Decoding the W Sample Chart: A Complete Information to its That means and Implications

Associated Articles: Decoding the W Sample Chart: A Complete Information to its That means and Implications

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the W Sample Chart: A Complete Information to its That means and Implications. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the W Sample Chart: A Complete Information to its That means and Implications

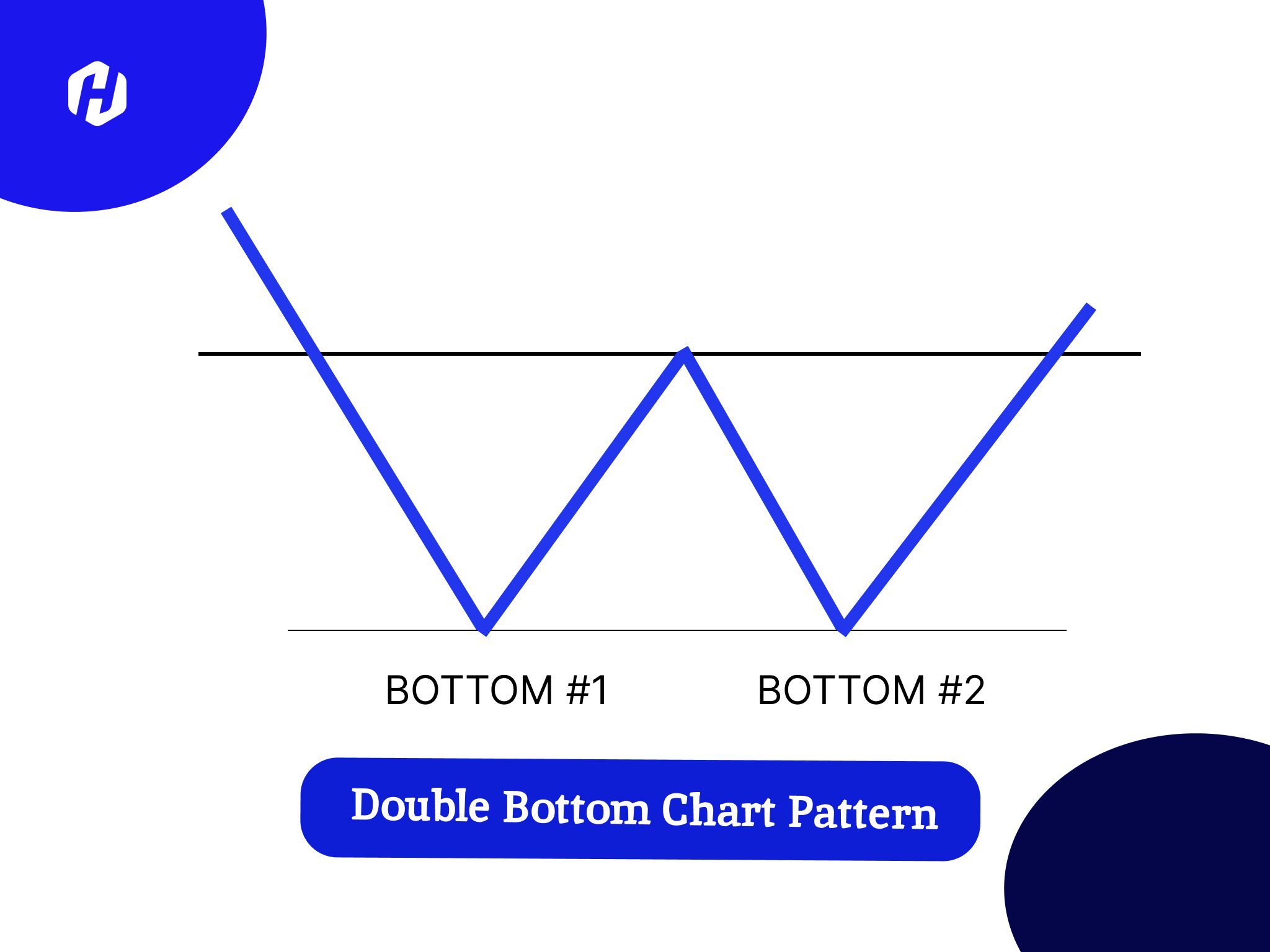

The world of technical evaluation is replete with patterns, formations, and indicators designed to foretell future worth actions. Amongst these, the "W" sample, also referred to as a double backside or inverse head and shoulders, holds a big place. Whereas seemingly easy in its visible illustration, understanding the nuances of the W sample chart requires delving into its formation, affirmation, and implications for buying and selling methods. This text offers a complete overview of the W sample, exploring its which means, figuring out its key parts, and discussing its sensible functions in numerous market contexts.

Understanding the Formation of the W Sample

The W sample, in its purest type, resembles the letter "W" on a worth chart. It is characterised by two distinct troughs (lows) related by the next peak in between. This central peak represents a brief reversal within the prevailing downtrend, earlier than the worth resumes its upward trajectory. The sample signifies a possible shift from bearish momentum to bullish momentum, providing merchants a beneficial alternative to enter lengthy positions.

The important thing parts of a W sample are:

-

Left Trough (Low 1): This marks the preliminary vital low within the worth. It is essential that this low establishes a transparent help stage, indicating sturdy promoting stress has been absorbed. The quantity related to this low can present beneficial insights into the energy of the help. Excessive quantity confirms the importance of the low, whereas low quantity could recommend a weak help stage, doubtlessly invalidating the sample.

