Decoding the Lithium Worth Chart: A Rollercoaster Trip By way of a Important Commodity

Associated Articles: Decoding the Lithium Worth Chart: A Rollercoaster Trip By way of a Important Commodity

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Lithium Worth Chart: A Rollercoaster Trip By way of a Important Commodity. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Lithium Worth Chart: A Rollercoaster Trip By way of a Important Commodity

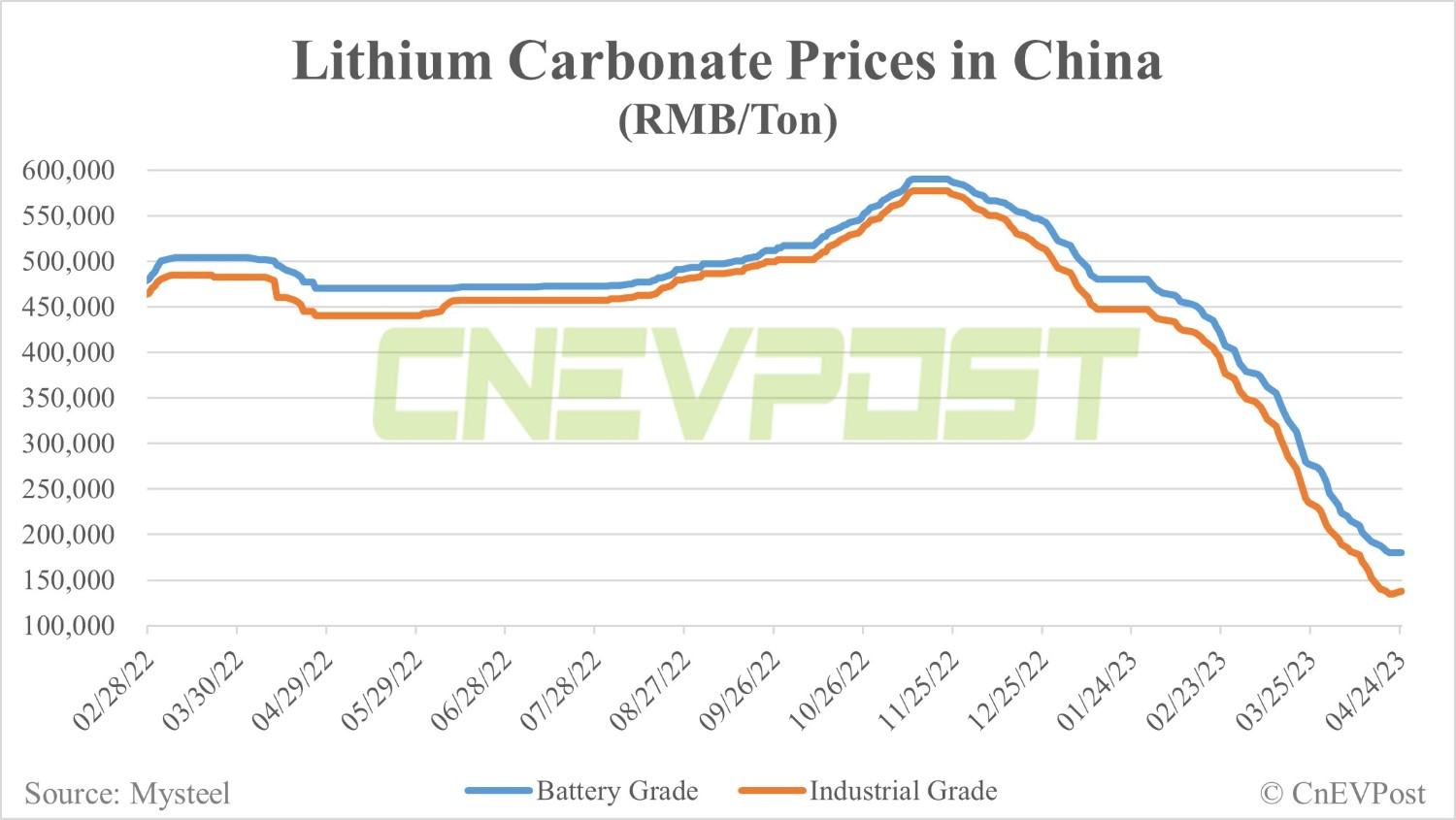

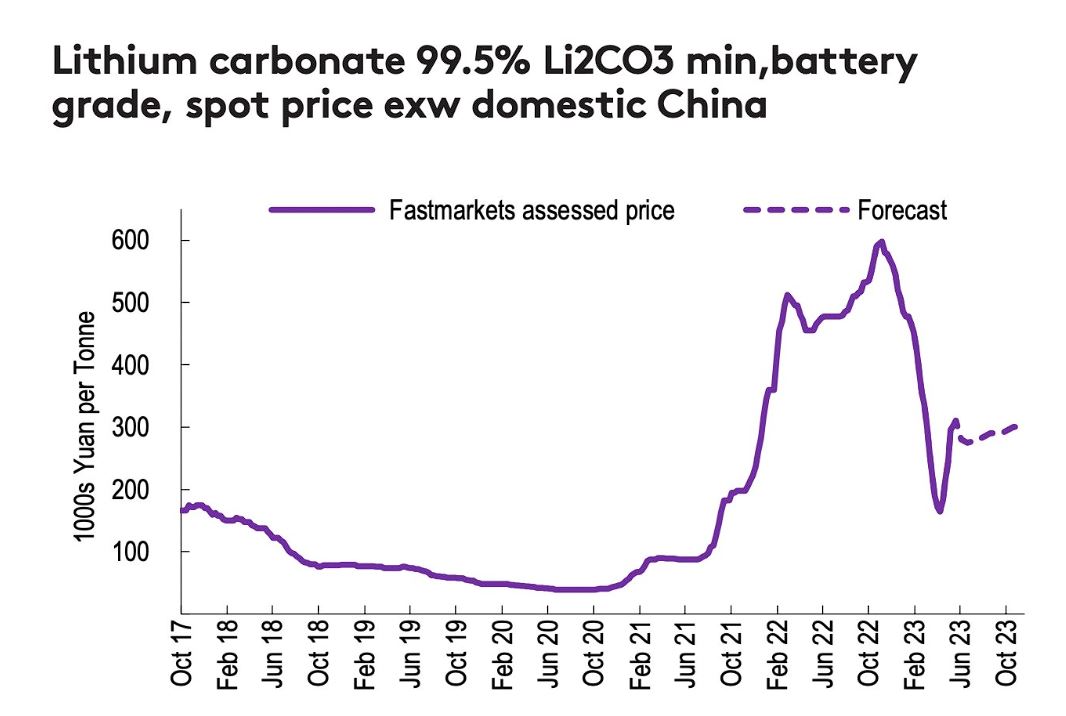

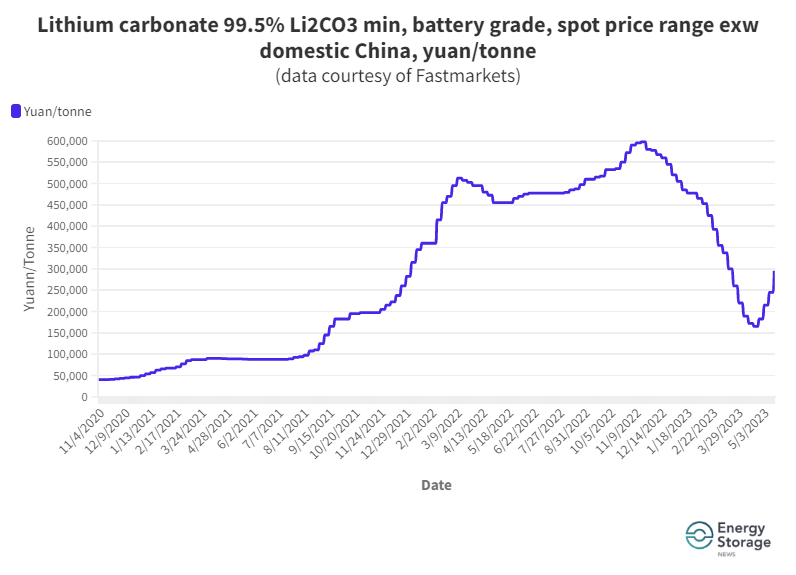

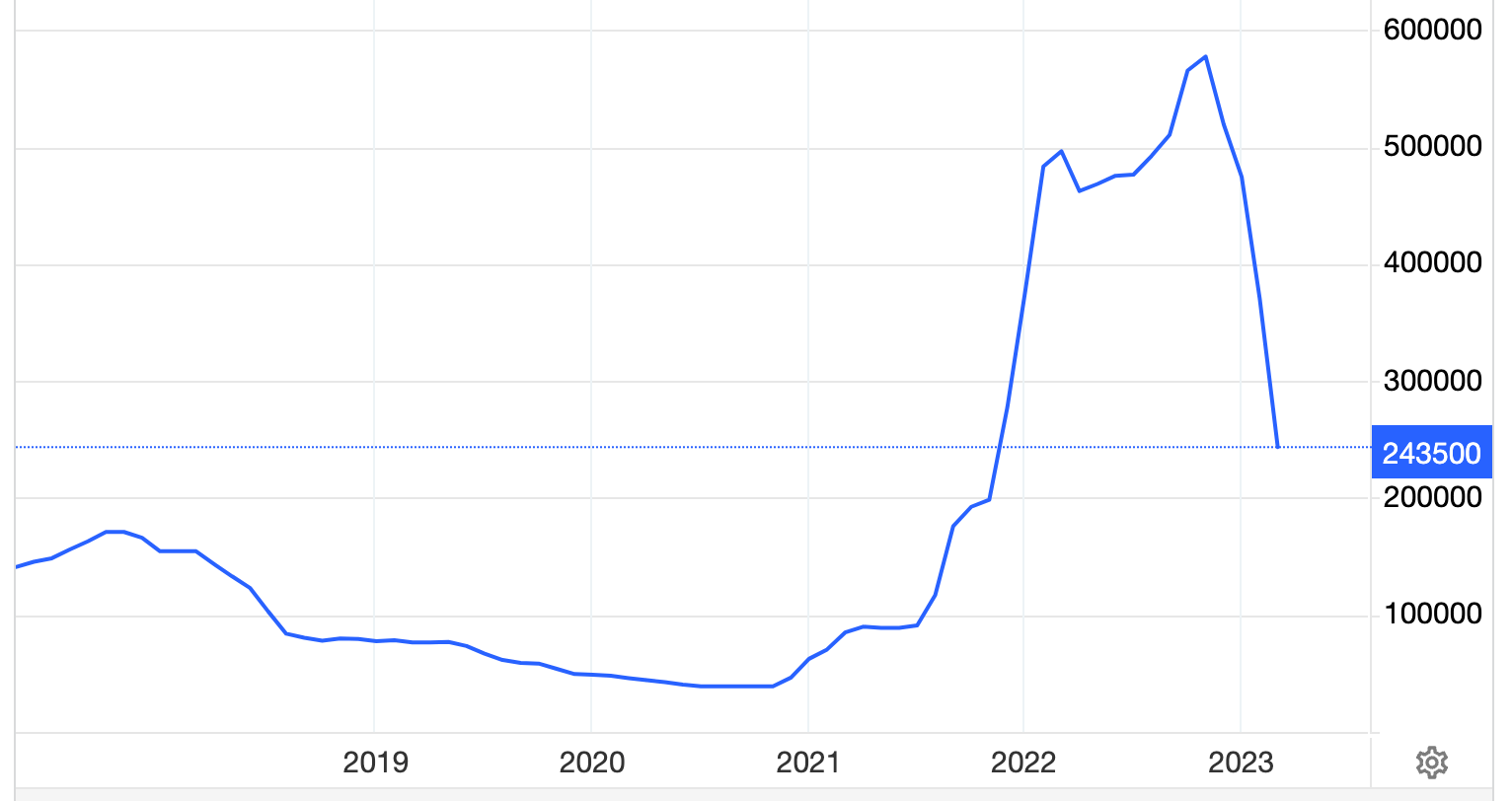

The lithium value chart is a charming, if unstable, spectacle. This seemingly innocuous steel, hardly ever seen in its pure type, has develop into a cornerstone of the trendy world, powering