Decoding the Jet Gasoline Value Chart: A Complicated Panorama of International Components

Associated Articles: Decoding the Jet Gasoline Value Chart: A Complicated Panorama of International Components

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Jet Gasoline Value Chart: A Complicated Panorama of International Components. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Jet Gasoline Value Chart: A Complicated Panorama of International Components

The worth of jet gasoline, a crucial element of the airline business’s working prices, is a dynamic and complicated beast. Its fluctuations instantly impression airfares, airline profitability, and even the broader world financial system. Understanding the forces that form the jet gasoline value chart requires navigating a posh internet of geopolitical occasions, financial indicators, seasonal calls for, and technological developments. This text delves deep into the components influencing jet gasoline costs, analyzing historic tendencies and providing insights into potential future situations.

The Composition of Jet Gasoline Costs: Extra Than Simply Crude Oil

In contrast to gasoline, jet gasoline is not a instantly traded commodity in the identical means. Its value is primarily derived from the worth of crude oil, its major element. Nonetheless, it isn’t a easy one-to-one relationship. A number of different components considerably affect the ultimate value on the pump, together with:

-

Crude Oil Costs: That is essentially the most important driver. The worth of crude oil, decided by world provide and demand, varieties the muse upon which jet gasoline costs are constructed. Geopolitical instability in main oil-producing areas, OPEC manufacturing quotas, and surprising occasions like pure disasters can all drastically impression crude oil costs, and consequently, jet gasoline.

-

Refining Prices: Crude oil have to be refined into jet gasoline, a course of that consumes vitality and assets. The price of refining, together with labor, upkeep, and vitality consumption, is added to the crude oil value, contributing to the ultimate jet gasoline value. These prices can fluctuate based mostly on components like vitality costs and technological developments in refining processes.

-

Taxes and Laws: Governments impose numerous taxes and rules on jet gasoline, various significantly throughout nations. These levies add to the general value, impacting the ultimate value customers not directly pay by way of airfares. Environmental rules, geared toward lowering the carbon footprint of aviation, can even affect refining processes and doubtlessly improve prices.

-

Transportation and Distribution: Getting jet gasoline from refineries to airports entails advanced logistics, together with pipelines, tankers, and specialised storage services. Transportation prices, influenced by gasoline costs for these transport strategies and logistical efficiencies, are factored into the ultimate value.

-

Seasonal Demand: The demand for air journey, and consequently jet gasoline, fluctuates all year long. Peak journey seasons, reminiscent of summer time holidays and the vacation interval, sometimes see greater demand, driving up costs. Conversely, decrease demand throughout off-peak seasons can result in value reductions.

-

Trade Charges: The worldwide nature of the aviation business signifies that jet gasoline costs are sometimes traded in US {dollars}. Fluctuations in alternate charges can considerably impression the price of jet gasoline for airways based mostly in nations with totally different currencies. A stronger greenback could make jet gasoline dearer for airways exterior the US.

Analyzing the Jet Gasoline Value Chart: Historic Tendencies and Patterns

Inspecting historic jet gasoline value charts reveals a number of key tendencies:

