Decoding the W Chart Sample: A Complete Information for Inventory Traders

Associated Articles: Decoding the W Chart Sample: A Complete Information for Inventory Traders

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the W Chart Sample: A Complete Information for Inventory Traders. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the W Chart Sample: A Complete Information for Inventory Traders

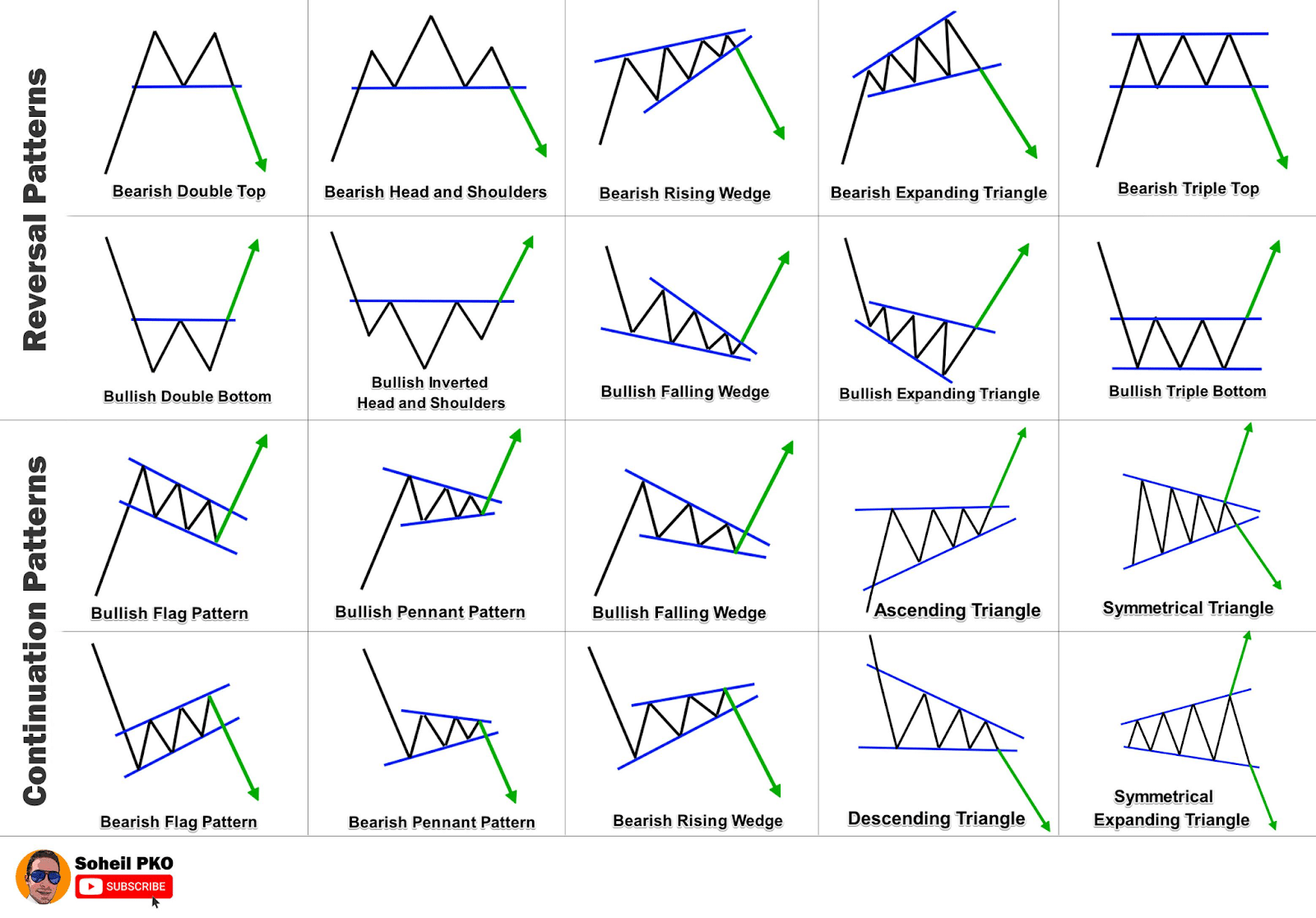

The world of technical evaluation is replete with chart patterns, every providing a novel perspective on potential value actions. Amongst these, the W chart sample, often known as a double backside, stands out as a probably highly effective indicator of a bullish reversal. Whereas seemingly easy in its visible illustration, understanding the nuances of the W sample, its formation, affirmation, and potential pitfalls, is essential for profitable buying and selling. This text delves deep into the W chart sample, equipping traders with the data to determine, interpret, and capitalize on its implications.

