Decoding the Nifty 50: A Complete Information to All Chart Sorts

Associated Articles: Decoding the Nifty 50: A Complete Information to All Chart Sorts

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Nifty 50: A Complete Information to All Chart Sorts. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Nifty 50: A Complete Information to All Chart Sorts

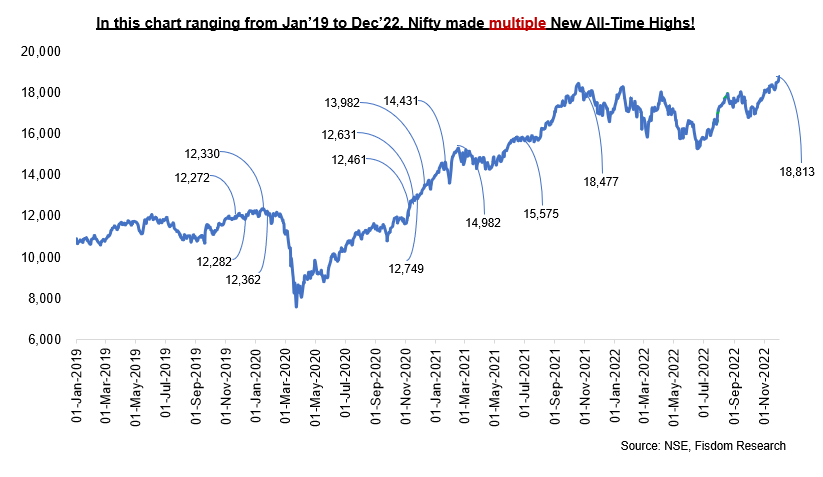

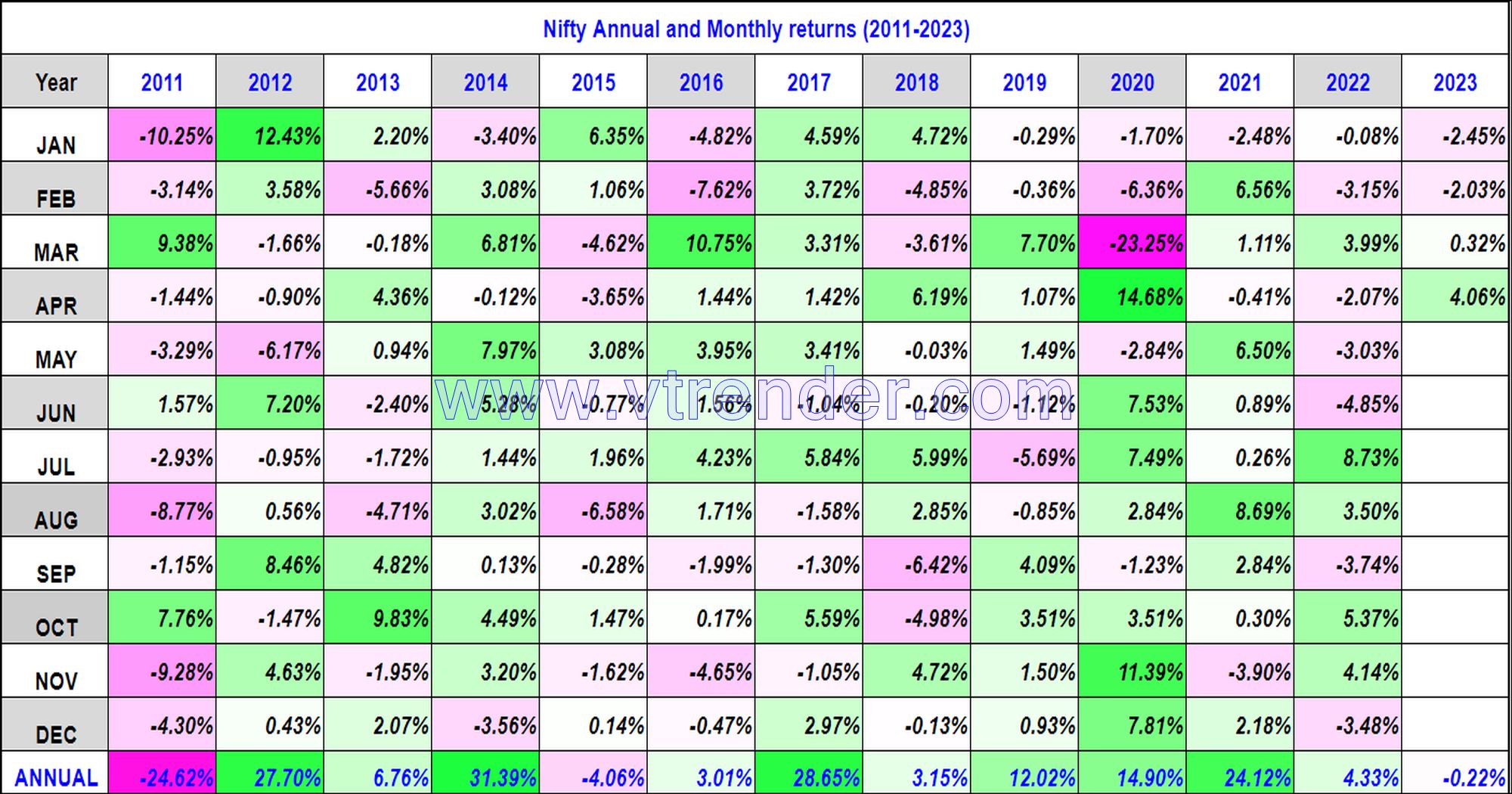

The Nifty 50 index, a benchmark for Indian equities, is a dynamic entity reflecting the nation’s financial well being and investor sentiment. Understanding its worth actions is essential for profitable investing, and charting performs a significant function on this course of. Totally different chart varieties supply distinctive views, revealing underlying developments, patterns, and potential future worth motion. This text supplies a complete information to varied chart varieties used to research the Nifty 50, explaining their strengths, weaknesses, and functions.

1. Candlestick Charts:

Arguably the preferred chart sort, candlestick charts supply a wealthy visible illustration of worth motion inside a selected timeframe. Every candlestick represents a single interval (e.g., every day, hourly, weekly), displaying the open, excessive, low, and shutting costs. The "physique" of the candlestick reveals the vary between the open and shut, whereas the "wicks" (or shadows) lengthen to the excessive and low costs.

