Decoding the USD/GBP Chart: A Deep Dive into the Greenback-Pound Alternate Fee

Associated Articles: Decoding the USD/GBP Chart: A Deep Dive into the Greenback-Pound Alternate Fee

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the USD/GBP Chart: A Deep Dive into the Greenback-Pound Alternate Fee. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the USD/GBP Chart: A Deep Dive into the Greenback-Pound Alternate Fee

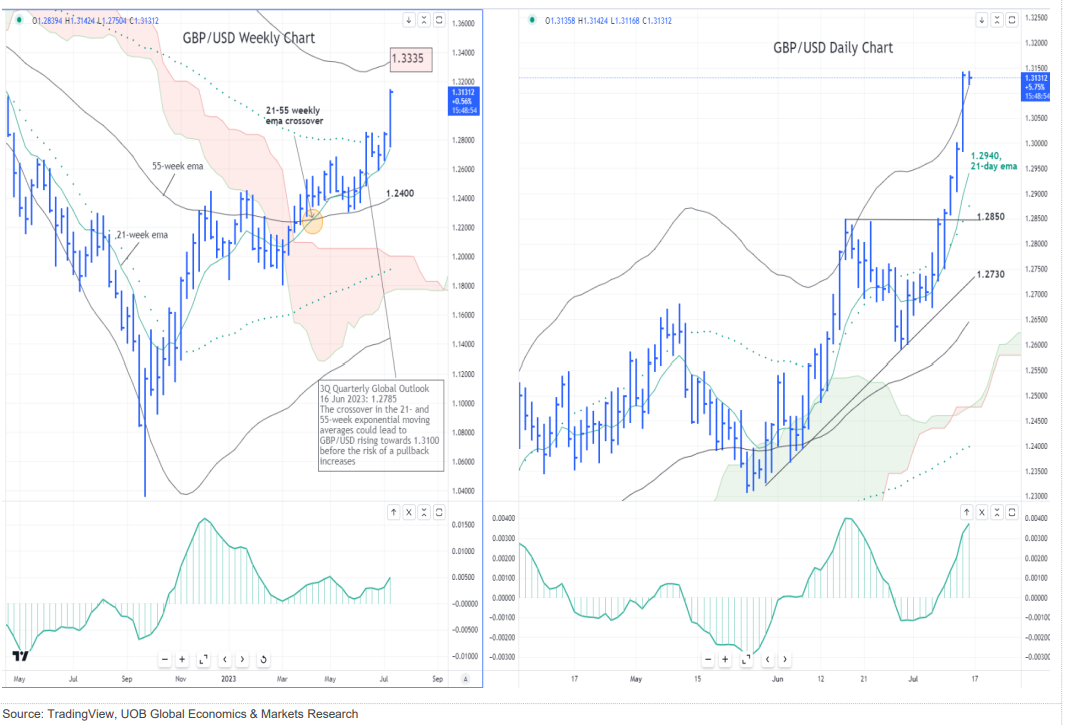

The USD/GBP chart, depicting the trade charge between the US greenback (USD) and the British pound (GBP), is a dynamic visible illustration of the complicated interaction of world financial forces. Understanding its fluctuations is essential for companies engaged in worldwide commerce, buyers making forex choices, and anybody impacted by the fluctuating worth of those two main currencies. This text gives a complete overview of the USD/GBP chart, exploring its historic tendencies, key influencing elements, and implications for various stakeholders.

Historic Perspective: A Century of Fluctuations

The USD/GBP trade charge has skilled important volatility all through its historical past. The gold normal, which lasted till the early twentieth century, offered a level of stability, with comparatively fastened trade charges. Nonetheless, the 2 World Wars and the following Bretton Woods system, which pegged currencies to the US greenback, led to intervals of each stability and dramatic shifts. The collapse of Bretton Woods in 1971 ushered in an period of floating trade charges, characterised by far larger volatility.

Inspecting the chart over the previous few many years reveals a number of key intervals:

-

The Nineteen Eighties and Nineties: This era noticed a comparatively sturdy greenback in opposition to the pound, reflecting the power of the US financial system and relative weak spot within the UK. This was influenced by elements corresponding to differing financial insurance policies and financial efficiency.

-

The 2000s: The early 2000s noticed a interval of fluctuating trade charges, influenced by occasions just like the dot-com bubble burst and the 9/11 terrorist assaults. The pound skilled intervals of each power and weak spot relative to the greenback.

-

The 2010s and past: This era has been marked by important volatility, influenced by the worldwide monetary disaster of 2008, Brexit, the COVID-19 pandemic, and the continued geopolitical uncertainties. The pound skilled a pointy decline following the Brexit referendum in 2016, and has since proven a blended efficiency in opposition to the greenback.

