Decoding the Nifty 50: A Complete Evaluation By Bar Graph Charts

Associated Articles: Decoding the Nifty 50: A Complete Evaluation By Bar Graph Charts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Nifty 50: A Complete Evaluation By Bar Graph Charts. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Nifty 50: A Complete Evaluation By Bar Graph Charts

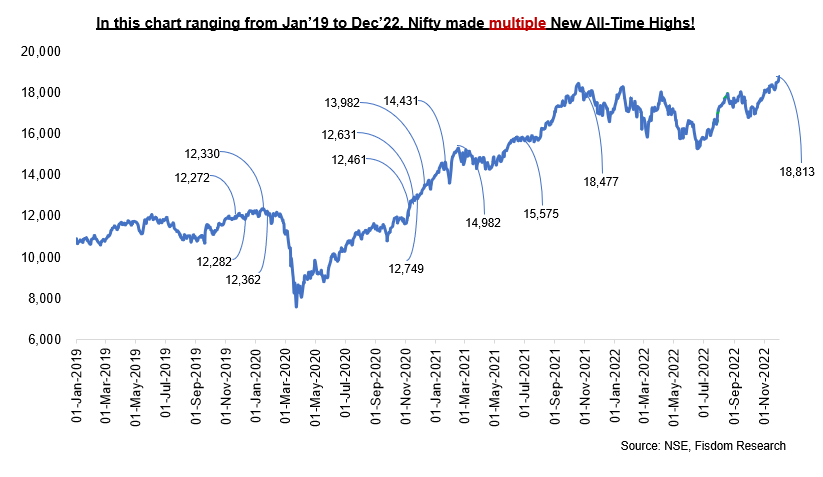

The Nifty 50 index, a benchmark for Indian equities, offers a compelling snapshot of the nation’s financial well being and market sentiment. Understanding its efficiency is essential for buyers, analysts, and anybody within the Indian monetary panorama. Whereas varied charting methods exist, the standard bar graph stays a robust software for visualizing and deciphering the Nifty 50’s trajectory. This text explores the utility of bar graph charts in analyzing the Nifty 50, highlighting their strengths and limitations, and demonstrating how they can be utilized to glean significant insights.

The Energy of Visible Illustration: Why Bar Graphs for Nifty 50?

Information alone may be overwhelming. A uncooked listing of Nifty 50 closing costs over time gives little rapid understanding. Bar graphs remodel this uncooked knowledge right into a visually compelling narrative. They successfully talk:

- Worth fluctuations: The peak of every bar immediately represents the index’s worth on a selected day, week, or month. This permits for fast identification of excessive and low factors, showcasing durations of serious progress or decline.

- Tendencies: By observing the course and magnitude of the bars, long-term tendencies (bullish or bearish) turn out to be readily obvious. Constant upward motion suggests a bullish development, whereas constant downward motion signifies a bearish development.

- Volatility: The variability in bar heights displays the volatility of the market. Intervals with giant fluctuations between bars signify increased volatility, whereas persistently related bar heights recommend a calmer market.

- Comparisons: Bar graphs facilitate straightforward comparisons between totally different time durations. As an illustration, one can readily evaluate the efficiency of the Nifty 50 throughout totally different financial cycles or after particular coverage bulletins.

Kinds of Nifty 50 Bar Graph Charts:

A number of varieties of bar graphs may be employed to research the Nifty 50, every providing distinctive views:

-

Every day Bar Chart: This shows the Nifty 50’s closing value for every buying and selling day. It is superb for short-term evaluation, specializing in each day value actions and figuring out short-term tendencies. Excessive granularity permits for detailed remark, however can be visually cluttered for longer timeframes.

-

Weekly Bar Chart: This aggregates each day knowledge into weekly closing costs, offering a much less cluttered view appropriate for medium-term evaluation. It smooths out each day noise, making it simpler to determine weekly tendencies and patterns.

-

Month-to-month Bar Chart: This shows the closing value for every month, providing a long-term perspective. It is helpful for figuring out main tendencies and cyclical patterns over prolonged durations. Nonetheless, it lacks the element of each day or weekly charts, doubtlessly masking shorter-term fluctuations.