-

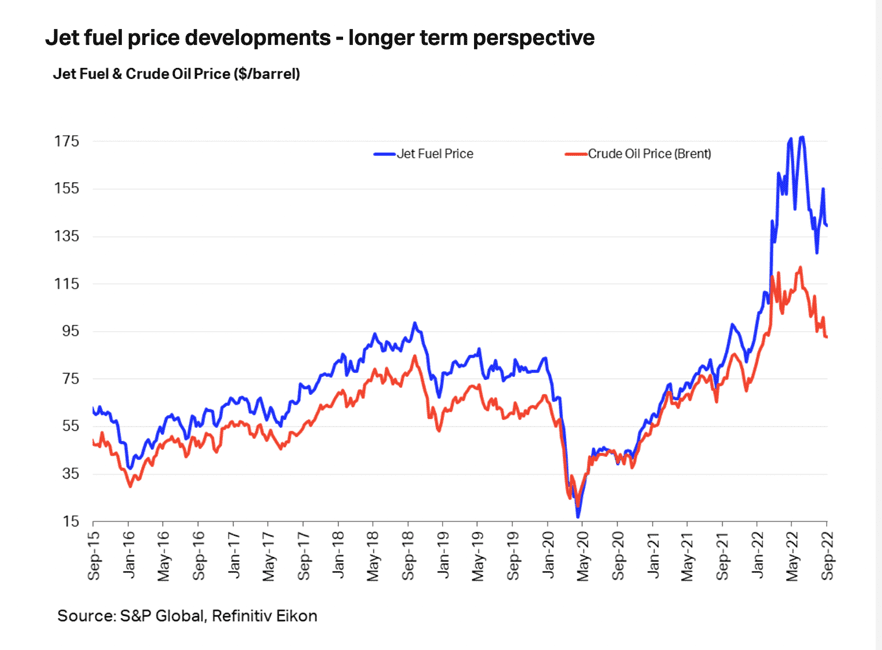

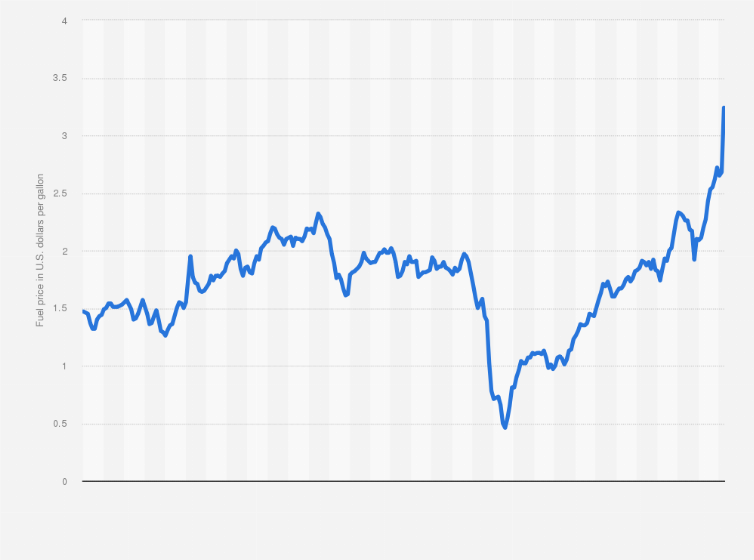

Correlation with Crude Oil: A robust optimistic correlation exists between crude oil costs and jet gasoline costs. When crude oil costs rise, jet gasoline costs usually comply with go well with, and vice versa. Nonetheless, the connection is not at all times linear, with different components sometimes influencing the hole between the 2.

-

Cyclical Nature: Jet gasoline costs exhibit cyclical patterns, mirroring the cyclical nature of the broader financial system and the aviation business. Financial booms are inclined to correlate with greater air journey demand and better jet gasoline costs, whereas recessions typically result in lowered demand and decrease costs.

-

Geopolitical Impacts: Main geopolitical occasions, reminiscent of wars, sanctions, and political instability in oil-producing areas, typically trigger important spikes in jet gasoline costs. These occasions create uncertainty within the world oil market, main to cost volatility.

-

Technological Developments: Technological improvements in plane design and engine effectivity can not directly impression jet gasoline costs. Extra fuel-efficient plane scale back the general demand for jet gasoline, doubtlessly placing downward stress on costs in the long term.

-

Provide Chain Disruptions: Surprising occasions like pure disasters or pandemics can disrupt the provision chain, resulting in non permanent shortages and value spikes. The COVID-19 pandemic, for example, drastically lowered air journey demand, initially inflicting a pointy decline in jet gasoline costs earlier than a gradual restoration.

Predicting Future Jet Gasoline Costs: A Difficult Activity

Predicting future jet gasoline costs is a posh endeavor, fraught with uncertainties. Whereas historic tendencies can present useful insights, quite a few unpredictable components can considerably affect future value actions. These embrace:

-

Geopolitical Danger: The continued battle in Ukraine, tensions within the Center East, and different geopolitical uncertainties pose important dangers to world oil provide and costs.

-

Power Transition: The worldwide shift in the direction of renewable vitality sources may finally scale back reliance on fossil fuels, doubtlessly influencing long-term jet gasoline demand and costs. Nonetheless, the transition is more likely to be gradual, with fossil fuels remaining a major a part of the vitality combine for the foreseeable future.

-

Financial Progress: International financial progress charges considerably affect air journey demand and, consequently, jet gasoline costs. Sturdy financial progress usually interprets to greater demand and better costs.

-

Technological Improvements: Additional developments in plane design, engine know-how, and different fuels may considerably impression future jet gasoline demand and costs. Sustainable aviation fuels (SAFs) are gaining traction, doubtlessly providing a extra environmentally pleasant and doubtlessly much less unstable different.

-

OPEC Insurance policies: The insurance policies and manufacturing selections of OPEC, the Group of the Petroleum Exporting Nations, proceed to play a pivotal function in shaping world oil provide and costs.

Conclusion: Navigating the Volatility

The jet gasoline value chart is a posh reflection of world forces, always shifting in response to a large number of things. Whereas predicting future costs with certainty is unimaginable, understanding the underlying drivers – from crude oil costs and refining prices to geopolitical occasions and technological developments – is essential for airways, traders, and policymakers alike. The business should adapt to the inherent volatility, implementing methods to mitigate value dangers and investing in sustainable options to scale back reliance on fossil fuels and make sure the long-term viability of air journey. Steady monitoring of world occasions, financial indicators, and technological breakthroughs stays important for navigating this dynamic and ever-evolving panorama. The jet gasoline value chart, subsequently, serves not simply as a document of previous costs however as a crucial device for understanding and anticipating the way forward for the aviation business.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Jet Gasoline Value Chart: A Complicated Panorama of International Components. We admire your consideration to our article. See you in our subsequent article!