Decoding the Lithium Value Chart: A Deep Dive into Market Dynamics and Future Developments

Associated Articles: Decoding the Lithium Value Chart: A Deep Dive into Market Dynamics and Future Developments

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the Lithium Value Chart: A Deep Dive into Market Dynamics and Future Developments. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Lithium Value Chart: A Deep Dive into Market Dynamics and Future Developments

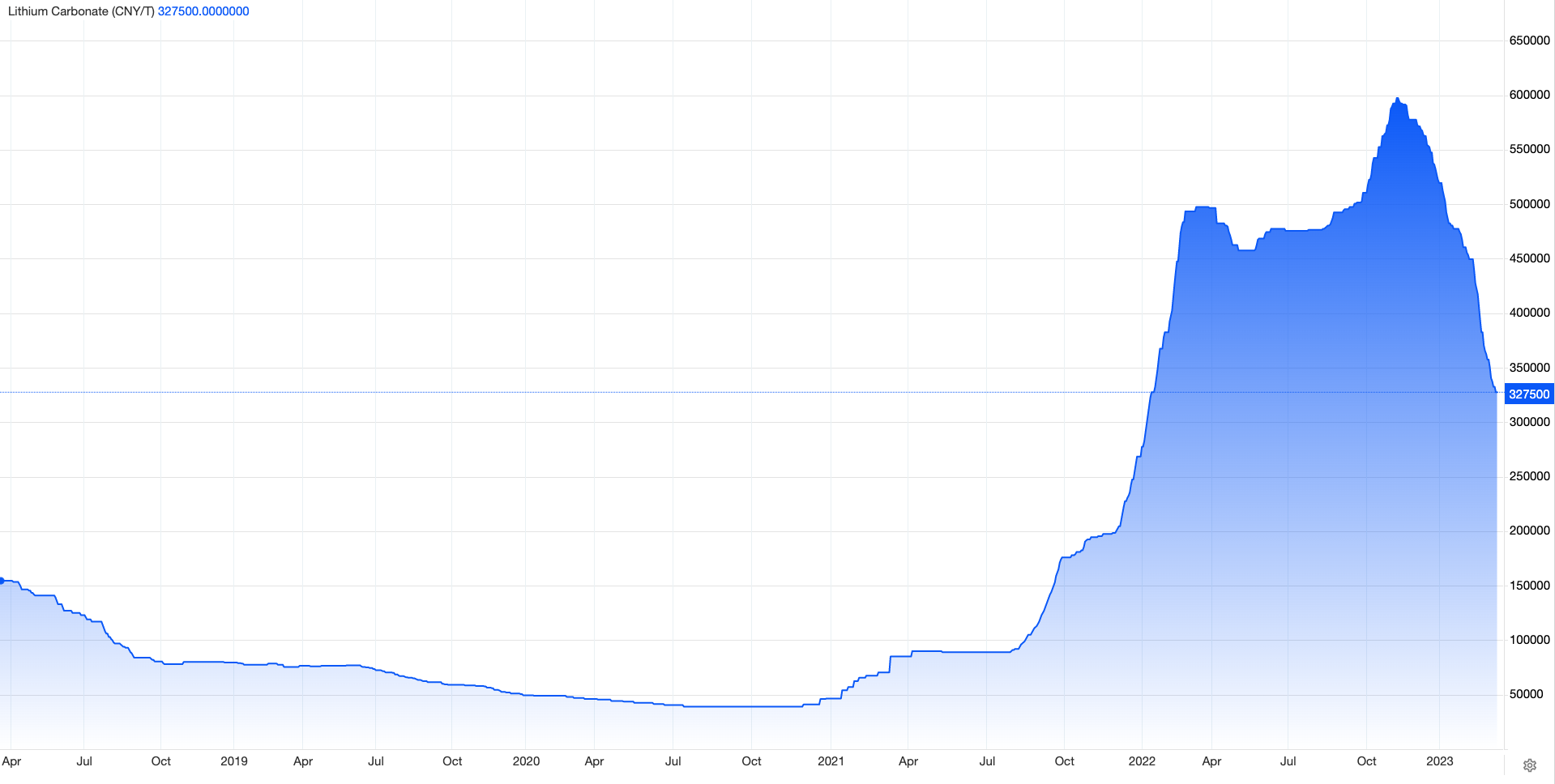

Lithium, a silvery-white alkali metallic, has turn into a crucial element within the fashionable world, primarily fueling the burgeoning electrical car (EV) and vitality storage industries. Its value, subsequently, has turn into a topic of intense scrutiny, fluctuating wildly in recent times on account of a posh interaction of provide, demand, geopolitical elements, and technological developments. Understanding the intricacies of the lithium value chart requires analyzing these numerous influences and predicting their future trajectory.

