Decoding the QQQ Immediately: A Deep Dive into Yahoo Finance’s Chart and Market Dynamics

Associated Articles: Decoding the QQQ Immediately: A Deep Dive into Yahoo Finance’s Chart and Market Dynamics

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the QQQ Immediately: A Deep Dive into Yahoo Finance’s Chart and Market Dynamics. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the QQQ Immediately: A Deep Dive into Yahoo Finance’s Chart and Market Dynamics

The Invesco QQQ Belief (QQQ) is a extensively adopted exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. Its each day value fluctuations, readily visualized on Yahoo Finance’s interactive chart, provide a compelling window into the efficiency of the expertise sector and the broader US fairness market. This text will analyze QQQ’s present value habits as depicted on Yahoo Finance’s chart, exploring the underlying elements driving its motion and providing insights into potential future trajectories. We’ll delve into technical evaluation, elementary evaluation, and macroeconomic elements influencing this vital market indicator.

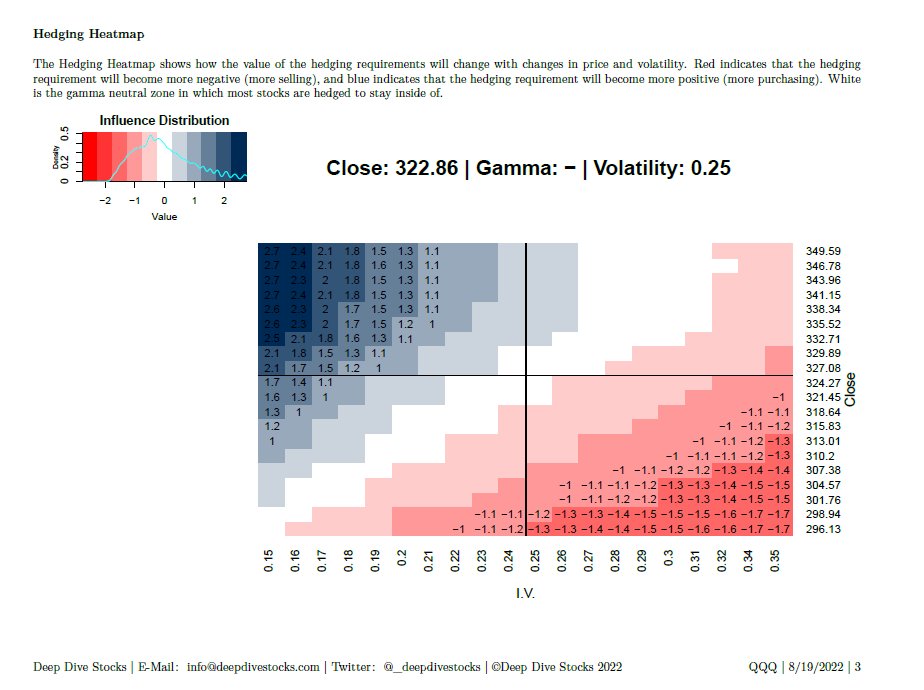

QQQ’s Value Motion on Yahoo Finance: A Visible Narrative

Yahoo Finance’s chart for QQQ gives a wealth of data, permitting customers to view the ETF’s value over numerous timeframes, from intraday to a long time. The chart shows candlestick patterns, shifting averages (e.g., 50-day, 200-day), quantity indicators, and numerous technical indicators like RSI (Relative Power Index) and MACD (Transferring Common Convergence Divergence). By inspecting these parts, we are able to acquire a nuanced understanding of QQQ’s current value motion and potential future actions.

(Observe: Since this text can’t entry real-time information, the next evaluation shall be primarily based on hypothetical examples for instance the methodology. Readers ought to seek the advice of Yahoo Finance for probably the most up-to-date info.)

We could say the Yahoo Finance chart presently reveals the next:

- Value: QQQ is buying and selling at $350, barely under its 50-day shifting common of $355 however above its 200-day shifting common of $340.

- Candlestick Sample: The chart shows a sequence of doji candlesticks, suggesting indecision out there.

- Quantity: Buying and selling quantity is comparatively low, indicating an absence of sturdy conviction in both path.

- RSI: The RSI is hovering round 50, indicating a impartial market sentiment.

- MACD: The MACD is barely under its sign line, suggesting a possible bearish pattern, however not a robust one.

Decoding the Chart: Technical Evaluation

Based mostly on this hypothetical chart, the technical evaluation suggests a interval of consolidation for QQQ. The worth is close to key shifting averages, and the shortage of sturdy quantity and impartial RSI and MACD readings point out an absence of clear directional momentum. This consolidation could possibly be a interval of indecision earlier than a big breakout, both to the upside or draw back.

