Decoding the SBI Nifty 500 Index Fund Direct Progress Chart: A Complete Evaluation

Associated Articles: Decoding the SBI Nifty 500 Index Fund Direct Progress Chart: A Complete Evaluation

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the SBI Nifty 500 Index Fund Direct Progress Chart: A Complete Evaluation. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the SBI Nifty 500 Index Fund Direct Progress Chart: A Complete Evaluation

The SBI Nifty 500 Index Fund Direct Progress choice has change into a preferred alternative for long-term buyers searching for diversified publicity to the Indian fairness market. Understanding its historic efficiency, as depicted in its progress chart, is essential for making knowledgeable funding choices. This text gives a complete evaluation of the SBI Nifty 500 Index Fund Direct Progress chart, exploring its historic trajectory, key efficiency indicators, threat components, and its suitability for various investor profiles.

Understanding the Fundamentals: SBI Nifty 500 Index Fund Direct Progress

Earlier than delving into the chart evaluation, it is important to know the basics of this specific funding automobile. The SBI Nifty 500 Index Fund is a passively managed mutual fund that goals to duplicate the efficiency of the Nifty 500 index. This index contains the five hundred largest firms listed on the Nationwide Inventory Trade of India (NSE), providing broad diversification throughout varied sectors and market capitalizations.

The "Direct Progress" choice signifies that buyers buy items straight from the fund home, bypassing intermediaries like distributors. This eliminates the expense ratio related to distributors, leading to increased returns for the investor. The "Progress" choice implies that any capital positive aspects are reinvested within the fund, resulting in compounding of returns over time.

Analyzing the SBI Nifty 500 Index Fund Direct Progress Chart: A Historic Perspective

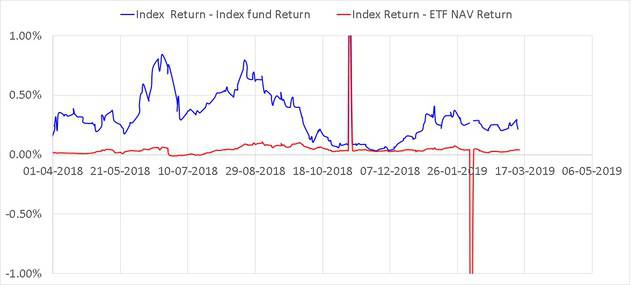

Analyzing the chart requires contemplating varied timeframes. A brief-term perspective (e.g., 1-3 years) will primarily reveal market volatility, whereas a long-term perspective (e.g., 5-10 years or extra) will spotlight the fund’s total progress potential. The chart usually shows the Web Asset Worth (NAV) of the fund over time. The NAV represents the market worth of the fund’s belongings per unit.

Quick-Time period Fluctuations (1-3 years): The short-term chart will exhibit vital ups and downs, reflecting the inherent volatility of the fairness market. Components like international financial circumstances, home coverage modifications, sector-specific occasions, and investor sentiment closely affect the NAV throughout this era. Whereas short-term fluctuations could be unsettling, it is essential to keep in mind that these are regular occurrences in fairness investments. Specializing in the short-term actions could be detrimental to long-term funding targets.

Mid-Time period Efficiency (3-5 years): The mid-term chart gives a greater image of the fund’s capability to climate market cycles. It smooths out among the short-term noise, revealing the underlying development. Throughout this era, the affect of compounding turns into extra seen, showcasing the facility of constant funding. Analyzing this timeframe helps assess the fund’s resilience in opposition to financial downturns and its capability for restoration.

Lengthy-Time period Progress (5-10 years or extra): The long-term chart is arguably an important side of the evaluation. Over prolonged intervals, the market’s inherent upward development typically outweighs short-term corrections. The long-term chart of the SBI Nifty 500 Index Fund Direct Progress will probably reveal constant progress, reflecting the general growth of the Indian financial system and the efficiency of large-cap firms. This timeframe is right for evaluating the fund’s long-term return potential and its capability to generate wealth over time.

Key Efficiency Indicators (KPIs) to Take into account:

Whereas the chart gives a visible illustration, a number of KPIs present a extra quantitative understanding of the fund’s efficiency:

-

Annualized Returns: This metric represents the typical annual return the fund has generated over a selected interval. Evaluating this to benchmark indices just like the Nifty 500 helps assess the fund’s efficiency relative to its goal.

-

Commonplace Deviation: This measures the volatility of the fund’s returns. A better normal deviation signifies better threat, whereas a decrease normal deviation suggests extra steady returns.

-

Sharpe Ratio: This ratio measures risk-adjusted returns, evaluating the surplus return of the fund over a risk-free charge (like authorities bonds) to its normal deviation. A better Sharpe ratio signifies higher risk-adjusted efficiency.

-

Expense Ratio: That is the annual payment charged by the fund home to handle the fund. A decrease expense ratio interprets to increased returns for the investor. The Direct Progress choice inherently has a decrease expense ratio in comparison with the Common Progress choice.

-

Beta: This measures the fund’s volatility relative to the market. A beta of 1 signifies that the fund’s worth strikes in keeping with the market, whereas a beta better than 1 suggests increased volatility.

Danger Components Related to the SBI Nifty 500 Index Fund:

Regardless of its diversification, the SBI Nifty 500 Index Fund carries sure dangers:

-

Market Danger: The fund is topic to fluctuations within the total fairness market. Financial downturns or detrimental investor sentiment can result in vital declines within the NAV.

-

Inflation Danger: Inflation can erode the actual returns of the fund, that means that the buying energy of the returns is perhaps decrease than anticipated.

-

Reinvestment Danger: Whereas the expansion choice reinvests positive aspects, the reinvestment is made at prevailing market costs, which may fluctuate.

-

Sector-Particular Dangers: Whereas diversified, the fund continues to be uncovered to dangers related to particular sectors throughout the Nifty 500 index. A downturn in a significant sector can affect the general efficiency.

Suitability for Totally different Investor Profiles:

The SBI Nifty 500 Index Fund Direct Progress is usually appropriate for:

-

Lengthy-term buyers: The fund is designed for buyers with a long-term horizon (5-10 years or extra) who can tolerate market volatility.

-

Danger-averse buyers searching for diversification: The broad diversification supplied by the Nifty 500 index helps mitigate among the dangers related to particular person inventory selecting.

-

Buyers searching for passive funding: The passive administration nature of the fund requires minimal lively involvement from the investor.

-

Price-conscious buyers: The Direct Progress choice provides decrease expense ratios in comparison with common plans.

Conclusion:

The SBI Nifty 500 Index Fund Direct Progress chart, when analyzed comprehensively, gives helpful insights into the fund’s historic efficiency and its potential for future progress. Nevertheless, it is essential to think about the fund’s threat components and to align the funding with one’s personal threat tolerance and funding horizon. By understanding the nuances of the chart and the related KPIs, buyers could make knowledgeable choices and probably profit from the long-term progress potential of the Indian fairness market. It is at all times advisable to seek the advice of with a monetary advisor earlier than making any funding choices. Keep in mind that previous efficiency shouldn’t be indicative of future outcomes. Thorough analysis and a well-defined funding technique are essential for fulfillment within the funding world.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the SBI Nifty 500 Index Fund Direct Progress Chart: A Complete Evaluation. We respect your consideration to our article. See you in our subsequent article!