Decoding the Language of the Market: A Complete Information to Studying Inventory Chart Patterns (PDF-Pleasant)

Associated Articles: Decoding the Language of the Market: A Complete Information to Studying Inventory Chart Patterns (PDF-Pleasant)

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Language of the Market: A Complete Information to Studying Inventory Chart Patterns (PDF-Pleasant). Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the Language of the Market: A Complete Information to Studying Inventory Chart Patterns (PDF-Pleasant)

Inventory charts, at first look, can seem as a chaotic jumble of traces and knowledge factors. Nevertheless, beneath the floor lies a wealthy tapestry of knowledge, revealing potential market tendencies and alternatives for savvy buyers. Understanding find out how to learn and interpret widespread inventory chart patterns is a vital ability for any investor aiming to navigate the complexities of the monetary markets. This complete information will equip you with the data to decipher these patterns, empowering you to make extra knowledgeable funding selections.

This information is designed to be simply printable and readable as a PDF, specializing in readability and sensible software. We are going to cowl each candlestick and bar charts, exploring essentially the most prevalent patterns and offering actionable insights for his or her interpretation.

I. Understanding the Fundamentals: Chart Varieties and Knowledge Factors

Earlier than diving into particular patterns, it is essential to know the basics of the 2 major chart sorts: candlestick charts and bar charts.

A. Bar Charts:

Bar charts signify value actions over a particular interval (e.g., day by day, weekly, month-to-month). Every bar shows 4 key knowledge factors:

- Open: The worth in the beginning of the interval.

- Excessive: The best value reached in the course of the interval.

- Low: The bottom value reached in the course of the interval.

- Shut: The worth on the finish of the interval.

The bar’s vertical size represents the vary between the excessive and low, whereas the tick marks on the left and proper point out the open and shut costs, respectively. A bar extending upwards (greater shut than open) signifies an upward development for that interval, whereas a downward-extending bar signifies a downward development.

