Decoding the Mortgage Utility Chart: A Complete Information for Debtors and Lenders

Associated Articles: Decoding the Mortgage Utility Chart: A Complete Information for Debtors and Lenders

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Mortgage Utility Chart: A Complete Information for Debtors and Lenders. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Mortgage Utility Chart: A Complete Information for Debtors and Lenders

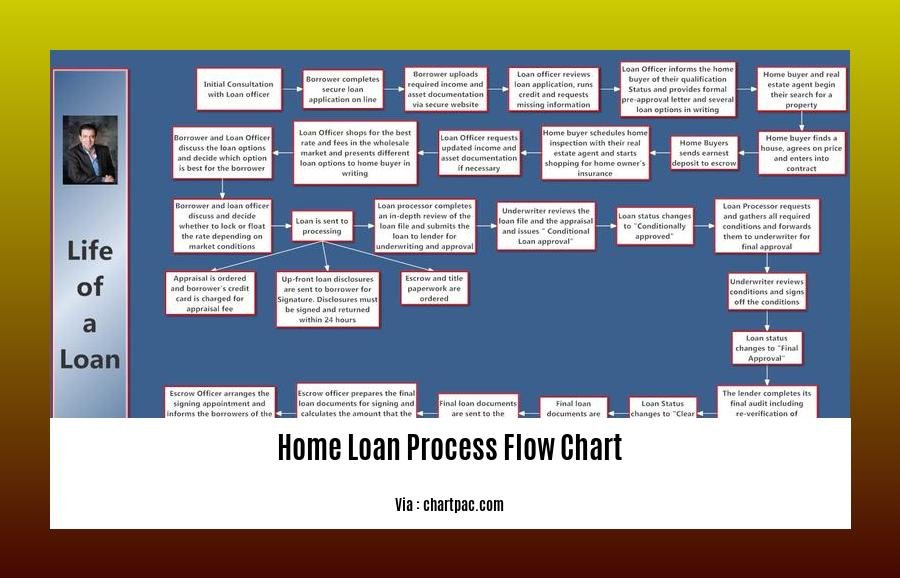

The mortgage software course of can really feel like navigating a labyrinth, stuffed with paperwork, jargon, and seemingly limitless necessities. Central to this course of is the mortgage software chart, a visible illustration of the borrower’s monetary standing and the proposed mortgage. Whereas the particular format can range between lenders, understanding the important thing elements of this chart is essential for each debtors looking for approval and lenders assessing threat. This text gives a complete overview of the standard parts present in a mortgage software chart, explaining their significance and implications.

I. The Basis: Key Knowledge Factors within the Chart

A typical mortgage software chart will consolidate an enormous quantity of knowledge right into a concise, simply digestible format. This information usually falls into a number of key classes:

A. Borrower Info: This part varieties the bedrock of the chart and contains:

- Identify and Contact Info: Primary figuring out particulars of the applicant(s), together with addresses, telephone numbers, and e-mail addresses. Accuracy is paramount, as any discrepancies can delay the method.

- Employment Historical past: An in depth account of the applicant’s employment historical past, together with job titles, employers, dates of employment, and revenue verification. Lenders scrutinize this part to evaluate the applicant’s stability and incomes capability. Constant employment historical past with regular revenue progress is very favorable.

- Earnings and Belongings: This vital part particulars the applicant’s revenue from all sources (wage, bonuses, investments, rental revenue, and so on.) and their liquid belongings (checking and financial savings accounts, funding accounts, retirement funds). The lender makes use of this info to find out the applicant’s debt-to-income ratio (DTI) and general monetary energy.

- Credit score Historical past: A abstract of the applicant’s credit score report, together with credit score scores from main credit score bureaus (Equifax, Experian, TransUnion), excellent money owed, cost historical past, and credit score utilization. A powerful credit score rating is a vital think about mortgage approval and rate of interest dedication. The chart might visually symbolize this via a credit score rating vary or a graphical illustration of credit score utilization.

- Debt Obligations: This part lists all excellent money owed, together with mortgages, auto loans, pupil loans, bank card balances, and different liabilities. The lender calculates the DTI ratio primarily based on this info, evaluating the applicant’s whole month-to-month debt funds to their gross month-to-month revenue. A decrease DTI is usually most well-liked.

- Residential Historical past: This part outlines the applicant’s residential historical past, demonstrating their stability and rental cost historical past (if relevant). Lenders use this info to evaluate the applicant’s reliability and duty.

B. Property Info: This part focuses on the small print of the property being bought:

- Property Deal with: The complete tackle of the property.

