Decoding the Time period Life Insurance coverage Fee Chart: Age, Well being, and Your Premium

Associated Articles: Decoding the Time period Life Insurance coverage Fee Chart: Age, Well being, and Your Premium

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Time period Life Insurance coverage Fee Chart: Age, Well being, and Your Premium. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Time period Life Insurance coverage Fee Chart: Age, Well being, and Your Premium

Time period life insurance coverage, a cornerstone of economic planning, gives an easy but highly effective solution to shield your family members financially within the occasion of your premature demise. Understanding how your age impacts your premiums is essential to creating an knowledgeable resolution. This text delves into the intricacies of time period life insurance coverage charge charts by age, exploring the components that affect premiums and providing steerage on navigating the method of securing reasonably priced and ample protection.

Understanding the Fundamentals of Time period Life Insurance coverage

Earlier than diving into charge charts, let’s make clear what time period life insurance coverage is. It offers protection for a selected interval, or "time period," normally starting from 10 to 30 years. In case you die inside that time period, your beneficiaries obtain the demise profit. In case you outlive the time period, the coverage expires, and you may have to renew or buy a brand new coverage. The important thing benefit is its affordability, particularly for youthful people. Premiums are sometimes fastened in the course of the time period, providing predictable budgeting.

The Age Issue: A Vital Affect on Premiums

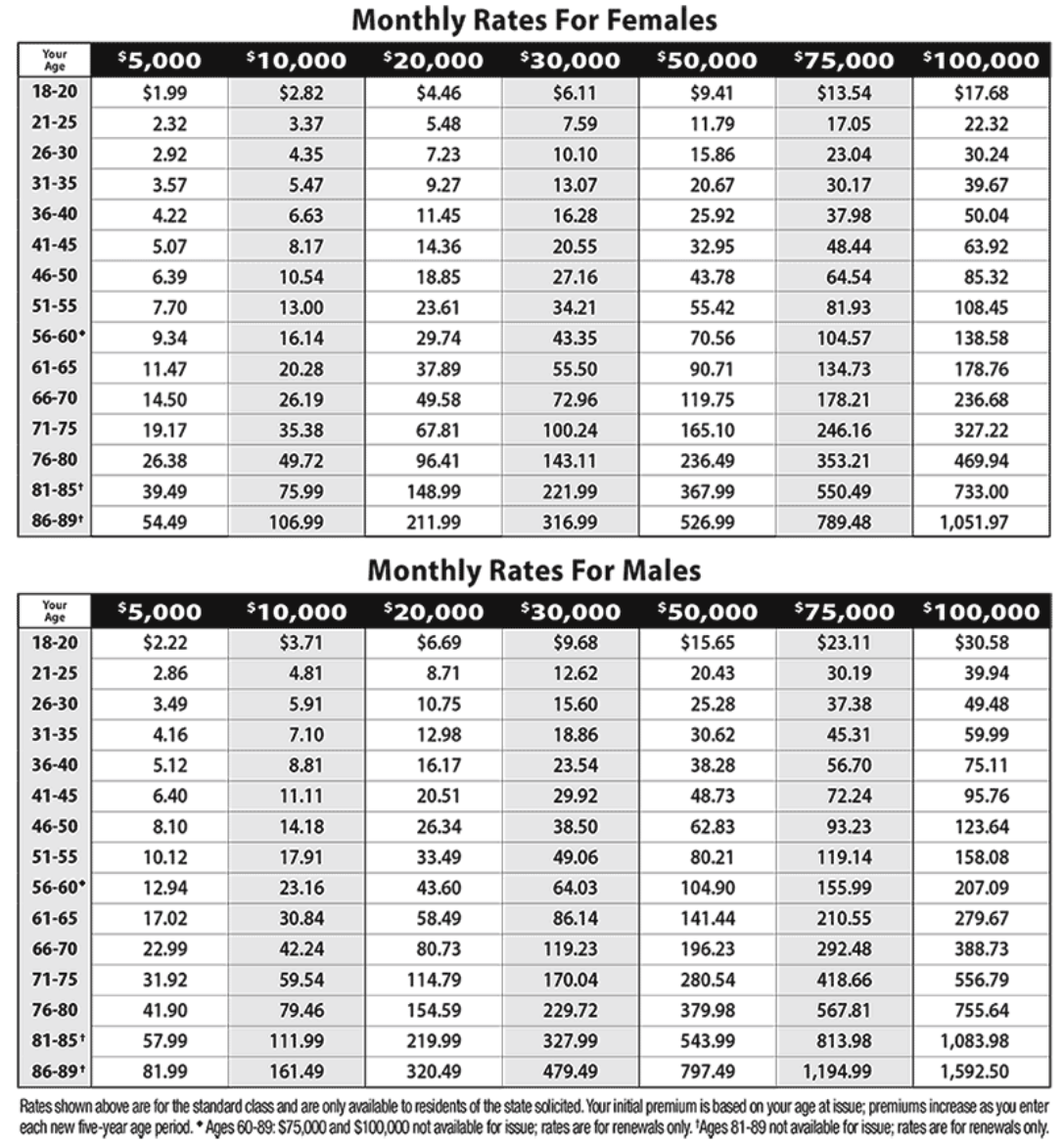

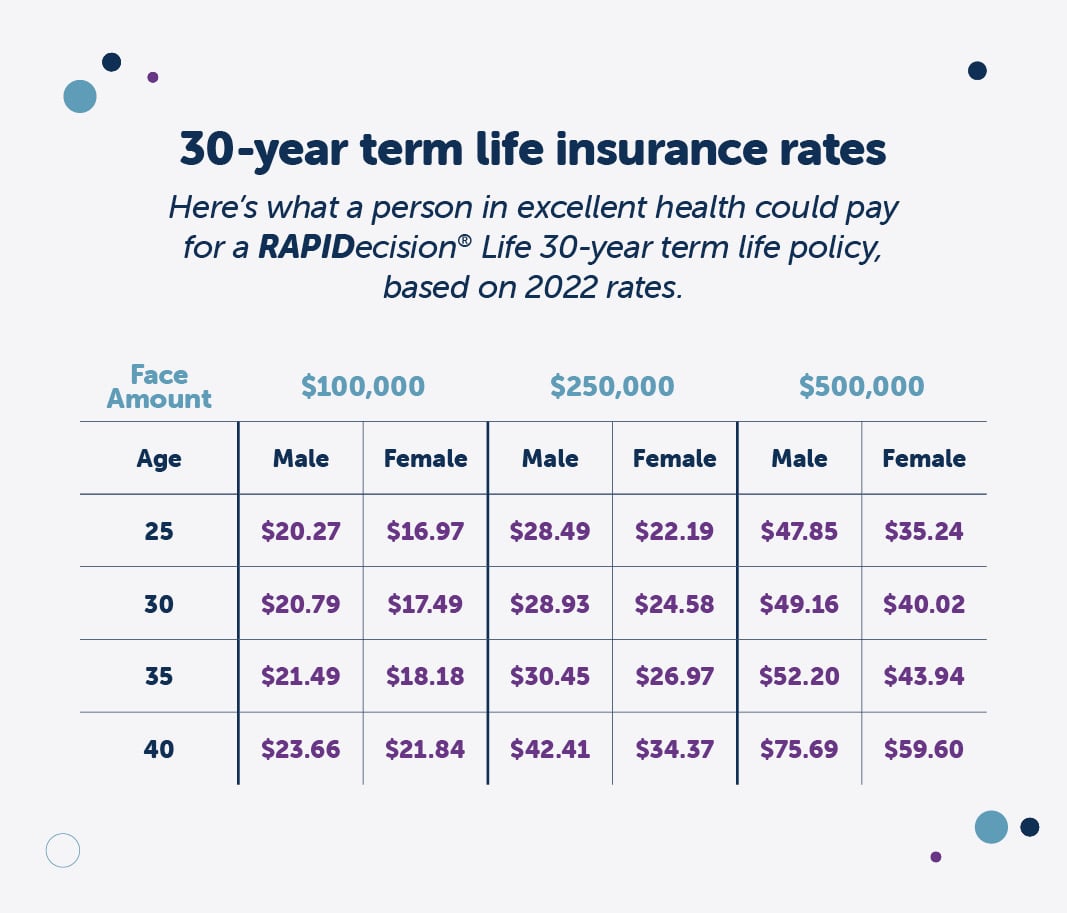

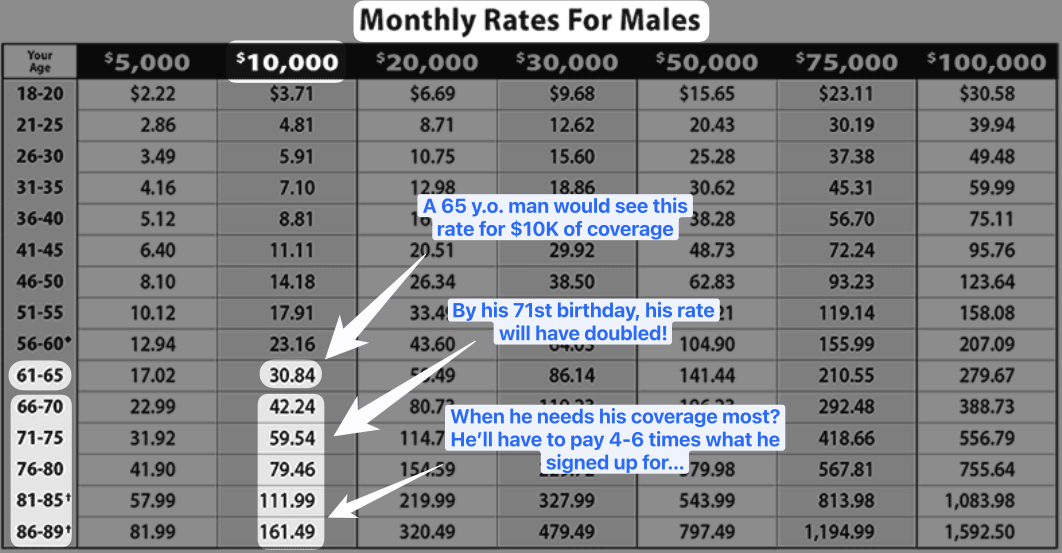

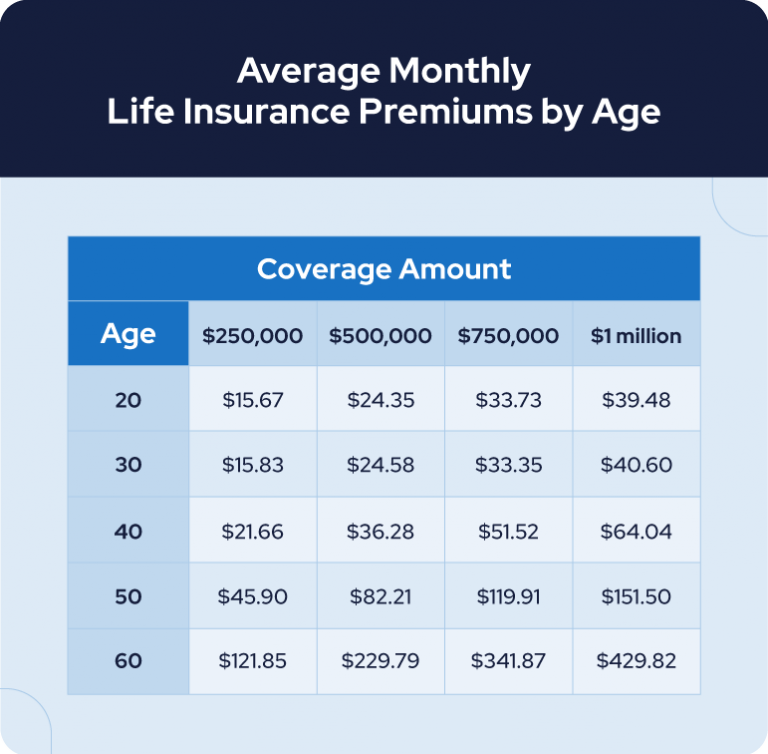

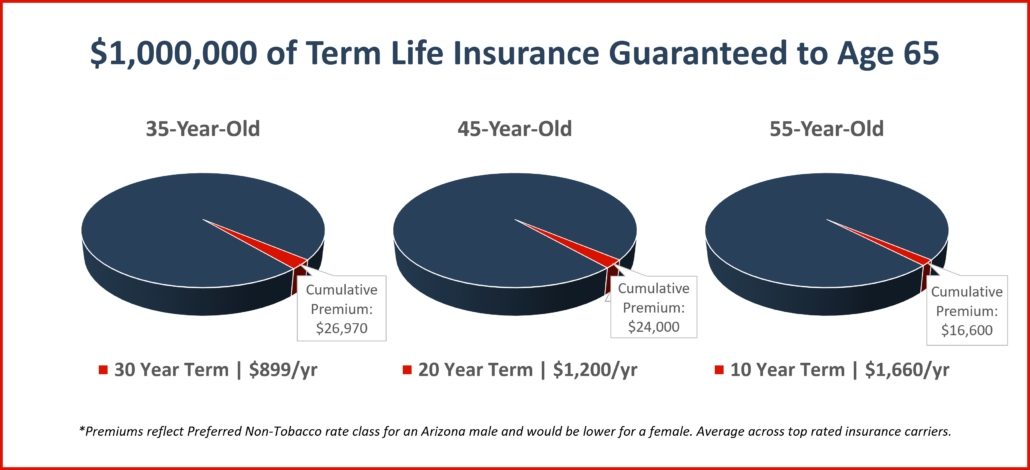

Age is essentially the most vital issue influencing time period life insurance coverage charges. Insurers assess threat primarily based on mortality statistics. The older you might be, the upper your chance of demise inside the coverage time period. This elevated threat interprets to greater premiums. A charge chart will clearly display this progressive enhance. A 30-year-old will usually pay considerably lower than a 50-year-old for a similar protection quantity and time period size.

