Decoding the S&P 500 Chart: A Complete Information for Buyers

Associated Articles: Decoding the S&P 500 Chart: A Complete Information for Buyers

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the S&P 500 Chart: A Complete Information for Buyers. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the S&P 500 Chart: A Complete Information for Buyers

The S&P 500 chart, a visible illustration of the Normal & Poor’s 500 index, is a cornerstone of monetary markets. It serves as a benchmark for the general well being of the U.S. financial system and offers invaluable insights for traders of all ranges. Understanding how you can learn and interpret this chart, nonetheless, requires greater than only a cursory look. This text will delve into the intricacies of the S&P 500 chart, exploring its parts, historic tendencies, analytical strategies, and implications for funding methods.

Understanding the S&P 500 and its Chart:

The S&P 500 index tracks the efficiency of 500 large-cap U.S. corporations throughout numerous sectors. These corporations signify roughly 80% of the overall U.S. fairness market capitalization, making it a sturdy and widely-followed indicator of market sentiment. The chart itself is a graphical illustration of the index’s worth over time, sometimes displayed as a line graph exhibiting the closing worth on every buying and selling day. Variations exist, with some charts displaying intraday information, exhibiting worth fluctuations all through the buying and selling day.

Key Parts of the S&P 500 Chart:

- Value Axis (Y-axis): This vertical axis reveals the index’s worth at any given time limit. The dimensions is usually logarithmic, which means equal proportion adjustments are represented by equal vertical distances, which is extra visually intuitive for giant worth swings.

- Time Axis (X-axis): This horizontal axis represents the time interval coated by the chart, starting from just a few days to a number of many years. The time scale might be adjusted to deal with particular intervals of curiosity.

- Value Candlesticks/Bars: Many charts make the most of candlestick or bar charts to show each day worth information. Candlesticks present the opening, closing, excessive, and low costs for a given day. Bar charts show the excessive and low costs with a line connecting them, and the opening and shutting costs are marked individually.

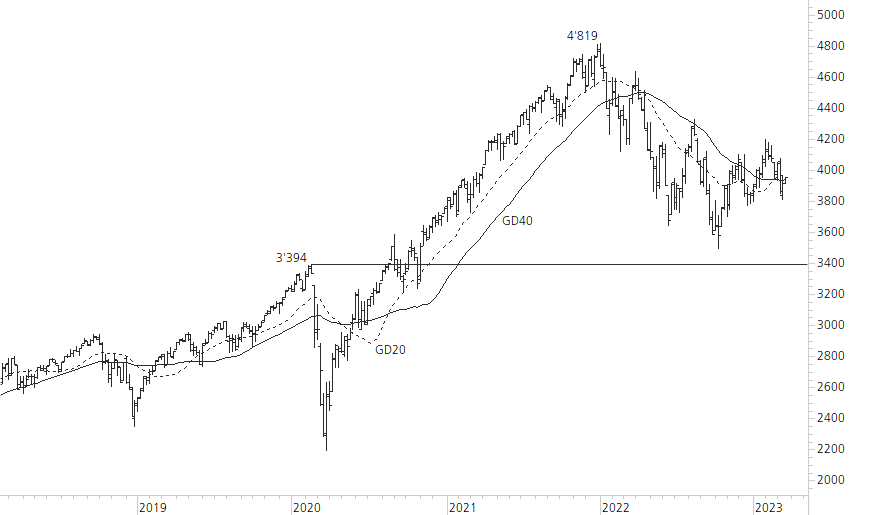

- Transferring Averages: These are traces plotted on the chart that signify the typical worth over a specified interval (e.g., 50-day transferring common, 200-day transferring common). They clean out short-term fluctuations and assist establish tendencies.

- Technical Indicators: A big selection of technical indicators might be overlaid on the chart, corresponding to Relative Energy Index (RSI), MACD (Transferring Common Convergence Divergence), Bollinger Bands, and others. These present further indicators about potential worth actions and momentum.

- Help and Resistance Ranges: These are worth ranges the place the worth has traditionally struggled to interrupt via. Help ranges signify areas the place consumers are more likely to step in, stopping additional worth declines, whereas resistance ranges signify areas the place sellers are more likely to dominate, stopping additional worth will increase.

- Quantity: Usually displayed alongside the worth chart, quantity signifies the variety of shares traded on a given day. Excessive quantity typically accompanies vital worth actions, confirming the energy of a development.

Decoding the S&P 500 Chart: Technical Evaluation:

Technical evaluation makes use of previous worth and quantity information to foretell future worth actions. A number of strategies might be utilized to the S&P 500 chart:

- Pattern Identification: Figuring out the general route of the market (uptrend, downtrend, or sideways development) is essential. Uptrends are characterised by increased highs and better lows, whereas downtrends present decrease highs and decrease lows. Sideways tendencies, also called consolidations, exhibit worth actions inside an outlined vary.

- Help and Resistance: Figuring out assist and resistance ranges can assist predict potential worth reversals. A break above resistance typically indicators a bullish continuation, whereas a break under assist can point out a bearish continuation.

- Transferring Common Crossovers: When a shorter-term transferring common crosses above a longer-term transferring common (e.g., 50-day MA crossing above 200-day MA), it is typically thought-about a bullish sign. The alternative (a loss of life cross) is seen as bearish.

- Candlestick Patterns: Particular candlestick patterns can point out potential worth reversals or continuations. Examples embody hammer, engulfing patterns, and doji.

- Technical Indicators: Indicators like RSI, MACD, and Bollinger Bands present further indicators about momentum, overbought/oversold circumstances, and potential development reversals.

