Decoding the S&P 500 PE Ratio Chart: A Complete Information for Traders

Associated Articles: Decoding the S&P 500 PE Ratio Chart: A Complete Information for Traders

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the S&P 500 PE Ratio Chart: A Complete Information for Traders. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the S&P 500 PE Ratio Chart: A Complete Information for Traders

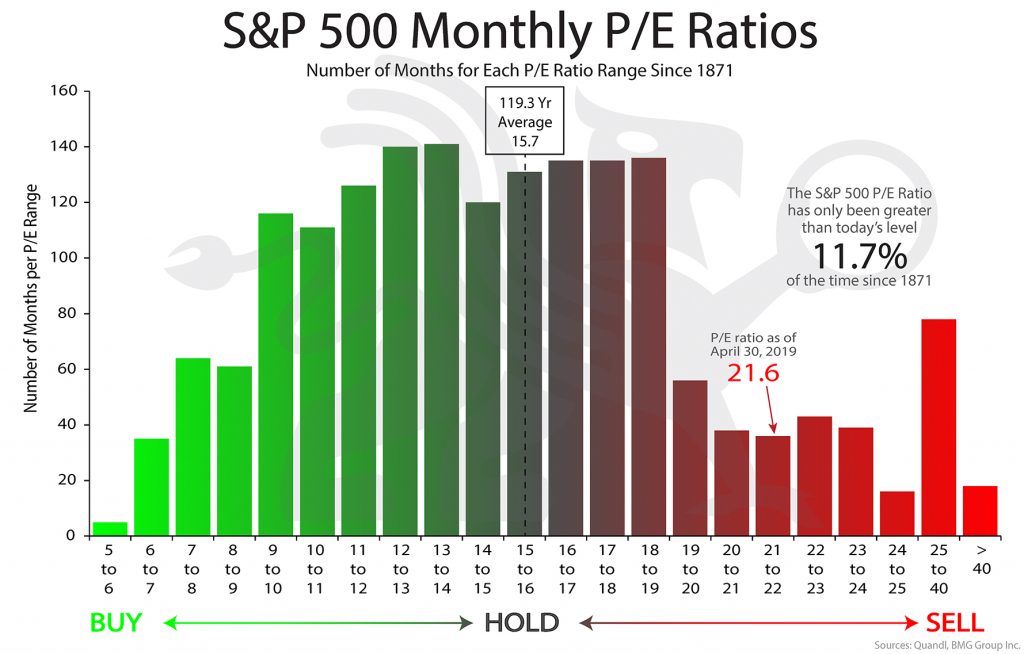

The S&P 500 Value-to-Earnings (PE) ratio is a cornerstone of market evaluation, providing an important perspective on the general valuation of the U.S. inventory market. A chart depicting its historic trajectory offers invaluable insights for each seasoned traders and newcomers alike. This text will delve into the intricacies of the S&P 500 PE ratio chart, explaining its calculation, interpretation, limitations, and its significance in funding decision-making.

Understanding the PE Ratio: A Basis for Evaluation

The PE ratio is a valuation metric that compares an organization’s or index’s inventory worth to its earnings per share (EPS). A better PE ratio usually means that traders are keen to pay extra for every greenback of earnings, implying increased progress expectations or a perceived decrease danger. Conversely, a decrease PE ratio would possibly point out that the market views the corporate or index as undervalued or carrying increased danger.

