Decoding the Retail Gasoline Worth Chart: A Complete Information

Associated Articles: Decoding the Retail Gasoline Worth Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Retail Gasoline Worth Chart: A Complete Information. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the Retail Gasoline Worth Chart: A Complete Information

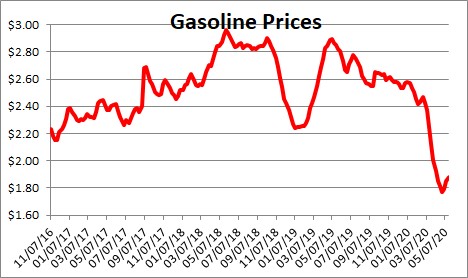

The retail gasoline value chart, a seemingly easy visible illustration, holds a wealth of data reflecting complicated financial, geopolitical, and environmental components. Understanding its fluctuations is essential for shoppers, companies, and policymakers alike. This text delves deep into the intricacies of the retail gasoline value chart, exploring its parts, influencing components, and the broader implications of its actions.

Understanding the Chart’s Elements:

A typical retail gasoline value chart shows the worth of gasoline (often per gallon or liter) over a selected interval, starting from days to years. The chart sometimes makes use of a line graph, the place the x-axis represents time, and the y-axis represents the worth. Key components usually included are:

- Worth Information: The core of the chart, exhibiting the common retail value of gasoline at a selected geographic location (nationwide, regional, or native). This knowledge is often collected from numerous sources, together with authorities businesses, trade associations, and personal firms.

- Time Scale: The time interval coated considerably impacts the chart’s interpretation. Quick-term charts (each day or weekly) spotlight value volatility, whereas long-term charts (month-to-month or yearly) reveal broader tendencies.

- Information Smoothing: Some charts use smoothing strategies to scale back the affect of each day fluctuations, offering a clearer image of underlying tendencies.

- Annotations: Charts usually embody annotations to focus on vital occasions which will have influenced value modifications, resembling hurricanes, geopolitical instability, or modifications in refinery operations.

- Comparability Information: Some charts embody comparative knowledge, exhibiting the worth of gasoline relative to different vitality sources or historic averages, offering context to the present value.

Elements Influencing Retail Gasoline Costs:

The value of gasoline on the pump is a fancy interaction of quite a few components, making correct prediction difficult. These components may be broadly categorized as:

1. Crude Oil Costs: That is probably the most vital driver of gasoline costs. Crude oil is the uncooked materials for gasoline, and its value immediately impacts the price of refining and distribution. Fluctuations in international crude oil provide (because of OPEC selections, geopolitical occasions, or surprising disruptions) immediately translate into gasoline value modifications. Futures markets play a crucial position right here, with hypothesis and hedging actions influencing crude oil costs effectively earlier than they affect the retail market.

2. Refining Prices: The method of reworking crude oil into gasoline requires vital funding in refineries, gear, and expert labor. Modifications in refinery capability, upkeep schedules, and operational prices all affect the ultimate value. Surprising refinery shutdowns because of accidents or upkeep may cause localized and even nationwide value spikes.

3. Distribution and Transportation Prices: Getting gasoline from the refinery to the gasoline station includes a fancy community of pipelines, tankers, and vehicles. Gas prices for transportation, labor prices for drivers and logistics personnel, and infrastructure upkeep all contribute to the ultimate value. Geographical location performs a major position right here, with areas farther from refineries typically paying increased costs.

4. Taxes: Governments at numerous ranges (federal, state, and native) impose taxes on gasoline, contributing considerably to the ultimate value. These taxes fund infrastructure tasks, environmental applications, and common authorities budgets. Variations in tax charges throughout totally different areas can result in noticeable value variations.

5. Seasonal Demand: Gasoline demand fluctuates all year long, with peak demand throughout summer season journey seasons. Elevated demand throughout these durations usually results in increased costs.

6. Hypothesis and Market Sentiment: The futures marketplace for gasoline and crude oil permits for hypothesis, the place merchants purchase and promote contracts primarily based on value predictions. Constructive market sentiment (expectation of future value will increase) can drive costs up, even with out a change in underlying provide or demand. Conversely, damaging sentiment can result in value declines.

7. Geopolitical Occasions: Political instability in oil-producing areas, sanctions, wars, or different geopolitical occasions can considerably disrupt international oil provides, resulting in sharp value will increase. These occasions usually create uncertainty and volatility available in the market, impacting costs past the quick affect on provide.

8. Financial Situations: Financial progress typically results in elevated gasoline demand, pushing costs increased. Recessions, however, can scale back demand and result in decrease costs. Change charges additionally play a task, as the worth of oil is usually denominated in US {dollars}, impacting costs in different nations.

9. Environmental Laws: Laws geared toward lowering emissions and bettering gasoline effectivity can affect gasoline costs. Laws requiring using cleaner-burning fuels or imposing carbon taxes can improve manufacturing prices and, consequently, retail costs.

Decoding the Chart and Its Implications:

Analyzing a retail gasoline value chart requires contemplating the components talked about above and the time scale of the info. Quick-term fluctuations are sometimes pushed by market sentiment and non permanent provide disruptions, whereas long-term tendencies replicate broader financial and geopolitical forces.

For Customers: Understanding the chart helps shoppers make knowledgeable selections about gasoline purchases, doubtlessly timing purchases to keep away from peak value durations. It additionally highlights the affect of presidency insurance policies and international occasions on their family budgets.

For Companies: Companies counting on gasoline (e.g., trucking, transportation) want to observe value tendencies to handle their gasoline prices successfully. Understanding value volatility permits for higher budgeting and danger administration.

For Policymakers: The chart supplies beneficial insights for policymakers creating vitality insurance policies, assessing the affect of taxes, and implementing laws to advertise vitality safety and sustainability.

Conclusion:

The retail gasoline value chart is greater than only a easy graph; it is a window into the complicated interaction of world economics, geopolitics, and environmental issues. Understanding its intricacies permits people, companies, and policymakers to make knowledgeable selections, navigate value volatility, and plan for the way forward for vitality consumption. Whereas predicting future costs stays difficult, cautious evaluation of the chart, mixed with an understanding of the underlying components, can present beneficial insights and enhance decision-making on this essential sector. Additional analysis into particular regional markets, technological developments in gasoline manufacturing, and the rising affect of renewable vitality sources will proceed to refine our understanding of this dynamic and ever-evolving market.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Retail Gasoline Worth Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!