Decoding the Jio Monetary Providers Share Worth Chart: A Deep Dive into Efficiency and Potential

Associated Articles: Decoding the Jio Monetary Providers Share Worth Chart: A Deep Dive into Efficiency and Potential

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the Jio Monetary Providers Share Worth Chart: A Deep Dive into Efficiency and Potential. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Jio Monetary Providers Share Worth Chart: A Deep Dive into Efficiency and Potential

Jio Monetary Providers (JFSL), the monetary providers arm of Reliance Industries, has generated important buzz since its itemizing. Its share value journey, nonetheless, has been something however easy, presenting a posh image for buyers. This text delves deep into the JFSL share value chart, analyzing its efficiency, figuring out key traits, and exploring the elements influencing its volatility and future potential.

The Preliminary Public Providing (IPO) and the Itemizing:

JFSL’s itemizing was distinctive, a demerger from Reliance Industries adopted by a list with no conventional IPO. This unconventional method instantly set the stage for a risky share value. Whereas the preliminary value was set, the next buying and selling noticed important fluctuations, pushed by a mix of excessive investor anticipation, market sentiment, and the inherent uncertainties surrounding a newly listed entity in a aggressive sector. Understanding this preliminary part is essential to decoding the next value actions depicted on the share value chart.

Analyzing the Chart: Key Tendencies and Patterns:

An in depth evaluation of the JFSL share value chart reveals a number of outstanding traits and patterns:

-

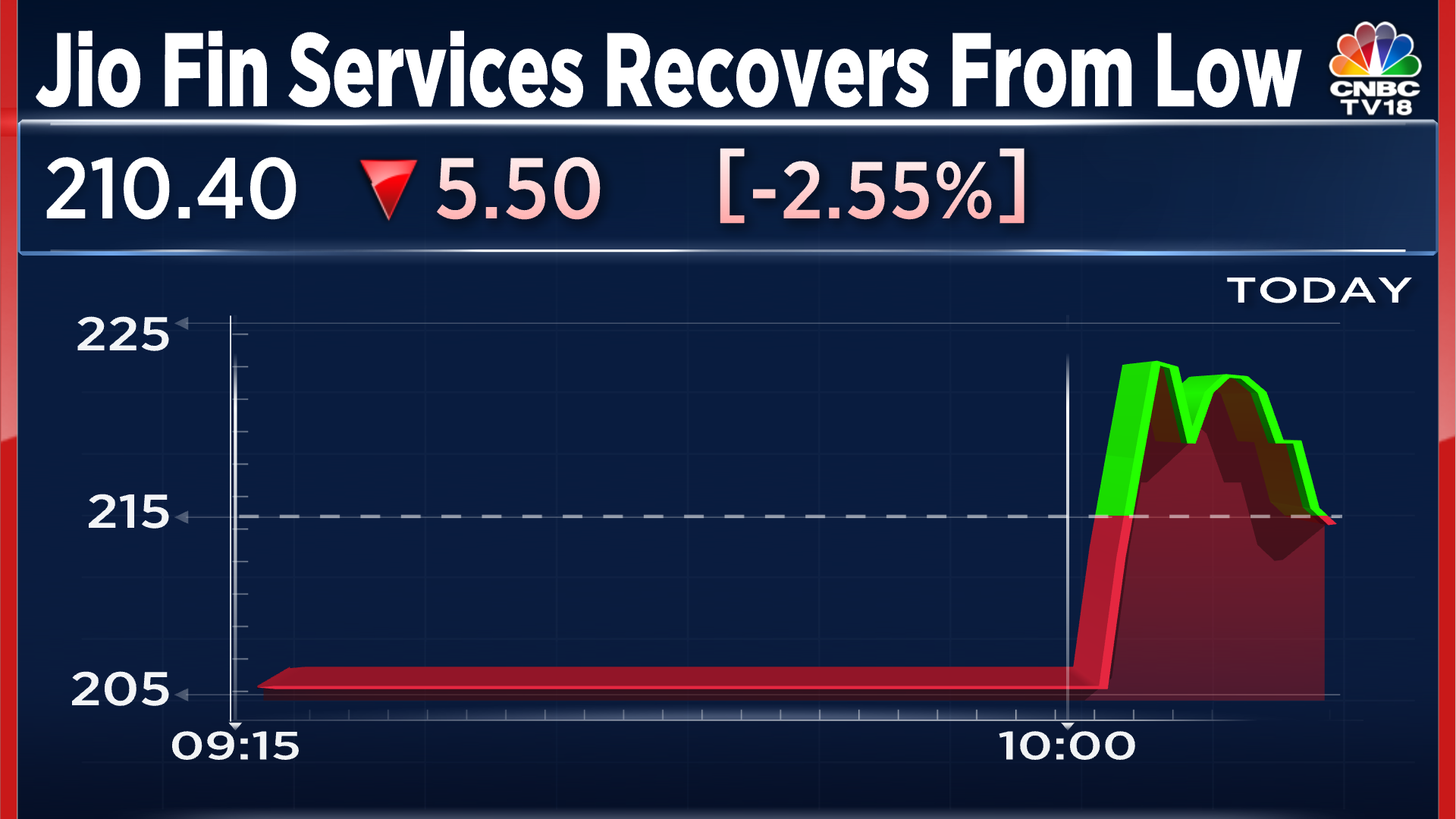

Preliminary Volatility: The post-listing interval confirmed excessive value swings, a attribute usually seen in newly listed corporations with excessive market curiosity. The chart would seemingly show sharp peaks and troughs, reflecting the speculative nature of buying and selling throughout this era. Buyers had been grappling with valuation uncertainties, and the absence of a conventional IPO value discovery mechanism amplified the volatility.

