Decoding the Inverse Head and Shoulders Sample: A Complete Information for Charting Success

Associated Articles: Decoding the Inverse Head and Shoulders Sample: A Complete Information for Charting Success

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding the Inverse Head and Shoulders Sample: A Complete Information for Charting Success. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Inverse Head and Shoulders Sample: A Complete Information for Charting Success

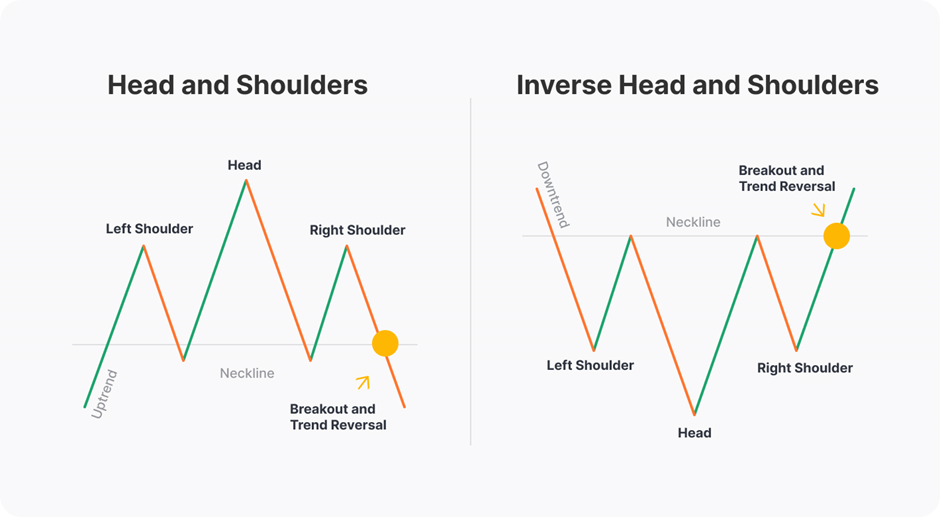

The Inverse Head and Shoulders (IHS) sample is a strong chart formation in technical evaluation, signaling a possible bullish reversal in a downtrend. Acknowledged for its distinct three-peak construction, it provides merchants a high-probability setup for getting into lengthy positions. Nonetheless, understanding its nuances, affirmation strategies, and danger administration methods is essential for profitable implementation. This text delves deep into the IHS sample, offering a complete understanding for each novice and skilled merchants.

Understanding the Formation:

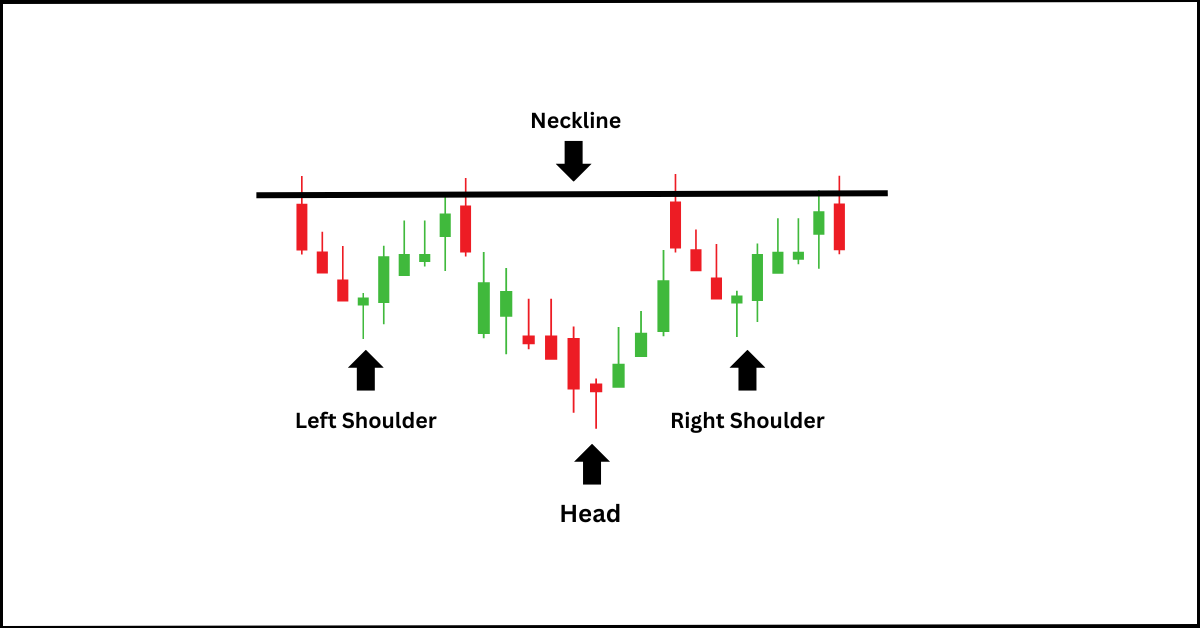

The IHS sample is actually the inverse of the basic Head and Shoulders sample. Whereas the Head and Shoulders suggests a bearish reversal, the IHS signifies a bullish one. It is characterised by three distinct troughs (lows) and two peaks (highs), forming a visible illustration resembling an inverted human head and shoulders.

- Left Shoulder: The preliminary trough, marking the start of the downtrend. That is adopted by a rally, creating the primary peak.