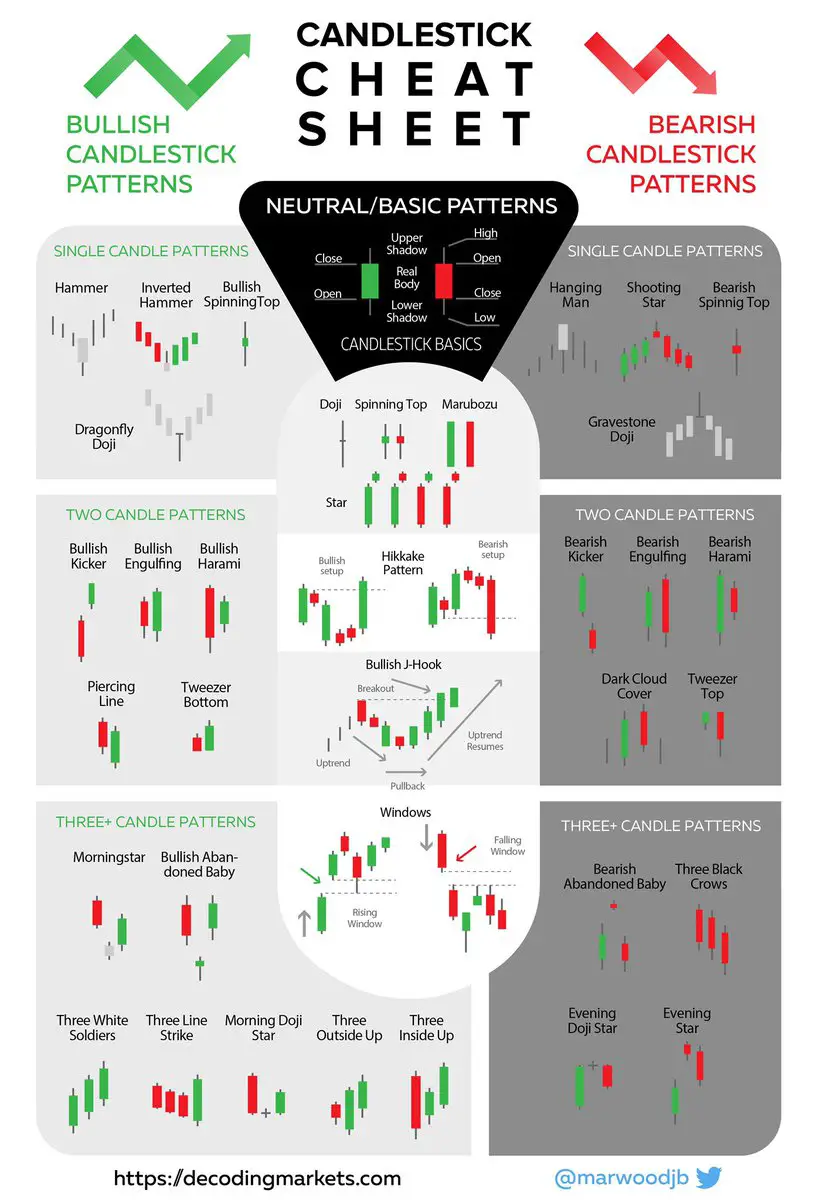

B. Candlestick Charts:

Candlestick charts supply a visually richer illustration of value actions. Every candlestick contains:

- Actual Physique: The oblong a part of the candlestick, representing the vary between the open and shut costs. A stuffed (black or pink) physique signifies a closing value decrease than the opening value (bearish), whereas a hole (white or inexperienced) physique signifies a closing value greater than the opening value (bullish).

- Wicks (Shadows): The skinny traces extending above and under the actual physique. The higher wick reveals the very best value reached, whereas the decrease wick reveals the bottom value reached in the course of the interval. Lengthy wicks typically counsel indecision or rejection of a value degree.

Candlestick charts present a extra nuanced understanding of market sentiment and value motion in comparison with bar charts.

II. Widespread Chart Patterns: Figuring out Traits and Reversals

Quite a few chart patterns emerge from the interaction of provide and demand, providing clues about potential future value actions. We are going to discover among the most well known patterns:

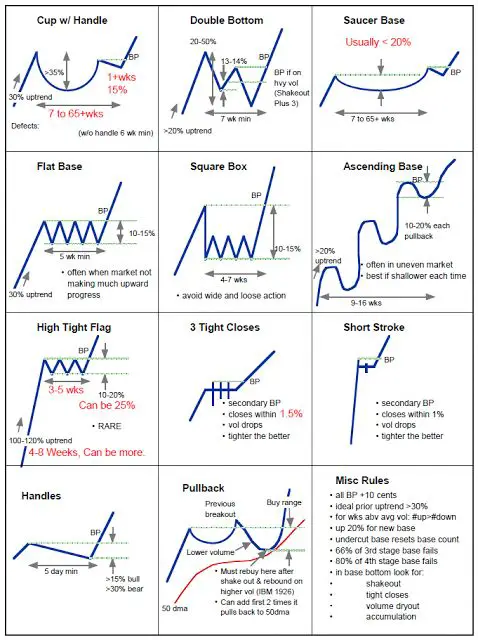

A. Development Continuation Patterns:

These patterns counsel that the present development is prone to proceed.

-

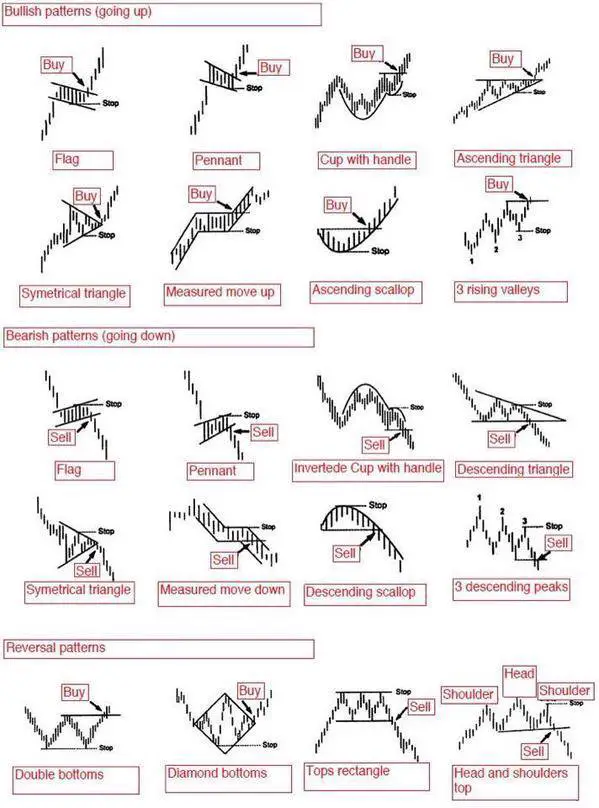

Flags and Pennants: These patterns seem as brief durations of consolidation inside a bigger development. Flags are characterised by parallel traces sloping barely in opposition to the primary development, whereas pennants are characterised by converging traces forming a triangle form. Breakouts from these patterns typically sign a continuation of the prevailing development.