A Hypothetical Fee Chart Illustration

Whereas particular charges fluctuate broadly between insurers and rely upon particular person components (mentioned under), a hypothetical instance illustrates the age-related premium variations:

Hypothetical Time period Life Insurance coverage Charges (10-12 months Time period, $500,000 Protection)

| Age | Month-to-month Premium (USD) |

|---|---|

| 25 | $25 |

| 30 | $35 |

| 35 | $50 |

| 40 | $75 |

| 45 | $125 |

| 50 | $200 |

| 55 | $350 |

| 60 | $600 |

Disclaimer: It is a hypothetical instance and doesn’t mirror precise charges from any particular insurer. Actual-world charges will fluctuate considerably.

Components Past Age Affecting Premiums

Whereas age is paramount, a number of different components considerably impression your time period life insurance coverage charge:

-

Well being: Your total well being performs an important position. Insurers evaluate your medical historical past, together with pre-existing circumstances, present medicines, and way of life selections (smoking, alcohol consumption, and many others.). People with glorious well being sometimes obtain decrease charges than these with pre-existing circumstances or unhealthy life. Medical underwriting is a core element of the rate-setting course of.

-

Gender: Historically, girls have loved decrease charges than males as a consequence of statistically greater life expectations. Nevertheless, this hole is narrowing in lots of jurisdictions.

-

Occupation: Excessive-risk occupations (e.g., development employee, police officer) might lead to greater premiums as a consequence of elevated mortality threat.

-

Way of life: As talked about, unhealthy habits like smoking considerably enhance premiums. Insurers think about these components as they contribute to a better threat profile.

-

Protection Quantity: The upper the demise profit you search, the upper your premium will likely be. It is a easy reflection of the elevated payout the insurer would want to make.

-

Coverage Time period: Longer phrases usually carry greater premiums monthly, though the overall price could be greater or decrease relying on the person’s age and well being. A 20-year time period will likely be costlier than a 10-year time period, nevertheless it offers longer protection.

-

Insurer: Totally different insurance coverage firms have various underwriting pointers and threat assessments, resulting in variations in premium charges. Evaluating quotes from a number of insurers is important to discovering the very best deal.

Navigating the Fee Chart and Discovering the Proper Coverage

Understanding the interaction of those components is essential when deciphering a time period life insurance coverage charge chart. Do not solely concentrate on the age-related numbers. Contemplate your total well being, way of life, and monetary objectives.

Steps to Safe Inexpensive and Enough Protection:

-

Assess Your Wants: Decide how a lot protection you want. Contemplate excellent money owed, mortgage funds, future training bills, and your loved ones’s monetary wants.

-

Examine Quotes: Acquire quotes from a number of insurers. Use on-line comparability instruments or contact brokers straight. Do not hesitate to ask questions on their underwriting course of and the components influencing your charge.

-

Evaluate Your Well being: Be trustworthy and clear about your well being historical past throughout the utility course of. Omitting data may result in coverage denial or greater premiums later.

-

Contemplate Your Way of life: Making wholesome way of life modifications (quitting smoking, bettering weight loss plan and train) can positively impression your charges. Some insurers provide reductions for wholesome habits.

-

Perceive the Coverage Particulars: Rigorously evaluate the coverage paperwork earlier than signing. Perceive the protection particulars, exclusions, and renewal choices.

The Significance of Skilled Recommendation

Whereas on-line assets and comparability instruments are useful, consulting with a professional insurance coverage skilled can show invaluable. An skilled agent will help you navigate the complexities of time period life insurance coverage, assess your wants, and discover essentially the most appropriate coverage at a aggressive worth. They will clarify the intricacies of charge charts and allow you to perceive how your particular circumstances have an effect on your premiums.

Conclusion:

Time period life insurance coverage charge charts by age present a beneficial overview of how age impacts premiums. Nevertheless, it is essential to keep in mind that age is only one piece of the puzzle. Your well being, way of life, and monetary objectives all play vital roles in figuring out your ultimate charge. By understanding these components and evaluating quotes from a number of insurers, you may safe reasonably priced and ample time period life insurance coverage protection that protects your family members’ monetary future. Bear in mind to leverage the experience of an expert insurance coverage advisor to information you thru this vital resolution. Do not underestimate the worth of planning forward and securing the monetary security web that time period life insurance coverage offers.

![Globe Life Insurance Rates Chart By Age [2022 Update] GetSure](https://getsure.org/wp-content/uploads/2022/10/Globe-Life-Insurance-Rates-Charts-Men-and-Women-768x827.png)

Closure

Thus, we hope this text has offered beneficial insights into Decoding the Time period Life Insurance coverage Fee Chart: Age, Well being, and Your Premium. We hope you discover this text informative and useful. See you in our subsequent article!