Decoding the W Sample in Chartink: A Complete Information to Figuring out and Buying and selling Reversal Alternatives

Associated Articles: Decoding the W Sample in Chartink: A Complete Information to Figuring out and Buying and selling Reversal Alternatives

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the W Sample in Chartink: A Complete Information to Figuring out and Buying and selling Reversal Alternatives. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the W Sample in Chartink: A Complete Information to Figuring out and Buying and selling Reversal Alternatives

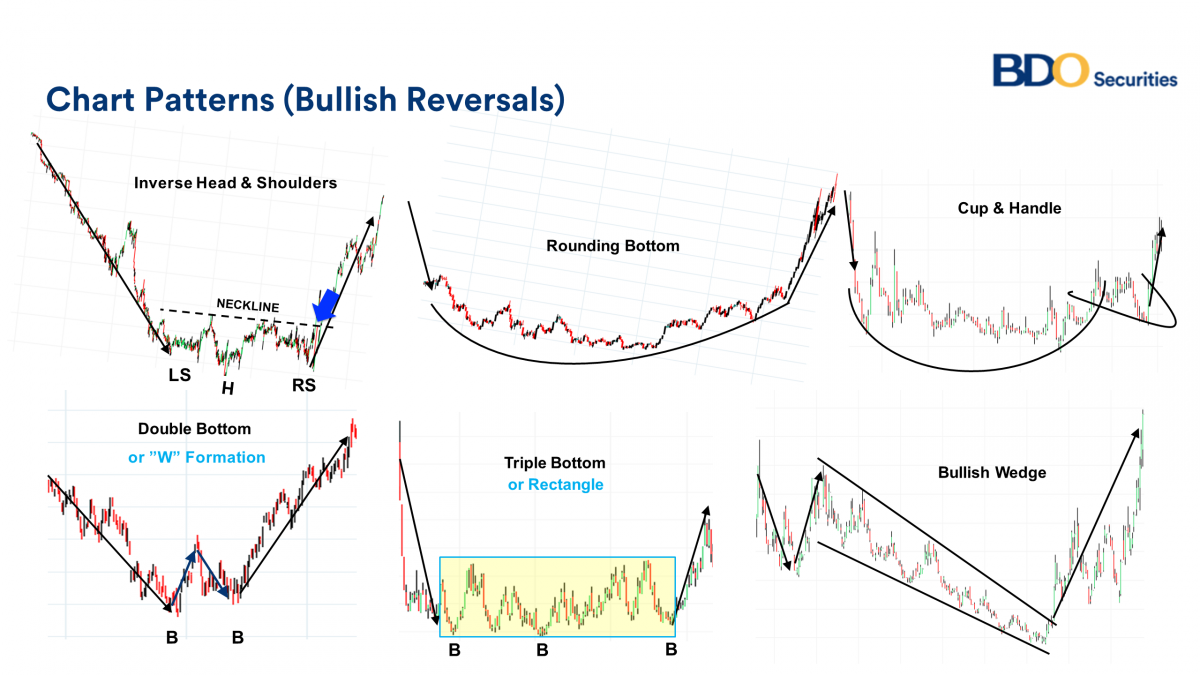

The world of technical evaluation is crammed with patterns, every whispering potential buying and selling alternatives to the astute observer. Amongst these, the W sample, often known as a double backside, stands out as a big reversal sign, typically indicating a shift from a downtrend to an uptrend. This text delves deep into understanding the W sample throughout the context of Chartink, a preferred charting and screening platform, exploring its formation, identification, affirmation methods, threat administration methods, and sensible functions.

Understanding the W Sample Formation:

The W sample is characterised by two distinct troughs (lows) related by a rally, forming a visible resemblance to the letter "W." The primary trough marks the preliminary low of the downtrend, adopted by a rebound. This rebound, nevertheless, fails to maintain momentum, leading to a second trough, ideally at or close to the extent of the primary trough. Subsequently, the worth breaks above the neckline (the excessive level connecting the 2 troughs), signaling a possible bullish reversal.

Key Components of the W Sample:

- Two Distinct Troughs: The muse of the W sample lies within the two comparatively equal lows. Whereas excellent symmetry is not necessary, vital disparity between the troughs weakens the sample’s reliability.

- The Rally (Rebound): The value motion between the 2 troughs represents a short lived restoration. The peak of this rally is essential; the next rally usually suggests stronger bullish potential.

- The Neckline: That is the horizontal line connecting the 2 troughs’ highs. A decisive break above the neckline confirms the sample and triggers a purchase sign.

- Quantity Affirmation: Whereas not all the time crucial, observing growing quantity through the breakout above the neckline strengthens the sign. Conversely, lowering quantity would possibly point out weak spot and forged doubt on the reversal.

