances, whereas readings beneath 30 point out oversold circumstances.

- MACD (Shifting Common Convergence Divergence): One other momentum indicator that identifies adjustments within the energy, route, momentum, and period of a development. It consists of a MACD line, a sign line, and a histogram. Crossovers between the MACD and sign strains can sign potential purchase or promote alternatives.

- Bollinger Bands: Envelopes plotted round a shifting common, usually the SMA, displaying worth volatility. The bands widen in periods of excessive volatility and slim in periods of low volatility. Worth breakouts from the bands can sign important worth actions.

- Fibonacci Retracements: Primarily based on the Fibonacci sequence, these retracements determine potential help and resistance ranges throughout worth corrections.

- Assist and Resistance Ranges: Worth ranges the place the value has traditionally struggled to interrupt by means of. Assist ranges act as potential shopping for alternatives, whereas resistance ranges act as potential promoting alternatives.

Basic Evaluation and Gold Costs:

Whereas technical evaluation focuses on worth charts, basic evaluation considers macroeconomic components influencing gold’s worth. These embody:

- US Greenback Energy: Gold is inversely correlated with the US greenback. A stronger greenback usually results in decrease gold costs, and vice versa. TradingView lets you overlay the USD index chart alongside the gold chart for comparative evaluation.

- Inflation: Gold is usually seen as a hedge towards inflation. Larger inflation charges usually drive up gold costs as buyers search to guard their buying energy. Inflation information releases, such because the Client Worth Index (CPI), can considerably affect gold costs.

- Curiosity Charges: Larger rates of interest improve the chance price of holding non-yielding belongings like gold, doubtlessly resulting in decrease gold costs. Conversely, decrease rates of interest can enhance gold’s attractiveness. Central financial institution bulletins relating to rate of interest choices are essential occasions to watch.

- Geopolitical Occasions: Political instability, wars, and different geopolitical uncertainties usually drive buyers in the direction of safe-haven belongings like gold, pushing costs greater. Information occasions and geopolitical threat indices could be useful sources of data.

- Provide and Demand: The general provide and demand dynamics of gold affect its worth. Mining manufacturing, central financial institution shopping for/promoting, and jewellery demand all play a job.

Buying and selling Methods utilizing TradingView’s Gold Chart:

TradingView allows the implementation of assorted buying and selling methods:

- Development Following: Figuring out the prevailing development (uptrend or downtrend) utilizing shifting averages, development strains, and different indicators, after which buying and selling within the route of the development.

- Imply Reversion: Figuring out overbought or oversold circumstances utilizing oscillators like RSI and MACD, and anticipating a worth reversal in the direction of the imply.

- Breakout Buying and selling: Figuring out worth breakouts from help/resistance ranges, development strains, or Bollinger Bands, and coming into trades within the route of the breakout.

- Scalping: Making the most of short-term worth fluctuations for small income.

- Swing Buying and selling: Holding positions for a number of days or perhaps weeks, capitalizing on intermediate-term worth swings.

Threat Administration:

Efficient threat administration is paramount in gold buying and selling. TradingView facilitates this by means of:

- Cease-Loss Orders: Routinely exiting a commerce when the value reaches a predetermined stage, limiting potential losses.

- Take-Revenue Orders: Routinely exiting a commerce when the value reaches a predetermined stage, securing income.

- Place Sizing: Figuring out the suitable quantity of capital to allocate to every commerce, minimizing threat publicity.

- Diversification: Spreading investments throughout completely different belongings to scale back general portfolio threat.

Conclusion:

TradingView presents a robust platform for analyzing the gold worth chart and growing efficient buying and selling methods. By combining technical evaluation with basic evaluation, using applicable threat administration strategies, and constantly studying and adapting, merchants can enhance their probabilities of success within the dynamic gold market. Nonetheless, it is essential to do not forget that gold buying and selling includes inherent dangers, and no technique ensures income. Thorough analysis, disciplined buying and selling, and a sensible understanding of market dynamics are important for long-term success. Using TradingView’s instructional assets and group options can additional improve your understanding and expertise in gold worth chart evaluation. Bear in mind to all the time apply accountable buying and selling and handle your threat successfully.

Closure

Thus, we hope this text has offered useful insights into Decoding the Gold Worth Chart on TradingView: A Complete Information for Merchants. We hope you discover this text informative and helpful. See you in our subsequent article!