Decoding the Language of the Market: A Complete Information to Chart Patterns in Inventory Buying and selling

Associated Articles: Decoding the Language of the Market: A Complete Information to Chart Patterns in Inventory Buying and selling

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the Language of the Market: A Complete Information to Chart Patterns in Inventory Buying and selling. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Language of the Market: A Complete Information to Chart Patterns in Inventory Buying and selling

Chart patterns, the visible representations of worth motion over time, are a cornerstone of technical evaluation. They provide merchants a possible glimpse into the longer term, revealing potential shifts in momentum and predicting worth actions. Whereas not foolproof predictors, understanding and appropriately figuring out chart patterns can considerably improve buying and selling methods and threat administration. This text delves into the world of chart patterns, exploring their classifications, interpretation, and sensible utility in inventory buying and selling.

Forms of Chart Patterns:

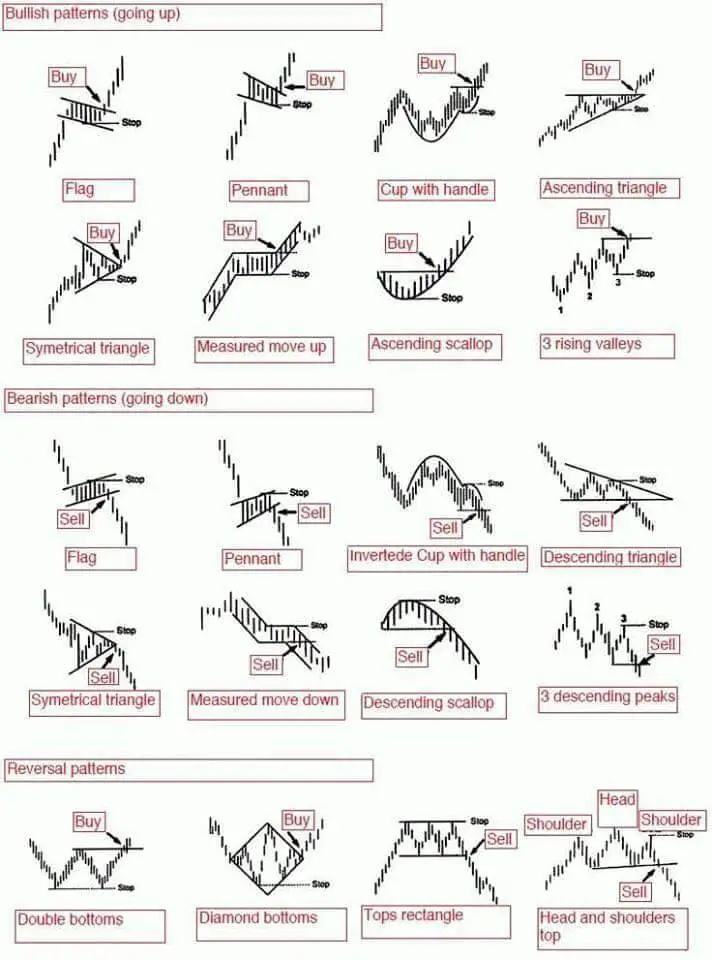

Chart patterns are broadly categorized into two important teams: continuation patterns and reversal patterns.

1. Continuation Patterns: These patterns counsel a short lived pause within the prevailing development, adopted by a resumption of the unique course. They point out a interval of consolidation earlier than the value continues its upward (uptrend) or downward (downtrend) motion. Frequent continuation patterns embody:

-

Triangles: Triangles are characterised by converging trendlines, forming a triangular form on the chart. There are three important sorts:

- Symmetrical Triangles: These exhibit converging trendlines with no clear upward or downward bias. The breakout normally happens midway by the sample’s formation.

- Ascending Triangles: These present a flat decrease trendline and an upward sloping higher trendline, suggesting bullish continuation. Breakouts are sometimes upward.

- Descending Triangles: These characteristic a flat higher trendline and a downward sloping decrease trendline, implying bearish continuation. Breakouts are normally downward.

-

Rectangles: Rectangles show a horizontal worth vary bounded by two parallel horizontal trendlines. The value consolidates inside this vary earlier than breaking out within the course of the prevailing development. Breakouts above the higher trendline are bullish, whereas breakouts beneath the decrease trendline are bearish.

-

Flags and Pennants: These are short-term continuation patterns characterised by a quick interval of consolidation following a pointy worth transfer.

- Flags: These resemble an oblong sample, however are sometimes shorter and steeper.

- Pennants: These are triangular patterns, just like symmetrical triangles, however shaped after a pointy worth motion. Breakouts normally happen within the course of the previous development.

