Deconstructing the NVDA Yahoo Finance Chart: A Deep Dive into NVIDIA’s Inventory Efficiency

Associated Articles: Deconstructing the NVDA Yahoo Finance Chart: A Deep Dive into NVIDIA’s Inventory Efficiency

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Deconstructing the NVDA Yahoo Finance Chart: A Deep Dive into NVIDIA’s Inventory Efficiency. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Deconstructing the NVDA Yahoo Finance Chart: A Deep Dive into NVIDIA’s Inventory Efficiency

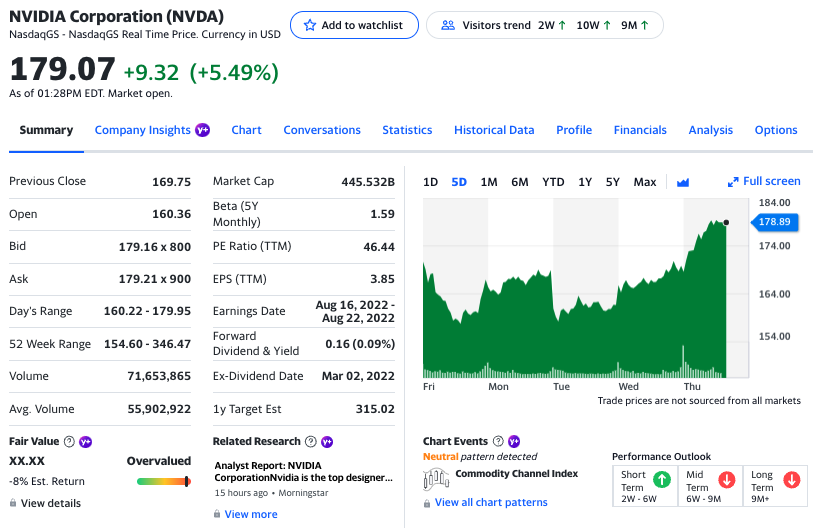

NVIDIA (NVDA) has grow to be a titan within the expertise sector, its inventory value reflecting a meteoric rise fueled by developments in synthetic intelligence (AI), gaming, and knowledge facilities. Analyzing the NVDA Yahoo Finance chart gives a captivating case research in understanding market dynamics, investor sentiment, and the influence of technological innovation on inventory efficiency. This text will dissect the chart, exploring key developments, important occasions, and potential future implications.

Navigating the Chart: Key Indicators and Interpretations

The Yahoo Finance chart for NVDA gives a wealth of knowledge, together with:

-

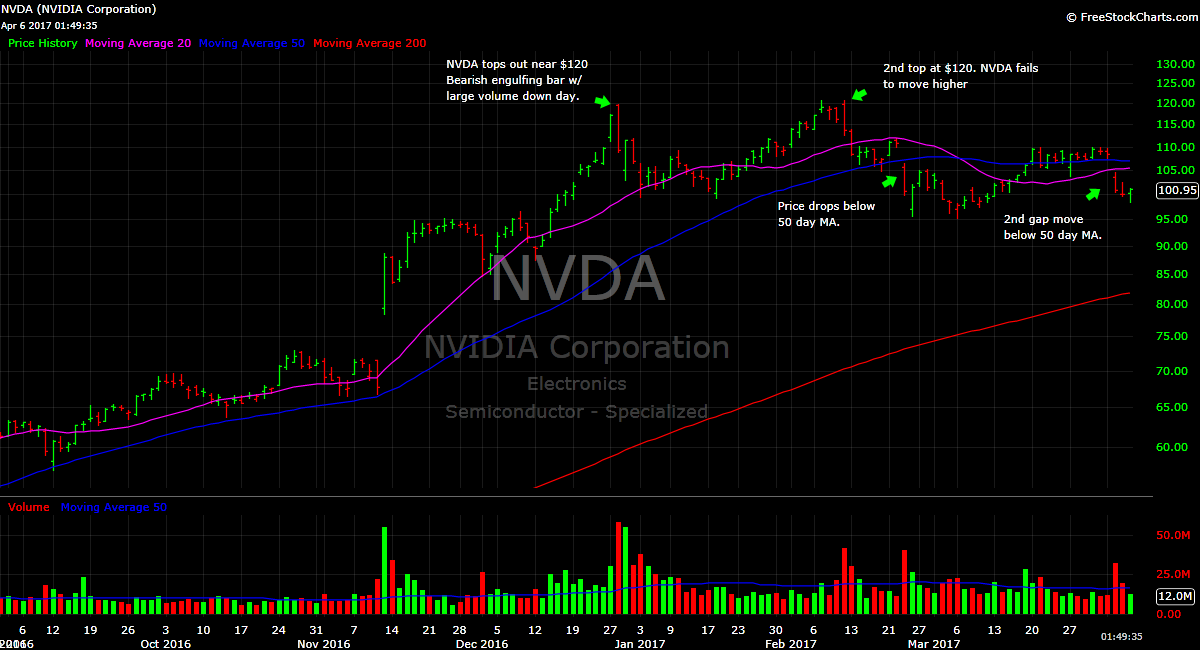

Worth Historical past: The first part, exhibiting the inventory’s value fluctuations over time (every day, weekly, month-to-month, or yearly). Analyzing value actions permits us to determine developments, help and resistance ranges, and potential turning factors.