-

Comparative Bar Charts: These can evaluate the Nifty 50’s efficiency in opposition to different indices (e.g., Sensex, Dow Jones) or in opposition to particular sectors throughout the Indian financial system. This helps assess relative efficiency and determine sector-specific drivers of market actions.

-

Bar Charts with Extra Information: Bar graphs may be enhanced by incorporating extra knowledge factors, similar to buying and selling quantity, transferring averages, or key financial indicators. This offers a richer context for deciphering value actions and figuring out potential correlations. For instance, overlaying buying and selling quantity on a bar chart can reveal whether or not value actions are supported by vital buying and selling exercise.

Deciphering Nifty 50 Bar Graph Charts: Key Issues:

Whereas bar graphs provide a transparent visible illustration, deciphering them requires cautious consideration:

-

Scale: The dimensions of the y-axis (representing the index worth) considerably impacts the visible notion of value actions. A compressed scale would possibly decrease the obvious magnitude of fluctuations, whereas an expanded scale would possibly exaggerate them.

-

Timeframe: The chosen timeframe (each day, weekly, month-to-month) profoundly impacts the interpretation. A brief timeframe reveals short-term volatility, whereas an extended timeframe highlights long-term tendencies.

-

Context: Deciphering bar graphs requires contemplating the broader financial and political context. Main occasions like international crises, coverage modifications, or geopolitical tensions can considerably affect the Nifty 50’s efficiency and ought to be factored into the evaluation.

-

Limitations: Bar graphs primarily concentrate on value actions. They do not immediately seize different vital components influencing market conduct, similar to investor sentiment, danger urge for food, or the influence of particular firm information.

Examples of Insights from Nifty 50 Bar Graphs:

By analyzing Nifty 50 bar graphs, buyers can determine:

-

Assist and Resistance Ranges: Recurring excessive and low factors on the chart can point out assist and resistance ranges, which can be utilized to foretell future value actions.

-

Pattern Reversals: Adjustments within the course of the bars can sign potential development reversals, offering early warning indicators for buyers to regulate their portfolios.

-

Breakouts: Important value actions past established assist or resistance ranges can point out breakouts, suggesting a possible shift within the prevailing development.

-

Consolidation Intervals: Intervals with comparatively restricted value fluctuations can recommend consolidation, a interval of sideways motion earlier than a possible breakout or development reversal.

-

Seasonality: Analyzing bar graphs throughout a number of years can reveal seasonal patterns within the Nifty 50’s efficiency, which may be useful for timing funding choices.

Combining Bar Graphs with Different Technical Indicators:

Whereas bar graphs present a robust visible basis, combining them with different technical indicators enhances the evaluation. For instance:

-

Shifting Averages: Overlaying transferring averages (e.g., 50-day, 200-day) on the bar chart helps determine long-term tendencies and potential purchase/promote indicators. Crossovers of transferring averages can sign development modifications.

-

Relative Energy Index (RSI): The RSI, a momentum indicator, can be utilized to determine overbought or oversold circumstances, offering insights into potential value reversals.

-

Bollinger Bands: Bollinger Bands, which measure volatility, will help determine durations of excessive and low volatility, aiding in danger administration.

Conclusion:

The Nifty 50 bar graph chart, regardless of its simplicity, stays a robust software for understanding and analyzing the Indian inventory market. Its visible nature permits for fast identification of tendencies, volatility, and potential turning factors. Nonetheless, it is essential to interpret bar graphs inside a broader context, contemplating financial components, geopolitical occasions, and supplementing the evaluation with different technical indicators. By combining visible illustration with a nuanced understanding of market dynamics, buyers can leverage the insights provided by Nifty 50 bar graphs to make extra knowledgeable funding choices. Keep in mind, nevertheless, that previous efficiency shouldn’t be indicative of future outcomes, and all funding choices ought to be made after thorough due diligence and consideration of particular person danger tolerance.

![[DIAGRAM] Crash Bar Diagram - MYDIAGRAM.ONLINE](http://assessment.tki.org.nz/var/tki-assess/storage/images/media/images/bar-graph/17395-1-eng-NZ/Bar-graph.jpg)

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Nifty 50: A Complete Evaluation By Bar Graph Charts. We admire your consideration to our article. See you in our subsequent article!