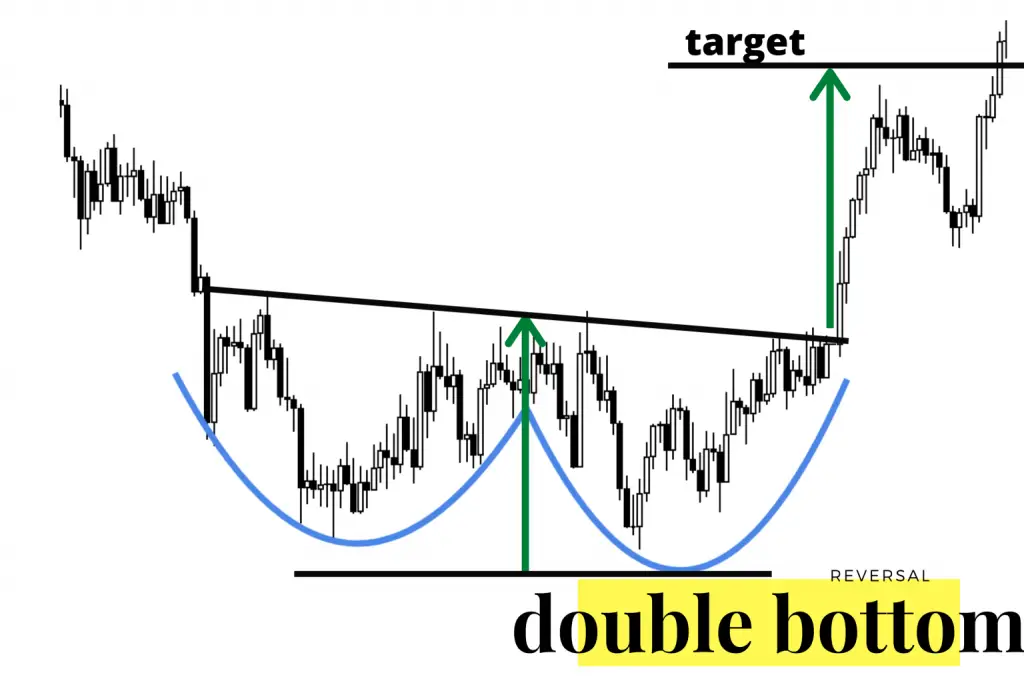

Understanding the W Chart Sample: A Visible Illustration

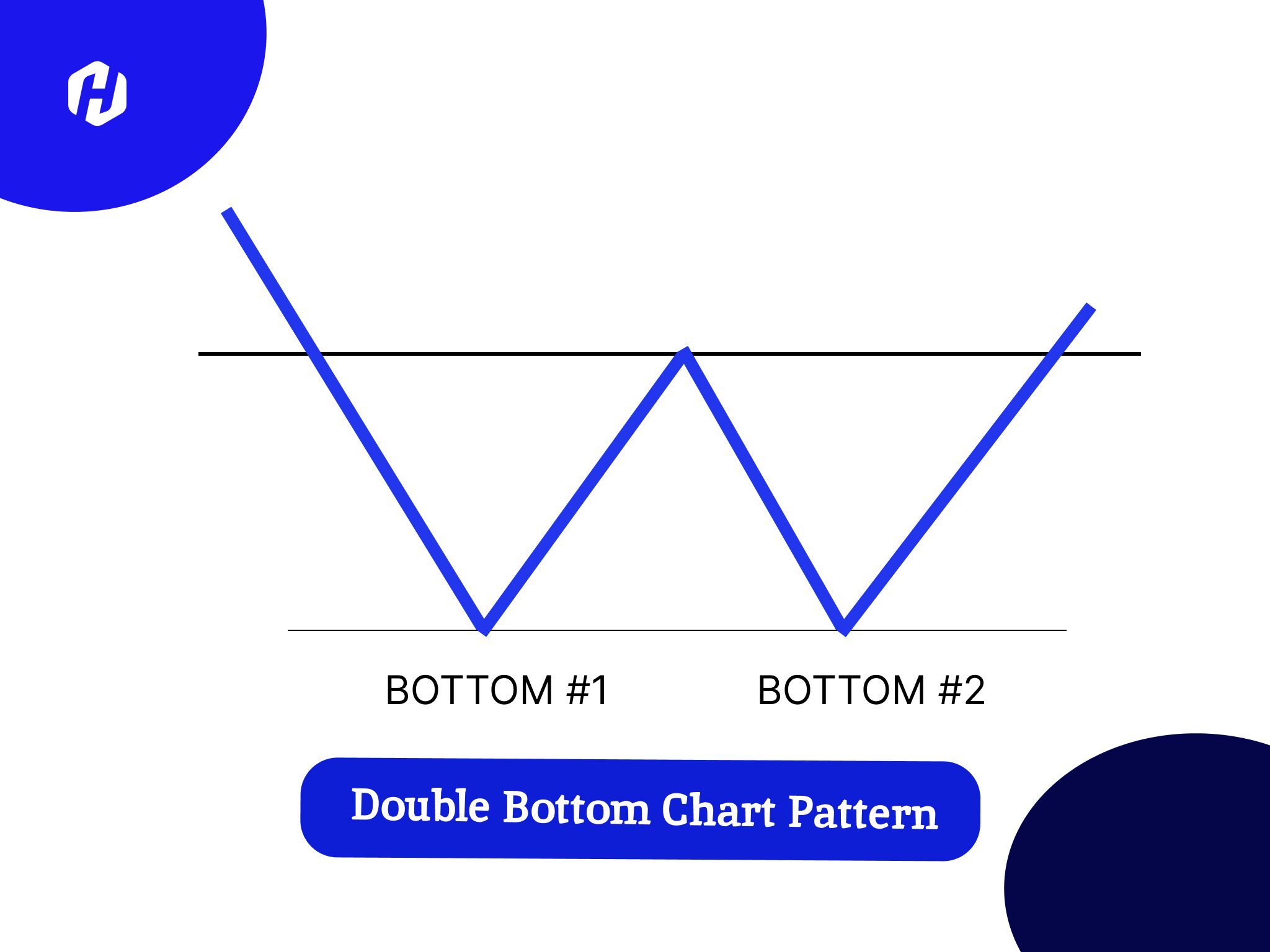

The W chart sample is characterised by two distinct troughs, forming a "W" form on the value chart. These troughs characterize durations of great value decline, adopted by a bounce again, a subsequent decline to an analogous low, and eventually, a decisive upward motion. The 2 troughs ought to be comparatively shut in value, and the following rallies ought to exhibit related heights. The perfect W sample is symmetrical, with each troughs at roughly the identical stage and the 2 rallies reaching roughly the identical excessive. Nonetheless, good symmetry isn’t noticed in the true world; slight deviations are acceptable.

Key Parts of the W Sample:

- Left Trough (First Backside): This marks the preliminary vital value decline, typically related to unfavorable market sentiment or company-specific points.

- Rally: A value rebound following the primary trough, indicating a possible shift in market sentiment.

- Proper Trough (Second Backside): A second decline, typically testing the value stage of the primary trough, confirming the assist stage. This trough is essential for sample affirmation.

- Neckline: The road connecting the peaks of the 2 rallies kinds the neckline. A decisive break above the neckline alerts a bullish affirmation.

- Affirmation Breakout: The value breaking above the neckline confirms the sample and alerts a possible upward development.

Formation and Significance:

The formation of a W sample typically displays a battle between patrons and sellers. The preliminary decline represents the dominance of sellers, pushing the value down. Nonetheless, as the value approaches an important assist stage, patrons step in, stopping additional declines. The second decline assessments this assist, confirming its power. The next break above the neckline signifies that patrons have gained the higher hand, resulting in a possible value improve.

