Decoding the US GDP Development Fee Chart: A Two-Decade Journey of Financial Ups and Downs

Associated Articles: Decoding the US GDP Development Fee Chart: A Two-Decade Journey of Financial Ups and Downs

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the US GDP Development Fee Chart: A Two-Decade Journey of Financial Ups and Downs. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the US GDP Development Fee Chart: A Two-Decade Journey of Financial Ups and Downs

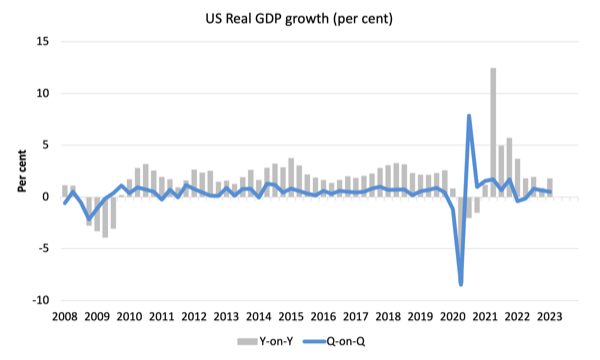

The US’ Gross Home Product (GDP) progress price, a vital indicator of the nation’s financial well being, tells a compelling story of booms, busts, and the enduring resilience of the American financial system. Analyzing its trajectory over the previous 20 years reveals priceless insights into the elements driving financial growth and contraction, providing a roadmap for understanding present developments and anticipating future prospects. This text delves into an in depth evaluation of the US GDP progress price chart from 2000 onwards, exploring key turning factors, contributing elements, and the implications for policymakers and residents alike.

The Roaring 2000s (with a major caveat):

The early 2000s, following the dot-com bubble burst, witnessed a interval of reasonable GDP progress, fluctuating round a 3% annual common. Whereas not spectacular, this era represented a restoration from the tech sector downturn. The expansion was largely pushed by sturdy shopper spending, fueled by available credit score and a comparatively robust labor market. Nonetheless, this obvious stability masked the underlying vulnerabilities that will quickly unravel. The housing market growth, fueled by straightforward credit score and lax lending requirements, was laying the groundwork for the upcoming disaster. The chart reveals a comparatively clean trajectory throughout this era, with minor dips and rises, providing a misleading sense of financial equilibrium.

The Nice Recession (2007-2009): A Sharp Dip and Lingering Results:

The 12 months 2007 marked a dramatic turning level. The bursting of the housing bubble triggered a cascading impact, culminating within the Nice Recession – essentially the most extreme financial downturn for the reason that Nice Melancholy. The GDP progress price plummeted into adverse territory, reaching a trough of -8.4% within the second quarter of 2009. The chart vividly illustrates this sharp, virtually vertical drop, a stark visible illustration of the disaster’s severity. The recession was characterised by a collapse within the housing market, a credit score crunch, hovering unemployment, and a major decline in shopper spending. The federal government responded with huge fiscal stimulus packages and financial easing by the Federal Reserve, aiming to mitigate the disaster’s influence.

Restoration and the Period of Quantitative Easing (2009-2015): A Gradual Climb Again:

The restoration following the Nice Recession was gradual and uneven. The chart reveals a gradual upward development, however the progress price remained considerably under pre-recession ranges for a number of years. This sluggish restoration was attributed to a number of elements, together with excessive ranges of family debt, the lingering results of the monetary disaster on credit score markets, and weak enterprise funding. The Federal Reserve carried out a number of rounds of quantitative easing (QE), a coverage of injecting liquidity into the monetary system by buying authorities bonds and mortgage-backed securities. Whereas QE helped stabilize monetary markets and decrease rates of interest, its effectiveness in stimulating broader financial progress was debated. The chart throughout this era displays the gradual, incremental progress of the financial system, showcasing the challenges of recovering from such a deep recession.

The Trump Period (2017-2020): Tax Cuts and Commerce Wars:

The interval below the Trump administration noticed a interval of comparatively robust GDP progress, peaking at over 3% in 2018. This progress was partly attributed to the 2017 tax cuts, which considerably lowered company and particular person revenue taxes. Nonetheless, the administration’s commerce insurance policies, together with tariffs on imported items, created uncertainty and negatively impacted sure sectors of the financial system. The chart reveals a noticeable uptick in progress throughout this era, reflecting the stimulative impact of tax cuts, but additionally hints on the potential draw back of commerce tensions. The general influence of those insurance policies on long-term financial progress stays a topic of ongoing debate.

