Decoding the S&P 500 Index Futures Dwell Chart: A Complete Information

Associated Articles: Decoding the S&P 500 Index Futures Dwell Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the S&P 500 Index Futures Dwell Chart: A Complete Information. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the S&P 500 Index Futures Dwell Chart: A Complete Information

The S&P 500 index futures reside chart is a dynamic, real-time illustration of the anticipated future worth of the S&P 500 index. It is a essential software for merchants, traders, and market analysts looking for to grasp and take part on the planet’s most outstanding fairness market. Understanding how you can interpret this chart, its nuances, and its implications is paramount for navigating the complexities of the monetary markets. This text will present a complete overview of the S&P 500 index futures reside chart, its elements, and its sensible purposes.

Understanding the Fundamentals: S&P 500 Index and Futures Contracts

Earlier than delving into the reside chart, it is essential to grasp the underlying property. The S&P 500 index tracks the efficiency of 500 large-cap U.S. firms, representing roughly 80% of the full U.S. fairness market capitalization. It is a broadly adopted benchmark, reflecting the general well being and path of the American economic system.

S&P 500 index futures contracts, however, are standardized agreements to purchase or promote the S&P 500 index at a predetermined value on a future date. These contracts are traded on exchanges just like the Chicago Mercantile Alternate (CME Group), providing a extremely liquid and environment friendly approach to speculate on or hedge in opposition to the index’s value actions. Not like proudly owning particular person shares, futures contracts present leverage, permitting merchants to manage a bigger place with a smaller capital outlay. Nonetheless, this leverage additionally amplifies each potential earnings and losses.

Deconstructing the S&P 500 Index Futures Dwell Chart

A typical S&P 500 index futures reside chart shows a variety of data, together with:

-

Worth: Probably the most outstanding function is the value itself, often displayed as a steady line graph displaying the value fluctuations over time. The worth represents the present contract’s worth in factors (every level is usually value $500).

-

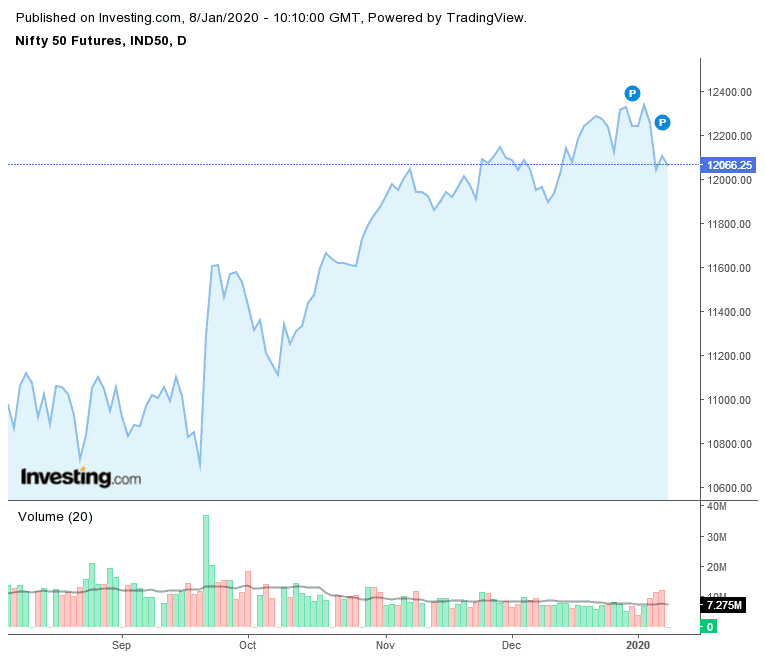

Time: The x-axis shows the time-frame, starting from intraday (minutes, hours) to every day, weekly, or month-to-month charts. The time scale is essential for deciphering value developments and volatility.

-

Quantity: The amount indicator often displayed as bars or histograms, exhibits the variety of contracts traded throughout a selected interval. Excessive quantity typically accompanies vital value actions, suggesting robust market conviction. Low quantity can point out indecision or a scarcity of participation.

-

Open Curiosity: This metric represents the full variety of excellent contracts that have not been settled. A rising open curiosity alongside a rising value typically suggests a strengthening bullish pattern, whereas a falling open curiosity with a rising value might point out a weakening pattern.