The importance of the W sample lies in its potential to foretell a bullish reversal. It means that the downward development has exhausted itself, and the value is poised for a major upward transfer. The sample’s reliability will increase with the affirmation of the breakout above the neckline and the quantity accompanying the breakout.

Figuring out a Legitimate W Sample:

Not each "W" form on a chart represents a legitimate W sample. A number of elements should be thought-about:

- Quantity: The amount through the formation of the sample is essential. A lower in quantity through the two troughs suggests weakening promoting stress, whereas elevated quantity through the breakout confirms the bullish reversal.

- Timeframe: The timeframe of the chart influences the interpretation of the sample. A W sample on a each day chart carries extra weight than one on an intraday chart.

- Symmetry: Whereas good symmetry is uncommon, vital asymmetry can weaken the sample’s predictive energy. The troughs ought to be comparatively shut in value, and the rallies ought to attain related heights.

- Neckline Breach: The breakout above the neckline is essential for affirmation. A weak breakout or a failure to maintain the value above the neckline invalidates the sample.

- Contextual Evaluation: Contemplate the broader market circumstances and the corporate’s fundamentals. A robust W sample in a bearish market won’t result in a major upward transfer.

Affirmation and Validation:

A number of elements can verify the validity of a W sample:

- Breakout above the neckline: That is the first affirmation sign. The value ought to decisively break above the neckline with elevated quantity.

- Relative Energy Index (RSI): A bullish divergence between the value and the RSI can verify the sample. The next low within the RSI whereas the value kinds a decrease low signifies bullish momentum.

- Shifting Averages: A break above a key shifting common, such because the 20-day or 50-day shifting common, after the neckline breakout can present additional affirmation.

- Assist and Resistance Ranges: The value ought to maintain above the neckline and the earlier lows, indicating robust assist.

Potential Pitfalls and Limitations:

Regardless of its potential, the W sample isn’t foolproof. Traders ought to pay attention to the next limitations:

- False Breakouts: The value could quickly break above the neckline earlier than reversing downwards, making a false sign.

- Weak Breakouts: A weak breakout with out vital quantity improve could not result in a sustained upward development.

- Market Situations: The effectiveness of the sample might be influenced by broader market circumstances. A robust W sample in a bearish market could not lead to a major value improve.

- Subjectivity: Figuring out the precise factors of the troughs and the neckline might be subjective, resulting in completely different interpretations.

Buying and selling Methods with the W Sample:

As soon as a confirmed W sample is recognized, a number of buying and selling methods might be employed:

- Breakout Buying and selling: Enter an extended place after a decisive breakout above the neckline, inserting a stop-loss order beneath the second trough.

- Pullback Buying and selling: Anticipate a pullback to the neckline after the breakout earlier than coming into an extended place, decreasing the danger of coming into at a excessive value.

- Trailing Cease-Loss: Use a trailing stop-loss order to guard earnings as the value rises.

Examples of W Sample Shares (Hypothetical):

Whereas offering particular inventory examples would require real-time market information and is past the scope of this common article, let’s think about hypothetical eventualities. Think about inventory XYZ reveals a traditional W sample. Its value drops, recovers partially, drops once more to close the preliminary low, after which breaks decisively above the neckline. This might sign a bullish reversal, prompting traders to think about lengthy positions. Equally, inventory ABC would possibly present a much less good, however nonetheless recognizable, W sample, with barely asymmetrical troughs. A cautious evaluation of quantity and different indicators can be essential to assess its validity and potential.

Conclusion:

The W chart sample, whereas not a assured predictor of future value actions, is a useful software in a technical analyst’s arsenal. By understanding its formation, affirmation alerts, and potential pitfalls, traders can enhance their means to determine potential bullish reversals and make knowledgeable buying and selling selections. Nonetheless, it is essential to do not forget that technical evaluation ought to be used along side basic evaluation and danger administration methods for a holistic method to investing. At all times conduct thorough analysis and think about your danger tolerance earlier than making any funding selections. The W sample is a strong software, but it surely’s only one piece of the puzzle within the complicated world of inventory market evaluation.

Closure

Thus, we hope this text has offered useful insights into Decoding the W Chart Sample: A Complete Information for Inventory Traders. We thanks for taking the time to learn this text. See you in our subsequent article!