Decoding the QQQ Put/Name Ratio Chart: A Deep Dive into Market Sentiment

Associated Articles: Decoding the QQQ Put/Name Ratio Chart: A Deep Dive into Market Sentiment

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the QQQ Put/Name Ratio Chart: A Deep Dive into Market Sentiment. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the QQQ Put/Name Ratio Chart: A Deep Dive into Market Sentiment

The Invesco QQQ Belief (QQQ) tracks the Nasdaq-100 Index, a technology-heavy benchmark that always serves as a proxy for the general market’s well being and sentiment. Analyzing the QQQ put/name ratio chart gives a singular perspective on investor psychology, offering helpful insights into potential market actions. This text will delve into the intricacies of the QQQ put/name ratio, explaining its calculation, interpretation, and limitations, in the end empowering readers to make use of this device successfully inside their funding methods.

Understanding the Put/Name Ratio

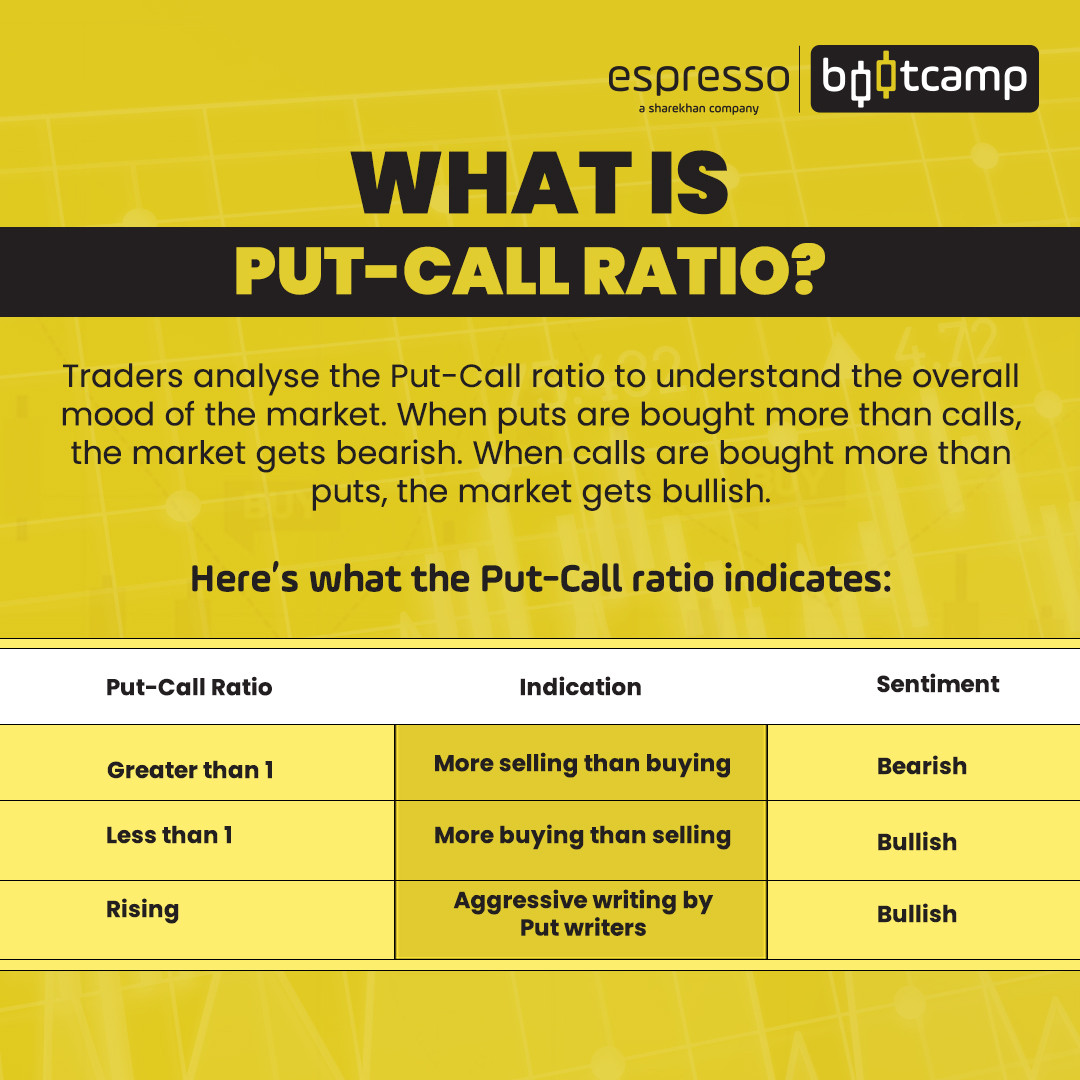

The put/name ratio is a technical indicator that measures the ratio of put choices contracts to name choices contracts traded on a particular underlying asset, on this case, QQQ. Put choices grant the holder the fitting, however not the duty, to promote the underlying asset at a particular value (the strike value) earlier than a sure date (the expiration date). Name choices, conversely, grant the holder the fitting, however not the duty, to purchase the underlying asset at a particular strike value earlier than the expiration date.