-

Technical Indicators: Many reside charts incorporate technical indicators to help in evaluation. These embrace:

-

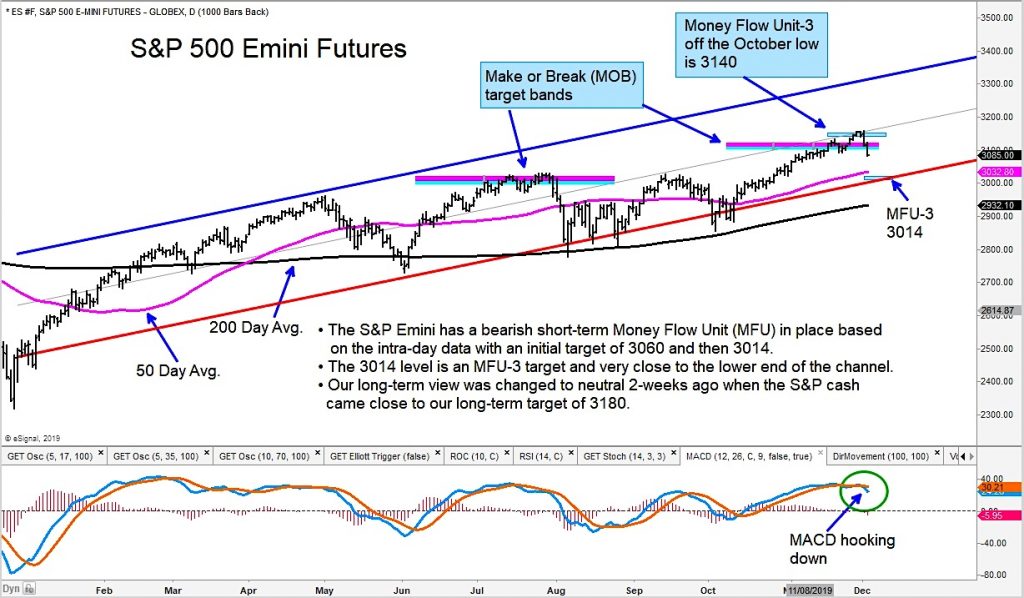

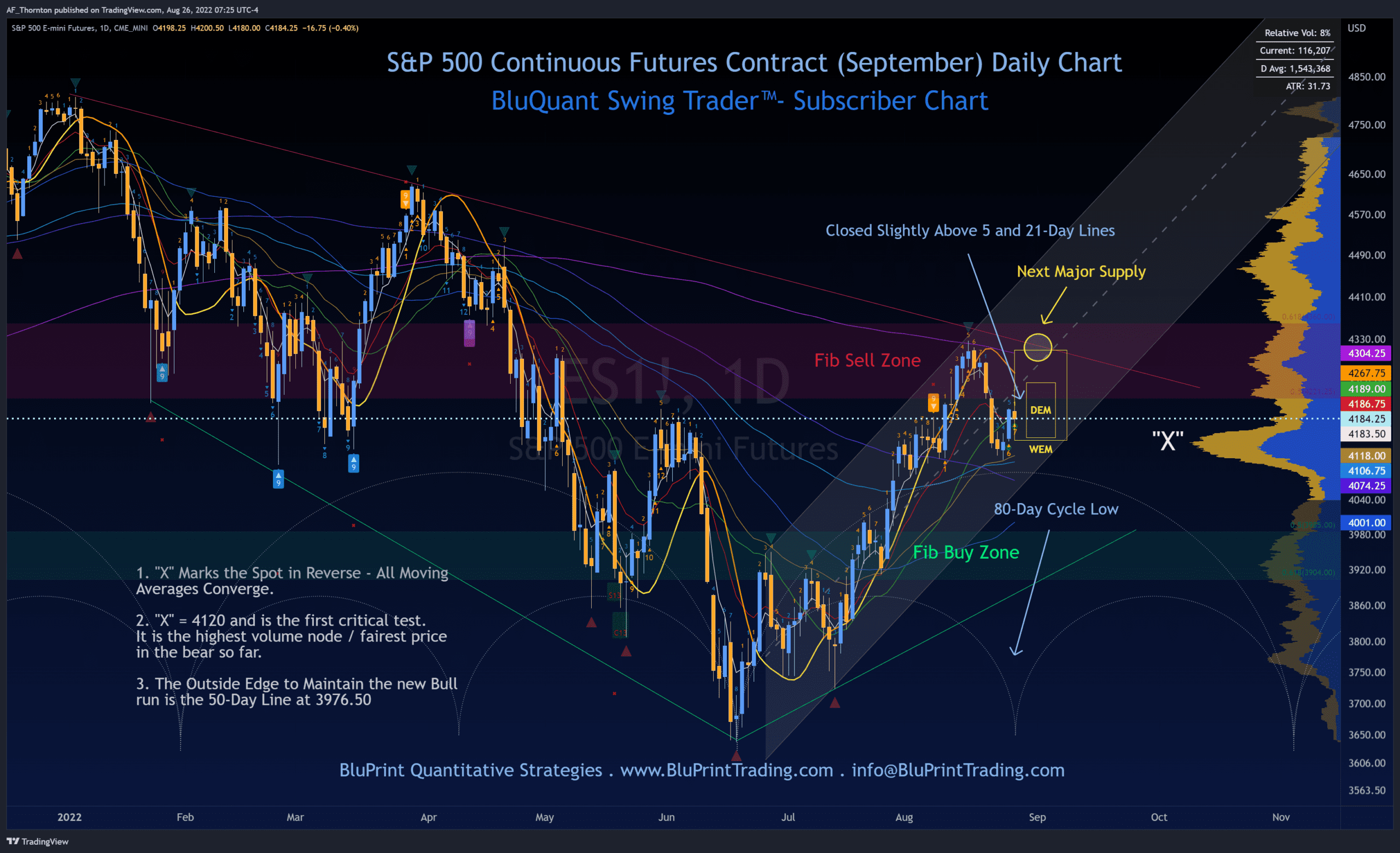

Transferring Averages (MA): Calculate the typical value over a selected interval (e.g., 50-day MA, 200-day MA). They clean out value fluctuations and assist establish developments. Crossovers between completely different MAs can sign potential purchase or promote alerts.

-

Relative Energy Index (RSI): Measures the magnitude of latest value modifications to guage overbought or oversold situations. Readings above 70 typically counsel an overbought market, whereas readings beneath 30 point out an oversold market.

-

Bollinger Bands: Plot commonplace deviations round a transferring common, visualizing value volatility. Worth bounces off the bands can sign potential reversals.

-

MACD (Transferring Common Convergence Divergence): Identifies modifications in momentum by evaluating two transferring averages. Crossovers and divergences between the MACD line and its sign line can generate buying and selling alerts.

-

-

Candlestick Charts: As a substitute of a easy line graph, many platforms provide candlestick charts. Every candlestick represents a selected time interval and shows the opening, closing, excessive, and low costs. The candlestick patterns present precious insights into market sentiment and potential value actions.

Deciphering the Chart and Figuring out Buying and selling Alternatives

The S&P 500 index futures reside chart is a robust software, however deciphering it requires understanding its complexities. Merchants make use of numerous methods, together with:

-

Pattern Following: Figuring out the dominant pattern (uptrend, downtrend, or sideways) and capitalizing on its continuation. This entails utilizing transferring averages, trendlines, and different technical indicators to substantiate the pattern’s power and path.

-

Imply Reversion: Assuming costs will finally revert to their common. This technique entails figuring out overbought or oversold situations utilizing indicators like RSI and Bollinger Bands, anticipating a value correction.

-