The COVID-19 Pandemic and its Aftermath (2020-Current): Unprecedented Volatility:

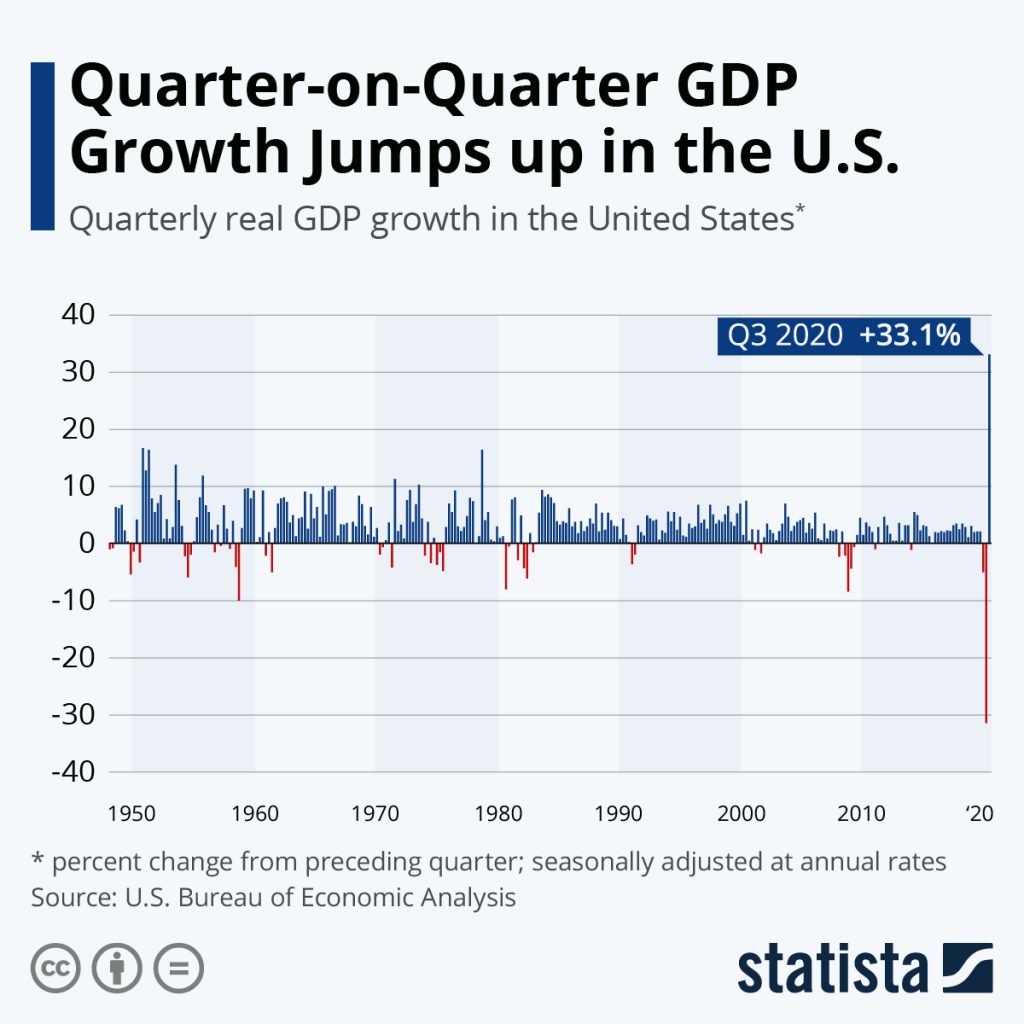

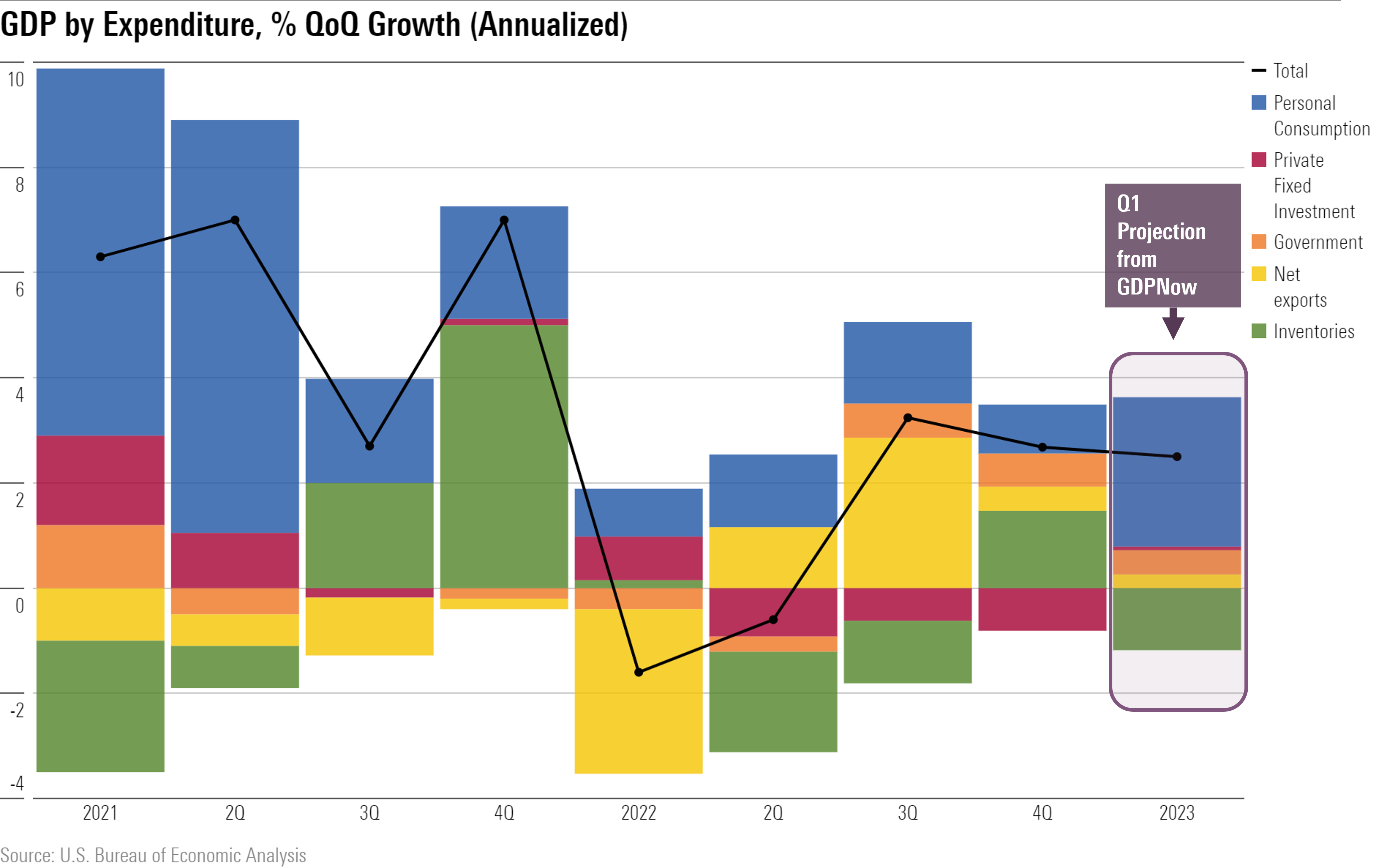

The COVID-19 pandemic triggered essentially the most important financial shock for the reason that Nice Melancholy. The chart reveals a dramatic plunge in GDP progress within the second quarter of 2020, reflecting the widespread lockdowns, enterprise closures, and the collapse in shopper demand. The next restoration was remarkably swift, pushed by huge authorities stimulus packages, together with direct funds to people and companies, and the fast rollout of vaccines. Nonetheless, the restoration has been uneven, with some sectors recovering quicker than others. Provide chain disruptions, inflation, and labor shortages have offered ongoing challenges. The latest interval on the chart demonstrates the unprecedented volatility induced by the pandemic and the next efforts to navigate the restoration.

Components Influencing the US GDP Development Fee:

A number of elements affect the US GDP progress price, together with:

- Client Spending: As the most important part of GDP, adjustments in shopper spending have a major influence on total financial progress.

- Enterprise Funding: Funding in new gear, know-how, and infrastructure drives productiveness and long-term financial progress.

- Authorities Spending: Authorities spending on infrastructure, social applications, and protection can stimulate financial exercise.

- Internet Exports: The distinction between exports and imports impacts total GDP progress.

- Technological Innovation: Technological developments drive productiveness good points and financial progress.

- Financial Coverage: The Federal Reserve’s actions, resembling rate of interest changes, affect borrowing prices and funding.

- Fiscal Coverage: Authorities spending and taxation insurance policies have an effect on combination demand and financial progress.

- World Financial Circumstances: World financial progress and geopolitical occasions can affect the US financial system.

