Decoding the Head and Shoulders Sample: A Complete Information with Chart Examples

Associated Articles: Decoding the Head and Shoulders Sample: A Complete Information with Chart Examples

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Head and Shoulders Sample: A Complete Information with Chart Examples. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Head and Shoulders Sample: A Complete Information with Chart Examples

The top and shoulders sample is a basic chart formation in technical evaluation, famend for its reliability in predicting worth reversals. This highly effective indicator alerts a possible shift from an uptrend to a downtrend, providing merchants a useful alternative to anticipate market actions and handle their threat. Whereas not foolproof, understanding its elements, variations, and limitations is essential for efficient implementation. This text will delve deep into the pinnacle and shoulders sample, offering a complete information with illustrative chart examples.

Understanding the Anatomy of a Head and Shoulders Sample

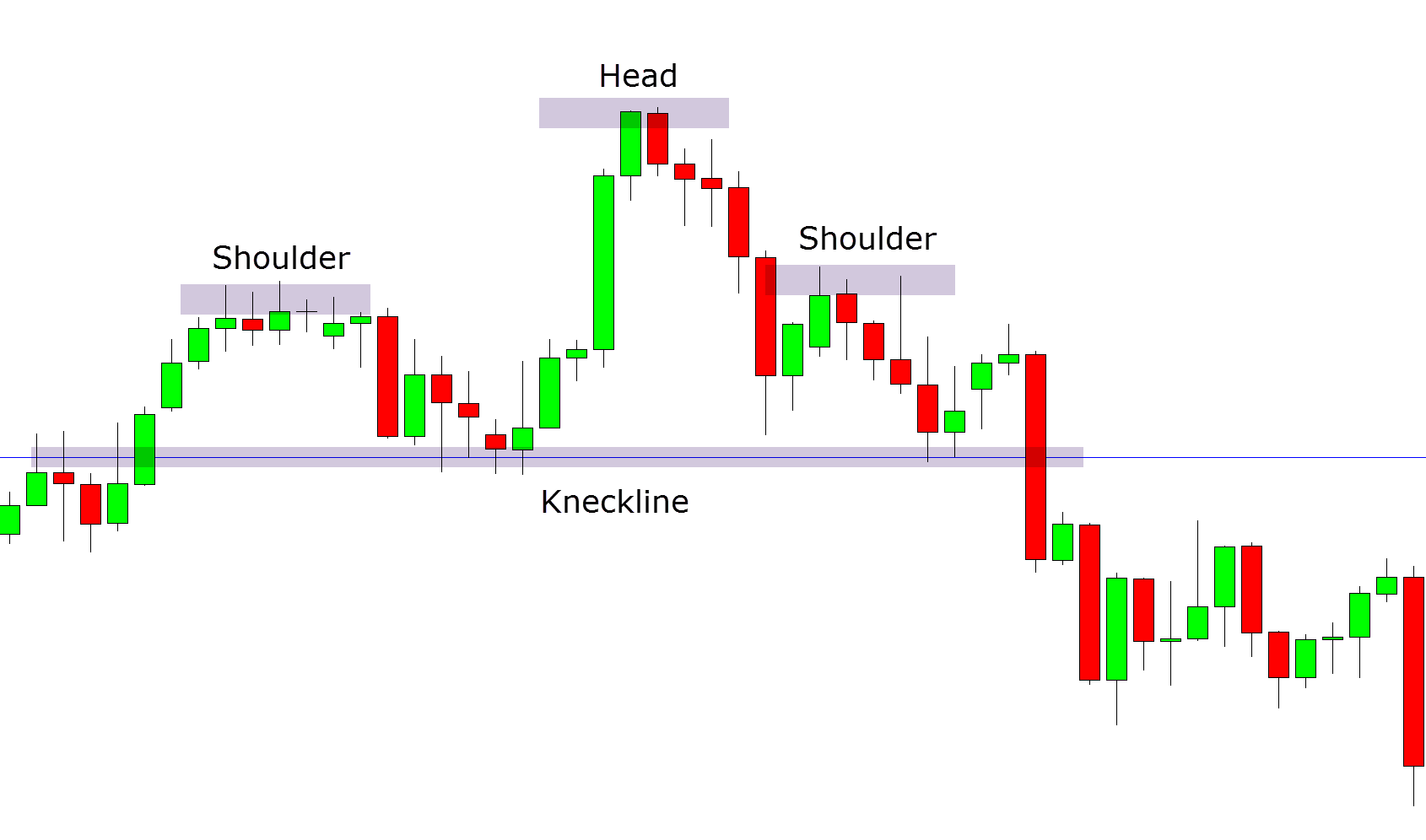

The top and shoulders sample is characterised by three distinct peaks, resembling a head and two shoulders. Let’s break down every element:

-

Left Shoulder: That is the preliminary peak, representing a major worth improve adopted by a pullback. It types the primary excessive level of the sample. The amount related to this peak is often comparatively excessive, indicating sturdy shopping for stress.