The Rollercoaster Journey: A Historic Perspective

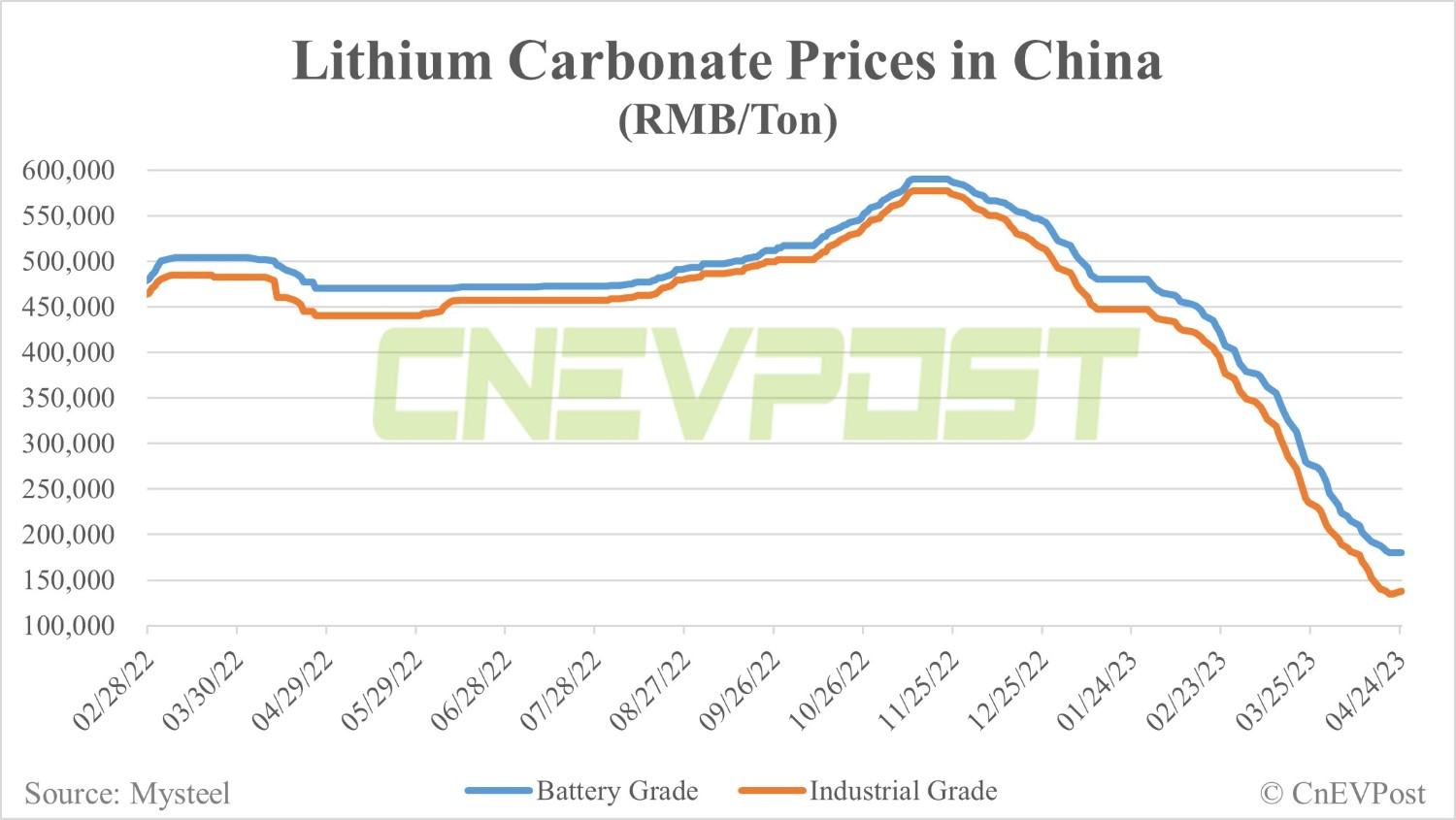

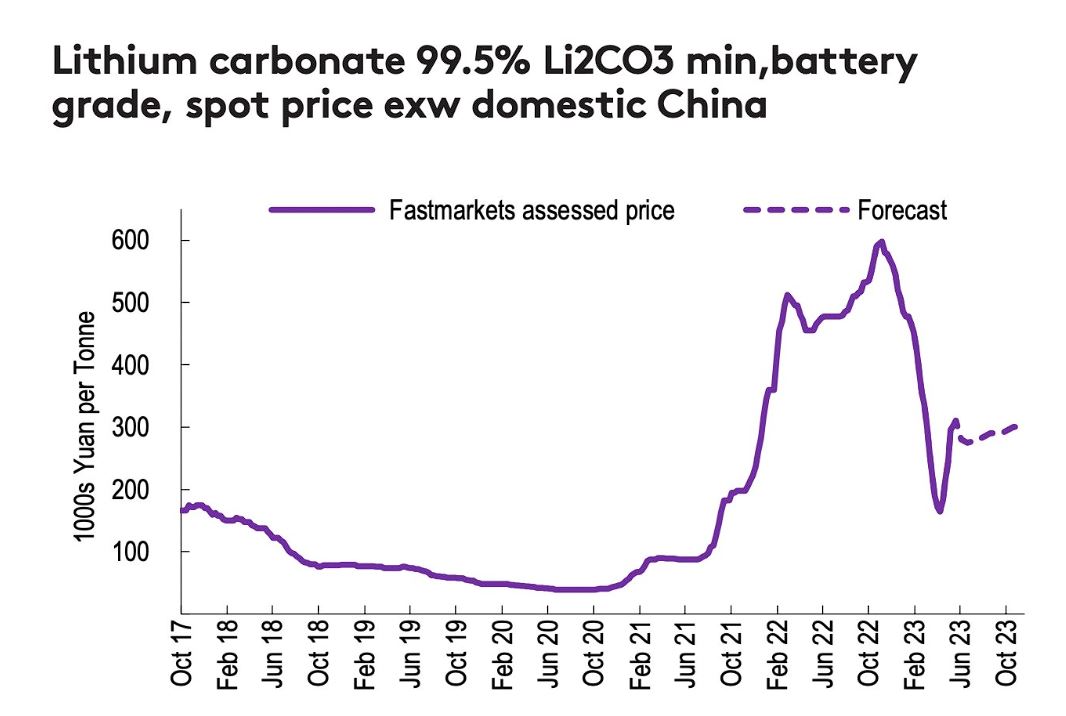

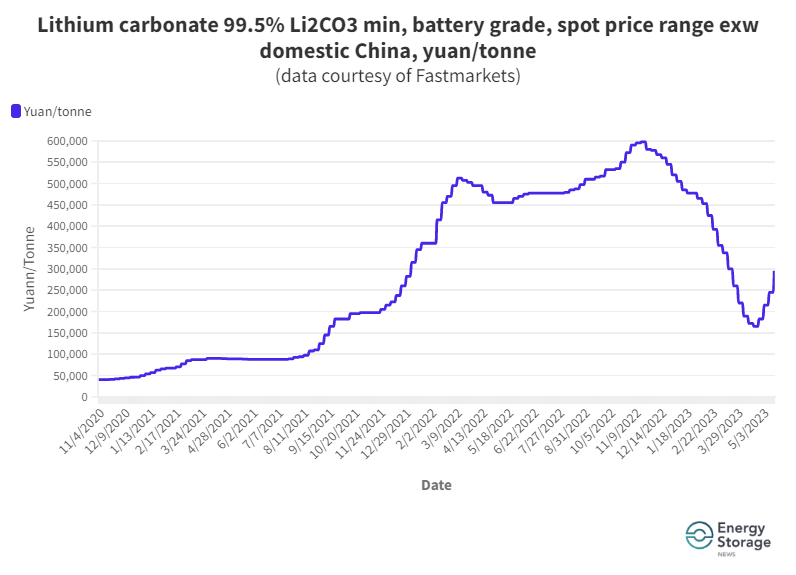

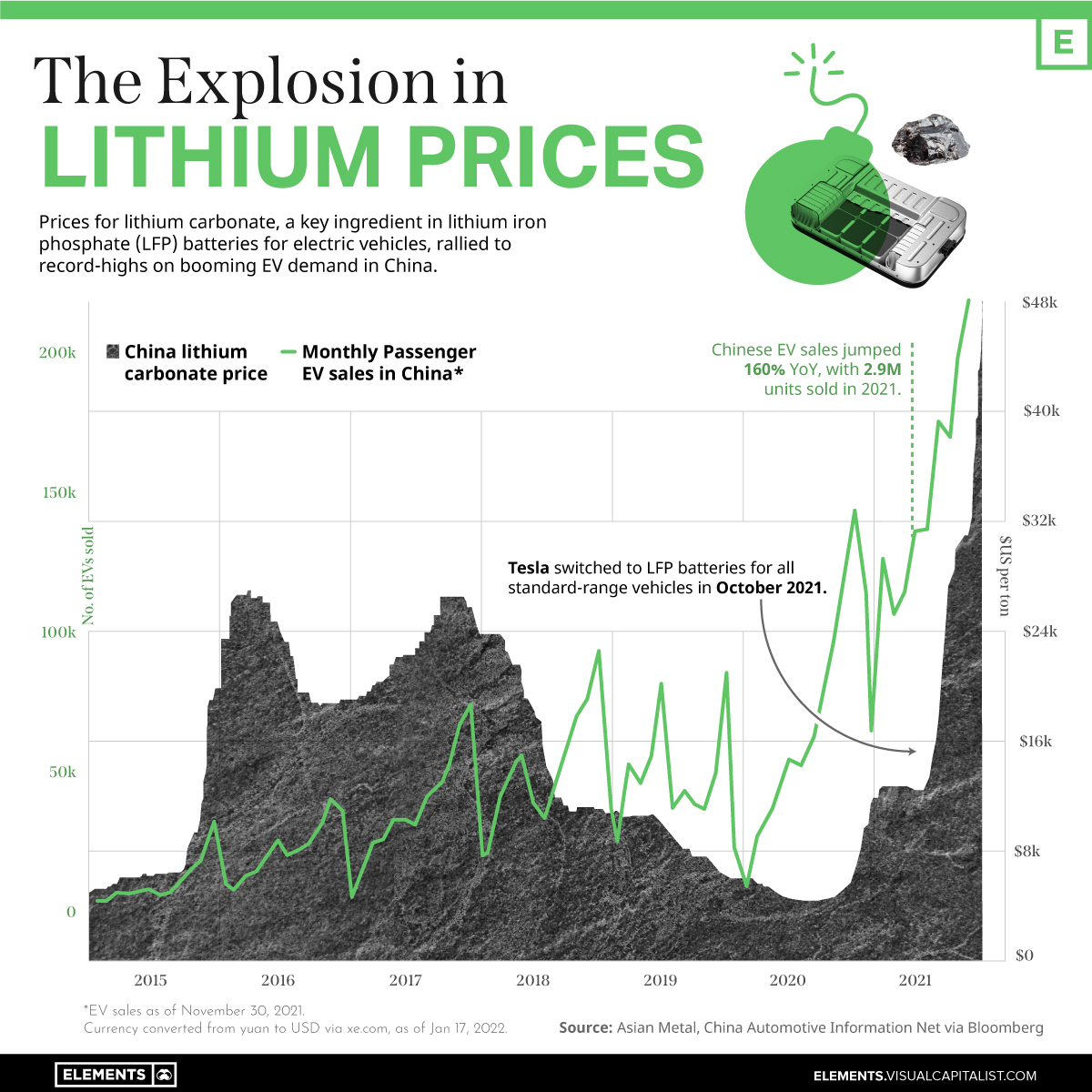

The lithium value chart is not a clean, regular climb. It is extra akin to a rollercoaster, experiencing durations of dramatic spikes and equally sharp declines. The early 2000s noticed comparatively steady costs, largely pushed by demand from ceramics and lubricants. Nonetheless, the rise of EVs and large-scale vitality storage techniques (ESS) within the late 2000s and early 2010s ignited a surge in demand, sending costs hovering.

This preliminary value enhance was amplified by a number of elements:

- Restricted Provide: Lithium manufacturing is geographically concentrated, with Australia, Chile, and Argentina dominating the market. The institution of recent mines and processing amenities takes appreciable time and funding, making a bottleneck in provide.

- Geopolitical Dangers: Manufacturing in sure areas is topic to political instability and regulatory hurdles, creating uncertainty and potential disruptions to the provision chain.

- Technological Developments: The fast evolution of battery know-how, notably by way of vitality density and value discount, additional fueled demand, outpacing the power of the trade to fulfill it.

