Decoding the Market’s Pulse: A Complete Information to Inventory Market Quantity Charts

Associated Articles: Decoding the Market’s Pulse: A Complete Information to Inventory Market Quantity Charts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Market’s Pulse: A Complete Information to Inventory Market Quantity Charts. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Market’s Pulse: A Complete Information to Inventory Market Quantity Charts

The inventory market is a fancy ecosystem pushed by the collective actions of hundreds of thousands of consumers and sellers. Whereas worth charts provide a visible illustration of asset worth fluctuations, they inform solely half the story. The opposite, equally essential, half is revealed by means of quantity charts, which depict the variety of shares or contracts traded over a particular interval. Understanding and deciphering quantity charts is important for any critical investor, offering invaluable insights into market sentiment, development affirmation, and potential reversals. This text dives deep into the world of inventory market quantity charts, exploring their varied interpretations and sensible purposes.

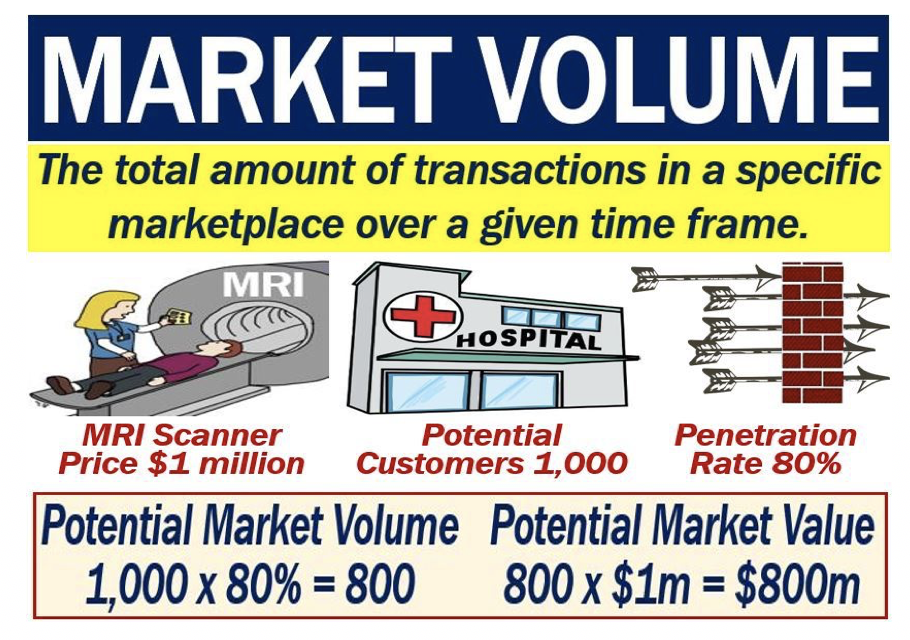

What’s Inventory Market Quantity?

Merely put, quantity represents the overall variety of shares or contracts traded for a selected safety throughout a given timeframe (e.g., each day, weekly, month-to-month). Excessive quantity signifies vital buying and selling exercise, suggesting sturdy conviction amongst market members. Conversely, low quantity suggests much less curiosity and doubtlessly weaker worth actions. Quantity is not only a numerical determine; it is a highly effective indicator reflecting the underlying energy or weak spot of a worth development.

Why is Quantity Necessary?

Value actions alone may be deceptive. A pointy worth improve on low quantity is likely to be a short lived, unsustainable surge pushed by a couple of massive trades, whereas the same worth improve on excessive quantity suggests broader market participation and a stronger chance of sustained upward momentum. Quantity gives context to cost motion, serving to buyers differentiate between real traits and fleeting market noise. Key advantages of analyzing quantity embrace:

-

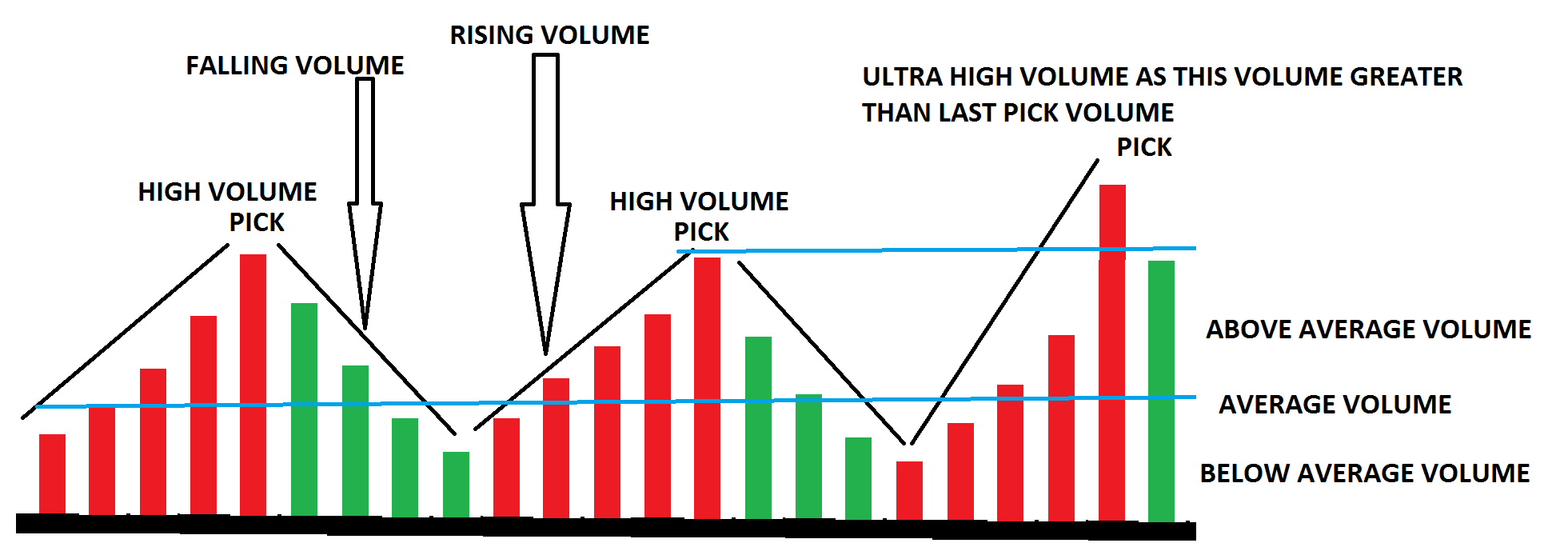

Affirmation of Value Traits: Rising costs accompanied by growing quantity affirm the energy of an uptrend. Conversely, falling costs with growing quantity affirm a downtrend. This confluence of worth and quantity gives a a lot stronger sign than worth alone.

-

Identification of Potential Reversals: Excessive quantity at worth tops or bottoms usually indicators a possible development reversal. A big improve in quantity throughout a worth decline, for instance, can point out a stronger promoting strain, suggesting a attainable continuation of the downtrend or perhaps a sharp reversal.

-

Detection of Distribution and Accumulation: Quantity evaluation can assist establish intervals of distribution (promoting strain) and accumulation (shopping for strain). Excessive quantity with falling costs suggests distribution, whereas excessive quantity with rising costs signifies accumulation.

-

Gauging Market Sentiment: Excessive quantity typically displays sturdy market sentiment, whether or not bullish or bearish. Low quantity usually suggests indecision or lack of conviction amongst market members.

-

Figuring out Weaknesses in Traits: A worth improve on lowering quantity can sign weakening bullish momentum, doubtlessly indicating an impending reversal. Equally, a worth lower on lowering quantity suggests weakening bearish momentum.

Kinds of Quantity Charts

Quantity charts are usually displayed alongside worth charts, usually as a separate bar chart under the value chart. The peak of every bar represents the quantity traded in the course of the corresponding interval. Completely different chart varieties can be utilized:

-

Bar Charts: The commonest sort, the place every bar represents the quantity for a particular interval (e.g., each day, hourly).

-

Candlestick Charts with Quantity: Combining candlestick charts with quantity gives a complete view of each worth and quantity knowledge.

-

Level and Determine Charts: Whereas much less frequent for quantity evaluation, level and determine charts can incorporate quantity knowledge to additional refine buying and selling indicators.

Deciphering Quantity Charts: Key Methods

A number of methods can improve your potential to interpret quantity charts successfully:

-

Quantity Spikes: Sudden, vital will increase in quantity usually sign necessary market occasions, corresponding to information bulletins, earnings reviews, or vital shifts in market sentiment. These spikes warrant shut consideration.

-

Quantity Drying Up: Reducing quantity throughout a worth development can point out weakening momentum. That is notably vital throughout uptrends, suggesting a possible exhaustion of shopping for strain.

-

Affirmation of Breakouts: Excessive quantity accompanying a breakout from a big worth degree (e.g., resistance or assist) confirms the energy of the breakout and will increase the chance of a sustained worth transfer within the breakout course.

