Decoding the M2 Cash Provide Chart: A Deep Dive into Financial Coverage and Financial Indicators

Associated Articles: Decoding the M2 Cash Provide Chart: A Deep Dive into Financial Coverage and Financial Indicators

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the M2 Cash Provide Chart: A Deep Dive into Financial Coverage and Financial Indicators. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the M2 Cash Provide Chart: A Deep Dive into Financial Coverage and Financial Indicators

The M2 cash provide chart, a seemingly easy graph depicting the evolution of a nation’s cash provide over time, truly holds a wealth of data essential to understanding financial developments, financial coverage effectiveness, and future financial prospects. This text will delve into the intricacies of the M2 cash provide, its parts, the importance of its fluctuations, and its relationship to different key financial indicators. We are going to discover how analyzing the M2 chart can present priceless insights for buyers, policymakers, and economists alike.

Understanding M2 Cash Provide:

The M2 cash provide represents a broader measure of cash in an financial system than M1, which primarily consists of forex in circulation and demand deposits. M2 encompasses M1 plus a number of further parts, providing a extra complete view of liquidity and potential inflationary pressures. The particular parts can range barely relying on the nation, however usually embody:

-

M1: This varieties the bottom of M2 and consists of probably the most liquid types of cash:

- Forex in circulation: Bodily money held by the general public.

- Demand deposits: Checking accounts that permit for speedy withdrawals.

- Traveler’s checks: Although declining in use, these nonetheless contribute a small quantity.

-

Financial savings deposits: These are accounts that usually earn curiosity however could have some restrictions on speedy entry.

-

Small-denomination time deposits: These are certificates of deposit (CDs) with comparatively quick maturities, providing larger rates of interest than financial savings accounts however with restricted liquidity.

-

Cash market mutual funds (MMMFs): These funds spend money on short-term, low-risk securities and provide check-writing capabilities, making them comparatively liquid.

The inclusion of those much less liquid belongings in M2 displays the truth that they are often readily transformed into money or used for transactions, thus contributing to the general buying energy within the financial system. The relative proportions of every part inside M2 may also provide priceless insights into shifting financial behaviors and preferences.

Deciphering the M2 Cash Provide Chart:

The M2 cash provide chart usually shows the full worth of M2 over time, often on a month-to-month or quarterly foundation. The chart’s actions are usually introduced as a line graph, permitting for straightforward visualization of developments and fluctuations. Analyzing this chart requires understanding a number of key points:

-

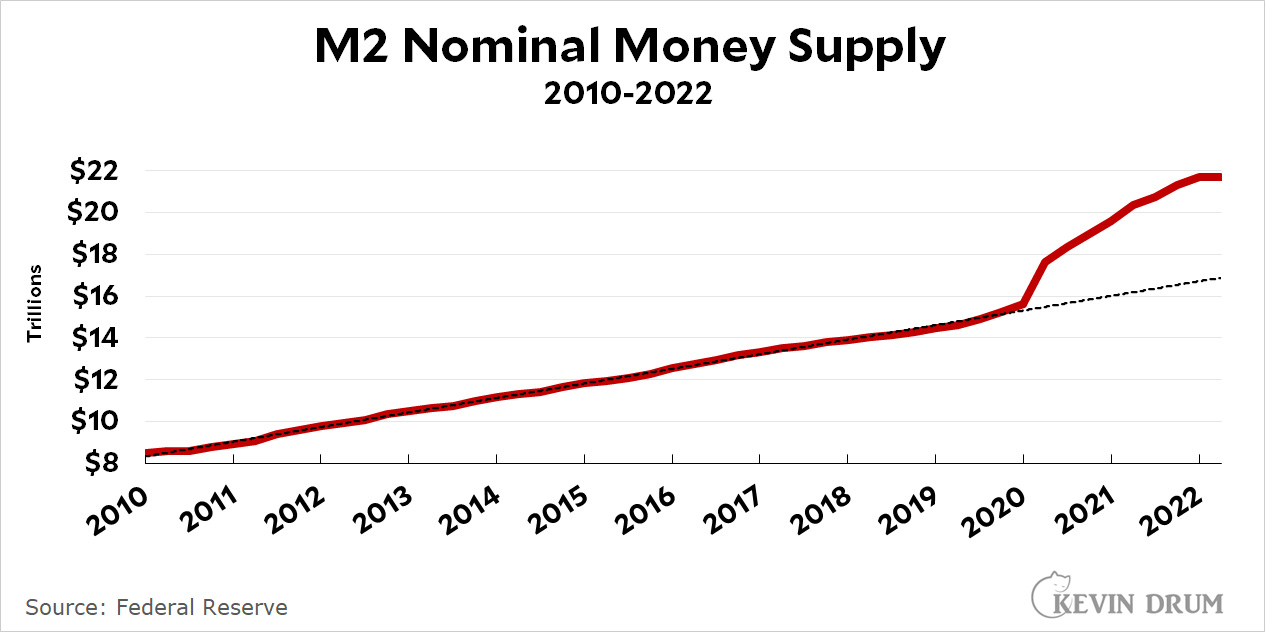

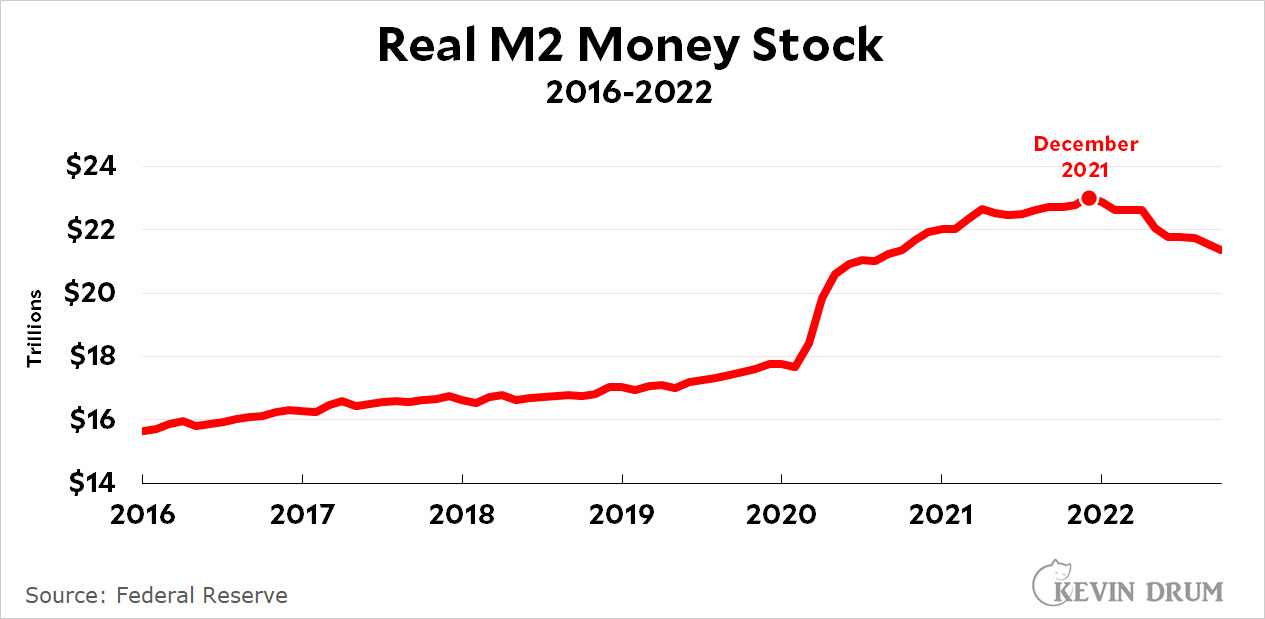

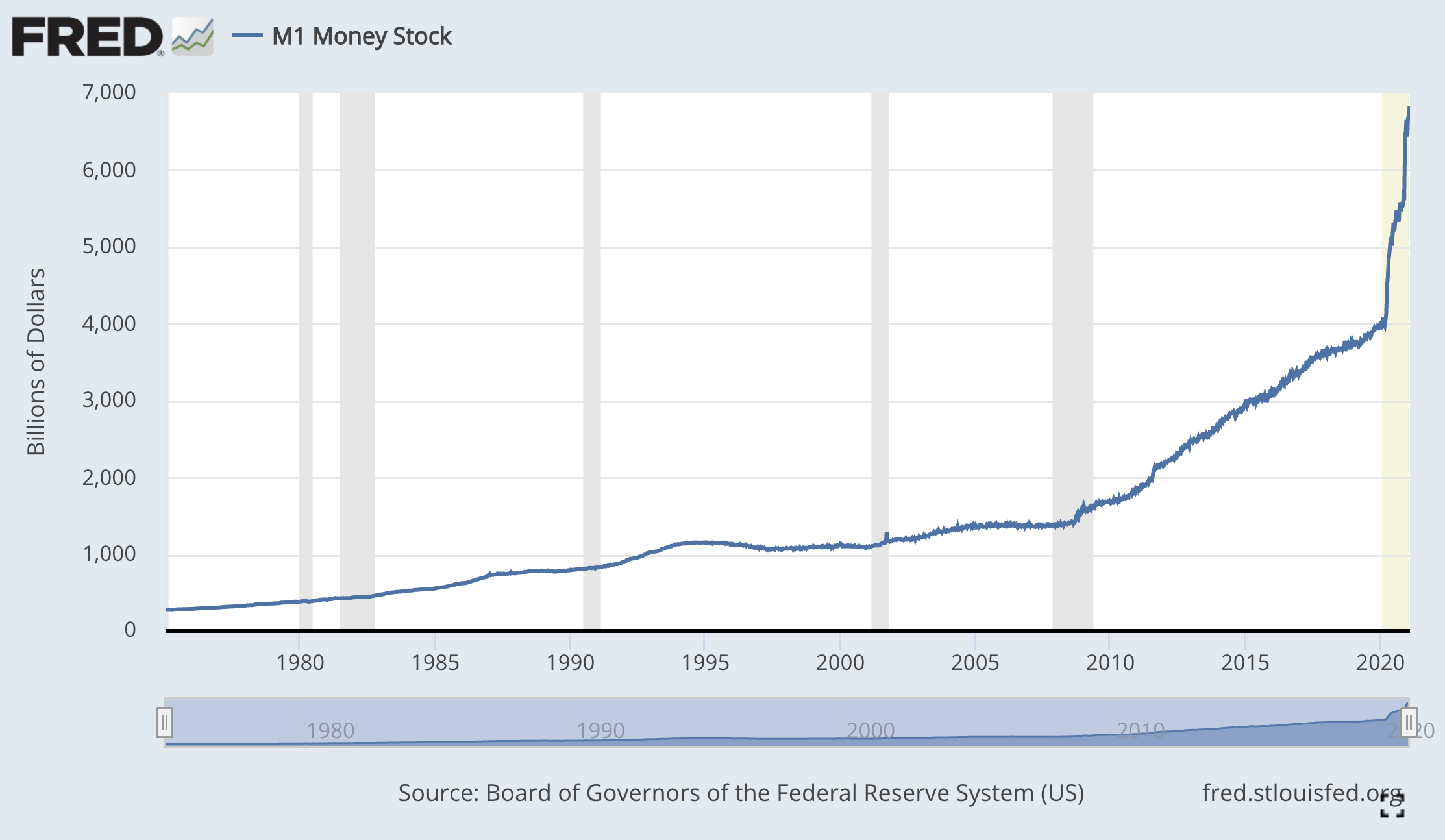

Traits: A steadily growing M2 suggests a rising cash provide, which may gas financial progress but in addition probably result in inflation if not managed fastidiously. Conversely, a declining M2 may point out a contractionary financial coverage or a weakening financial system, probably resulting in deflation or recession. The speed of progress is essential; a fast enhance warrants nearer scrutiny than a gradual, regular rise.

-

Volatility: Sharp fluctuations within the M2 cash provide can sign instability within the monetary system or abrupt shifts in financial coverage. These sudden adjustments typically require additional investigation to know their underlying causes and potential implications.