every thing from smartphones to electrical automobiles. Its value, nonetheless, displays a posh interaction of provide, demand, geopolitical components, and technological developments, leading to a rollercoaster trip that retains buyers, producers, and governments on edge. Understanding the fluctuations depicted within the lithium value chart requires a deep dive into the dynamics shaping this significant commodity market.

The Ascent: From Obscurity to Important Commodity

For many years, lithium remained a comparatively area of interest commodity, primarily utilized in ceramics and lubricants. Nonetheless, the rise of electrical automobiles (EVs) and power storage methods (ESS), significantly lithium-ion batteries, catapulted lithium into the highlight. The demand surge, initially gradual, has develop into exponential, driving a dramatic enhance in lithium costs, significantly for the reason that mid-2010s. The value chart reveals a transparent upward pattern, punctuated by intervals of fast acceleration and occasional corrections.

A number of components contributed to this ascent:

-

The EV Revolution: The worldwide shift in direction of electrical mobility is the first driver of lithium demand. Every EV battery requires vital portions of lithium, and as EV gross sales proceed to develop exponentially, so too does the demand for lithium carbonate and lithium hydroxide, the 2 major types of lithium utilized in battery manufacturing. Authorities incentives, stricter emission laws, and rising shopper consciousness of environmental issues are all accelerating this pattern.

