Decoding the U-Chart Sample: A Complete Information for Merchants

Associated Articles: Decoding the U-Chart Sample: A Complete Information for Merchants

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the U-Chart Sample: A Complete Information for Merchants. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the U-Chart Sample: A Complete Information for Merchants

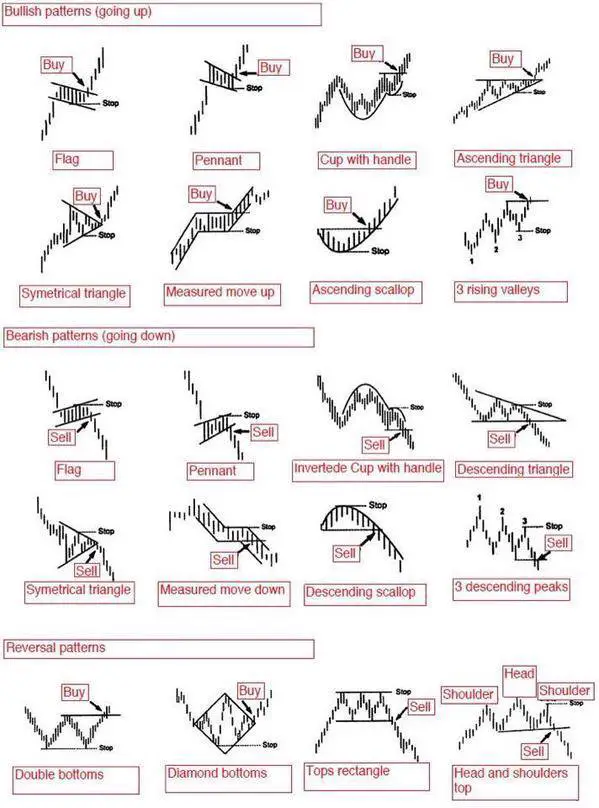

The U-chart sample, a robust reversal formation in technical evaluation, signifies a possible shift in market sentiment from bearish to bullish. Whereas visually distinct from different chart patterns like head and shoulders or double tops/bottoms, the U-chart’s underlying ideas stay rooted within the interaction of provide and demand. Understanding its formation, identification, and buying and selling implications is essential for any dealer aiming to capitalize on market reversals. This complete information delves into the intricacies of the U-chart sample, offering an in depth evaluation of its traits, affirmation methods, threat administration strategies, and real-world examples.

Understanding the Formation of a U-Chart Sample

The U-chart sample, also referred to as a U-shaped backside or inverted V-shaped backside, is characterised by a pointy decline adopted by a interval of consolidation and, lastly, a pointy upturn. This resembles the letter "U" on a value chart. Not like a rounded backside, which encompasses a gradual curve, the U-chart shows a extra pronounced and swift reversal. The formation usually unfolds over a shorter timeframe in comparison with different reversal patterns, making it doubtlessly extra risky and rewarding, but additionally riskier.

A number of key parts outline a basic U-chart:

-

The Downward Development: The sample begins with a transparent and decisive downward pattern, usually pushed by detrimental information, promoting stress, or common market pessimism. This decline varieties the left aspect of the "U".

-

The Backside (Reversal Level): The downward pattern culminates at a major low level, representing the height of bearish sentiment. This low is essential for figuring out the sample and serves because the potential assist degree for the next uptrend. This level is usually characterised by excessive buying and selling quantity, indicating a doable exhaustion of promoting stress.

-

The Consolidation Part: After reaching the underside, the worth tends to consolidate inside a comparatively tight vary. This era of sideways buying and selling signifies a battle between patrons and sellers, with neither aspect gaining a transparent higher hand. This section varieties the bottom of the "U". The size of this consolidation section can fluctuate considerably, impacting the reliability and potential revenue of the sample.

-

The Upward Development (Breakout): The essential component of the U-chart is the sharp and decisive breakout above the resistance degree shaped throughout the consolidation section. This upward surge alerts a shift in market sentiment, indicating a possible bullish reversal. Excessive quantity accompanying this breakout additional strengthens the affirmation of the sample.

