Decoding the Nifty 50 Futures Chart: A Complete Information for Merchants

Associated Articles: Decoding the Nifty 50 Futures Chart: A Complete Information for Merchants

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Nifty 50 Futures Chart: A Complete Information for Merchants. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the Nifty 50 Futures Chart: A Complete Information for Merchants

The Nifty 50 index futures contract (usually abbreviated as "Fin Nifty" or just "Nifty Futures") is a strong device for merchants looking for publicity to the Indian fairness market. Understanding its chart is essential for profitable buying and selling. This text delves deep into the intricacies of deciphering the Nifty 50 futures chart, protecting technical evaluation, elementary concerns, danger administration, and sensible buying and selling methods.

Understanding the Fundamentals:

The Nifty 50 futures contract is a spinoff instrument whose worth is derived from the underlying Nifty 50 index. It represents a dedication to purchase or promote a specified amount of the Nifty 50 index at a predetermined future date (the expiry date). Not like investing straight within the Nifty 50 index by means of ETFs or mutual funds, futures buying and selling presents leverage, permitting merchants to manage a bigger place with a smaller preliminary funding. This leverage, nonetheless, amplifies each earnings and losses.

The Nifty 50 futures chart shows the value motion of the contract over time, often represented as a candlestick or line chart. Every candle or line phase depicts the value motion throughout a particular time interval (e.g., 1 minute, 5 minutes, 1 hour, day by day, weekly). The chart offers a visible illustration of worth traits, momentum, and volatility, enabling merchants to determine potential buying and selling alternatives.

Key Parts of the Nifty 50 Futures Chart:

- Value Axis: Represents the value of the Nifty 50 futures contract at completely different closing dates.

- Time Axis: Represents the time interval over which the value information is displayed (e.g., day by day, weekly, month-to-month).

- Candlesticks/Strains: Depict the value motion throughout a particular interval. Candlesticks present the open, excessive, low, and shutting costs, whereas line charts solely present the closing costs.

- Quantity: Signifies the variety of contracts traded throughout every interval. Excessive quantity usually confirms worth actions.

- Shifting Averages: Calculated averages of previous costs, used to determine traits and potential help/resistance ranges. Widespread transferring averages embody 50-day, 100-day, and 200-day transferring averages.

- Indicators: Technical indicators like Relative Power Index (RSI), Shifting Common Convergence Divergence (MACD), Bollinger Bands, and Stochastic Oscillator present insights into momentum, overbought/oversold situations, and potential pattern reversals.

- Assist and Resistance Ranges: Value ranges the place the value has traditionally struggled to interrupt by means of. Assist ranges act as potential shopping for alternatives, whereas resistance ranges act as potential promoting alternatives.

- Trendlines: Strains drawn to attach vital highs or lows, indicating the prevailing pattern (uptrend, downtrend, or sideways).

Technical Evaluation of the Nifty 50 Futures Chart:

Technical evaluation focuses on deciphering previous worth information and chart patterns to foretell future worth actions. A number of methods are employed when analyzing the Nifty 50 futures chart:

- Pattern Identification: Figuring out the prevailing pattern (uptrend, downtrend, or sideways) is essential. That is usually carried out utilizing trendlines, transferring averages, and different indicators.

- Assist and Resistance Ranges: Figuring out these ranges helps merchants anticipate potential worth reversals or breakouts.