-

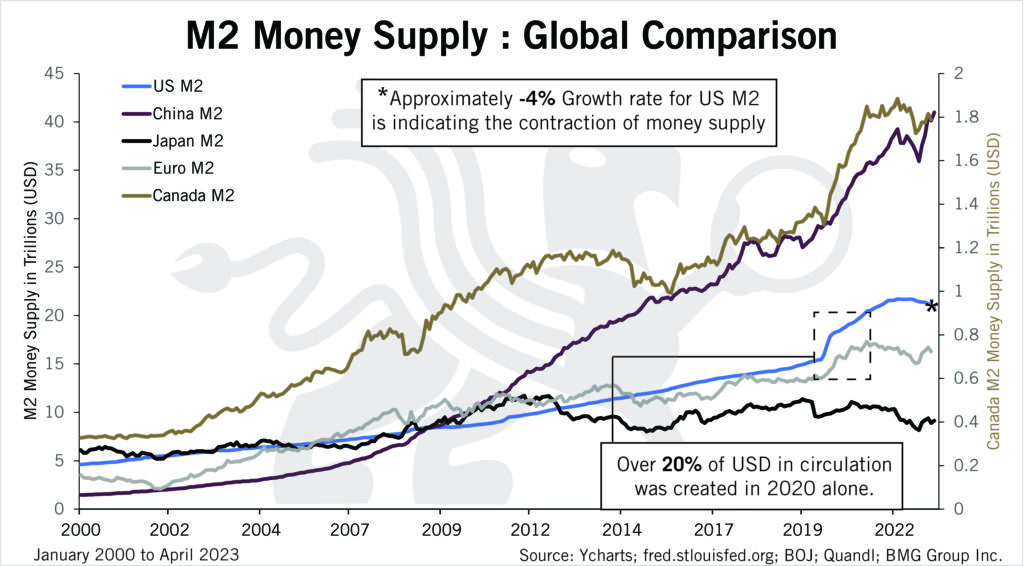

Comparability to different indicators: The M2 chart shouldn’t be analyzed in isolation. Evaluating its actions with different key financial indicators, akin to GDP progress, inflation charges (CPI or PCE), rates of interest, and unemployment charges, is crucial for a holistic understanding of the financial panorama. For instance, a fast enhance in M2 coupled with excessive inflation suggests potential financial coverage overreach.

-

Seasonality: Some minor fluctuations within the M2 cash provide could be attributed to seasonal elements, akin to elevated spending throughout vacation seasons. Analyzing the info on a seasonally adjusted foundation helps to take away these short-term variations and reveal underlying developments extra clearly.

-

Coverage Implications: Central banks actively handle the cash provide by means of numerous financial coverage instruments, together with rate of interest changes, reserve necessities, and open market operations. Analyzing the M2 chart along side the central financial institution’s coverage statements and actions supplies priceless insights into the effectiveness of those insurance policies and their affect on the financial system.

M2 and Inflation:

The connection between M2 and inflation is a fancy and sometimes debated subject. The amount principle of cash suggests a direct hyperlink between the cash provide and value ranges; a bigger cash provide results in elevated demand, driving up costs. Nevertheless, this relationship is just not at all times easy. The speed of cash (how shortly cash circulates by means of the financial system) and the general demand for cash can considerably affect the inflationary affect of adjustments within the M2 cash provide. In periods of financial uncertainty, as an example, folks may hoard money, decreasing the speed of cash and dampening inflationary pressures, even with a rising M2.

Moreover, different elements, akin to provide chain disruptions, international commodity costs, and authorities spending, additionally play a major position in figuring out inflation. Due to this fact, whereas M2 progress could be a main indicator of potential inflation, it is essential to think about these different elements to precisely predict inflationary pressures.

M2 and Financial Progress:

A rising M2 cash provide can stimulate financial progress by growing the supply of credit score and inspiring funding and spending. Nevertheless, extreme progress can result in inflation, probably undermining financial stability. Due to this fact, the optimum degree of M2 progress is a fragile steadiness that central banks continually attempt to realize. A wholesome financial system usually reveals a average and steady enhance in M2, reflecting sustainable financial growth with out extreme inflationary pressures.

Limitations of Utilizing M2:

Whereas M2 is a priceless financial indicator, it is vital to acknowledge its limitations:

-

Not an ideal predictor: M2 is just not an ideal predictor of future financial exercise or inflation. Different elements, as beforehand talked about, considerably affect these outcomes.

-

Adjustments in monetary expertise: The fast evolution of monetary expertise, akin to digital currencies and fintech improvements, can have an effect on the composition and interpretation of M2 information.

-

World interconnectedness: In an more and more globalized financial system, worldwide capital flows and change fee fluctuations can affect the M2 cash provide and complicate its interpretation.

Conclusion:

The M2 cash provide chart is a robust software for understanding the dynamics of an financial system. By analyzing its developments, volatility, and relationship to different financial indicators, buyers, policymakers, and economists can achieve priceless insights into the well being of the financial system, the effectiveness of financial coverage, and potential future financial developments. Nevertheless, it is essential to keep in mind that M2 is only one piece of the puzzle, and a complete evaluation requires contemplating a variety of financial information and elements. The interpretation of the M2 chart ought to at all times be nuanced and contextualized throughout the broader financial surroundings. Utilizing the M2 chart successfully requires a deep understanding of financial coverage, financial principle, and the constraints of utilizing any single indicator to foretell advanced financial phenomena. Steady monitoring and cautious interpretation are key to extracting significant insights from this significant financial metric.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the M2 Cash Provide Chart: A Deep Dive into Financial Coverage and Financial Indicators. We respect your consideration to our article. See you in our subsequent article!