- Bullish Candlestick Patterns: These point out upward worth momentum. Examples embody the bullish engulfing sample (a big bullish candle following a bearish one), the hammer (a small physique with a protracted decrease wick), and the morning star (a three-candle reversal sample).

- Bearish Candlestick Patterns: These counsel downward worth stress. Examples embody the bearish engulfing sample, the hanging man (a small physique with a protracted decrease wick), and the night star (a three-candle reversal sample).

- Strengths: Visually interesting, straightforward to interpret fundamental patterns, supplies data on open, excessive, low, and shut costs.

- Weaknesses: Subjectivity in figuring out patterns, may be cluttered with many candlesticks on shorter timeframes, requires observe to precisely interpret complicated patterns.

2. Bar Charts:

Just like candlestick charts, bar charts symbolize worth motion inside a selected interval. Nevertheless, as an alternative of a candlestick physique, they use a vertical bar. The highest of the bar signifies the excessive, the underside the low, and a brief horizontal line marks the open and shut costs.

- Strengths: Easy and straightforward to grasp, appropriate for freshmen, much less cluttered than candlestick charts on shorter timeframes.

- Weaknesses: Much less visually interesting than candlestick charts, doesn’t supply as a lot data at a look.

3. Line Charts:

Line charts plot the closing worth of the Nifty 50 over time, connecting every knowledge level with a line. They’re the only chart sort, focusing solely on worth developments.