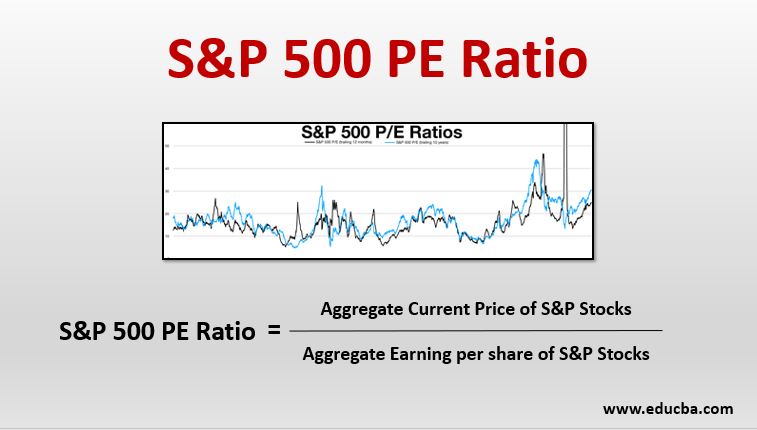

For the S&P 500, the PE ratio is calculated by taking the overall market capitalization of all 500 firms and dividing it by the sum of their complete earnings. This offers a single, combination PE ratio reflecting the general valuation of the broad market index. It is essential to know that this can be a trailing PE ratio, that means it makes use of the previous twelve months’ earnings information. Ahead PE ratios, which make the most of projected future earnings, are additionally accessible however are inherently extra inclined to estimation errors.

Studying the S&P 500 PE Ratio Chart: Key Interpretations

A historic chart of the S&P 500 PE ratio reveals an enchanting narrative of market sentiment and valuation shifts over time. Observing the chart permits traders to determine:

-

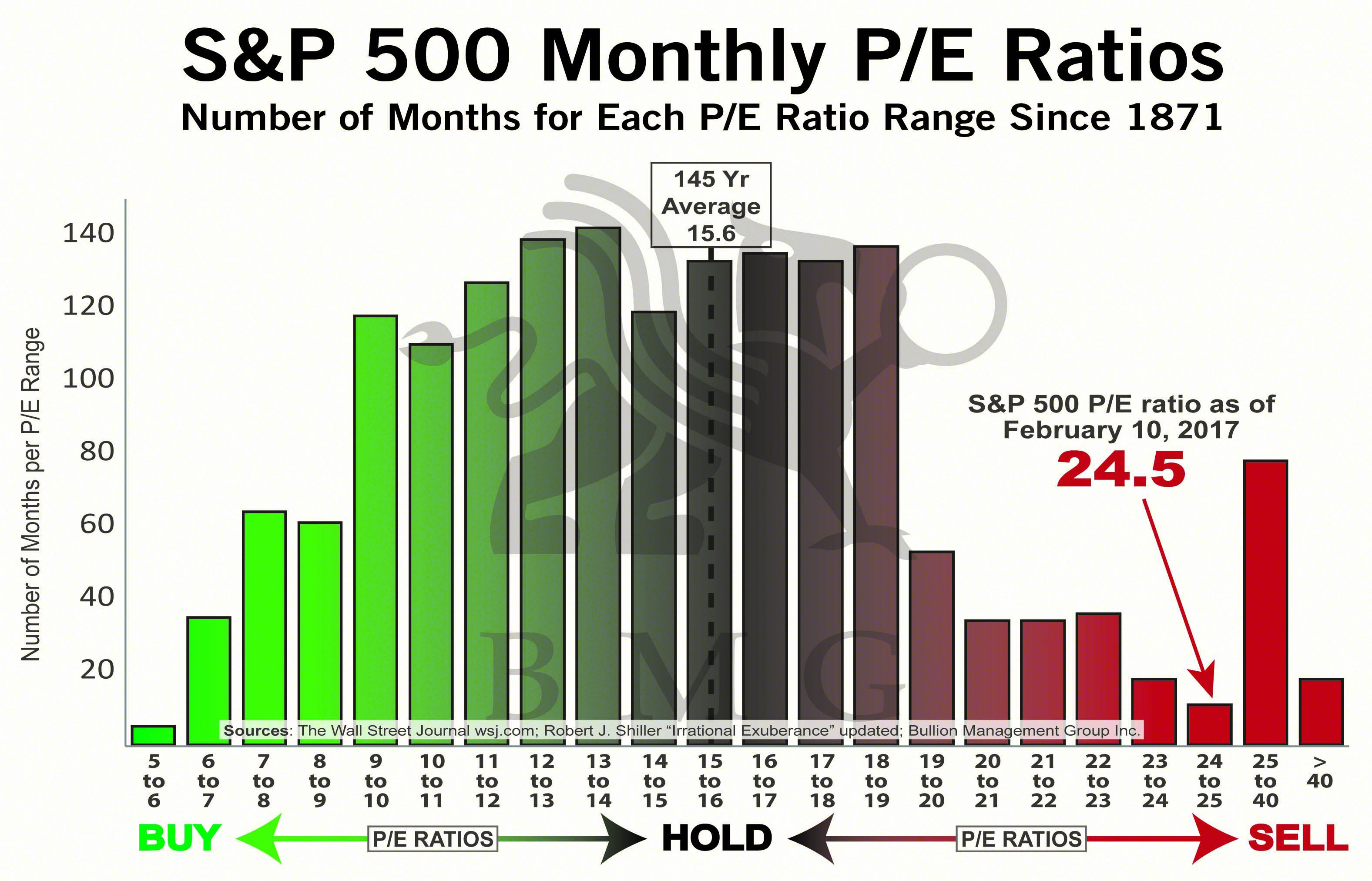

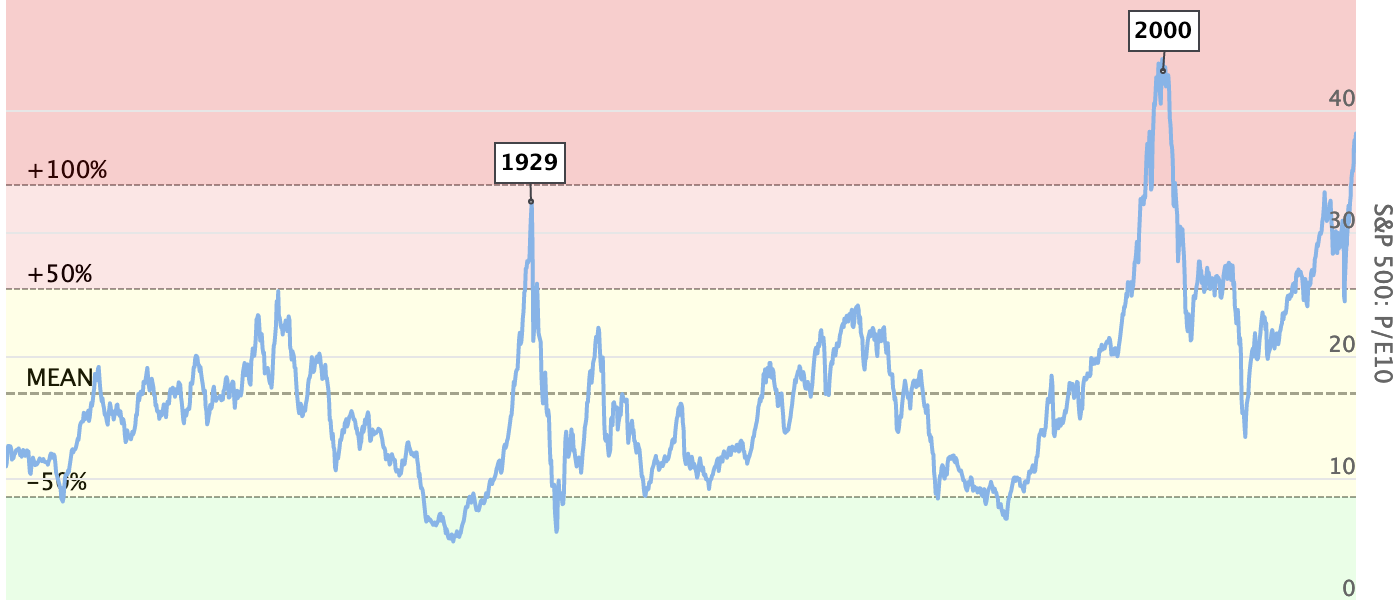

Market Bubbles and Corrections: Durations of excessively excessive PE ratios typically precede market corrections or crashes. These "bubble" durations replicate exuberant investor optimism, typically pushed by speculative buying and selling and a disregard for basic valuation metrics. The dot-com bubble of the late Nineteen Nineties and the housing bubble of the mid-2000s are prime examples, each characterised by considerably elevated PE ratios earlier than dramatic market declines.

-

Market Sentiment Shifts: The PE ratio acts as a barometer of investor confidence. A rising PE ratio suggests rising optimism and expectations of future earnings progress, whereas a falling PE ratio signifies waning confidence and doubtlessly a bearish outlook. This data might help traders gauge the prevailing market sentiment and alter their portfolio methods accordingly.

