Decoding the TradeStation Chart: A Complete Information for Merchants

Associated Articles: Decoding the TradeStation Chart: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the TradeStation Chart: A Complete Information for Merchants. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the TradeStation Chart: A Complete Information for Merchants

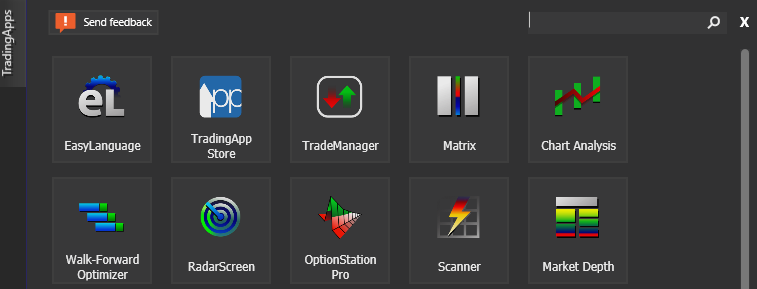

TradeStation’s charting platform is famend amongst merchants for its intensive performance and customizability. Whether or not you are a seasoned skilled or a novice simply beginning your buying and selling journey, understanding its capabilities is essential for efficient market evaluation and profitable buying and selling. This text delves into the intricacies of the TradeStation chart, exploring its options, customization choices, and the best way to leverage them for optimum buying and selling efficiency.

I. The Basis: Understanding Chart Varieties and Indicators

TradeStation presents a wide selection of chart varieties, every offering a novel perspective on worth motion:

-

Candlestick Charts: These are arguably the preferred chart kind, displaying open, excessive, low, and shutting costs for a selected interval (e.g., 1-minute, 5-minute, every day). The visible illustration of those worth factors permits for simple identification of developments and potential reversal patterns.

-

Bar Charts: Just like candlestick charts, bar charts show open, excessive, low, and shutting costs. Nonetheless, they use vertical bars as a substitute of candles, making them barely much less visually intuitive for some merchants.

-

Line Charts: These charts merely join the closing costs of every interval, offering a simplified view of worth developments over time. They’re finest suited to long-term evaluation and figuring out main developments.

-

Space Charts: These charts fill the realm between the worth line and the zero line, highlighting the cumulative worth motion over time. They’re typically used to visualise quantity or different indicators alongside worth.

Past chart varieties, TradeStation’s energy lies in its huge library of technical indicators. These mathematical calculations are overlaid on the chart, offering insights into worth momentum, development energy, volatility, and potential help and resistance ranges. Some key indicators embrace:

-

Shifting Averages (MA): Calculate the common worth over a specified interval, smoothing out worth fluctuations and figuring out developments. Widespread varieties embrace Easy Shifting Common (SMA), Exponential Shifting Common (EMA), and Weighted Shifting Common (WMA).

-

Relative Energy Index (RSI): Measures the magnitude of latest worth modifications to judge overbought and oversold situations.

-

Shifting Common Convergence Divergence (MACD): A trend-following momentum indicator that identifies modifications within the energy, route, momentum, and period of a development.

-

Bollinger Bands: Plot customary deviations round a shifting common, visualizing worth volatility and potential reversal factors.

-

Stochastic Oscillator: Compares a safety’s closing worth to its worth vary over a given interval, figuring out overbought and oversold situations.

II. Chart Customization: Tailoring Your Buying and selling View

TradeStation’s true energy lies in its unparalleled customization capabilities. Merchants can personalize their charts to go well with their particular person buying and selling types and analytical wants. Key customization choices embrace:

-

Timeframes: Regulate the timeframe from intraday (seconds, minutes, hours) to every day, weekly, or month-to-month charts, permitting for evaluation throughout numerous time horizons.

-

Research and Indicators: Add, take away, and modify an unlimited vary of technical indicators, customizing their parameters (e.g., interval size, smoothing issue) to optimize their efficiency for particular buying and selling methods.

-

Drawing Instruments: Make the most of a complete set of drawing instruments, together with development strains, Fibonacci retracements, horizontal and vertical strains, rectangles, ellipses, and Gann strains, to visually determine patterns and potential buying and selling alternatives.

-

A number of Charts: Show a number of charts concurrently, permitting for comparative evaluation of various securities or timeframes.

-

Templates: Save custom-made chart setups as templates, permitting for fast entry to most well-liked configurations throughout completely different securities.

-

Shade Schemes and Kinds: Personalize the visible look of the chart with completely different shade schemes, font types, and background photographs, enhancing readability and creating a snug buying and selling surroundings.

-

Alerting System: Arrange custom-made alerts based mostly on worth actions, indicator alerts, or different chart occasions, receiving notifications by way of e-mail, SMS, or straight throughout the platform.

III. Superior Charting Options: Unlocking Deeper Insights

Past the fundamental functionalities, TradeStation presents a number of superior options that improve analytical capabilities:

-

DOM (Depth of Market): Gives a real-time view of purchase and promote orders at numerous worth ranges, providing beneficial insights into market liquidity and potential worth actions.

-

Market Profile: Visualizes the distribution of buying and selling exercise all through the day, figuring out areas of excessive and low quantity and potential help and resistance ranges.

-

Quantity Profile: Shows quantity traded at every worth degree, providing insights into worth energy and potential areas of help and resistance.

-

Heatmaps: Visually characterize worth and quantity knowledge utilizing shade gradients, highlighting areas of serious exercise.

-

Customizable Research: For knowledgeable programmers, TradeStation permits for the creation of customized indicators and research utilizing EasyLanguage, a proprietary programming language. This empowers merchants to develop distinctive analytical instruments tailor-made to their particular buying and selling methods.

IV. Integrating Charts with Buying and selling Execution:

TradeStation seamlessly integrates its charting platform with its order entry system. This enables merchants to execute trades straight from the chart, minimizing delays and maximizing effectivity. Options like:

- One-click buying and selling: Execute trades with a single click on straight from the chart.

- Order administration: Handle current orders and positions straight from the chart.

- Drawing instruments built-in with order placement: Place orders based mostly on chart patterns and technical indicators.

V. Mastering the TradeStation Chart: A Steady Studying Course of

The TradeStation charting platform is a strong instrument that requires effort and time to grasp absolutely. Efficient utilization entails:

-

Experimentation: Discover completely different chart varieties, indicators, and customization choices to seek out what works finest in your buying and selling fashion.

-

Backtesting: Check your buying and selling methods utilizing historic knowledge to judge their effectiveness earlier than deploying them in dwell buying and selling.

-

Observe: Constant observe is essential to creating proficiency in utilizing the platform’s options and decoding chart patterns.

-

Steady Studying: Keep up to date with the most recent options and developments within the TradeStation platform via on-line sources, webinars, and academic supplies.

Conclusion:

TradeStation’s charting platform is a complete and extremely customizable instrument that empowers merchants of all ranges. By mastering its options and integrating them right into a well-defined buying and selling technique, merchants can considerably improve their market evaluation capabilities and enhance their buying and selling efficiency. Keep in mind that the important thing to success isn’t just understanding the instruments obtainable, but additionally creating a constant and disciplined strategy to buying and selling, backed by thorough analysis and danger administration. The TradeStation chart is merely a strong instrument; its effectiveness is finally decided by the dealer’s ability and information.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the TradeStation Chart: A Complete Information for Merchants. We recognize your consideration to our article. See you in our subsequent article!