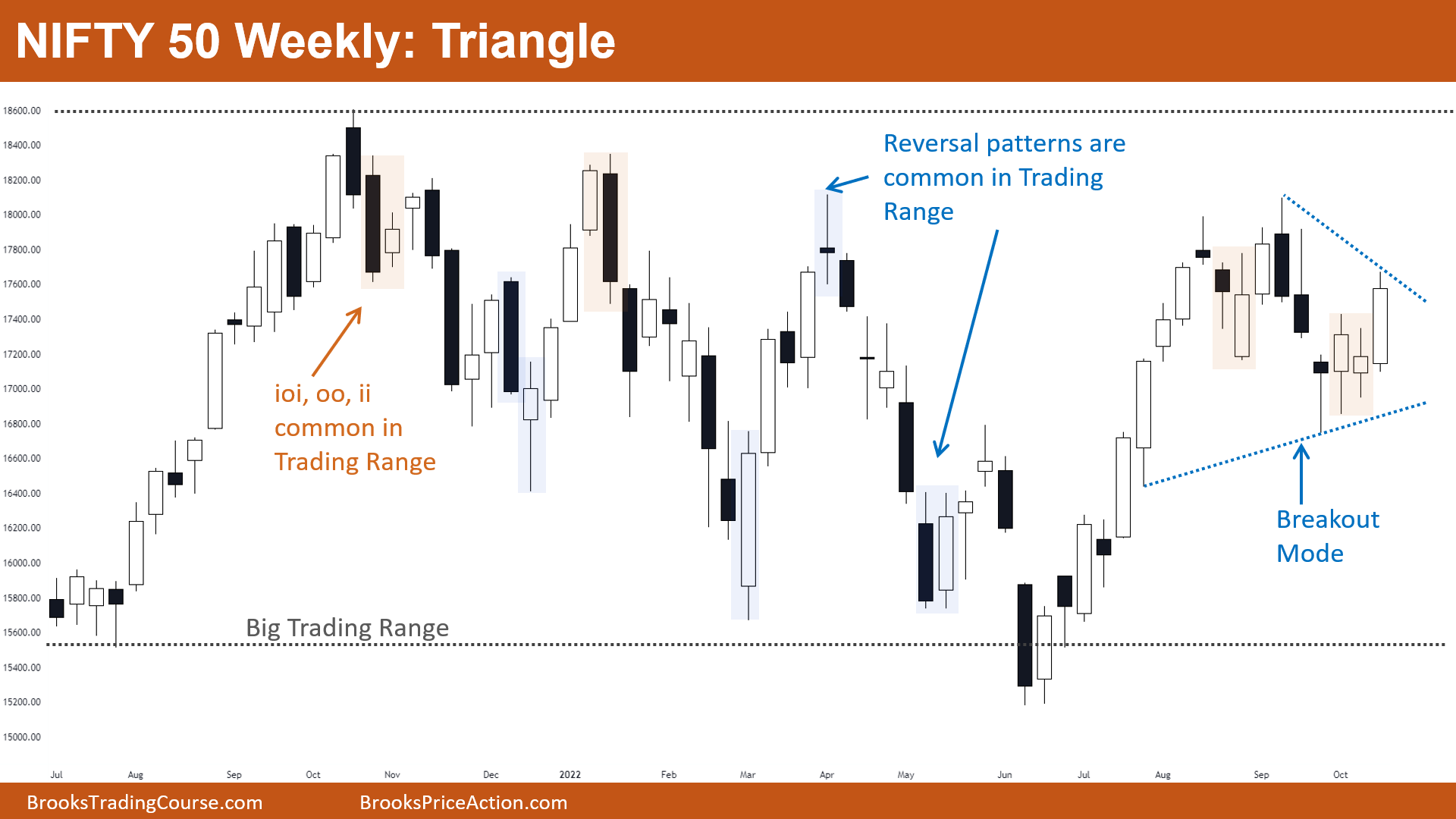

- Chart Patterns: Recognizing chart patterns like head and shoulders, double tops/bottoms, triangles, and flags can present insights into potential worth actions.

- Indicator Evaluation: Utilizing indicators like RSI, MACD, and Bollinger Bands helps assess momentum, overbought/oversold situations, and potential pattern reversals.

- Quantity Evaluation: Inspecting buying and selling quantity alongside worth actions helps affirm the energy of traits and potential breakouts.

Elementary Evaluation and its Affect:

Whereas technical evaluation focuses on chart patterns, elementary evaluation considers macroeconomic elements, firm earnings, rates of interest, and geopolitical occasions that may affect the Nifty 50 index and, consequently, the futures contract. Elements like:

- GDP Development: Sturdy GDP progress typically results in greater inventory costs.

- Inflation: Excessive inflation can negatively impression inventory costs.

- Curiosity Charges: Rate of interest hikes can dampen market sentiment.

- International Financial Situations: International financial slowdowns can have an effect on the Indian market.

- Authorities Insurance policies: Authorities insurance policies and rules can considerably impression the market.

- Company Earnings: Sturdy company earnings typically increase market sentiment.

Understanding these elementary elements offers context for the technical evaluation and helps in making knowledgeable buying and selling choices.

Threat Administration in Nifty 50 Futures Buying and selling:

Futures buying and selling entails vital danger on account of leverage. Efficient danger administration methods are essential:

- Place Sizing: Figuring out the suitable variety of contracts to commerce primarily based in your danger tolerance and account measurement.

- Cease-Loss Orders: Inserting stop-loss orders to restrict potential losses if the market strikes towards your place.

- Take-Revenue Orders: Setting take-profit orders to safe earnings when your goal worth is reached.

- Diversification: Spreading your investments throughout completely different property to cut back danger.

- Margin Administration: Sustaining adequate margin in your buying and selling account to keep away from margin calls.

Buying and selling Methods:

Numerous buying and selling methods could be employed when buying and selling Nifty 50 futures:

- Day Buying and selling: Holding positions for a brief interval, usually inside a single buying and selling day.

- Swing Buying and selling: Holding positions for a number of days or even weeks, capitalizing on short-term worth swings.

- Scalping: Executing quite a few trades inside a short while body, aiming for small earnings on every commerce.

- Arbitrage: Exploiting worth discrepancies between the spot market and the futures market.

- Unfold Buying and selling: Buying and selling the value distinction between two associated contracts.

Deciphering Chart Alerts:

Let’s take into account some widespread chart alerts and their potential implications:

- Bullish engulfing candle: A big bullish candle following a bearish candle suggests a possible bullish reversal.

- Bearish engulfing candle: A big bearish candle following a bullish candle suggests a possible bearish reversal.

- Breakout from a triangle sample: A worth breakout above a triangle sample suggests a bullish continuation, whereas a breakout beneath suggests a bearish continuation.

- RSI divergence: When the value makes a brand new excessive however the RSI fails to make a brand new excessive, it suggests bearish divergence and a possible worth reversal.

- MACD crossover: A bullish crossover happens when the MACD line crosses above the sign line, suggesting a bullish pattern. A bearish crossover happens when the MACD line crosses beneath the sign line, suggesting a bearish pattern.

Conclusion:

The Nifty 50 futures chart is a fancy however highly effective device for merchants. Profitable buying and selling requires a deep understanding of technical and elementary evaluation, efficient danger administration, and the choice of applicable buying and selling methods. By combining these parts, merchants can enhance their probabilities of attaining constant profitability within the dynamic world of Nifty 50 futures buying and selling. Nevertheless, it’s essential to keep in mind that futures buying and selling is inherently dangerous, and losses can exceed preliminary investments. Thorough analysis, steady studying, and disciplined buying and selling are important for fulfillment. Think about looking for recommendation from a professional monetary advisor earlier than partaking in futures buying and selling.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Nifty 50 Futures Chart: A Complete Information for Merchants. We hope you discover this text informative and helpful. See you in our subsequent article!