Decoding the Markets: A Complete Information to Buying and selling Chart Patterns (with Cheat Sheet PDF Obtain)

Associated Articles: Decoding the Markets: A Complete Information to Buying and selling Chart Patterns (with Cheat Sheet PDF Obtain)

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the Markets: A Complete Information to Buying and selling Chart Patterns (with Cheat Sheet PDF Obtain). Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Markets: A Complete Information to Buying and selling Chart Patterns (with Cheat Sheet PDF Obtain)

The monetary markets, a fancy tapestry woven with threads of provide and demand, can appear formidable to the novice dealer. Nonetheless, by understanding and using recurring chart patterns, you possibly can considerably enhance your buying and selling accuracy and profitability. These patterns, shaped by value motion and quantity, provide useful insights into potential future value actions, performing as visible cues for knowledgeable decision-making. This text serves as a complete information to widespread chart patterns, offering detailed explanations and actionable methods, culminating in a downloadable cheat sheet PDF to assist your buying and selling journey.

Understanding Chart Sample Evaluation:

Chart sample evaluation is a type of technical evaluation that focuses on figuring out recurring value formations on charts. These patterns are usually not assured predictors of future value actions, however they supply possibilities based mostly on historic market conduct. Profitable merchants mix chart sample evaluation with different technical indicators and basic evaluation for a holistic method. The effectiveness of chart patterns relies on components just like the timeframe used, the asset being traded, and the general market context.

Main Chart Sample Classes:

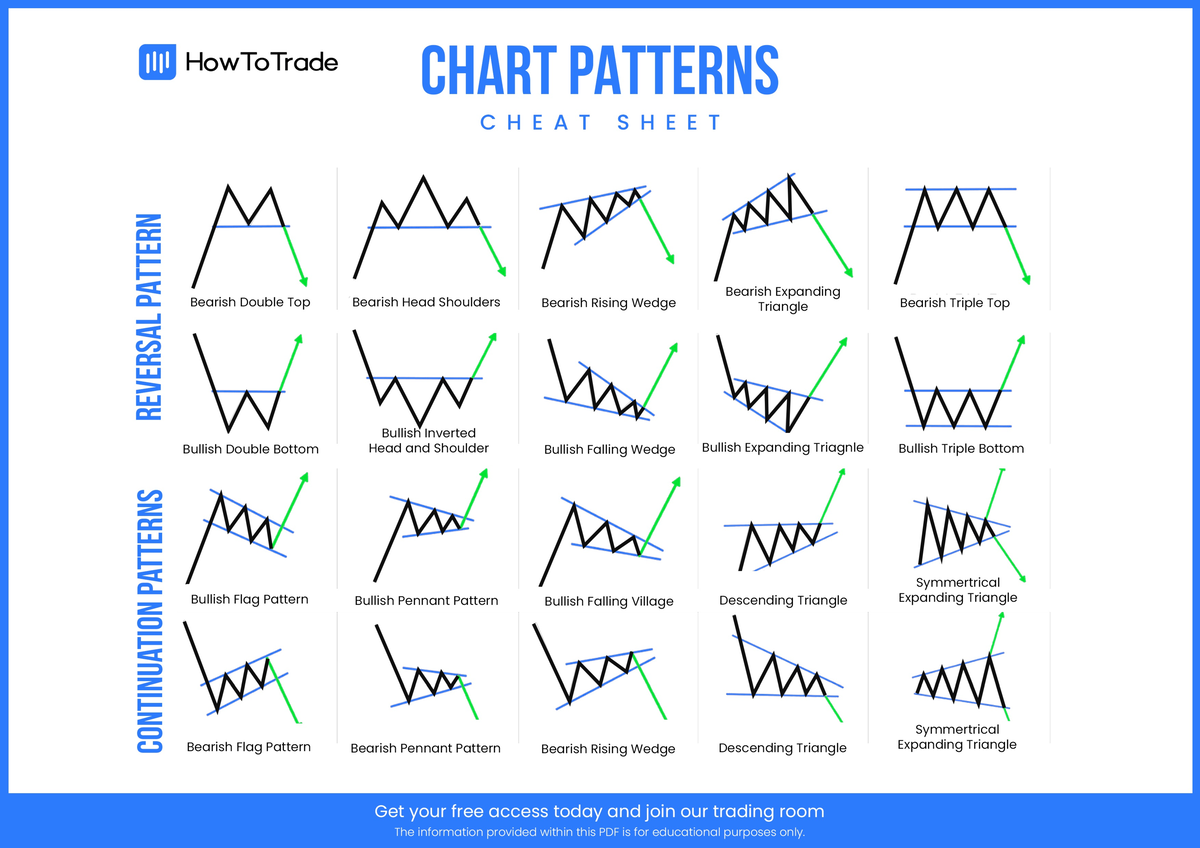

Chart patterns broadly fall into two classes: continuation patterns and reversal patterns.