Figuring out a U-Chart Sample: Key Issues

Whereas the visible illustration of the "U" is a main identifier, merchants ought to take into account a number of elements to substantiate the sample and reduce false alerts:

-

Quantity Evaluation: Quantity performs a pivotal function in validating the U-chart. Excessive quantity throughout the preliminary decline confirms promoting stress, whereas excessive quantity throughout the breakout confirms shopping for stress, enhancing the reliability of the sample. Low quantity throughout the consolidation section may counsel a weak reversal.

-

Help and Resistance Ranges: Figuring out clear assist and resistance ranges is essential. The underside of the "U" ought to act as a robust assist degree, whereas the breakout above the resistance line confirms the reversal. Breaks beneath the assist degree invalidate the sample.

-

Technical Indicators: RSI (Relative Power Index), MACD (Transferring Common Convergence Divergence), and Stochastic Oscillator can present extra affirmation. A bullish divergence (value making decrease lows whereas the indicator makes larger lows) throughout the consolidation section can foreshadow a possible uptrend.

-

Timeframe: The timeframe used for analyzing the chart considerably impacts the sample’s interpretation. A U-chart recognized on a every day chart can have totally different implications than one recognized on a 5-minute chart. Longer-term charts typically present extra dependable alerts.

-

Contextual Evaluation: Contemplate the broader market surroundings. A U-chart forming throughout a robust bull market is extra more likely to succeed than one forming throughout a bear market. Elementary evaluation may also present precious insights into the underlying causes for the worth motion.

Buying and selling Methods for the U-Chart Sample

As soon as a U-chart sample is recognized and confirmed, a number of buying and selling methods could be employed:

-

Breakout Technique: The most typical technique entails coming into a protracted place as soon as the worth decisively breaks above the resistance degree shaped throughout the consolidation section. A stop-loss order must be positioned beneath the assist degree to restrict potential losses.

-

Pullback Technique: A extra conservative strategy entails ready for a minor pullback after the breakout. This pullback offers a possible entry level with a decrease threat profile, because it permits for affirmation of the uptrend’s continuation.

-

Trailing Cease-Loss: As the worth rises, a trailing stop-loss order could be applied to guard earnings. This order mechanically adjusts the stop-loss degree as the worth strikes upward, guaranteeing that earnings are locked in even when the worth experiences a short lived pullback.

Danger Administration and Issues

Buying and selling the U-chart sample, like another buying and selling technique, entails inherent dangers. Efficient threat administration is paramount:

-

Cease-Loss Orders: All the time use stop-loss orders to restrict potential losses. Place the stop-loss beneath the assist degree to reduce threat.

-

Place Sizing: Keep away from over-leveraging. Decide the suitable place measurement primarily based in your threat tolerance and account stability.

-

False Breakouts: Concentrate on the potential for false breakouts. A value could break above the resistance degree solely to revert again to the downward pattern. Affirmation by way of quantity and technical indicators is essential to reduce this threat.

-

Sample Recognition: Correct identification of the sample is essential. Misinterpreting a distinct chart sample as a U-chart can result in important losses. Apply and expertise are important for correct sample recognition.

Actual-World Examples and Case Research

Analyzing historic value charts of varied belongings can illuminate the appliance of the U-chart sample. As an illustration, analyzing the worth motion of particular shares or cryptocurrencies in periods of market volatility can reveal cases the place the U-chart sample precisely predicted a bullish reversal. Nonetheless, it is essential to keep in mind that previous efficiency would not assure future outcomes.

Conclusion: The U-Chart Sample within the Broader Buying and selling Panorama

The U-chart sample provides merchants a robust instrument for figuring out potential bullish reversals. Nonetheless, it is essential to keep in mind that no buying and selling technique ensures success. Profitable buying and selling with the U-chart sample requires a mix of correct sample recognition, efficient threat administration, and a complete understanding of market dynamics. By combining technical evaluation with basic evaluation and incorporating sound threat administration ideas, merchants can considerably improve their probabilities of capitalizing on the alternatives introduced by this dynamic chart sample. Steady studying, apply, and disciplined execution are key to mastering this precious instrument within the dealer’s arsenal. Bear in mind to all the time backtest your methods and adapt your strategy primarily based on market circumstances and particular person asset traits.

Closure

Thus, we hope this text has supplied precious insights into Decoding the U-Chart Sample: A Complete Information for Merchants. We recognize your consideration to our article. See you in our subsequent article!