The following years witnessed a interval of value volatility. Durations of oversupply, pushed by elevated manufacturing capability, led to cost corrections. Nonetheless, the underlying demand continued to develop steadily, stopping a sustained value collapse. The COVID-19 pandemic initially precipitated a dip in costs, however the subsequent world restoration and the accelerated adoption of EVs reignited the upward development.

Understanding the Totally different Lithium Value Benchmarks

It is essential to know that there is not a single, universally accepted lithium value. Totally different benchmarks exist, reflecting variations in the kind of lithium product and the placement of the transaction. Probably the most generally tracked costs embrace:

- Lithium Carbonate (Li2CO3): It is a extensively used lithium chemical compound, primarily used within the manufacturing of lithium-ion batteries. Its value is usually thought of a benchmark for the general lithium market.

- Lithium Hydroxide (LiOH): That is one other essential lithium chemical, favored within the manufacturing of high-nickel cathode supplies, that are more and more vital in high-energy-density batteries. Its value typically tracks intently with lithium carbonate however can exhibit some divergence on account of particular demand dynamics.

- Lithium Steel: That is the purest type of lithium, although its direct use in batteries is much less widespread. Its value is much less continuously tracked however supplies insights into the general metallic market dynamics.

- Spot Costs vs. Contract Costs: Spot costs replicate fast market transactions, whereas contract costs signify agreements between patrons and sellers for future supply. Contract costs are usually extra steady than spot costs however could lag behind market shifts.

These completely different value benchmarks, together with regional variations, contribute to the complexity of deciphering the lithium value chart.

Components Influencing the Present and Future Lithium Value

The present and future trajectory of lithium costs hinges on a number of key elements:

- EV Adoption Charges: The tempo of EV adoption globally is the only most vital driver of lithium demand. Authorities insurance policies selling EVs, technological developments making EVs extra reasonably priced and accessible, and shopper preferences all play a task.

- Vitality Storage Market Development: The rising deployment of large-scale vitality storage techniques, pushed by the necessity for grid stability and renewable vitality integration, represents a big supply of lithium demand.

- Provide Chain Improvement: The growth of lithium mining and processing capability is essential in assembly the rising demand. Nonetheless, this growth is constrained by environmental considerations, allowing processes, and the supply of expert labor.

- Technological Innovation: Developments in battery know-how, akin to solid-state batteries and various battery chemistries, may probably cut back lithium demand or shift the demand in the direction of completely different lithium compounds.

- Geopolitical Issues: Political stability in key lithium-producing areas, commerce insurance policies, and potential provide disruptions stay important dangers to the market. Diversification of provide sources is turning into more and more vital.

- Recycling Initiatives: The event of efficient lithium-ion battery recycling applied sciences can considerably impression the long-term value trajectory by decreasing reliance on major lithium sources.

Predicting the Future: Challenges and Alternatives

Predicting the longer term value of lithium is a difficult activity, given the interaction of those numerous and infrequently unpredictable elements. Nonetheless, a number of traits counsel potential situations:

- Continued Value Volatility: Within the close to time period, value volatility is more likely to persist as provide struggles to maintain tempo with quickly rising demand.

- Lengthy-Time period Value Stabilization: Over the long term, elevated funding in mining and processing capability, coupled with technological developments, may result in higher value stability. Nonetheless, this is determined by the profitable mitigation of geopolitical dangers and environmental considerations.

- Potential Value Declines: The profitable implementation of large-scale battery recycling applications and the emergence of other battery chemistries may put downward stress on lithium costs sooner or later.

Funding Implications:

The lithium market presents each important alternatives and dangers for traders. The long-term outlook for lithium demand is optimistic, pushed by the worldwide transition to scrub vitality. Nonetheless, the worth volatility and geopolitical uncertainties necessitate cautious consideration of funding methods. Diversification throughout completely different lithium corporations, geographical areas, and funding autos is essential to mitigate dangers.

Conclusion:

The lithium value chart is a posh and dynamic illustration of a quickly evolving market. Understanding the interaction of provide, demand, technological developments, and geopolitical elements is essential for deciphering the present traits and predicting the longer term trajectory. Whereas the long-term outlook for lithium is usually optimistic, traders and trade gamers want to stay vigilant to the inherent dangers and uncertainties related to this very important commodity. The way forward for lithium costs will in the end be decided by the stability between innovation, funding, and the worldwide push in the direction of a sustainable vitality future.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Lithium Value Chart: A Deep Dive into Market Dynamics and Future Developments. We hope you discover this text informative and helpful. See you in our subsequent article!