Decoding the Market: A Complete Information to Chart Sample Evaluation

Associated Articles: Decoding the Market: A Complete Information to Chart Sample Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Market: A Complete Information to Chart Sample Evaluation. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Market: A Complete Information to Chart Sample Evaluation

Chart patterns, the visible representations of worth motion over time, are a cornerstone of technical evaluation. They provide merchants and traders invaluable insights into potential market shifts, offering clues about future worth actions. Whereas no sample ensures success, understanding and recognizing these patterns can considerably improve buying and selling methods and threat administration. This text serves as a complete encyclopedia of widespread chart patterns, exploring their traits, implications, and sensible purposes.

I. Introduction to Chart Sample Evaluation:

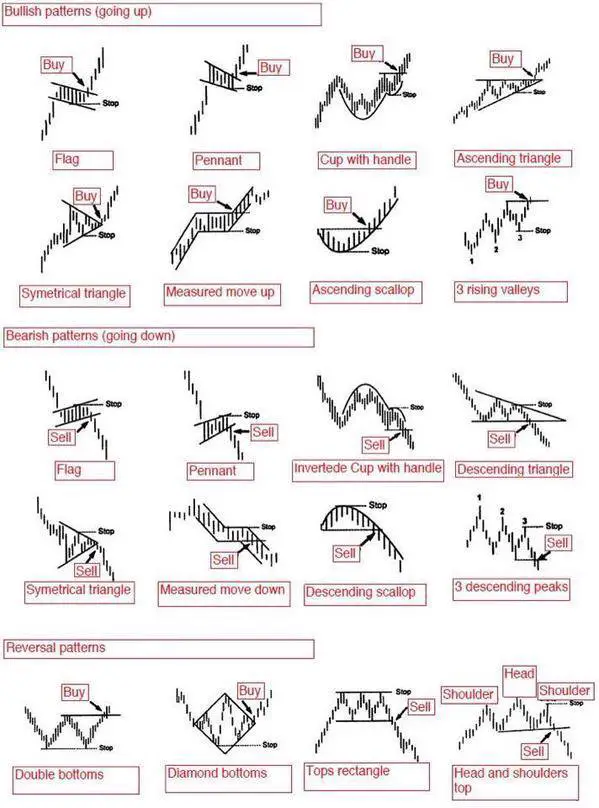

Technical evaluation depends on the idea that historical past repeats itself. Chart patterns determine recurring formations in worth charts, suggesting that previous worth habits can predict future worth actions. These patterns might be categorized broadly into two major teams: continuation patterns and reversal patterns.

-

Continuation Patterns: These patterns recommend a short lived pause in an current pattern earlier than the pattern resumes in its authentic path. They signify a interval of consolidation or relaxation earlier than a renewed push greater (for uptrends) or decrease (for downtrends).

-

Reversal Patterns: These patterns point out a possible change within the prevailing pattern. They sign a potential shift from an uptrend to a downtrend (or vice-versa), representing a big turning level available in the market.

II. Continuation Patterns:

A number of key continuation patterns continuously seem on charts. Understanding their nuances is essential for profitable buying and selling:

-

Triangles: Triangles are characterised by converging trendlines, making a triangular form on the chart. There are three major sorts: symmetrical, ascending, and descending.

- Symmetrical Triangles: These patterns exhibit a symmetrical convergence of two trendlines, with costs oscillating between them. The breakout normally happens within the path of the previous pattern.

- Ascending Triangles: These patterns have a flat backside trendline and an upward sloping high trendline. They’re bullish continuation patterns, indicating a possible upward breakout.

- Descending Triangles: These patterns characteristic a flat high trendline and a downward sloping backside trendline. They’re bearish continuation patterns, suggesting a possible downward breakout.

-

Rectangles: Rectangles are characterised by two parallel horizontal trendlines, with costs fluctuating between them. They signify a interval of consolidation, and a breakout usually happens within the path of the previous pattern.

-

Flags and Pennants: These patterns are characterised by a pointy worth transfer adopted by a interval of consolidation inside a small, roughly parallel channel.

- Flags: These have barely sloping trendlines, usually parallel to the primary pattern.

- Pennants: These have converging trendlines, forming a triangle-like form. Each flags and pennants usually sign a continuation of the previous pattern after the breakout.

