Deconstructing the Balkrishna Industries Chart: A Deep Dive into Efficiency, Traits, and Future Outlook

Associated Articles: Deconstructing the Balkrishna Industries Chart: A Deep Dive into Efficiency, Traits, and Future Outlook

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deconstructing the Balkrishna Industries Chart: A Deep Dive into Efficiency, Traits, and Future Outlook. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Deconstructing the Balkrishna Industries Chart: A Deep Dive into Efficiency, Traits, and Future Outlook

Balkrishna Industries (BKT), a number one producer of off-highway tires, boasts a fancy and interesting chart reflecting its journey via varied market cycles and financial circumstances. Analyzing this chart requires a multi-faceted method, contemplating not simply worth actions but in addition quantity, indicators like RSI and MACD, and an intensive understanding of the corporate’s fundamentals and business panorama. This text will delve right into a complete evaluation of BKT’s chart, exploring its previous efficiency, figuring out key traits, and providing insights into potential future trajectories.

Understanding the Macroeconomic Context:

Earlier than diving into the specifics of BKT’s chart, it is essential to grasp the broader macroeconomic elements influencing its efficiency. The corporate’s fortunes are intricately linked to world agricultural output, building exercise, and industrial manufacturing. Recessions, commodity worth fluctuations (particularly rubber), and geopolitical occasions can considerably impression demand for off-highway tires, instantly affecting BKT’s gross sales and profitability. Subsequently, any chart evaluation should take into account these exterior elements to supply an entire image. For instance, durations of robust world financial development typically correlate with greater BKT inventory costs, whereas downturns are likely to exert downward stress. Equally, fluctuations in rubber costs, a key uncooked materials, instantly impression BKT’s manufacturing prices and margins, influencing its profitability and subsequently its inventory worth.