- Property Worth: The appraised worth of the property, which is essential in figuring out the loan-to-value ratio (LTV).

- Buy Value: The agreed-upon buy value between the client and vendor.

- Down Cost: The amount of cash the applicant is contributing in the direction of the acquisition value. A bigger down cost usually results in higher mortgage phrases.

- Mortgage Quantity: The amount of cash being borrowed from the lender.

C. Mortgage Particulars: This part outlines the specifics of the mortgage mortgage:

- Mortgage Kind: The kind of mortgage being utilized for (e.g., fixed-rate, adjustable-rate, FHA, VA, typical).

- Curiosity Charge: The annual rate of interest on the mortgage.

- Mortgage Time period: The size of the mortgage (e.g., 15 years, 30 years).

- Month-to-month Cost: The estimated month-to-month cost, together with principal, curiosity, taxes, and insurance coverage (PITI).

- Mortgage-to-Worth Ratio (LTV): The ratio of the mortgage quantity to the appraised worth of the property. A decrease LTV usually signifies much less threat for the lender.

II. Visible Illustration and Interpretation

The mortgage software chart does not simply current information; it typically visualizes it to facilitate understanding. Frequent visible parts embrace:

- Bar Charts: These are sometimes used to symbolize revenue sources, debt obligations, and asset holdings, offering a fast comparability of various elements.

- Pie Charts: These can successfully showcase the proportion of revenue allotted to completely different bills, together with housing prices, debt funds, and disposable revenue.

- Line Graphs: These is likely to be used for instance the applicant’s revenue historical past over time, demonstrating traits and stability.

- Tables: Tables are important for organizing detailed info, akin to employment historical past, credit score historical past, and debt obligations.

- Coloration-Coding: Coloration-coding can spotlight key information factors, akin to excessive debt ratios or low credit score scores, drawing consideration to potential dangers.

III. The Lender’s Perspective: Assessing Threat

Lenders use the mortgage software chart as a major instrument for assessing threat. They rigorously analyze the info to find out the applicant’s means to repay the mortgage. Key components they think about embrace:

- Debt-to-Earnings Ratio (DTI): A excessive DTI signifies that a good portion of the applicant’s revenue is already dedicated to debt funds, leaving much less room for the mortgage cost. Lenders usually choose a DTI beneath 43%, however this could range relying on the lender and mortgage kind.

- Credit score Rating: A better credit score rating signifies a decrease threat of default. Lenders use credit score scores to find out the rate of interest and eligibility for the mortgage.

- Mortgage-to-Worth Ratio (LTV): A excessive LTV means the borrower is borrowing a bigger share of the property’s worth, growing the chance for the lender. Larger LTV loans typically require non-public mortgage insurance coverage (PMI).

- Employment Historical past and Earnings Stability: Constant employment historical past with steady revenue is essential for demonstrating the applicant’s means to make constant mortgage funds.

- Down Cost: A bigger down cost reduces the mortgage quantity and the LTV, mitigating threat for the lender.

IV. The Borrower’s Perspective: Understanding Your Utility

For debtors, understanding the data offered within the mortgage software chart is significant. It permits them to:

- Establish potential weaknesses: By reviewing the chart, debtors can establish areas of concern, akin to a excessive DTI or low credit score rating, and take steps to enhance their monetary standing earlier than making use of for a mortgage.

- Negotiate higher phrases: A powerful understanding of the chart permits debtors to barter higher rates of interest and mortgage phrases with lenders.

- Evaluate mortgage presents: The chart gives a transparent comparability of various mortgage presents from varied lenders, facilitating knowledgeable decision-making.

- Monitor the appliance course of: The chart can function a invaluable instrument for monitoring the progress of the mortgage software.

V. Conclusion: A Highly effective Device for Transparency and Effectivity

The mortgage software chart is greater than only a assortment of knowledge; it is a highly effective instrument that promotes transparency and effectivity within the mortgage software course of. By understanding the important thing elements and their implications, each debtors and lenders can navigate this advanced course of with better readability and confidence. Whereas the particular format and particulars might range, the underlying rules stay constant: assessing threat, evaluating monetary stability, and guaranteeing accountable lending practices. For debtors, proactive preparation and a radical understanding of their very own monetary profile are essential for a profitable software. For lenders, the chart gives an important framework for making knowledgeable selections and minimizing threat. In the end, a well-understood and successfully utilized mortgage software chart advantages all events concerned.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Mortgage Utility Chart: A Complete Information for Debtors and Lenders. We admire your consideration to our article. See you in our subsequent article!