-

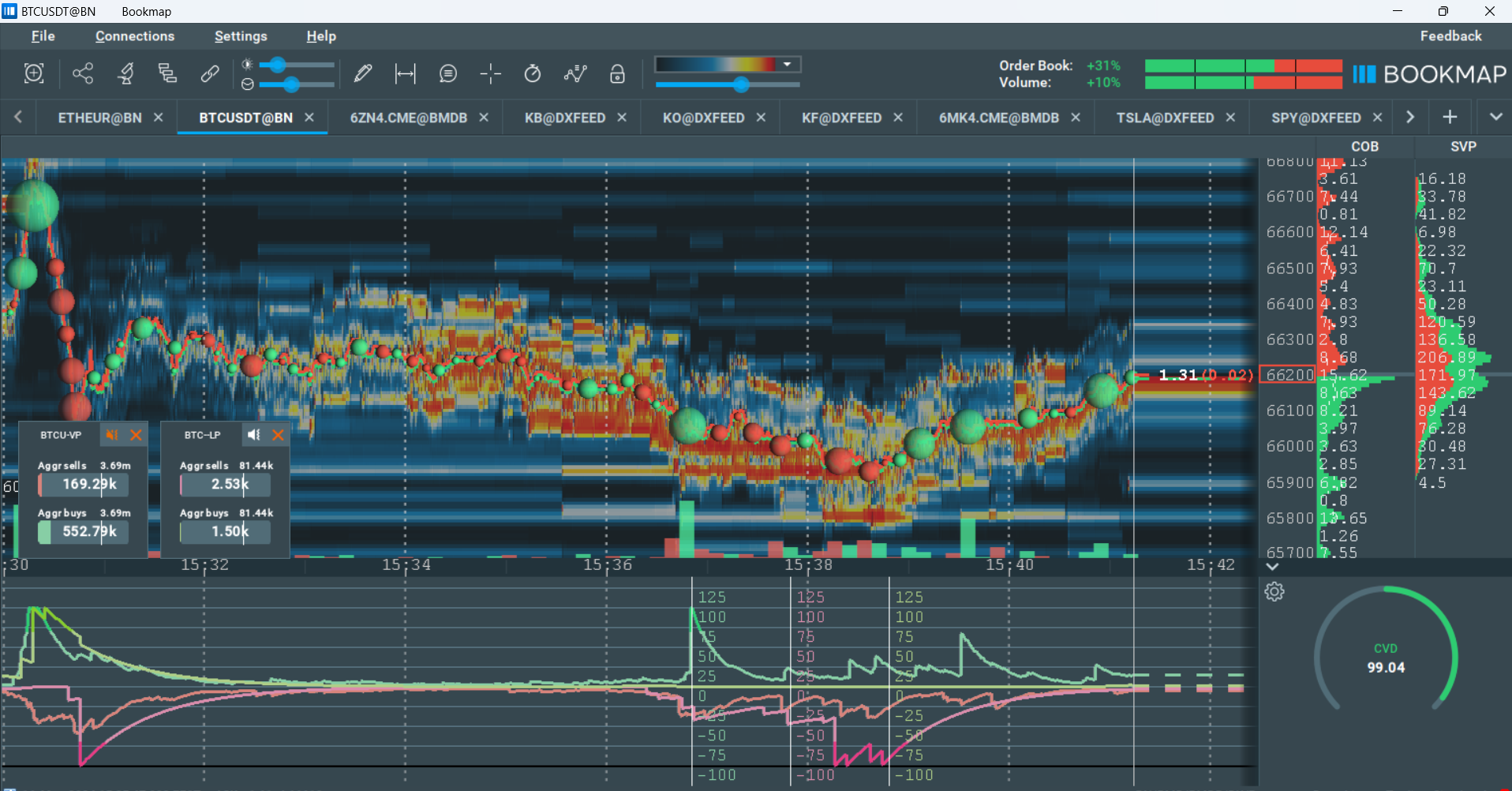

On-Stability Quantity (OBV): OBV is a cumulative quantity indicator that provides quantity on up days and subtracts quantity on down days. It helps establish divergence between worth and quantity, doubtlessly signaling a development reversal.

-

Chaikin Cash Movement (CMF): CMF is one other quantity indicator that considers each quantity and worth modifications. It helps establish intervals of accumulation and distribution.

-

Quantity Weighted Common Value (VWAP): VWAP calculates the typical worth weighted by quantity, offering a reference level for evaluating worth actions relative to common buying and selling exercise.

Widespread Errors to Keep away from

Whereas quantity charts are invaluable, it is essential to keep away from frequent pitfalls:

-

Ignoring Value Motion: Quantity is a supporting indicator, not a standalone buying and selling sign. At all times take into account worth motion along with quantity evaluation.

-

Over-reliance on Single Indicators: Relying solely on quantity indicators with out contemplating different technical or elementary components can result in inaccurate conclusions.

-

Misinterpreting Low Quantity: Low quantity does not at all times sign weak spot. It may possibly additionally point out a interval of consolidation earlier than a big worth transfer.

-

Ignoring Context: The importance of quantity modifications relies upon closely on the context, together with the general market atmosphere, the particular safety, and the timeframe being analyzed.

Conclusion:

Inventory market quantity charts are an indispensable device for any critical investor. They supply essential context to cost actions, serving to to verify traits, establish potential reversals, and gauge market sentiment. By mastering the artwork of deciphering quantity charts, buyers can considerably improve their buying and selling choices and enhance their total market understanding. Nevertheless, it is essential to do not forget that quantity evaluation is handiest when used along with different technical and elementary evaluation methods, avoiding over-reliance on any single indicator. Steady studying and apply are key to successfully using quantity charts to navigate the dynamic world of inventory market buying and selling. By combining cautious statement, a radical understanding of market dynamics, and a disciplined method, buyers can leverage the facility of quantity knowledge to make extra knowledgeable and worthwhile funding decisions.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Market’s Pulse: A Complete Information to Inventory Market Quantity Charts. We hope you discover this text informative and useful. See you in our subsequent article!