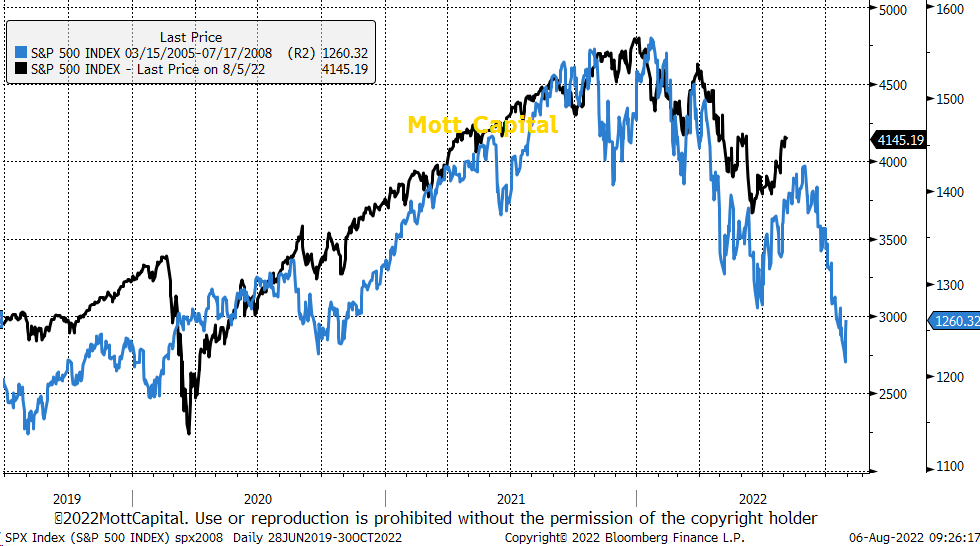

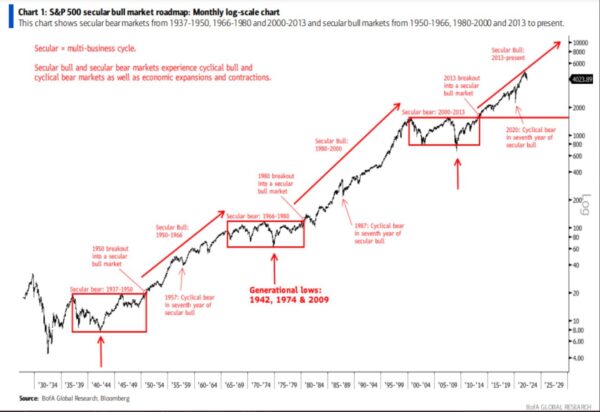

Historic Tendencies and Market Cycles:

The S&P 500 chart reveals a long-term upward development, punctuated by periodic corrections and bear markets. Understanding these cycles is important for long-term traders.

- Bull Markets: Prolonged intervals of rising costs, typically characterised by optimism and powerful financial progress.

- Bear Markets: Prolonged intervals of falling costs, typically triggered by financial downturns, geopolitical occasions, or market corrections.

- Corrections: Non permanent worth declines of 10% or extra, which are sometimes a part of a wholesome bull market.

- Financial Cycles: The S&P 500 typically displays the broader financial cycle, with peaks and troughs correlating with financial expansions and contractions.

Implications for Funding Methods:

The S&P 500 chart is a crucial instrument for numerous funding methods:

- Lengthy-Time period Investing: For long-term traders, the chart demonstrates the facility of compounding returns over time, regardless of short-term volatility. A buy-and-hold technique typically proves profitable in the long term.

- Worth Investing: Buyers can establish undervalued corporations by analyzing particular person parts of the S&P 500 and evaluating their efficiency to the general index.

- Development Investing: Specializing in corporations with excessive progress potential, typically mirrored of their particular person inventory charts and general contribution to the S&P 500’s progress.

- Index Funds and ETFs: The S&P 500 chart offers a benchmark for the efficiency of index funds and exchange-traded funds (ETFs) that monitor the index.

- Tactical Asset Allocation: Buyers can alter their portfolio allocation based mostly on the present market development and technical indicators derived from the S&P 500 chart.

Limitations and Issues:

Whereas the S&P 500 chart presents helpful insights, it is essential to acknowledge its limitations:

- Previous efficiency will not be indicative of future outcomes. Whereas historic tendencies can inform predictions, they aren’t ensures.

- The chart solely displays the efficiency of 500 large-cap corporations. It does not signify your complete market, together with small-cap shares, worldwide markets, or various asset lessons.

- Technical evaluation will not be foolproof. Indicators might be deceptive, and relying solely on technical evaluation might be dangerous.

- Market sentiment and exterior components play a big position. Geopolitical occasions, financial information, and investor psychology can considerably affect the S&P 500’s efficiency, no matter technical indicators.

Conclusion:

The S&P 500 chart is a robust instrument for understanding the U.S. fairness market and making knowledgeable funding selections. By combining an intensive understanding of its parts, historic tendencies, and analytical strategies, traders can achieve helpful insights into market dynamics and develop efficient funding methods. Nevertheless, it is important to keep in mind that no single indicator is ideal, and a diversified method incorporating elementary evaluation, threat administration, and a long-term perspective is essential for fulfillment within the ever-evolving world of finance. Utilizing the S&P 500 chart successfully requires steady studying, cautious commentary, and a balanced method to funding decision-making.

Closure

Thus, we hope this text has offered helpful insights into Decoding the S&P 500 Chart: A Complete Information for Buyers. We hope you discover this text informative and useful. See you in our subsequent article!