Decoding the Share Market Index Chart: A Complete Information

Associated Articles: Decoding the Share Market Index Chart: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Share Market Index Chart: A Complete Information. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Share Market Index Chart: A Complete Information

The share market, a dynamic and sometimes risky entity, presents a fancy panorama for buyers. Understanding its actions is essential for knowledgeable decision-making. A key device for navigating this complexity is the share market index chart. This visible illustration of market efficiency presents a wealth of knowledge, permitting buyers to trace traits, determine patterns, and in the end, make extra strategic funding decisions. This text gives a complete information to understanding and decoding share market index charts, masking their numerous sorts, parts, and the essential data they convey.

Understanding Share Market Indices:

Earlier than diving into the charts themselves, it is important to know the idea of a share market index. An index is a statistical measure of the efficiency of a particular part of the inventory market. It is a weighted common of the costs of chosen shares, representing a broader market phase or all the market itself. For instance, the S&P 500 within the US tracks the efficiency of 500 large-cap firms, whereas the FTSE 100 within the UK represents the 100 largest firms listed on the London Inventory Change. These indices present a benchmark in opposition to which particular person shares and funding portfolios could be in contrast.

The collection of shares inside an index follows particular standards, typically primarily based on market capitalization, sector illustration, and liquidity. The weighting methodology additionally varies; some indices use market-cap weighting (bigger firms have a higher affect), whereas others make use of equal weighting (every firm has an equal influence). Understanding the index’s methodology is essential for correct interpretation.

Sorts of Share Market Index Charts:

A number of kinds of charts are used to visually symbolize index information, every providing distinctive views:

-

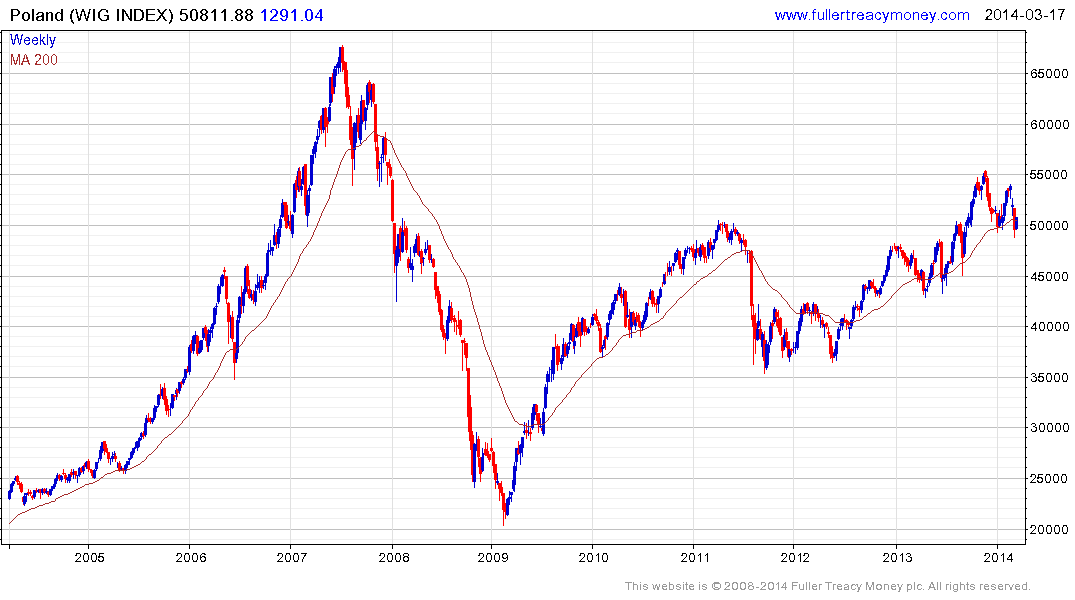

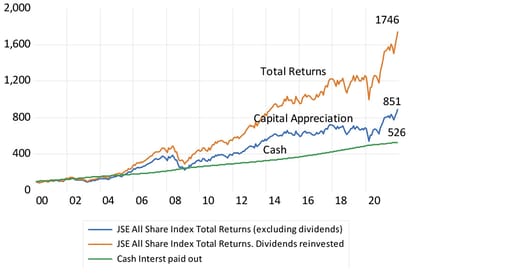

Line Charts: The commonest sort, line charts depict the index’s worth over time. The x-axis represents time (day by day, weekly, month-to-month, or yearly), and the y-axis represents the index’s worth. Line charts are glorious for figuring out traits, recognizing assist and resistance ranges, and visualizing the general market motion.