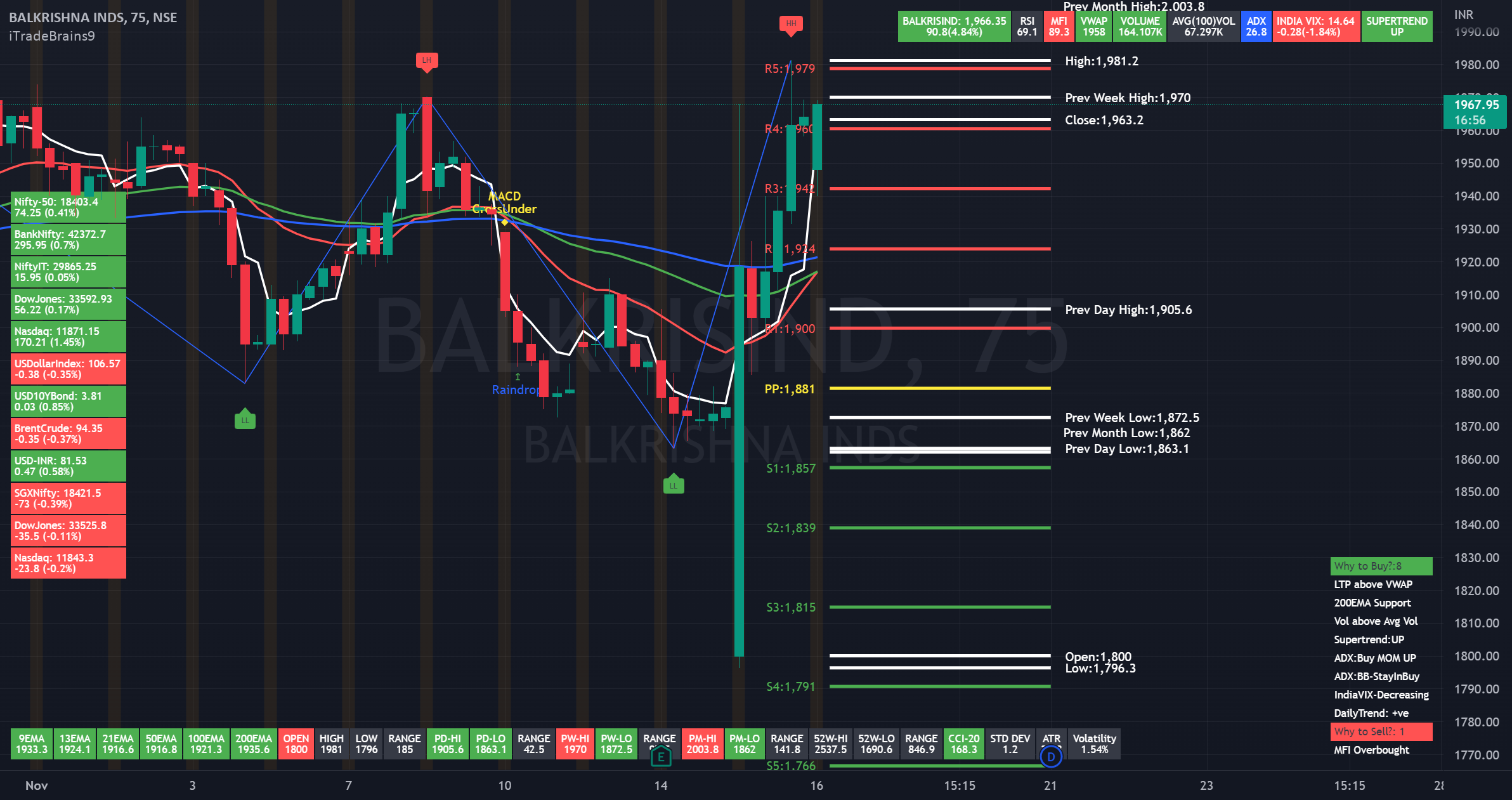

Analyzing the Worth Chart: Lengthy-Time period Traits and Key Help/Resistance Ranges:

An extended-term perspective on BKT’s chart reveals a transparent upward pattern over a number of years, punctuated by durations of consolidation and correction. Figuring out key help and resistance ranges is essential for understanding potential worth actions. Help ranges symbolize costs at which shopping for stress tends to outweigh promoting stress, stopping additional declines. Conversely, resistance ranges symbolize costs the place promoting stress overwhelms shopping for stress, hindering additional worth will increase. By analyzing historic highs and lows, one can establish these essential ranges. As an illustration, a historic low would possibly function a robust help degree sooner or later, whereas a earlier excessive may act as a resistance degree till it is decisively damaged.

The chart must be analyzed utilizing totally different timeframes – each day, weekly, and month-to-month – to establish each short-term and long-term traits. Day by day charts spotlight short-term volatility and momentum, whereas weekly and month-to-month charts present a clearer image of the underlying pattern. The identification of trendlines, connecting vital highs or lows, will help predict future worth actions. For instance, an upward-sloping trendline suggests a bullish outlook, whereas a downward-sloping trendline suggests a bearish outlook.

Technical Indicators: RSI, MACD, and Quantity:

Technical indicators present invaluable insights into the momentum and potential future course of the inventory worth. The Relative Energy Index (RSI) measures the magnitude of current worth modifications to judge overbought or oversold circumstances. An RSI above 70 typically signifies an overbought situation, suggesting a possible worth correction, whereas an RSI under 30 suggests an oversold situation, probably indicating a worth rebound.

The Shifting Common Convergence Divergence (MACD) is one other in style indicator that identifies modifications in momentum by evaluating two transferring averages. A bullish crossover (MACD line crossing above the sign line) suggests a possible upward pattern, whereas a bearish crossover suggests a possible downward pattern. Analyzing the MACD alongside the worth chart will help verify or contradict present traits.

Buying and selling quantity is a vital ingredient in chart evaluation. Excessive quantity throughout worth will increase confirms the power of the uptrend, whereas excessive quantity throughout worth decreases confirms the power of the downtrend. Low quantity throughout worth actions suggests weak conviction and potential for reversal. Subsequently, analyzing quantity alongside worth and technical indicators gives a extra complete image of market sentiment.