-

Wedges: Wedges are triangular patterns that slope both upward (bullish wedge) or downward (bearish wedge). Opposite to instinct, a bullish wedge is taken into account a bearish sample, because it suggests weakening upward momentum, resulting in a possible downward breakout. Conversely, a bearish wedge is usually seen as bullish, signaling a possible upward breakout because the downward momentum weakens.

2. Reversal Patterns: These patterns counsel a possible change within the prevailing development. They point out a shift in market sentiment, probably signaling a turning level from an uptrend to a downtrend (or vice versa). Key reversal patterns embody:

-

Head and Shoulders: It is a basic reversal sample, characterised by three peaks (left shoulder, head, proper shoulder) with two troughs (necklines) connecting them. A neckline breakout to the draw back confirms the bearish reversal. The sample’s goal worth is usually the gap between the pinnacle and the neckline, projected downwards from the breakout level.

-

Inverse Head and Shoulders: That is the mirror picture of the pinnacle and shoulders sample, indicating a bullish reversal. It options three troughs, with two peaks forming the necklines. A neckline breakout to the upside confirms the bullish reversal.

-

Double Tops and Double Bottoms: These patterns include two comparable worth peaks (double prime) or troughs (double backside) adopted by a interval of consolidation. A double prime suggests a bearish reversal, with a breakout beneath the neckline (the low level between the 2 peaks). A double backside suggests a bullish reversal, with a breakout above the neckline (the excessive level between the 2 troughs).

-

Triple Tops and Triple Bottoms: Much like double tops and bottoms, however with three peaks or troughs, reinforcing the reversal sign. These patterns typically require extra affirmation earlier than coming into a commerce.

Deciphering Chart Patterns:

Figuring out a chart sample is barely step one. Profitable buying and selling requires cautious interpretation, contemplating a number of elements:

-

Quantity: Quantity affirmation is essential. A robust breakout needs to be accompanied by elevated buying and selling quantity, indicating robust conviction behind the value motion. Low quantity breakouts are sometimes weak and vulnerable to failure.

-

Trendline Assist and Resistance: The energy of the trendlines forming the sample is necessary. Stronger trendlines, supported by a number of touches, present extra dependable indicators.

-

Different Technical Indicators: Combining chart patterns with different technical indicators, similar to shifting averages, RSI, MACD, and Bollinger Bands, can improve accuracy and scale back threat.

-

Elementary Evaluation: Whereas chart patterns are a technical evaluation instrument, it is essential to think about basic elements, similar to firm earnings, business tendencies, and total financial circumstances. These elements can considerably influence the inventory’s worth and invalidate chart sample predictions.

-

Timeframe: The timeframe used for evaluation considerably impacts the interpretation. Patterns recognized on a day by day chart may not be related on a weekly or month-to-month chart. Selecting the suitable timeframe will depend on your buying and selling technique and threat tolerance.

Sensible Utility in Inventory Buying and selling:

Chart patterns might be integrated into varied buying and selling methods:

-

Breakout Buying and selling: This technique entails coming into a commerce after a worth breaks out of a chart sample. Merchants sometimes place stop-loss orders beneath the breakout degree for bearish patterns and above the breakout degree for bullish patterns.

-

Pullback Buying and selling: This entails ready for a worth pullback in the direction of the damaged trendline after a breakout, providing a probably higher entry level with lowered threat.

-

Affirmation Buying and selling: This technique entails ready for affirmation indicators from different technical indicators earlier than coming into a commerce, additional lowering threat.

Dangers and Limitations:

It is essential to keep in mind that chart patterns aren’t good predictors. A number of elements can result in false indicators:

-

False Breakouts: Costs can typically get away of a sample solely to reverse shortly afterward. Because of this quantity affirmation and different technical indicators are essential.

-

Subjectivity: Figuring out chart patterns might be subjective, with totally different merchants probably deciphering the identical chart otherwise.

-

Market Manipulation: Market manipulation can distort worth motion, making chart patterns unreliable.

Conclusion:

Chart patterns supply beneficial insights into market dynamics, serving to merchants anticipate potential worth actions. Nonetheless, they need to be used as a part of a broader buying and selling technique, mixed with different technical indicators and basic evaluation. Understanding the assorted chart patterns, their interpretation, and their limitations is essential for profitable buying and selling. Steady studying, follow, and threat administration are important for mastering the artwork of studying and making use of chart patterns within the dynamic world of inventory buying and selling. Do not forget that constant self-discipline and threat administration are paramount to long-term success in any buying and selling endeavor. By no means make investments greater than you may afford to lose, and all the time diversify your portfolio to mitigate threat.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Language of the Market: A Complete Information to Chart Patterns in Inventory Buying and selling. We recognize your consideration to our article. See you in our subsequent article!