-

Bar Charts: Bar charts are helpful for evaluating the index’s efficiency throughout completely different time intervals. Every bar represents a particular interval (e.g., a day, per week), with its peak comparable to the index’s worth throughout that interval. They’re significantly useful for highlighting intervals of great features or losses.

-

Candlestick Charts: These charts present a extra detailed view of day by day worth actions. Every "candle" represents a day’s buying and selling, with the physique displaying the opening and shutting costs, and the wicks (higher and decrease shadows) representing the excessive and low costs for that day. Candlestick charts are widespread amongst technical analysts, as they reveal details about worth momentum and potential reversals.

-

Level and Determine Charts: Not like the earlier sorts, level and determine charts deal with worth adjustments quite than time. They’re much less widespread however provide a singular perspective by filtering out noise and highlighting vital worth actions.

Key Parts of a Share Market Index Chart:

Whatever the chart sort, a number of key parts are widespread:

-

X-axis (Time): Represents the time interval over which the index’s efficiency is displayed. The size can fluctuate from intraday to a long time.

-

Y-axis (Index Worth): Represents the numerical worth of the index at a given cut-off date.

-

Worth Ranges: Horizontal traces indicating vital worth factors, comparable to assist ranges (the place the value tends to seek out patrons) and resistance ranges (the place the value tends to seek out sellers).

-

Trendlines: Traces drawn to attach vital worth factors, illustrating the general development (uptrend, downtrend, or sideways).

-

Transferring Averages: Calculated averages of the index’s worth over a particular interval (e.g., 50-day, 200-day transferring common). They clean out short-term fluctuations and assist determine the underlying development.

-

Quantity: (Typically displayed as a separate chart) Signifies the buying and selling quantity related to every interval. Excessive quantity typically accompanies vital worth actions.

-

Indicators: Technical indicators, comparable to Relative Power Index (RSI), Transferring Common Convergence Divergence (MACD), and Bollinger Bands, are sometimes overlaid on the chart to supply further insights into market momentum and potential reversals.

Decoding Share Market Index Charts:

Decoding a share market index chart entails analyzing its numerous parts to grasp the market’s present state and potential future path. This entails:

-

Figuring out the Development: Decide whether or not the general development is upward, downward, or sideways. This may be finished by observing the trendlines and transferring averages.

-

Recognizing Assist and Resistance Ranges: Establish worth ranges the place the index has traditionally discovered assist (shopping for stress) or resistance (promoting stress). These ranges can act as potential turning factors.

-

Analyzing Quantity: Excessive quantity accompanying worth actions suggests robust conviction behind the transfer. Low quantity might point out a weaker development.

-

Utilizing Technical Indicators: Technical indicators can present further alerts about overbought or oversold situations, potential momentum shifts, and different market dynamics.

-

Contemplating Exterior Elements: Whereas the chart gives priceless data, it is essential to think about exterior components comparable to financial information, geopolitical occasions, and industry-specific developments, which might considerably influence market efficiency.

Limitations of Share Market Index Charts:

Whereas share market index charts provide priceless insights, it is essential to acknowledge their limitations:

-

Previous Efficiency is Not Indicative of Future Outcomes: Charts mirror previous efficiency, however they do not assure future outcomes. Market actions could be unpredictable.

-

Subjectivity in Interpretation: Decoding charts can contain a point of subjectivity, with completely different analysts doubtlessly drawing completely different conclusions.

-

Oversimplification: Charts present a simplified view of a fancy market, doubtlessly overlooking nuances and particular company-level components.

-

Lagging Indicators: Some indicators, comparable to transferring averages, are lagging indicators, that means they mirror previous efficiency quite than predicting future actions.

Conclusion:

Share market index charts are highly effective instruments for understanding and analyzing market traits. By mastering the artwork of decoding these charts, buyers can achieve priceless insights, make extra knowledgeable selections, and doubtlessly enhance their funding outcomes. Nevertheless, it is essential to do not forget that charts are only one piece of the puzzle. A complete funding technique requires contemplating a variety of things, together with elementary evaluation, danger administration, and diversification. Utilizing index charts successfully, along side different analytical instruments and a sound funding philosophy, can considerably improve an investor’s skill to navigate the complexities of the share market. Steady studying and observe are important for creating proficiency in decoding these invaluable visible representations of market dynamics.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Share Market Index Chart: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!