Analyzing long-term tendencies on the USD/GBP chart requires contemplating the financial fundamentals of each the US and UK economies. Components corresponding to inflation charges, rate of interest differentials, authorities debt ranges, and financial development charges play a big position in figuring out the path of the trade charge.

Key Components Influencing the USD/GBP Alternate Fee

The USD/GBP trade charge is influenced by a large number of interconnected elements. These will be broadly categorized as:

-

Financial Fundamentals: The relative power of the US and UK economies is a major driver. Increased financial development, decrease inflation, and a powerful steadiness of funds are inclined to help a stronger forex. Conversely, weak financial information typically results in forex depreciation. Key financial indicators to look at embody GDP development, inflation charges (CPI and PPI), unemployment charges, and commerce balances.

-

Financial Coverage: The actions of the Federal Reserve (Fed) within the US and the Financial institution of England (BoE) considerably affect the trade charge. Rate of interest differentials are notably essential. Increased rates of interest in a single nation relative to a different have a tendency to draw overseas funding, rising demand for that forex and strengthening its worth. The communication methods of central banks additionally play a big position, with ahead steerage on rate of interest expectations influencing market sentiment.

-

Political Components: Political stability and coverage choices in each nations can have a profound affect on the trade charge. Political uncertainty, corresponding to elections or modifications in authorities, can result in elevated volatility. Main coverage shifts, corresponding to Brexit, can have a dramatic and lasting impact on the trade charge. Geopolitical occasions additionally play a task, with world tensions typically impacting investor sentiment and forex values.

-

Market Sentiment and Hypothesis: The USD/GBP trade charge can also be influenced by market sentiment and hypothesis. Investor confidence, danger urge for food, and the general temper within the monetary markets can all affect the path of the trade charge. Giant-scale buying and selling by institutional buyers can amplify short-term fluctuations.

-

World Financial Occasions: World occasions, corresponding to recessions, monetary crises, and commodity worth shocks, can have a big affect on each the US and UK economies, and consequently, on the USD/GBP trade charge. These occasions typically result in elevated volatility and uncertainty within the overseas trade market.

Deciphering the USD/GBP Chart: Technical Evaluation and Basic Evaluation

Analyzing the USD/GBP chart requires a mixture of technical and basic evaluation.

-

Technical Evaluation: This includes learning the chart’s historic worth patterns, utilizing indicators like shifting averages, relative power index (RSI), and help and resistance ranges to foretell future worth actions. Technical analysts search for tendencies, chart patterns, and momentum indicators to establish potential shopping for or promoting alternatives.

-

Basic Evaluation: This includes assessing the underlying financial and political elements that affect the trade charge. Basic analysts think about macroeconomic information, financial coverage choices, and geopolitical occasions to find out the honest worth of the forex pair and predict future actions.

Combining each technical and basic evaluation gives a extra complete image of the USD/GBP trade charge and improves the accuracy of forecasts.

Implications for Completely different Stakeholders

The USD/GBP trade charge has important implications for a variety of stakeholders:

-

Worldwide Companies: Corporations engaged in worldwide commerce between the US and UK are straight affected by trade charge fluctuations. A powerful greenback makes US items cheaper for UK shoppers however costlier for US firms exporting to the UK. Conversely, a powerful pound makes UK items costlier for US shoppers. Hedging methods are sometimes employed to mitigate trade charge danger.

-

Buyers: Foreign money merchants and buyers can revenue from fluctuations within the USD/GBP trade charge by hypothesis or hedging. Understanding the elements influencing the trade charge is essential for making knowledgeable funding choices.

-

Vacationers: The trade charge straight impacts the price of journey between the US and UK. A powerful greenback makes journey to the UK cheaper for US vacationers, whereas a powerful pound makes journey to the US cheaper for UK vacationers.

-

Central Banks: Central banks monitor the trade charge carefully and will intervene within the overseas trade market to handle the worth of their forex. Intervention is usually used to stop extreme volatility or to realize particular financial coverage goals.

Conclusion: Navigating the Complexities of the USD/GBP Chart

The USD/GBP chart is a fancy and dynamic illustration of the interaction between the US and UK economies and the worldwide monetary panorama. Understanding the historic tendencies, key influencing elements, and implications for various stakeholders is essential for anybody concerned in worldwide commerce, funding, or just within the world financial system. By combining technical and basic evaluation, people and organizations can acquire a deeper understanding of the USD/GBP trade charge and make extra knowledgeable choices in a continually evolving market. Nonetheless, it’s essential to do not forget that predicting trade charge actions with full accuracy is unattainable because of the inherent uncertainty and volatility of the overseas trade market. Steady monitoring and adaptation to altering market circumstances are important for profitable navigation of this complicated panorama.

Closure

Thus, we hope this text has offered precious insights into Decoding the USD/GBP Chart: A Deep Dive into the Greenback-Pound Alternate Fee. We thanks for taking the time to learn this text. See you in our subsequent article!