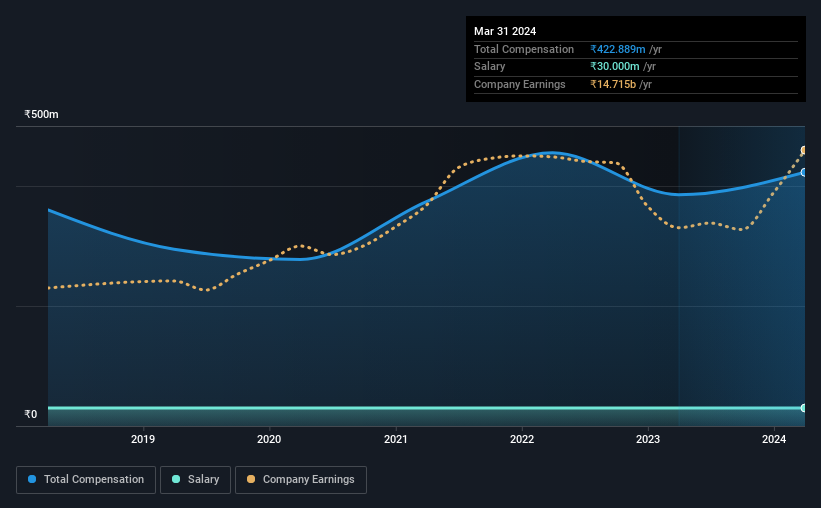

Basic Evaluation: Integrating Firm Efficiency:

Whereas technical evaluation gives insights into worth actions, basic evaluation considers the underlying monetary well being and efficiency of the corporate. This consists of elements similar to income development, profitability margins, debt ranges, and aggressive panorama. Analyzing BKT’s monetary statements, information releases, and business reviews can present essential context for decoding the worth chart. For instance, robust income development and growing profitability can help a bullish outlook, whereas declining income and growing debt ranges would possibly recommend a bearish outlook. Evaluating BKT’s efficiency to its opponents may also present invaluable insights into its market place and future prospects.

Business Evaluation: The Off-Freeway Tire Market:

The off-highway tire market is cyclical, influenced by elements similar to agricultural manufacturing, building exercise, and industrial output. Analyzing business traits and forecasts can present invaluable context for decoding BKT’s chart. As an illustration, a interval of robust world financial development and elevated infrastructure spending would possibly result in greater demand for off-highway tires, supporting a bullish outlook for BKT. Conversely, a worldwide financial slowdown would possibly result in decreased demand, probably exerting downward stress on BKT’s inventory worth.

Future Outlook: Predicting Potential Worth Actions:

Predicting future worth actions is inherently unsure, however by combining technical and basic evaluation with an understanding of the macroeconomic and business context, one can type a reasoned outlook. Based mostly on the evaluation of BKT’s chart, monetary statements, and business traits, a possible situation would possibly contain continued development, punctuated by durations of consolidation or correction. Nonetheless, unexpected occasions, similar to geopolitical instability or vital modifications in uncooked materials costs, may considerably impression the corporate’s efficiency and inventory worth.

Conclusion:

Analyzing the Balkrishna Industries chart requires a holistic method, integrating technical evaluation, basic evaluation, and an understanding of the macroeconomic and business context. Whereas previous efficiency is just not indicative of future outcomes, an intensive evaluation can present invaluable insights into potential future worth actions. By combining the assorted analytical instruments and contemplating the exterior elements, traders could make extra knowledgeable selections relating to their funding in BKT. Nonetheless, it is essential to do not forget that investing within the inventory market entails inherent danger, and no evaluation can assure future returns. This evaluation must be thought of alongside skilled monetary recommendation earlier than making any funding selections.

Closure

Thus, we hope this text has supplied invaluable insights into Deconstructing the Balkrishna Industries Chart: A Deep Dive into Efficiency, Traits, and Future Outlook. We hope you discover this text informative and helpful. See you in our subsequent article!