-

Rally (Peak): Following the left trough, the worth rallies, forming the central peak. This rally is normally pushed by brief masking and the entry of bullish merchants. The peak of this rally relative to the troughs is critical. The next peak suggests stronger bullish sentiment and a doubtlessly extra vital worth reversal.

-

Proper Trough (Low 2): After the height, the worth retraces, forming the second trough (Low 2). Ideally, Low 2 must be roughly on the similar stage as Low 1, or barely increased. This confirms the help stage established by the primary trough. A considerably increased Low 2 weakens the sample, whereas a considerably decrease Low 2 invalidates it, suggesting the downtrend continues to be intact.

-

Breakout: The ultimate and essential ingredient is the breakout above the height (resistance). As soon as the worth decisively breaks above the height, it alerts a affirmation of the sample and the potential for a sustained uptrend. The quantity accompanying this breakout is essential; excessive quantity confirms the energy of the bullish momentum.

Differentiating the W Sample from Noise:

It is important to distinguish real W patterns from random worth fluctuations. A number of elements contribute to a sturdy W sample:

-

Quantity Affirmation: As talked about earlier, quantity performs a vital position in confirming the importance of the troughs and the breakout. Excessive quantity on the troughs signifies sturdy shopping for stress, whereas excessive quantity on the breakout confirms the energy of the bullish momentum. Low quantity all through the sample can point out a weak formation, vulnerable to failure.

-

Time Body: The timeframe of the chart considerably impacts the interpretation of the W sample. A W sample fashioned on a each day chart holds extra weight than one fashioned on a 5-minute chart, because it displays a longer-term pattern reversal.

-

Neckline Break: The road connecting the 2 troughs is usually known as the "neckline." A decisive break above the neckline confirms the sample and initiates the bullish sign.

-

Clear Help and Resistance: The sample ought to exhibit clear help and resistance ranges, including to its credibility. The troughs ought to symbolize sturdy help ranges, whereas the height represents resistance that’s ultimately overcome.

The Inverse Head and Shoulders Sample: A Shut Relative

The W sample is sometimes called an inverse head and shoulders sample. It’s because it’s the mirror picture of the top and shoulders sample, which is a bearish reversal sample. The top and shoulders sample has a central peak (the top) flanked by two decrease peaks (the shoulders), adopted by a breakdown beneath the neckline, signaling a possible downtrend. The W sample, subsequently, represents the other—a bullish reversal.

Buying and selling Methods Primarily based on the W Sample

Figuring out a W sample offers merchants with a number of potential buying and selling methods:

-

Lengthy Entry: The commonest technique is to enter an extended place after the worth decisively breaks above the height (resistance). A stop-loss order must be positioned beneath Low 2 to restrict potential losses if the sample fails.

-

Goal Worth: The goal worth for an extended place will be calculated utilizing numerous methods. One frequent technique is to undertaking the peak of the height above the neckline and add that distance to the breakout level.

-

Danger-Reward Ratio: Merchants ought to at all times think about the risk-reward ratio earlier than getting into a commerce. The stop-loss order must be positioned strategically to attenuate potential losses, whereas the goal worth must be set to maximise potential earnings. A good risk-reward ratio is essential for profitable buying and selling.

-

Affirmation Indicators: Utilizing different technical indicators, such because the Relative Power Index (RSI) or Shifting Common Convergence Divergence (MACD), can present additional affirmation of the sample and improve buying and selling choices. For example, a bullish divergence between the worth and the RSI can strengthen the bullish sign.

Limitations and Potential Pitfalls of the W Sample

Regardless of its potential usefulness, the W sample isn’t foolproof. A number of elements can result in false alerts:

-

False Breakouts: The value could break above the height solely to retrace rapidly, resulting in losses for merchants who entered lengthy positions.

-

Incomplete Patterns: A sample could also be incomplete, missing a transparent second trough or a decisive breakout. This makes it tough to verify the sample and will increase the danger of false alerts.

-

Market Circumstances: The effectiveness of the W sample will be influenced by broader market situations. During times of excessive volatility or vital information occasions, the sample could also be much less dependable.

-

Subjectivity: Figuring out a W sample includes a level of subjectivity. Totally different merchants could interpret the chart otherwise, resulting in various conclusions.

Conclusion:

The W sample, or inverse head and shoulders, is a strong instrument in a dealer’s arsenal. Nevertheless, it’s essential to know its formation, affirmation, and limitations. Relying solely on the W sample for buying and selling choices is dangerous. Combining it with different technical indicators, basic evaluation, and a sound danger administration technique is important for maximizing potential earnings and minimizing losses. Thorough evaluation, persistence, and self-discipline are key to efficiently using the W sample in your buying and selling endeavors. Keep in mind to at all times follow correct danger administration and think about the broader market context earlier than making any buying and selling choices based mostly on this or some other technical sample. The W sample, whereas a beneficial instrument, must be one element of a well-rounded buying and selling technique, not the only real determinant of your market entries and exits.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the W Sample Chart: A Complete Information to its That means and Implications. We hope you discover this text informative and helpful. See you in our subsequent article!