-

Lengthy-Time period Traits and Valuation Benchmarks: Whereas short-term fluctuations are frequent, long-term traits within the S&P 500 PE ratio can present worthwhile context. Analyzing the historic common PE ratio helps set up a benchmark for assessing present valuation ranges. Understanding whether or not the present PE ratio is considerably above or under the historic common can supply insights into potential overvaluation or undervaluation.

-

Financial Cycles and Development Expectations: The PE ratio typically correlates with financial cycles. Durations of sturdy financial progress and growth are usually related to increased PE ratios, reflecting investor confidence in future company income. Conversely, financial downturns or recessions are normally accompanied by decrease PE ratios, as earnings decline and investor sentiment deteriorates.

Limitations and Concerns When Utilizing the S&P 500 PE Ratio Chart

Whereas the S&P 500 PE ratio chart is a worthwhile software, it is important to acknowledge its limitations:

-

Accounting Practices and Earnings Manipulation: The accuracy of the PE ratio relies on the reliability of reported earnings. Accounting practices can affect reported earnings, and in some instances, firms could interact in earnings manipulation. This may distort the true image of an organization’s monetary well being and consequently affect the general S&P 500 PE ratio.

-

Cyclicality of Earnings: Earnings are cyclical, that means they fluctuate over time attributable to financial situations and industry-specific components. A excessive PE ratio throughout a interval of low earnings could not essentially point out overvaluation, and vice versa. Contemplating the earnings cycle is essential for correct interpretation.

-

Ignoring Qualitative Elements: The PE ratio is a quantitative metric that does not account for qualitative components, comparable to administration high quality, aggressive panorama, and technological disruption. These components can considerably affect an organization’s future efficiency and shouldn’t be ignored in funding choices.

-

Sectoral Variations: The S&P 500 is a diversified index, however its constituent firms characterize numerous sectors with totally different progress traits and valuation multiples. A excessive general PE ratio would possibly masks undervalued sectors, and vice versa. Analyzing sector-specific PE ratios can supply a extra nuanced perspective.

-

Curiosity Charges and Inflation: Rates of interest and inflation considerably affect valuations. Larger rates of interest usually result in decrease PE ratios, as traders demand increased returns for his or her investments. Inflation may also erode earnings, impacting the PE ratio.

Utilizing the PE Ratio Chart in Funding Methods

The S&P 500 PE ratio chart, when used judiciously, can inform numerous funding methods:

-

Worth Investing: Worth traders typically search for firms or indices buying and selling at decrease PE ratios than their historic averages, suggesting potential undervaluation. They imagine that these belongings are prone to outperform in the long term because the market corrects their valuation.

-

Development Investing: Development traders, however, could also be much less involved about present PE ratios and deal with firms with excessive progress potential, even when they commerce at premium valuations. They anticipate that future earnings progress will justify the upper worth.

-

Market Timing: Some traders try and time the market utilizing the PE ratio as an indicator. They could cut back their fairness publicity when the PE ratio reaches traditionally excessive ranges and enhance their allocation when it falls to traditionally low ranges. Nevertheless, market timing is notoriously tough and dangerous.

-

Portfolio Diversification: Understanding the general market valuation mirrored within the S&P 500 PE ratio might help traders diversify their portfolios throughout asset courses. When the market is perceived as overvalued, traders could contemplate allocating a bigger portion of their portfolio to much less correlated belongings, comparable to bonds or actual property.

Conclusion:

The S&P 500 PE ratio chart is a strong software for understanding market valuations and investor sentiment. Nevertheless, it is essential to interpret it inside its limitations, contemplating components like accounting practices, financial cycles, and rates of interest. By combining the insights gleaned from the PE ratio chart with basic evaluation, qualitative components, and a well-defined funding technique, traders could make extra knowledgeable choices and doubtlessly improve their long-term funding outcomes. It isn’t a crystal ball, however a worthwhile lens via which to view the ever-evolving panorama of the inventory market. Bear in mind to at all times seek the advice of with a monetary advisor earlier than making any important funding choices.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the S&P 500 PE Ratio Chart: A Complete Information for Traders. We thanks for taking the time to learn this text. See you in our subsequent article!