A excessive put/name ratio suggests a higher variety of put choices are being bought relative to name choices. This typically signifies a bearish sentiment, as buyers are hedging towards potential value declines or actively betting on a downward development. Conversely, a low put/name ratio signifies extra name choices being bought, suggesting bullish sentiment and a perception that the worth will rise.

Calculating the QQQ Put/Name Ratio

The calculation is simple:

QQQ Put/Name Ratio = Whole Variety of QQQ Put Choices Traded / Whole Variety of QQQ Name Choices Traded

It is essential to know that this ratio could be calculated for numerous timeframes (day by day, weekly, month-to-month) and throughout completely different strike costs. The selection of timeframe and strike value considerably impacts the interpretation. Analyzing a single day’s ratio could be deceptive on account of short-term volatility. A extra sturdy evaluation includes observing tendencies over longer durations, reminiscent of weekly or month-to-month averages. Equally, contemplating the ratio throughout a spread of strike costs (quite than simply specializing in at-the-money choices) gives a extra complete image.

Deciphering the QQQ Put/Name Ratio Chart

The QQQ put/name ratio chart, sometimes displayed graphically, permits for a visible illustration of the ratio’s fluctuations over time. Deciphering this chart requires understanding a number of key ideas:

-

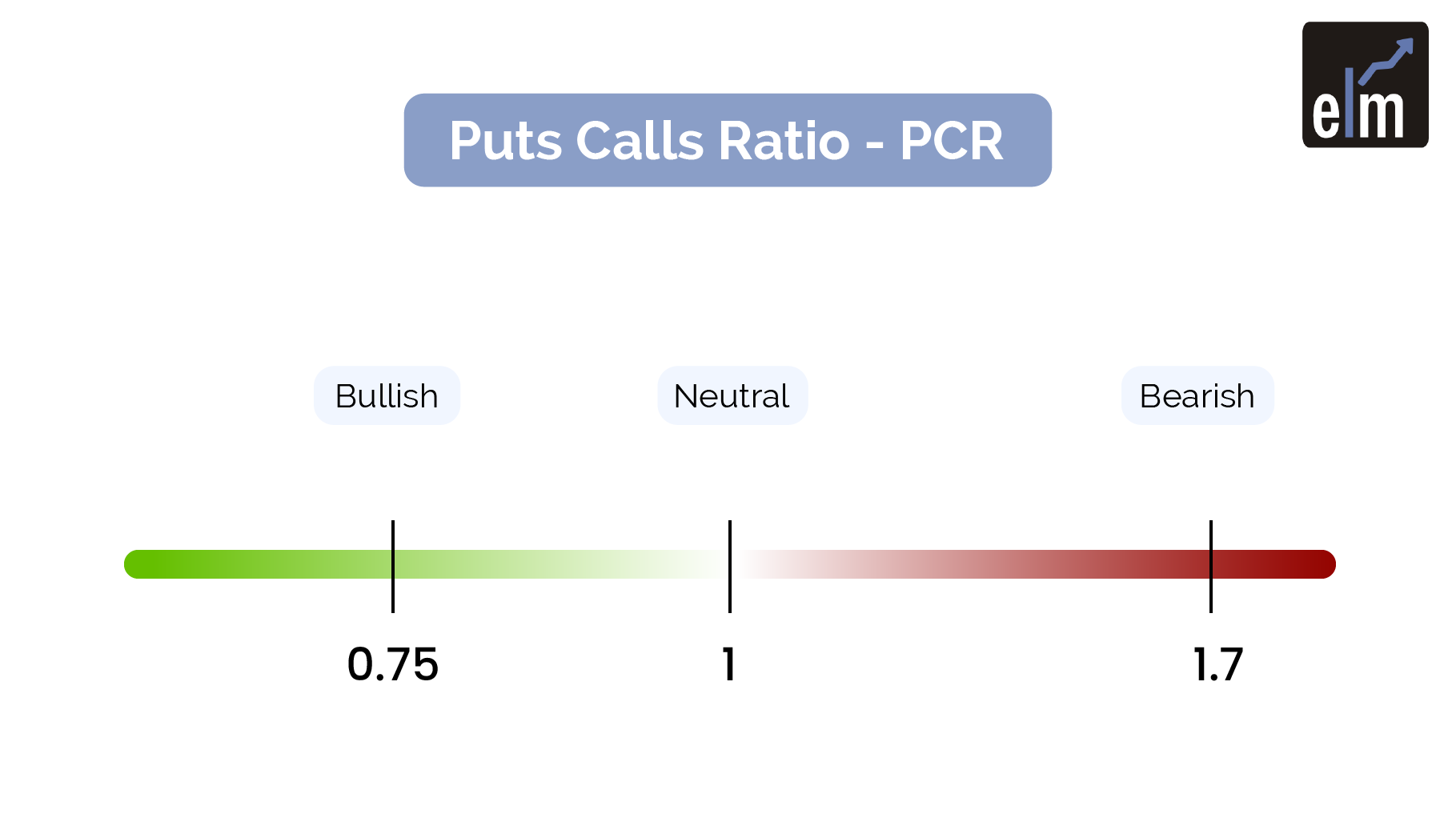

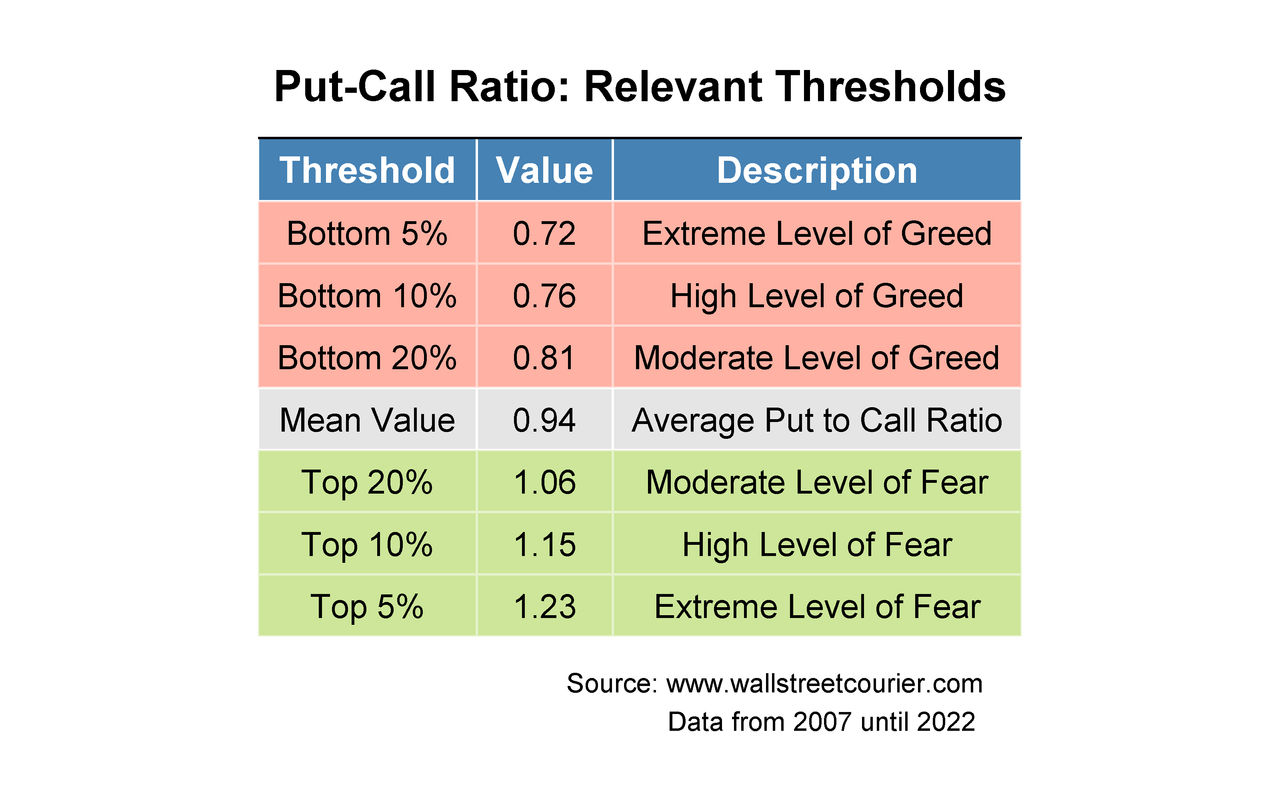

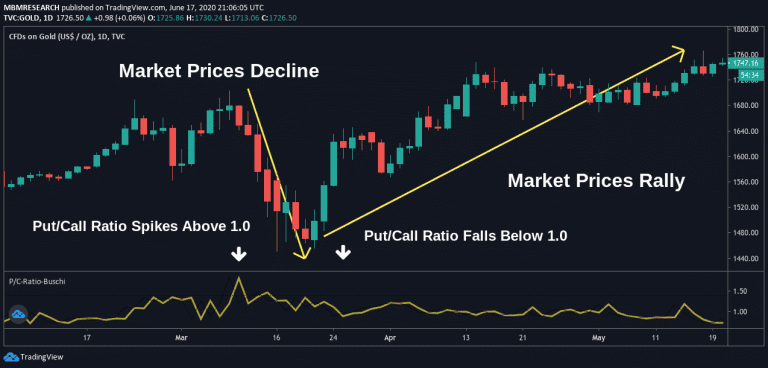

Excessive Readings: Extraordinarily excessive put/name ratios (e.g., above 1.0) are sometimes thought-about contrarian indicators. Whereas they signify important bearish sentiment, they will additionally sign a possible market backside, as extreme pessimism could be nearing its peak. Conversely, extraordinarily low put/name ratios (e.g., under 0.5) counsel excessive bullishness, doubtlessly indicating an overbought market and a potential correction.

-