-

Quantity: The variety of shares traded every interval. Excessive quantity throughout value will increase suggests robust shopping for stress, whereas excessive quantity throughout value decreases signifies important promoting stress. Low quantity can signify indecision or a scarcity of curiosity.

-

Shifting Averages: Technical indicators just like the 50-day and 200-day transferring averages clean out value fluctuations, serving to to determine developments and potential purchase/promote indicators. Crossovers between these averages might be interpreted as important indicators.

-

Relative Energy Index (RSI): A momentum indicator that measures the magnitude of current value modifications to guage overbought or oversold circumstances. Readings above 70 usually counsel an overbought market, whereas readings beneath 30 counsel an oversold market.

-

MACD (Shifting Common Convergence Divergence): One other momentum indicator that reveals the connection between two transferring averages. Crossovers of the MACD line and sign line can point out potential pattern modifications.

-

Candlestick Charts: These visible representations of value actions present insights into the opening, closing, excessive, and low costs for every interval, providing a richer understanding of market sentiment. Patterns like hammer, engulfing, and doji candles can counsel potential future value actions.

Historic Efficiency: A Rollercoaster Trip of Innovation

Inspecting the NVDA Yahoo Finance chart over the previous decade reveals a narrative of explosive development punctuated by durations of correction. Early development was primarily pushed by the success of its graphics processing items (GPUs) within the gaming market. Nonetheless, the corporate’s strategic pivot in the direction of AI, significantly with the event of its highly effective knowledge heart GPUs, has been the first catalyst for its current phenomenal surge.

The chart clearly illustrates durations of serious upward momentum, usually coinciding with:

-

Main product launches: The discharge of recent GPU architectures, such because the Ampere and Hopper collection, has constantly pushed constructive investor sentiment and value will increase.

-

Robust monetary outcomes: Constantly beating earnings expectations and demonstrating strong income development have solidified investor confidence.

-

Strategic partnerships and acquisitions: Collaborations with main tech firms and acquisitions of promising AI startups have additional fueled the expansion narrative.

Conversely, durations of correction or consolidation are sometimes noticed after:

-

Market-wide downturns: The NVDA chart, like many tech shares, has skilled dips throughout broader market corrections, reflecting investor threat aversion.

-

Geopolitical uncertainty: World occasions can influence investor confidence and result in momentary value declines.

-

Considerations about competitors: The emergence of opponents within the AI and GPU markets can quickly dampen investor enthusiasm.

Analyzing Key Assist and Resistance Ranges

By learning the NVDA chart, we will determine key help and resistance ranges. Assist ranges signify value factors the place shopping for stress is powerful sufficient to forestall additional declines. Resistance ranges signify value factors the place promoting stress is powerful sufficient to forestall additional will increase. These ranges might be recognized by observing earlier value highs and lows, in addition to by technical evaluation indicators. Breaks above resistance ranges usually signify bullish momentum, whereas breaks beneath help ranges can sign bearish developments. Understanding these ranges is essential for making knowledgeable funding selections.

The Affect of AI: A Paradigm Shift

The rise of AI has undoubtedly been essentially the most important issue shaping the NVDA Yahoo Finance chart lately. NVIDIA’s GPUs have grow to be important for coaching and deploying massive language fashions (LLMs) and different AI purposes. The rising demand for high-performance computing energy within the AI sector has translated into explosive development for NVIDIA, driving its inventory value to unprecedented heights. The chart displays this paradigm shift, with a transparent acceleration in value development coinciding with the rising adoption of AI throughout varied industries.

Future Outlook: Navigating Uncertainty

Whereas the long run is inherently unsure, a number of components may affect the long run trajectory of the NVDA inventory value:

-

Continued AI adoption: The continued development and adoption of AI throughout varied sectors will doubtless stay a key driver of NVDA’s efficiency.

-

Competitors: The rising competitors within the GPU and AI markets may put stress on NVDA’s market share and profitability.

-

Financial circumstances: Macroeconomic components, akin to inflation and rates of interest, may influence investor sentiment and total market efficiency.

-

Regulatory panorama: Authorities rules associated to AI and knowledge privateness may additionally have an effect on NVDA’s development trajectory.

Conclusion: A Chart Value Learning

The NVDA Yahoo Finance chart gives a compelling case research within the interaction between technological innovation, market dynamics, and investor sentiment. By rigorously analyzing the chart’s historic efficiency, figuring out key help and resistance ranges, and contemplating future potential catalysts and dangers, buyers can acquire priceless insights into this dynamic inventory. Nonetheless, it is essential to keep in mind that previous efficiency just isn’t indicative of future outcomes, and investing within the inventory market at all times entails inherent threat. Thorough analysis and a well-defined funding technique are important for navigating the complexities of the market and making knowledgeable selections. The NVDA chart serves as a robust reminder of the potential rewards and dangers related to investing in expertise firms on the forefront of innovation. Steady monitoring and adaptation are essential for efficiently navigating the ever-evolving panorama of the expertise sector.

Closure

Thus, we hope this text has supplied priceless insights into Deconstructing the NVDA Yahoo Finance Chart: A Deep Dive into NVIDIA’s Inventory Efficiency. We admire your consideration to our article. See you in our subsequent article!