Decoding the NVIDIA Value Chart: A Deep Dive into the GPU Large’s Market Efficiency

Associated Articles: Decoding the NVIDIA Value Chart: A Deep Dive into the GPU Large’s Market Efficiency

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the NVIDIA Value Chart: A Deep Dive into the GPU Large’s Market Efficiency. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the NVIDIA Value Chart: A Deep Dive into the GPU Large’s Market Efficiency

NVIDIA, the undisputed king of the graphics processing unit (GPU) market, has seen its inventory value bear a dramatic rollercoaster journey lately. Understanding the forces driving these fluctuations requires an in depth examination of the corporate’s efficiency, the broader technological panorama, and the ever-shifting dynamics of the worldwide financial system. This text will delve into the complexities of NVIDIA’s value chart, exploring key historic developments, influential components, and potential future trajectories.

A Historic Perspective: From Humble Beginnings to Tech Titan

NVIDIA’s journey started in 1993, a far cry from its present standing as a trillion-dollar firm. Early years noticed modest progress, primarily centered on the gaming market. The worth chart throughout this era displays a gradual upward pattern, punctuated by durations of consolidation and minor corrections. Nevertheless, the actual acceleration started with the appearance of the GeForce line of GPUs, which revolutionized the gaming expertise and solidified NVIDIA’s place as a market chief.

The early 2000s noticed the value chart mirror the burgeoning demand for high-performance computing, with NVIDIA capitalizing on the expansion of the skilled visualization and high-performance computing (HPC) sectors. The chart reveals durations of serious upward momentum pushed by technological breakthroughs and profitable product launches. Nevertheless, financial downturns and competitors from AMD often resulted in value corrections, highlighting the cyclical nature of the know-how sector.

The introduction of CUDA (Compute Unified Gadget Structure) marked a pivotal second. This parallel computing platform opened up an enormous array of functions past gaming, together with synthetic intelligence (AI), deep studying, and information science. This diversification considerably impacted NVIDIA’s value chart, setting the stage for explosive progress within the following decade.

The AI Revolution and its Impression on the Value Chart:

The previous 5 years have witnessed an unprecedented surge in NVIDIA’s inventory value, largely fueled by the explosive progress of the AI business. The corporate’s GPUs, notably the A100 and H100 collection, have develop into indispensable for coaching and deploying giant language fashions (LLMs) and different AI functions. This demand has pushed important income progress, mirrored in a steep upward trajectory on the value chart. The chart vividly illustrates the correlation between developments in AI and the hovering worth of NVIDIA’s inventory.

A number of key occasions additional fueled this upward pattern:

- The rise of generative AI: The exceptional success of instruments like ChatGPT and DALL-E 2 dramatically elevated the demand for high-performance computing energy, straight benefiting NVIDIA. The worth chart reveals a pointy improve coinciding with the general public launch of those groundbreaking functions.

- Elevated cloud computing adoption: The shift in the direction of cloud-based computing has created an enormous marketplace for NVIDIA’s information heart GPUs. Main cloud suppliers like AWS, Azure, and Google Cloud rely closely on NVIDIA {hardware}, boosting demand and driving up the inventory value.

- Strategic partnerships and acquisitions: NVIDIA’s strategic alliances with main know-how corporations and its acquisitions of key AI-related companies have additional solidified its place available in the market, leading to constructive momentum on the value chart.

Elements Influencing Value Volatility:

Whereas the general pattern has been upward, NVIDIA’s value chart isn’t with out its volatility. A number of components contribute to those fluctuations:

- Financial downturns: As a know-how firm, NVIDIA is inclined to broader financial cycles. Recessions or durations of financial uncertainty usually result in decreased demand for high-cost {hardware}, leading to value corrections. The chart displays this sensitivity, displaying dips in periods of financial instability.

- Competitors: Whereas NVIDIA dominates the GPU market, it faces competitors from AMD, Intel, and different gamers. The introduction of latest, aggressive merchandise or technological breakthroughs from rivals can affect NVIDIA’s market share and, consequently, its inventory value.