1. Continuation Patterns: These patterns counsel a brief pause within the prevailing pattern earlier than the pattern resumes in its authentic route. They point out a interval of consolidation or sideways motion earlier than an extra value transfer.

-

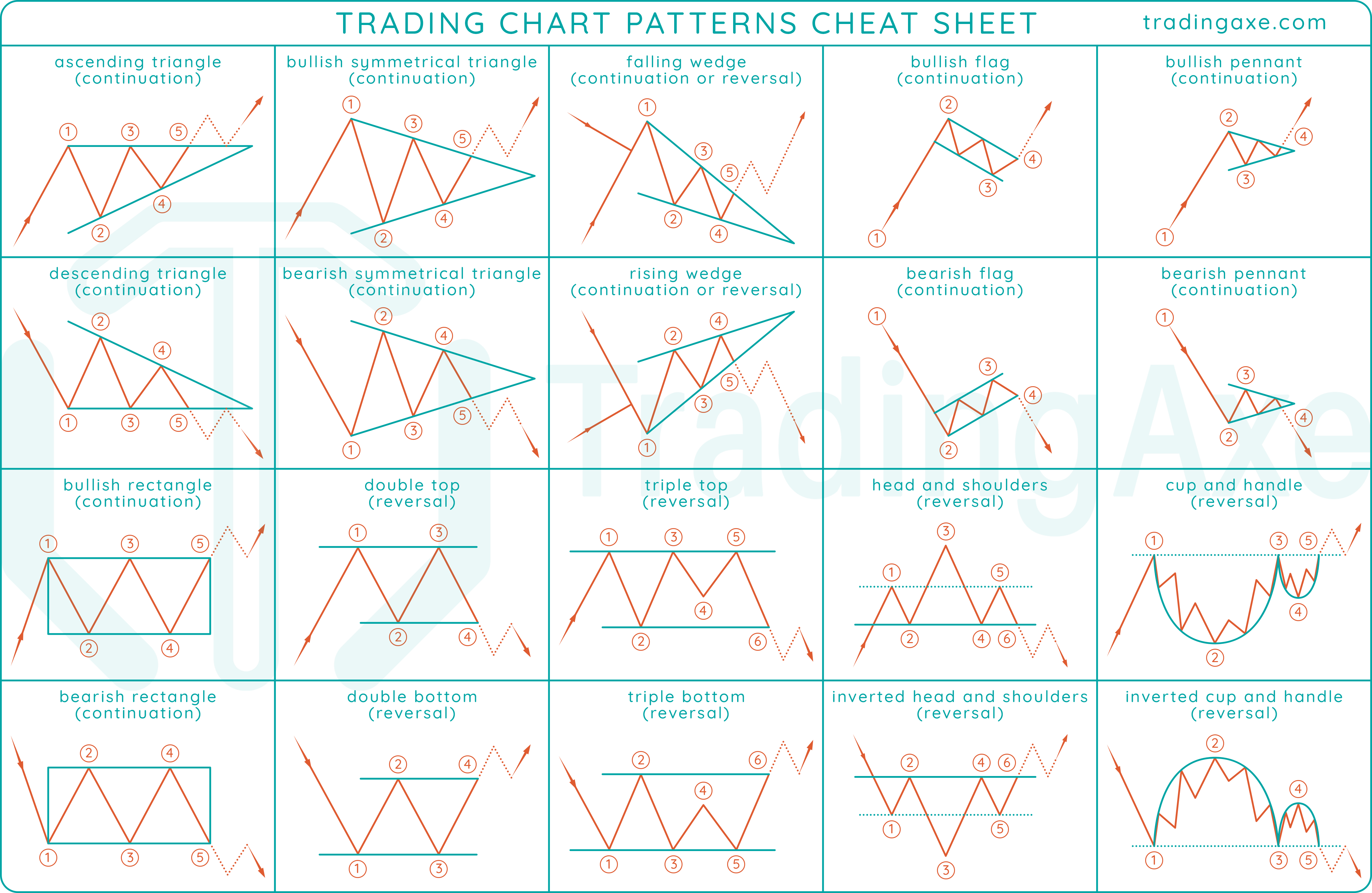

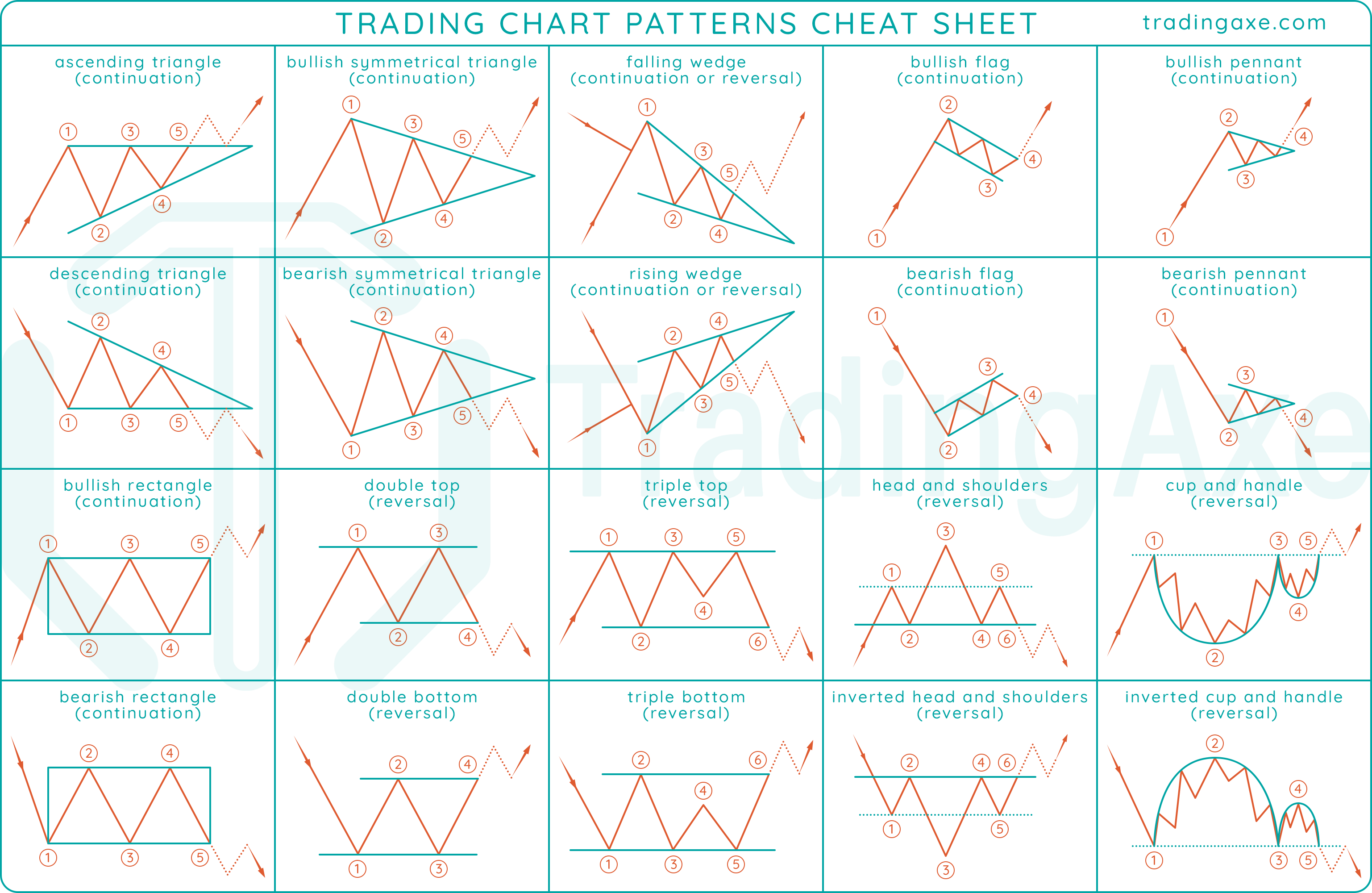

Triangles: Triangles are characterised by converging trendlines, making a triangular form. There are three major varieties: symmetrical, ascending, and descending. Symmetrical triangles counsel a continuation with a breakout in both route, whereas ascending triangles anticipate an upward breakout and descending triangles a downward breakout.

-

Flags and Pennants: These patterns resemble small flags or pennants connected to a pole (the previous pattern). Flags are characterised by parallel trendlines, whereas pennants have converging trendlines. Each patterns normally result in a continuation of the previous pattern after a short consolidation.