-

Head: That is the best peak in the complete formation, signifying the fruits of the uptrend. The top represents a surge in shopping for stress exceeding that of the left shoulder, usually accompanied by considerably greater quantity than the shoulder.

-

Proper Shoulder: This peak is usually barely decrease than the pinnacle, indicating weakening shopping for stress. It resembles the left shoulder in form and signifies a possible exhaustion of the uptrend. Quantity is usually decrease than the pinnacle however greater than the next neckline breakout.

-

Neckline: This can be a essential aspect, shaped by connecting the troughs between the left shoulder, head, and proper shoulder. It acts as a help stage through the formation of the sample and serves as a key affirmation level for the bearish sign. A break under the neckline confirms the sample and triggers the promote sign.

-

Affirmation: The sample is confirmed when the value breaks under the neckline. This breakout is commonly accompanied by elevated quantity, additional reinforcing the bearish sign. The space between the pinnacle’s excessive and the neckline is commonly used as a worth goal for the potential draw back transfer.

Variations of the Head and Shoulders Sample

Whereas the basic head and shoulders sample is well recognizable, variations exist, requiring cautious commentary:

-

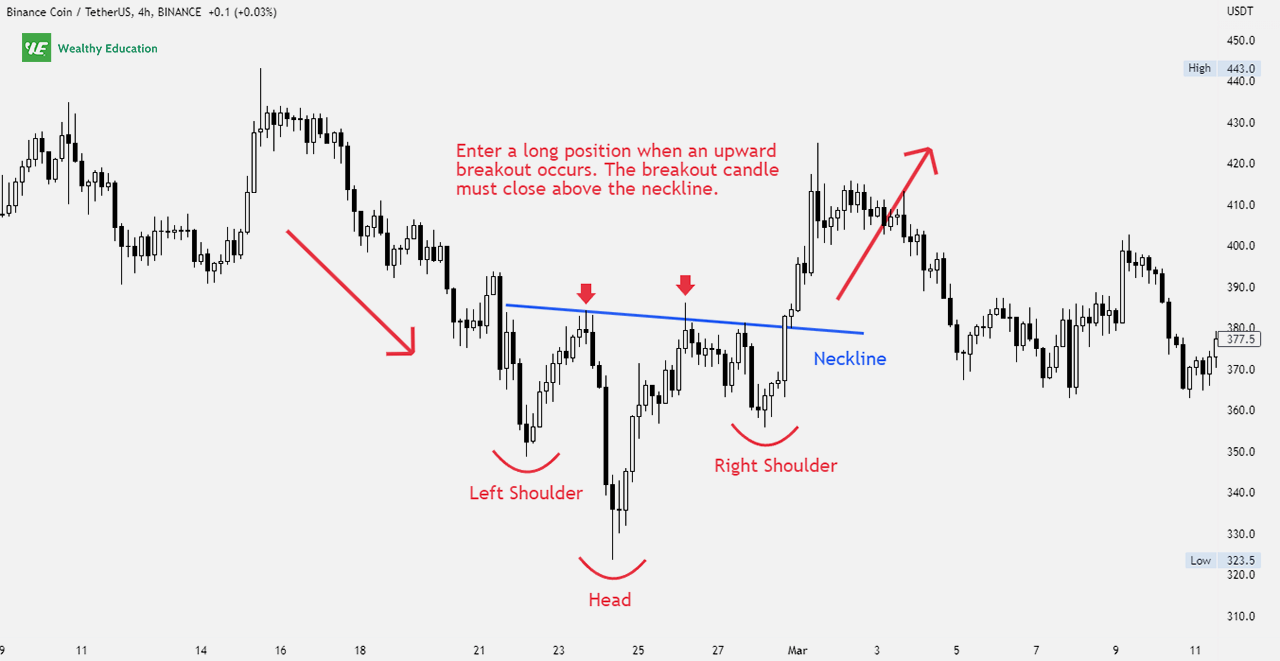

Inverse Head and Shoulders: That is the bullish counterpart of the pinnacle and shoulders sample. It alerts a possible reversal from a downtrend to an uptrend. The sample’s anatomy is mirrored, with three troughs forming the "head" and "shoulders," and a "neckline" connecting the peaks. A breakout above the neckline confirms the sample.