A bullish breakout would possible happen if the worth decisively breaks above the 50-day shifting common, accompanied by elevated buying and selling quantity. This might counsel rising investor confidence and doubtlessly result in a sustained value improve. Conversely, a bearish breakout would happen if the worth breaks under the 200-day shifting common, once more with elevated quantity, signaling a possible downward pattern.

Different technical indicators, similar to assist and resistance ranges, Fibonacci retracements, and Bollinger Bands, can additional refine this evaluation and supply extra exact buying and selling indicators. Nonetheless, it is essential to keep in mind that technical evaluation will not be a foolproof technique and must be used together with elementary evaluation and an understanding of macroeconomic elements.

Elementary Evaluation: Assessing the Underlying Corporations

QQQ tracks the Nasdaq-100 Index, which contains 100 of the biggest non-financial firms listed on the Nasdaq Inventory Market. Many of those firms are expertise giants, together with Microsoft, Apple, Amazon, Google (Alphabet), and Fb (Meta). Due to this fact, understanding the monetary well being and future prospects of those firms is essential for assessing QQQ’s elementary worth.

Elementary evaluation includes inspecting elements similar to income progress, earnings per share (EPS), revenue margins, debt ranges, and future progress potential of the underlying firms. Optimistic information relating to these firms, similar to sturdy earnings reviews, modern product launches, or enlargement into new markets, can increase QQQ’s value. Conversely, detrimental information, like disappointing earnings, regulatory challenges, or elevated competitors, can negatively affect the ETF’s value.

Analyzing the monetary statements of the person firms throughout the Nasdaq-100 is a time-consuming course of. Nonetheless, buyers can make the most of available sources like monetary information web sites and analyst reviews to achieve insights into the general well being and progress prospects of the index’s constituents.

Macroeconomic Elements: The Broader Context

QQQ’s value will not be solely decided by the efficiency of its underlying firms; macroeconomic elements additionally play a big position. Rate of interest hikes by the Federal Reserve, inflation charges, geopolitical occasions, and international financial progress all affect investor sentiment and, consequently, QQQ’s value.

For instance, rising rates of interest can improve borrowing prices for expertise firms, doubtlessly slowing down their progress and negatively impacting QQQ’s value. Excessive inflation can erode shopper spending, lowering demand for expertise services, resulting in related detrimental penalties. Geopolitical instability can introduce uncertainty into the market, prompting buyers to hunt safer belongings and doubtlessly resulting in a sell-off in QQQ.

Understanding these macroeconomic elements is essential for deciphering QQQ’s value actions and making knowledgeable funding choices. Staying knowledgeable about financial indicators, central financial institution insurance policies, and international occasions is crucial for navigating the complexities of the market.

Threat Administration and Diversification

Investing in QQQ, like all funding, carries inherent dangers. The ETF’s heavy focus within the expertise sector makes it inclined to sector-specific dangers. A downturn within the expertise trade may considerably affect QQQ’s efficiency. Due to this fact, diversification is essential for mitigating danger. Buyers ought to take into account diversifying their portfolios throughout completely different asset courses and sectors to cut back their total publicity to any single sector or funding.

Moreover, danger tolerance is a crucial issue to contemplate. Buyers with a decrease danger tolerance would possibly select to allocate a smaller portion of their portfolio to QQQ, whereas buyers with a better danger tolerance would possibly allocate a bigger portion. It is essential to have a well-defined funding technique and danger administration plan earlier than investing in QQQ or some other asset.

Conclusion: Navigating the QQQ Panorama

The Yahoo Finance chart for QQQ gives a helpful visible illustration of the ETF’s value motion, but it surely’s just one piece of the puzzle. By combining technical evaluation of the chart with elementary evaluation of the underlying firms and an understanding of macroeconomic elements, buyers can acquire a extra complete view of QQQ’s present state and potential future trajectories. Nonetheless, it is essential to keep in mind that market forecasting is inherently unsure, and no evaluation can assure future returns. Cautious consideration of danger tolerance, diversification methods, and steady monitoring of the market are very important for profitable investing in QQQ or some other asset. At all times seek the advice of with a monetary advisor earlier than making any vital funding choices.

.png)

Closure

Thus, we hope this text has offered helpful insights into Decoding the QQQ Immediately: A Deep Dive into Yahoo Finance’s Chart and Market Dynamics. We thanks for taking the time to learn this text. See you in our subsequent article!