- Strengths: Straightforward to determine total developments, glorious for visualizing long-term worth actions, much less cluttered than different chart varieties.

- Weaknesses: Lacks detailed worth data (open, excessive, low), much less helpful for figuring out short-term worth reversals or patterns.

4. Level & Determine Charts:

In contrast to the earlier chart varieties, Level & Determine charts ignore time. They focus solely on worth actions, plotting an "X" for an upward worth motion and an "O" for a downward motion, as soon as a predefined worth change (field dimension) is achieved. This filtering of time helps determine vital worth modifications and potential assist/resistance ranges.

- Strengths: Filters out noise, highlights vital worth modifications, identifies potential assist and resistance ranges, helpful for figuring out pattern reversals.

- Weaknesses: Ignores time ingredient, may be complicated to assemble and interpret, requires observe and understanding of its methodology.

5. Renko Charts:

Renko charts, just like Level & Determine charts, ignore time and deal with worth actions. Nevertheless, as an alternative of "X" and "O", they use bricks of a set dimension to symbolize worth modifications. A brand new brick is added solely when the value strikes past the brick dimension.

- Strengths: Filters out noise, simplifies worth motion, highlights vital worth modifications, helpful for figuring out developments and breakouts.

- Weaknesses: Ignores time ingredient, may be troublesome to interpret for freshmen, requires understanding of brick dimension choice.

6. Heikin Ashi Charts:

Heikin Ashi charts clean out worth fluctuations, making developments simpler to determine. They calculate every candlestick’s values utilizing a components that averages the open, excessive, low, and shut costs of the earlier interval. This leads to fewer whipsaws and clearer pattern identification.

- Strengths: Reduces noise, clarifies developments, simpler to determine potential assist and resistance ranges, appropriate for pattern following methods.

- Weaknesses: Lags behind precise worth actions, might miss short-term buying and selling alternatives, requires understanding of its smoothing impact.

7. Kagi Charts:

Kagi charts are one other sort of price-based chart that filters out noise and focuses on vital worth actions. They use vertical traces to symbolize worth modifications, with the course of the road indicating the pattern. A brand new line is created when the value strikes past a predefined reversal quantity.

- Strengths: Filters out noise, highlights vital worth modifications, helpful for figuring out developments and potential reversals.

- Weaknesses: Ignores time ingredient, may be complicated to interpret, requires understanding of reversal quantity choice.

8. Three-Line Break Charts:

Three-Line Break charts are a variation of the Kagi chart, the place a brand new line is just created after a worth reversal of thrice the road width. This additional filters out noise and highlights solely vital worth modifications.

- Strengths: Extremely filters noise, focuses on main worth actions, helpful for long-term pattern identification.

- Weaknesses: Ignores time ingredient, may be troublesome to interpret, requires understanding of line width choice.

Combining Chart Sorts and Technical Indicators:

Whereas every chart sort provides distinctive insights, combining them with technical indicators can improve evaluation. Indicators like transferring averages, RSI, MACD, and Bollinger Bands can present further alerts and ensure potential worth actions recognized on the charts. For example, utilizing candlestick charts mixed with transferring averages may also help determine potential purchase/promote alerts primarily based on worth motion and pattern affirmation.

Conclusion:

Understanding the Nifty 50 index requires a multifaceted method, and charting performs an important function. Totally different chart varieties present distinctive views, permitting merchants and traders to determine developments, patterns, and potential worth actions. Whereas every chart sort has its strengths and weaknesses, choosing the proper chart relies on particular person buying and selling kinds, timeframes, and threat tolerance. By mastering varied chart varieties and mixing them with technical indicators, traders can develop a sturdy buying and selling technique for navigating the dynamic world of the Nifty 50. Keep in mind that no single chart sort or indicator ensures success, and thorough analysis, threat administration, and steady studying are important for profitable investing.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Nifty 50: A Complete Information to All Chart Sorts. We thanks for taking the time to learn this text. See you in our subsequent article!