- Worth Targets: The potential worth goal for the W sample will be estimated by measuring the space between the neckline and the bottom trough and including it to the breakout level. This calculation affords a possible upside goal, however it’s essential to do not forget that worth targets are estimates, not ensures.

Figuring out the W Sample utilizing Chartink:

Chartink affords numerous instruments to determine the W sample. This is a breakdown of tips on how to successfully make the most of the platform:

- Chart Choice and Timeframe: Select the suitable chart and timeframe based mostly in your buying and selling type. Day by day charts are generally used for swing buying and selling, whereas intraday charts are most well-liked for day buying and selling.

- Drawing Instruments: Chartink gives drawing instruments to manually determine the sample. Draw the neckline connecting the 2 highs and observe the 2 lows. Assess the symmetry and quantity related to every worth motion.

- Indicators: Whereas Chartink does not have a devoted "W sample" indicator, sure indicators can support in identification. For instance, the Relative Energy Index (RSI) will help verify the oversold situation on the troughs, suggesting potential shopping for alternatives. Transferring averages will also be used to determine potential assist ranges and make sure the breakout.

- Scanning and Screening: Chartink’s highly effective scanning capabilities mean you can filter shares based mostly on particular standards. When you cannot instantly display for "W patterns," you should utilize standards like RSI ranges, transferring common crossovers, and worth motion close to assist ranges to slim down potential candidates. This pre-screening considerably reduces the time spent manually analyzing charts.

- Backtesting: Chartink permits for backtesting methods. When you cannot instantly backtest for W patterns, you should utilize the recognized standards (RSI, transferring averages, and so on.) to construct a method and take a look at its efficiency traditionally. This helps in refining your sample recognition and threat administration.

Affirmation Strategies and Danger Administration:

Figuring out the W sample is simply step one. Affirmation from different indicators and a sturdy threat administration plan are essential:

- RSI Affirmation: An RSI studying under 30 on the troughs suggests oversold situations, supporting the potential for a reversal.

- MACD Affirmation: A bullish crossover of the MACD strains can verify the upward momentum.

- Quantity Affirmation: Growing quantity through the breakout above the neckline reinforces the bullish sign.

- Assist and Resistance Ranges: Verify that the neckline acts as a assist degree after the breakout.

- Cease-Loss Orders: All the time use stop-loss orders to restrict potential losses. Place your stop-loss order under the neckline or the second trough, relying in your threat tolerance.

- Place Sizing: By no means threat greater than a small share of your buying and selling capital on any single commerce.

- Trailing Cease-Loss: As the worth strikes in your favor, think about using a trailing stop-loss order to guard your earnings.

Widespread Errors to Keep away from:

- Misidentification: Mistaking different patterns or random worth fluctuations for a W sample is a standard error. Guarantee the 2 troughs are comparatively equal and the neckline is clearly outlined.

- Ignoring Quantity: Neglecting quantity affirmation can result in false indicators.

- Overreliance on Worth Targets: Worth targets are estimates; do not blindly comply with them. Be ready to regulate your technique based mostly on market situations.

- Lack of Danger Administration: Failing to make use of stop-loss orders and correct place sizing can result in vital losses.

Sensible Purposes and Examples:

Let’s illustrate with a hypothetical instance. Think about a inventory’s worth declines, forming a primary trough. A rebound follows, however the worth fails to maintain the upward momentum, forming a second trough close to the extent of the primary. Utilizing Chartink, we draw a neckline connecting the 2 highs. The RSI on the troughs is under 30, indicating oversold situations. As the worth breaks above the neckline with growing quantity, we determine a possible W sample. We place a stop-loss order under the neckline and a goal based mostly on the measured transfer. This can be a simplified instance; thorough evaluation and affirmation are essential in real-world eventualities.

Conclusion:

The W sample, when accurately recognized and confirmed, affords worthwhile insights into potential market reversals. Chartink, with its various charting instruments and scanning capabilities, gives a wonderful platform for figuring out and analyzing this sample. Nonetheless, success relies upon not solely on sample recognition but additionally on a deep understanding of market dynamics, affirmation methods, and disciplined threat administration. Bear in mind to all the time mix technical evaluation with basic evaluation for a extra holistic buying and selling strategy. Steady studying and follow are key to mastering the artwork of figuring out and buying and selling the W sample efficiently utilizing Chartink or every other charting platform. Always remember that buying and selling includes threat, and losses are a chance. All the time commerce responsibly and inside your threat tolerance.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the W Sample in Chartink: A Complete Information to Figuring out and Buying and selling Reversal Alternatives. We hope you discover this text informative and helpful. See you in our subsequent article!