-

Rectangles and Channels: Rectangles present value oscillating between two horizontal assist and resistance ranges. Channels present value oscillating between two parallel trendlines, with a slight upward or downward slope. Breakouts from these patterns usually sign a continuation of the pattern.

2. Reversal Patterns: These patterns counsel a possible shift within the prevailing pattern, indicating a change in momentum. They sign a possible turning level out there.

-

Head and Shoulders: This can be a traditional reversal sample comprising three peaks (the left shoulder, the pinnacle, and the precise shoulder). The neckline connects the troughs between the peaks. A break under the neckline usually alerts a bearish reversal. An inverse head and shoulders sample alerts a bullish reversal.

-

Double Tops and Double Bottoms: Double tops kind when the value reaches the same excessive twice, adopted by a decline. Double bottoms are the other, with the value reaching the same low twice earlier than a subsequent rise. These patterns counsel a possible pattern reversal.

-

Triple Tops and Triple Bottoms: Just like double tops and bottoms, however with three cases of comparable highs or lows, indicating stronger reversal alerts.

-

Rounding Tops and Bottoms: These patterns signify a gradual change in pattern, forming a rounded form over an prolonged interval. Rounding tops sign a bearish reversal, whereas rounding bottoms counsel a bullish reversal.

Deciphering Chart Patterns:

A number of components affect the reliability and interpretation of chart patterns:

-

Quantity: Modifications in buying and selling quantity usually corroborate chart patterns. Elevated quantity throughout a breakout confirms the sample’s validity, whereas low quantity suggests weak spot.

-

Timeframe: The timeframe used considerably impacts the interpretation. Patterns recognized on every day charts may not be as important on hourly charts and vice versa.

-

Context: Take into account the general market situations and the particular asset’s fundamentals. A sample is perhaps much less dependable in periods of excessive market volatility or important information occasions.

-

Affirmation: It is essential to make use of affirmation alerts, similar to different technical indicators (e.g., transferring averages, RSI) or basic evaluation, to extend the likelihood of a profitable commerce.

Actionable Methods based mostly on Chart Patterns:

As soon as a chart sample is recognized, merchants can develop particular methods:

-

Breakout Buying and selling: This technique entails coming into a commerce when the value breaks out of a sample’s outlined boundaries (e.g., neckline, trendline). Cease-loss orders needs to be positioned under the breakout stage for lengthy positions and above for brief positions.

-

Pullback Buying and selling: This technique entails ready for a pullback to the sample’s assist or resistance stage earlier than coming into a commerce. This presents a probably higher entry level with a decrease danger.

-

Danger Administration: At all times use acceptable danger administration methods, similar to stop-loss and take-profit orders, to guard your capital. By no means danger greater than a small proportion of your buying and selling capital on a single commerce.

Downloadable Cheat Sheet PDF:

To help your understanding and utility of those chart patterns, we have ready a complete cheat sheet PDF (hyperlink to be inserted right here). This PDF offers a concise abstract of the important thing chart patterns mentioned, together with visible representations and concise explanations. It is designed to be a useful reference information to your buying and selling periods. (Observe: In a real-world utility, this could hyperlink to a downloadable PDF containing a visually wealthy abstract of the chart patterns mentioned.)

Conclusion:

Chart sample evaluation is a useful device for merchants of all ranges. By understanding the varied patterns, their interpretations, and acceptable buying and selling methods, you possibly can enhance your buying and selling selections and probably improve your profitability. Keep in mind that constant follow, mixed with steady studying and adaptation, is essential for fulfillment within the dynamic world of monetary markets. Make the most of the offered cheat sheet PDF as a useful resource to strengthen your understanding and construct your buying and selling experience. At all times bear in mind to handle your danger successfully and by no means make investments greater than you possibly can afford to lose. The knowledge offered right here is for instructional functions solely and shouldn’t be thought-about monetary recommendation. Seek the advice of with a certified monetary advisor earlier than making any funding selections.

![Chart Patterns Cheat Sheet PDF 2024 [FREE DOWNLOAD]](https://www.stockmarkethindi.in/wp-content/uploads/2023/08/20230822_214443_4321.webp)

Closure

Thus, we hope this text has offered useful insights into Decoding the Markets: A Complete Information to Buying and selling Chart Patterns (with Cheat Sheet PDF Obtain). We recognize your consideration to our article. See you in our subsequent article!