-

Triangles: Triangles are shaped by converging trendlines, indicating a interval of consolidation. Symmetrical triangles counsel uncertainty, whereas ascending triangles (greater highs and flat lows) are bullish, and descending triangles (flat highs and decrease lows) are bearish. Breakouts from triangles typically affirm the route of the development.

-

Head and Shoulders (Inverse Head and Shoulders): A head and shoulders sample is a bearish reversal sample characterised by three peaks, with the center peak ("head") being the very best. A neckline connects the troughs between the peaks. A break under the neckline confirms the sample and alerts a possible downward development. The inverse head and shoulders is a bullish reversal sample, mirroring the top and shoulders however with the troughs forming the "head."

B. Development Reversal Patterns:

These patterns counsel a possible shift within the prevailing development.

-

Double Tops/Bottoms: Double tops (bearish) are characterised by two comparable value peaks, adopted by a decline. Double bottoms (bullish) are the inverse, with two comparable value troughs adopted by an increase. Breakouts under the neckline of a double prime or above the neckline of a double backside affirm the sample and sign a possible development reversal.

-

Triple Tops/Bottoms: Much like double tops/bottoms, however with three peaks/troughs. These patterns are usually thought of stronger reversal alerts as a result of elevated affirmation.

-

Rounding Tops/Bottoms: These patterns are characterised by a gradual curve, forming a rounded peak (rounding prime – bearish) or trough (rounding backside – bullish). They point out a longer-term reversal in comparison with sharper patterns like double tops/bottoms.

III. Decoding Chart Patterns: Affirmation and Context

Whereas chart patterns present beneficial insights, it is essential to contemplate them inside a broader context:

-

Quantity Affirmation: Elevated quantity throughout a breakout from a sample confirms its energy and will increase the probability of a profitable continuation or reversal. Low quantity breakouts are sometimes weak and unreliable.

-

Assist and Resistance Ranges: Chart patterns typically work together with assist and resistance ranges. Breakouts above resistance or under assist strengthen the sign.

-

Technical Indicators: Combining chart patterns with technical indicators (e.g., shifting averages, RSI, MACD) gives extra affirmation and enhances the accuracy of predictions.

-

Basic Evaluation: Whereas technical evaluation based mostly on chart patterns is efficacious, it ought to be complemented by elementary evaluation to evaluate the underlying worth and prospects of the corporate.

IV. Sensible Software and Threat Administration

Studying chart patterns is a ability that improves with observe. Begin by specializing in a number of key patterns and steadily broaden your data. Use historic knowledge to determine patterns and backtest your methods.

Do not forget that no chart sample ensures success. Market circumstances can change quickly, and surprising occasions can disrupt even essentially the most promising patterns. Subsequently, efficient threat administration is essential. At all times use stop-loss orders to restrict potential losses and diversify your portfolio to mitigate threat.

V. Conclusion: Mastering the Artwork of Chart Sample Evaluation

Chart sample evaluation is a robust software for buyers searching for to know market dynamics and make knowledgeable funding selections. By mastering the flexibility to determine and interpret these patterns, coupled with a sound understanding of elementary evaluation and threat administration, you may considerably enhance your probabilities of success within the monetary markets. Constant observe, steady studying, and disciplined execution are key to unlocking the total potential of chart sample evaluation. Bear in mind to all the time keep up to date on market information and financial circumstances to reinforce your evaluation and decision-making course of. This information serves as a basis in your journey; additional analysis and sensible expertise will solidify your understanding and refine your abilities on this fascinating side of monetary market evaluation.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Language of the Market: A Complete Information to Studying Inventory Chart Patterns (PDF-Pleasant). We thanks for taking the time to learn this text. See you in our subsequent article!