Decoding the Chart and Wanting Forward:

The US GDP progress price chart provides a robust visible illustration of the nation’s financial journey over the previous 20 years. It reveals durations of prosperity and recession, highlighting the cyclical nature of financial exercise. Nonetheless, it is essential to know that the chart is only one piece of the puzzle. A complete evaluation requires contemplating different financial indicators, resembling unemployment charges, inflation, and shopper confidence. Wanting forward, the US financial system faces a number of challenges, together with persistent inflation, potential rate of interest hikes, and ongoing geopolitical uncertainty. Understanding the historic developments depicted within the GDP progress price chart offers a priceless context for navigating these challenges and formulating efficient financial insurance policies.

Conclusion:

The US GDP progress price chart is a robust software for understanding the complexities of the American financial system. By analyzing its fluctuations over the previous 20 years, we acquire priceless insights into the interaction of varied financial forces, the influence of coverage selections, and the resilience of the US financial system within the face of serious shocks. Whereas the long run stays unsure, understanding the previous offers a vital basis for navigating the challenges and alternatives that lie forward. The chart serves as a reminder that financial progress is just not a linear development, however fairly a dynamic course of formed by a mess of interacting elements, requiring steady monitoring, evaluation, and adaptation. The story instructed by the chart isn’t just about numbers; it is a narrative of financial resilience, innovation, and the continuing quest for sustainable prosperity.

:no_upscale()/cdn.vox-cdn.com/assets/4644965/fredgraph__6_.png)

Closure

Thus, we hope this text has supplied priceless insights into Decoding the US GDP Development Fee Chart: A Two-Decade Journey of Financial Ups and Downs. We thanks for taking the time to learn this text. See you in our subsequent article!