-

Wedges: Wedges are characterised by converging trendlines, just like triangles, however the trendlines slope in the identical path.

- Rising Wedges: These are bearish continuation patterns, with each trendlines sloping upward. A breakout under the decrease trendline is anticipated.

- Falling Wedges: These are bullish continuation patterns, with each trendlines sloping downward. A breakout above the higher trendline is anticipated.

III. Reversal Patterns:

Reversal patterns point out a possible shift available in the market’s path. These patterns require cautious consideration, as false breakouts can happen.

-

Head and Shoulders: This can be a traditional reversal sample, characterised by three distinct peaks. The center peak (the "head") is considerably greater than the opposite two peaks ("shoulders"). A neckline connects the lows of the 2 shoulders. A break under the neckline confirms the sample and indicators a possible downtrend. An inverse head and shoulders sample signifies a possible uptrend.

-

Double Tops and Double Bottoms: These patterns include two comparable peaks (double high) or troughs (double backside) at roughly the identical worth degree. A break under the neckline of a double high or above the neckline of a double backside indicators a possible pattern reversal.

-

Triple Tops and Triple Bottoms: Much like double tops and bottoms, however with three peaks or troughs. These patterns usually have stronger reversal indicators than their double counterparts.

-

Rounded Tops and Rounded Bottoms: These patterns type a gradual curve, indicating a protracted interval of indecision earlier than a pattern reversal. Rounded tops are bearish, whereas rounded bottoms are bullish.

-

M-High and W-Backside: These patterns are visually represented by the letters M and W respectively. The M-top signifies a possible bearish reversal, whereas the W-bottom suggests a possible bullish reversal.

IV. Decoding Chart Patterns: Key Issues:

Whereas chart patterns present invaluable insights, a number of elements should be thought-about for correct interpretation:

-

Quantity: Confirming a breakout with elevated quantity strengthens the sign. Weak quantity throughout a breakout can recommend a false sign.

-

Pattern Context: Chart patterns needs to be thought-about throughout the broader context of the prevailing market pattern. A reversal sample in a powerful uptrend could also be much less dependable than one in a sideways or weak uptrend.

-

Assist and Resistance Ranges: Chart patterns usually work together with help and resistance ranges, reinforcing their significance. Breakouts above resistance or under help ranges are stronger indicators.

-

Affirmation with Indicators: Combining chart sample evaluation with different technical indicators, akin to shifting averages, RSI, or MACD, can improve accuracy and scale back false indicators.

-

Time Body: The time-frame of the chart considerably impacts the interpretation of patterns. Patterns noticed on each day charts could have totally different implications than these on hourly or weekly charts.

V. Sensible Functions and Threat Administration:

Chart patterns are a invaluable device for numerous buying and selling methods:

-

Figuring out Entry and Exit Factors: Breakouts from continuation patterns provide potential entry factors, whereas breakouts from reversal patterns can sign potential exit factors or new entry factors in the wrong way.

-

Setting Cease-Loss Orders: Cease-loss orders might be positioned under the neckline of a head and shoulders sample or under help ranges for higher threat administration.

-

Managing Place Dimension: Understanding the potential threat related to a commerce, based mostly on the chart sample and its implications, permits for applicable place sizing.

VI. Limitations of Chart Sample Evaluation:

It is essential to acknowledge the constraints of chart sample evaluation:

-

Subjectivity: Figuring out and deciphering chart patterns might be subjective, resulting in differing opinions amongst merchants.

-

False Breakouts: Breakouts from patterns are usually not at all times dependable, and false breakouts can happen, resulting in losses.

-

Not a Standalone Technique: Chart patterns shouldn’t be used as a standalone buying and selling technique. They need to be mixed with different types of evaluation, akin to basic evaluation and threat administration strategies.

VII. Conclusion:

Chart sample evaluation is a robust device for technical merchants, offering invaluable insights into potential market actions. By understanding the traits of assorted patterns and contemplating the broader market context, merchants can enhance their decision-making and threat administration. Nevertheless, it is important to keep in mind that no sample ensures success, and mixing chart sample evaluation with different analytical strategies is essential for efficient buying and selling. Steady studying and observe are key to mastering this invaluable talent and using it successfully within the dynamic world of economic markets.

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Market: A Complete Information to Chart Sample Evaluation. We respect your consideration to our article. See you in our subsequent article!