-

Vitality Storage Options: Past EVs, the burgeoning renewable power sector depends closely on lithium-ion batteries for power storage. Photo voltaic and wind energy are inherently intermittent, and batteries present essential stability to the grid, smoothing out fluctuations in power provide. This utility additional intensifies the demand for lithium, significantly in areas with bold renewable power targets.

-

Technological Developments: Whereas demand is the first driver, technological developments have additionally performed a task. Enhancements in battery expertise, resulting in increased power density and longer lifespans, have elevated the quantity of lithium wanted per unit of power storage. Because of this even with enhancements in battery effectivity, the general demand for lithium continues to rise.

-

Geopolitical Components: The focus of lithium sources in particular areas, significantly Australia, Chile, and Argentina, introduces geopolitical complexities. Political instability, regulatory adjustments, and commerce disputes in these areas can considerably influence lithium provide and, consequently, costs. This provides one other layer of volatility to the worth chart.

The Volatility: Peaks, Troughs, and Market Corrections

Regardless of the general upward pattern, the lithium value chart is much from easy. Sharp value spikes and subsequent corrections are widespread, reflecting the inherent volatility of the market. These fluctuations are influenced by a number of components:

-

Provide Chain Bottlenecks: The fast enhance in demand has outpaced the power of the lithium trade to broaden manufacturing capability. This has led to vital provide chain bottlenecks, leading to value spikes. Mining, processing, and refining lithium are advanced and time-consuming processes, requiring vital funding and infrastructure improvement.

-

Hypothesis and Funding: The excessive progress potential of the lithium market has attracted vital funding, together with speculative buying and selling. This may amplify value fluctuations, creating intervals of each fast value will increase and sharp corrections.

-

Financial Cycles: World financial circumstances additionally influence lithium costs. Durations of financial progress sometimes result in elevated demand for EVs and power storage, driving up lithium costs. Conversely, financial downturns can dampen demand, main to cost corrections.

-

Technological Disruptions: The potential for technological breakthroughs in battery expertise, corresponding to the event of solid-state batteries or different battery chemistries, may considerably disrupt the lithium market. Whereas these applied sciences are nonetheless beneath improvement, the opportunity of their future adoption introduces uncertainty into value projections.

Deciphering the Chart: Forecasting the Future

Analyzing the lithium value chart requires a nuanced understanding of those interconnected components. Whereas predicting the long run value with certainty is inconceivable, a number of tendencies counsel potential future situations:

-

Continued Development, however with Moderation: Whereas the explosive progress of the previous few years is unlikely to proceed indefinitely, demand for lithium is predicted to stay sturdy within the coming a long time. The worldwide transition to electrical mobility and the enlargement of renewable power are long-term tendencies that may proceed to drive lithium demand.

-

Provide Chain Growth: Vital investments are being made to broaden lithium manufacturing capability globally. New mines are being developed, and current services are being upgraded. Nonetheless, this enlargement will take time, and provide chain bottlenecks might persist for a number of years.

-

Worth Stabilization (Finally): As provide catches up with demand, value volatility is predicted to steadily lower. Nonetheless, geopolitical components and technological developments will probably proceed to introduce some stage of uncertainty.

-

Diversification of Provide Sources: Efforts are underway to diversify lithium manufacturing past the present dominant gamers. This may assist to cut back reliance on particular areas and mitigate geopolitical dangers.

Conclusion: A Commodity of Important Significance

The lithium value chart is a dynamic illustration of a crucial commodity’s journey from relative obscurity to world significance. Whereas volatility is inherent to the market, understanding the underlying drivers – from EV adoption to geopolitical instability – is essential for navigating this advanced panorama. The way forward for the lithium market is inextricably linked to the worldwide power transition, and the worth chart will proceed to replicate the continued interaction between provide, demand, and technological innovation for years to come back. Cautious evaluation of the chart, coupled with a radical understanding of the market dynamics, is important for buyers, producers, and policymakers alike to make knowledgeable selections on this quickly evolving sector. The trip could also be bumpy, however the long-term trajectory suggests a continued, albeit doubtlessly extra moderated, ascent for this very important steel.

Closure

Thus, we hope this text has offered precious insights into Decoding the Lithium Worth Chart: A Rollercoaster Trip By way of a Important Commodity. We hope you discover this text informative and useful. See you in our subsequent article!