-

Broad Head and Shoulders: This variation options wider and extra prolonged shoulders and head, resulting in an extended formation time. The broader formation can typically provide a extra vital worth motion after the neckline breakout.

-

Rounded Head and Shoulders: On this variation, the peaks and troughs are much less outlined and seem extra rounded, making identification barely more difficult. Nonetheless, the underlying precept of three peaks and a neckline stays the identical.

-

Head and Shoulders with A number of Shoulders: Hardly ever, patterns would possibly exhibit greater than two shoulders. Whereas the core precept holds, analyzing these patterns requires cautious consideration of quantity and general market context.

Chart Examples: Illustrating the Head and Shoulders Sample

(Notice: As a result of limitations of this text-based format, I can’t immediately show charts. Nonetheless, I’ll describe eventualities that will help you visualize the patterns on any charting software program you employ. Seek for "Head and Shoulders Sample Chart Examples" on Google Pictures for visible representations.)

Instance 1: Basic Bearish Head and Shoulders Sample:

Think about a chart exhibiting a transparent uptrend. Then, observe three distinct peaks. The primary (left shoulder) is adopted by a trough, then the next peak (the pinnacle), adopted by one other trough, and eventually, a barely decrease peak (the fitting shoulder). Connecting the troughs types a transparent neckline. A subsequent break under the neckline with elevated quantity confirms the sample, indicating a possible worth drop. The worth goal is commonly estimated as the gap between the pinnacle’s excessive and the neckline, measured downwards from the breakout level.

Instance 2: Inverse Head and Shoulders Sample:

Take into account a chart exhibiting a downtrend. Now, observe three distinct troughs. The primary (left shoulder) is adopted by a peak, then a decrease trough (the pinnacle), adopted by one other peak, and eventually, a barely greater trough (the fitting shoulder). Connecting the peaks types a neckline. A breakout above the neckline with elevated quantity confirms the sample, suggesting a possible worth improve. The worth goal is commonly estimated as the gap between the pinnacle’s low and the neckline, measured upwards from the breakout level.

Figuring out False Breakouts and Limitations

It is essential to acknowledge that not each head and shoulders sample results in a profitable worth reversal. False breakouts can happen, the place the value briefly breaks the neckline however then reverses. A number of elements can contribute to false alerts:

-

Inadequate Quantity: A breakout with out vital quantity improve is a warning signal. Robust quantity confirms the bearish or bullish stress driving the break.

-

Market Context: Ignoring broader market developments and information occasions can result in misinterpretations. Important macroeconomic elements or company-specific information can override technical patterns.

-

Poorly Outlined Sample: Ambiguous formations with unclear peaks, troughs, and necklines are much less dependable. A well-defined sample is crucial for correct interpretation.

-

Affirmation is Key: Relying solely on the sample formation with out affirmation from different indicators (e.g., shifting averages, RSI, MACD) will increase the chance of false alerts.

Combining Head and Shoulders with Different Indicators

For enhanced accuracy, combining the pinnacle and shoulders sample with different technical indicators is extremely really helpful. This strategy reduces the probability of false alerts and improves the general buying and selling technique. Some generally used indicators embrace:

-

Shifting Averages: Confirming the pattern route earlier than and after the neckline breakout.

-

Relative Power Index (RSI): Figuring out overbought or oversold circumstances, which might coincide with the sample’s formation and breakout.

-

Shifting Common Convergence Divergence (MACD): Detecting momentum shifts and confirming the pattern reversal.

-

Quantity Indicators: Analyzing quantity adjustments through the sample’s formation and breakout for affirmation.

Conclusion:

The top and shoulders sample is a useful instrument in a dealer’s arsenal, providing insights into potential worth reversals. Nonetheless, it is essential to know its anatomy, variations, and limitations. Combining the sample with different technical indicators, contemplating market context, and punctiliously analyzing quantity adjustments are important for bettering the accuracy of buying and selling selections primarily based on this highly effective chart formation. Keep in mind, threat administration is paramount, and no technical indicator is foolproof. At all times use stop-loss orders to guard your capital and by no means make investments greater than you possibly can afford to lose.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Head and Shoulders Sample: A Complete Information with Chart Examples. We recognize your consideration to our article. See you in our subsequent article!