-

Influence of Market Sentiment: The broader market circumstances considerably influenced the JFSL share value. Durations of general market optimism usually correlated with increased JFSL costs, whereas bearish market sentiments usually led to declines. This underscores the significance of contemplating macroeconomic elements when decoding the share value chart.

-

Affect of Reliance Industries: Given its shut ties to Reliance Industries, JFSL’s share value has usually exhibited a level of correlation with its father or mother firm’s efficiency. Constructive information or sturdy monetary outcomes from Reliance Industries might translate into optimistic sentiment and value appreciation for JFSL. Conversely, unfavourable information relating to Reliance Industries might impression JFSL negatively. The chart ought to mirror this interconnectedness.

-

Sectoral Efficiency: The monetary providers sector itself performed a job in shaping JFSL’s value trajectory. Constructive regulatory adjustments, financial progress, or enhancements within the general monetary sector well being might increase JFSL’s value. Conversely, unfavourable developments inside the sector, akin to tightening credit score circumstances or elevated competitors, might result in value declines.

-

Information and Bulletins: Particular information occasions and bulletins associated to JFSL instantly influenced its share value. Bulletins regarding strategic partnerships, new product launches, growth plans, monetary efficiency updates, and regulatory approvals all had a demonstrable impression on the chart. Important value actions usually coincided with such occasions.

-

Technical Evaluation Indicators: Technical evaluation instruments, akin to transferring averages, Relative Energy Index (RSI), and quantity evaluation, might be utilized to the JFSL share value chart to determine potential help and resistance ranges, pattern reversals, and momentum adjustments. These indicators might present insights into potential future value actions, though they need to be used along side basic evaluation.

Basic Evaluation: Assessing the Underlying Worth:

Understanding the share value chart requires a complementary basic evaluation. This entails analyzing JFSL’s:

-

Enterprise Mannequin: JFSL’s enterprise mannequin, encompassing varied monetary providers, wants cautious analysis. Its aggressive benefits, market penetration methods, and the potential for progress inside every phase are essential elements.

-

Monetary Efficiency: Analyzing JFSL’s monetary statements, together with income, profitability, and debt ranges, is crucial to evaluate its monetary well being and sustainability. This data helps decide whether or not the present share value displays the underlying worth of the corporate.

-

Administration Crew: The expertise and experience of JFSL’s administration group are key elements influencing investor confidence and the corporate’s long-term prospects.

-

Aggressive Panorama: Analyzing the aggressive panorama inside the Indian monetary providers sector is essential. JFSL faces competitors from established gamers and new entrants. Understanding its aggressive positioning and skill to distinguish itself is important.

-

Regulatory Setting: The regulatory atmosphere in India considerably impacts the monetary providers sector. Adjustments in laws might current each alternatives and challenges for JFSL.

Decoding the Chart within the Context of Threat and Reward:

The JFSL share value chart, when considered alongside basic evaluation, gives a complete image of the funding alternative. Nevertheless, buyers should think about the inherent dangers:

-

Volatility Threat: JFSL’s share value has proven appreciable volatility, posing a danger to buyers with decrease danger tolerance.

-

Market Threat: The general market circumstances considerably impression JFSL’s share value, exposing buyers to market danger.

-

Firm-Particular Threat: JFSL’s efficiency depends upon varied elements, together with its capacity to execute its marketing strategy, handle competitors, and navigate regulatory adjustments.

-

Valuation Threat: The present share value may not precisely mirror JFSL’s intrinsic worth, resulting in potential overvaluation or undervaluation.

The potential rewards, nonetheless, are additionally important:

-

Progress Potential: JFSL operates in a quickly rising market, providing important progress potential.

-

Diversification: JFSL gives diversification inside the monetary providers sector.

-

Lengthy-Time period Funding: For long-term buyers, JFSL might provide enticing returns if the corporate efficiently executes its enterprise technique.

Conclusion:

The Jio Monetary Providers share value chart presents a dynamic and evolving story. Analyzing the chart in isolation is inadequate. A complete understanding requires combining chart evaluation with thorough basic evaluation, contemplating market circumstances, and acknowledging the inherent dangers and rewards. Buyers ought to develop a well-informed funding technique primarily based on their danger tolerance and long-term monetary objectives earlier than making any selections relating to JFSL. Common monitoring of the chart, coupled with ongoing basic evaluation, is essential for making knowledgeable funding selections and adapting to the altering dynamics of this newly listed entity. The way forward for JFSL’s share value stays intertwined with the success of its enterprise mannequin, the efficiency of the broader market, and the general well being of the Indian monetary providers sector.

Closure

Thus, we hope this text has offered precious insights into Decoding the Jio Monetary Providers Share Worth Chart: A Deep Dive into Efficiency and Potential. We hope you discover this text informative and useful. See you in our subsequent article!