- Head: A subsequent deeper trough varieties, representing the bottom level of the downtrend. That is adopted by a rally that surpasses the primary peak, creating the very best peak (the top).

- Proper Shoulder: A remaining trough varieties, barely increased than the top trough however decrease than the suitable shoulder peak. This peak is often decrease than the top’s peak.

- Neckline: A vital ingredient connecting the troughs of the left shoulder and the top, forming a horizontal or barely upward-sloping trendline. The neckline acts as essential assist. A decisive break above the neckline confirms the sample.

Figuring out a Legitimate IHS Sample:

Not each three-peak formation qualifies as a sound IHS sample. A number of components have to be thought of for affirmation:

- Clear Troughs and Peaks: The troughs and peaks needs to be clearly outlined and comparatively simple to determine. Ambiguous formations needs to be prevented.

- Neckline Readability: The neckline needs to be well-defined and constant. A wavering or unclear neckline weakens the sample’s validity. Think about using a trendline device to attract the neckline precisely.

- Quantity Affirmation: Elevated quantity throughout the formation of the top and the breakout above the neckline is a powerful confirming sign. Excessive quantity throughout the head signifies sturdy promoting stress, whereas elevated quantity throughout the breakout suggests sturdy shopping for stress. Conversely, low quantity throughout the breakout can weaken the sign.

- Value Motion Affirmation: Search for different bullish alerts to assist the IHS sample, reminiscent of optimistic divergences in technical indicators (like RSI or MACD), bullish engulfing candlesticks, or a bullish pennant formation inside the sample.

- Time Body Issues: The timeframe used to determine the IHS sample influences its significance. A sample shaped on a every day chart usually carries extra weight than one shaped on a 5-minute chart.

- Head Top Measurement: The gap between the top’s low and the neckline is usually used to mission the worth goal. As soon as the neckline is damaged, including this distance to the breakout level can present a possible worth goal for the bullish transfer.

Affirmation and Entry Methods:

Probably the most essential side of buying and selling the IHS sample is affirmation. Ready for a transparent breakout above the neckline minimizes the danger of false alerts. A number of affirmation methods exist:

- Neckline Breakout: The commonest affirmation is a decisive shut above the neckline. The breakout ought to ideally have sturdy quantity to bolster its significance.

- Retest of the Neckline: After the preliminary breakout, the worth may pull again and retest the neckline. This retest can present a lower-risk entry level for lengthy positions, offered the worth would not break under the neckline.

- Trailing Cease-Loss: As soon as an extended place is established, a trailing stop-loss order needs to be applied to guard earnings and restrict potential losses. The stop-loss order could be adjusted as the worth strikes increased.

- Mixture with different indicators: Utilizing different technical indicators like RSI, MACD, or Bollinger Bands can present additional affirmation and assist determine optimum entry and exit factors. For instance, a bullish divergence within the RSI whereas the worth varieties the IHS sample can strengthen the bullish sign.

Threat Administration and Place Sizing:

Profitable buying and selling entails meticulous danger administration. A number of key issues apply to buying and selling the IHS sample:

- Cease-Loss Placement: A stop-loss order needs to be positioned under the neckline or barely under the low of the suitable shoulder. This limits potential losses if the sample fails to play out.

- Place Sizing: By no means danger greater than a small proportion of your buying and selling capital on a single commerce. This protects your general portfolio from vital losses.

- Commerce Administration: Repeatedly monitor the commerce and regulate your stop-loss order as the worth strikes in your favor. Take earnings strategically, somewhat than ready for the worth goal to be reached absolutely. Think about partial profit-taking to safe some features and scale back danger.

False Indicators and Limitations:

Regardless of its effectiveness, the IHS sample is just not foolproof. False alerts can happen, significantly in sideways or uneven markets. To reduce the danger of false alerts:

- Quantity Evaluation: Low quantity throughout the breakout can point out a weak sign and a possible false breakout.

- Market Context: Think about the general market development and sentiment. An IHS sample in a powerful bearish development is much less more likely to succeed.

- Affirmation Indicators: Relying solely on the IHS sample with out affirmation from different technical indicators will increase the danger of false alerts.

Superior Strategies and Variations:

- Measuring the Value Goal: The gap between the top’s low and the neckline can be utilized as a worth goal. Add this distance to the breakout level to estimate the potential worth enhance.

- Asymmetrical IHS: The IHS sample would not all the time have completely symmetrical shoulders. Asymmetrical patterns can nonetheless be legitimate, however require cautious evaluation.

- A number of Timeframe Evaluation: Confirming the sample on a number of timeframes can enhance the arrogance stage. For instance, figuring out an IHS sample on a every day chart that’s supported by the same sample on a weekly chart strengthens the sign.

Conclusion:

The Inverse Head and Shoulders sample is a worthwhile device for figuring out potential bullish reversals. Nonetheless, profitable buying and selling requires a radical understanding of its formation, affirmation strategies, and danger administration methods. Combining the IHS sample with different technical indicators and sound danger administration practices considerably will increase the possibilities of worthwhile trades. Keep in mind, no buying and selling technique is foolproof, and steady studying and adaptation are essential for long-term success within the markets. All the time apply accountable buying and selling and take into account consulting with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Inverse Head and Shoulders Sample: A Complete Information for Charting Success. We thanks for taking the time to learn this text. See you in our subsequent article!