- Provide chain disruptions: The worldwide semiconductor business is susceptible to produce chain disruptions. Shortages of parts or logistical bottlenecks can affect NVIDIA’s manufacturing capability, affecting income and inventory value.

- Geopolitical components: World political occasions and commerce tensions may also affect NVIDIA’s efficiency. Restrictions on exports or sanctions can restrict market entry and negatively affect the inventory value.

- Investor sentiment: Market sentiment performs a big function in inventory value fluctuations. Optimistic information, comparable to sturdy earnings studies or technological breakthroughs, can increase investor confidence and drive up the value. Conversely, unfavourable information can result in sell-offs and value declines.

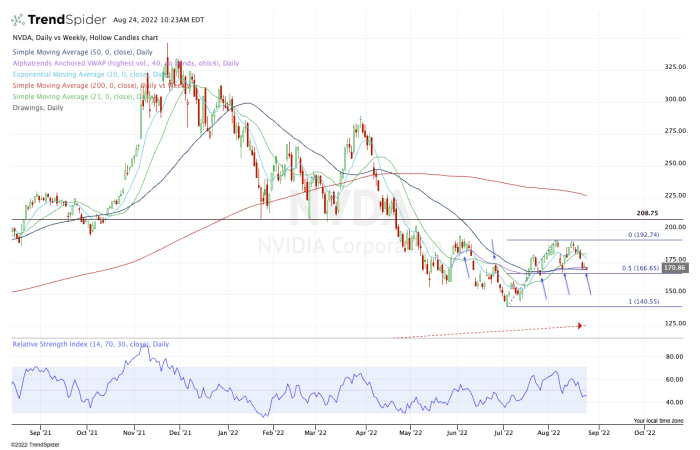

Analyzing the Value Chart: Key Indicators and Technical Evaluation

A radical evaluation of NVIDIA’s value chart requires the applying of technical evaluation instruments. Indicators like transferring averages, relative energy index (RSI), and quantity evaluation can present priceless insights into potential developments and assist/resistance ranges. For instance, a rising 200-day transferring common usually signifies a bullish pattern, whereas a declining RSI would possibly recommend an overbought situation and potential value correction.

Chart patterns, comparable to head and shoulders, double tops, and triangles, may also supply clues about future value actions. Nevertheless, it is essential to keep in mind that technical evaluation isn’t foolproof and must be used along side basic evaluation to achieve a complete understanding of the inventory’s efficiency.

Future Outlook and Potential Eventualities:

Predicting the longer term trajectory of NVIDIA’s value chart is inherently difficult. Nevertheless, a number of components recommend continued progress:

- Continued AI adoption: The AI revolution continues to be in its early phases, with immense potential for additional progress. As AI functions develop into extra subtle and widespread, the demand for NVIDIA’s GPUs is prone to improve.

- Growth into new markets: NVIDIA is actively increasing into new markets, comparable to autonomous automobiles and robotics, which may drive future progress.

- Technological innovation: NVIDIA’s dedication to analysis and growth ensures a steady stream of revolutionary merchandise, sustaining its aggressive edge.

Nevertheless, potential dangers stay:

- Elevated competitors: The aggressive panorama is evolving, with rivals investing closely in GPU know-how.

- Financial slowdown: A big financial downturn may negatively affect demand for high-cost {hardware}.

- Regulatory scrutiny: Elevated regulatory scrutiny of the know-how sector may pose challenges for NVIDIA.

Conclusion:

NVIDIA’s value chart tells a compelling story of innovation, market dominance, and the transformative energy of synthetic intelligence. Whereas the previous decade has seen exceptional progress, the longer term stays unsure. By rigorously analyzing historic developments, contemplating influential components, and using technical and basic evaluation, buyers can achieve a greater understanding of the dangers and alternatives related to investing on this know-how large. The journey of decoding the NVIDIA value chart is an ongoing course of, requiring steady monitoring and adaptation to the ever-evolving dynamics of the know-how panorama. Nevertheless, one factor stays clear: NVIDIA’s affect on the way forward for know-how, and its affect on the funding world, is simple.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the NVIDIA Value Chart: A Deep Dive into the GPU Large’s Market Efficiency. We hope you discover this text informative and useful. See you in our subsequent article!