Arbitrage: Exploiting value discrepancies between the futures contract and the underlying S&P 500 index. This requires subtle buying and selling methods and a deep understanding of market mechanics.

-

Hedging: Utilizing futures contracts to guard in opposition to potential losses in a portfolio of S&P 500 shares. This technique entails taking an offsetting place within the futures market to mitigate the chance of opposed value actions.

Dangers and Concerns

Buying and selling S&P 500 index futures entails vital threat. Leverage amplifies each earnings and losses, and sudden market occasions can result in substantial monetary setbacks. Merchants ought to:

-

Perceive leverage: Be absolutely conscious of the dangers related to utilizing leverage and solely commerce with capital they will afford to lose.

-

Handle threat: Implement threat administration methods, resembling stop-loss orders, to restrict potential losses.

-

Diversify: Do not put all of your eggs in a single basket. Diversify your investments throughout completely different asset lessons to scale back general threat.

-

Keep knowledgeable: Maintain abreast of financial information, geopolitical occasions, and market developments that may impression the S&P 500 index.

-

Search skilled recommendation: Take into account consulting with a monetary advisor earlier than making any funding selections.

Conclusion

The S&P 500 index futures reside chart is a dynamic and sophisticated software providing precious insights into the long run path of the U.S. fairness market. By understanding its elements, deciphering its alerts, and using sound threat administration methods, merchants and traders can leverage this highly effective software to make knowledgeable selections and probably revenue from market actions. Nonetheless, it’s essential to keep in mind that buying and selling futures entails vital threat, and success requires cautious planning, diligent analysis, and a disciplined strategy. Steady studying and adaptation are important for navigating the ever-changing panorama of the monetary markets.

Closure

Thus, we hope this text has offered precious insights into Decoding the S&P 500 Index Futures Dwell Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!