Tendencies and Patterns: Analyzing the development of the ratio is extra essential than specializing in particular person information factors. A persistently rising put/name ratio suggests rising bearish sentiment, whereas a declining ratio signifies rising bullishness. Figuring out patterns like assist and resistance ranges on the chart may also present helpful insights into potential turning factors.

-

Context is Essential: Deciphering the put/name ratio ought to by no means be performed in isolation. It is important to think about different market indicators, reminiscent of total market tendencies, financial information, information occasions, and technical evaluation, to achieve a holistic perspective. A excessive put/name ratio throughout a interval of common market uncertainty could be much less important than a excessive ratio throughout a interval of sustained financial progress.

-

Completely different Strike Costs: Analyzing the put/name ratio throughout completely different strike costs can reveal nuanced details about investor expectations. For instance, a excessive put/name ratio for out-of-the-money places suggests buyers are hedging towards a major value drop, whereas a excessive ratio for in-the-money places would possibly point out profit-taking or hedging towards minor declines.

Limitations of the QQQ Put/Name Ratio

Whereas the QQQ put/name ratio gives helpful insights, it is essential to acknowledge its limitations:

-

Manipulation: Massive institutional buyers can affect the ratio by their buying and selling actions, doubtlessly distorting the true market sentiment.

-

Choice Methods: The ratio does not differentiate between numerous choice methods. As an illustration, numerous put choices could possibly be on account of hedging actions quite than outright bearish bets.

-

Volatility: Elevated market volatility can result in fluctuations within the ratio that do not essentially mirror underlying sentiment adjustments.

-

Not a Predictive Software: The put/name ratio is just not a exact predictor of future value actions. It merely gives insights into present market sentiment, which will help inform funding selections however should not be solely relied upon.

Integrating the QQQ Put/Name Ratio into Your Funding Technique

The QQQ put/name ratio must be seen as one piece of a bigger funding puzzle. It is handiest when used along with different technical and elementary evaluation instruments. Listed below are some methods to combine it into your technique:

-

Affirmation of Tendencies: Use the ratio to substantiate present tendencies recognized by different strategies. A rising put/name ratio throughout a downtrend would possibly strengthen the bearish sign, whereas a falling ratio throughout an uptrend can reinforce the bullish outlook.

-

Figuring out Potential Turning Factors: Excessive readings within the put/name ratio can sign potential market turning factors, however all the time think about this alongside different indicators.

-

Danger Administration: The ratio will help inform danger administration selections. A excessive put/name ratio would possibly encourage a extra cautious strategy, whereas a low ratio would possibly counsel a better danger tolerance.

-

Contrarian Investing: Some buyers use the ratio as a contrarian indicator, shopping for when the ratio is extraordinarily excessive and promoting when it is extraordinarily low. This strategy requires a excessive diploma of danger tolerance and an intensive understanding of market dynamics.

Conclusion

The QQQ put/name ratio chart gives a helpful, albeit imperfect, device for assessing market sentiment. By understanding its calculation, interpretation, and limitations, buyers can successfully combine this indicator into their funding methods. Nonetheless, it is paramount to keep in mind that the put/name ratio is only one piece of the puzzle, and it must be used along with different analytical instruments and a complete understanding of market circumstances to make knowledgeable funding selections. Relying solely on the put/name ratio for funding selections is very dangerous and will result in important losses. At all times conduct thorough analysis and think about consulting with a monetary advisor earlier than making any funding decisions.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the QQQ Put/Name Ratio Chart: A Deep Dive into Market Sentiment. We hope you discover this text informative and helpful. See you in our subsequent article!