Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable Assets Included)

Associated Articles: Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable Assets Included)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable Assets Included). Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable Assets Included)

The international trade (foreign exchange) market, also called FX or the foreign money market, is the world’s largest and most liquid market. Its decentralized nature and 24/5 buying and selling hours current each important alternatives and challenges for merchants. Efficiently navigating this complicated panorama usually depends on understanding and using technical evaluation, an important part of which is recognizing and decoding chart patterns. This text explores varied foreign exchange chart patterns, their significance, and the way to make the most of them in your buying and selling technique. Moreover, we’ll present hyperlinks to downloadable PDF sources that delve deeper into particular patterns.

Understanding Chart Patterns in Foreign exchange Buying and selling:

Chart patterns are visually identifiable formations on worth charts that recommend potential future worth actions. These patterns emerge from the collective actions of patrons and sellers, reflecting the market’s sentiment and underlying momentum. By recognizing these patterns, merchants can anticipate potential worth reversals, continuations, or consolidations, enabling them to make knowledgeable buying and selling selections.

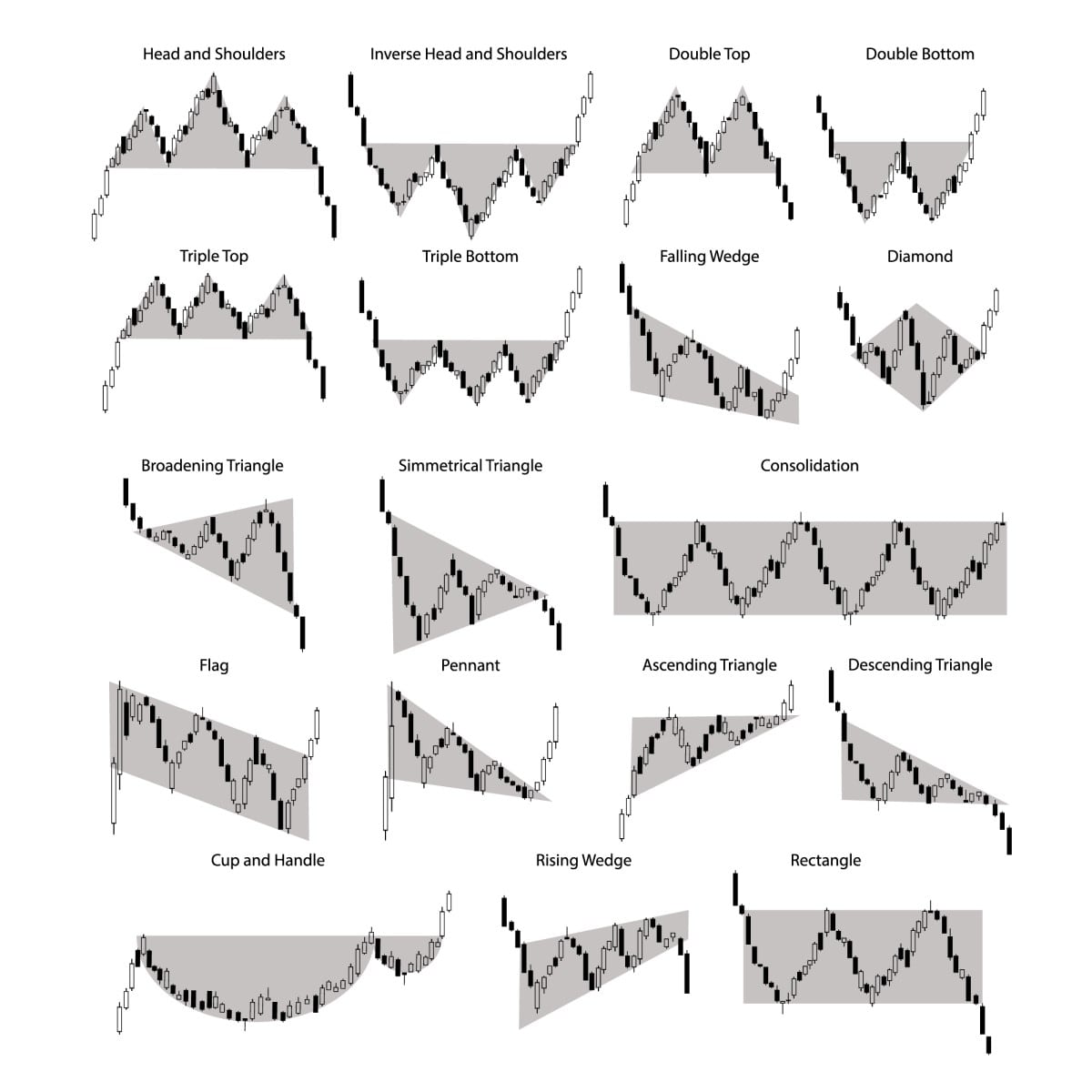

Chart patterns are typically categorized into two important teams:

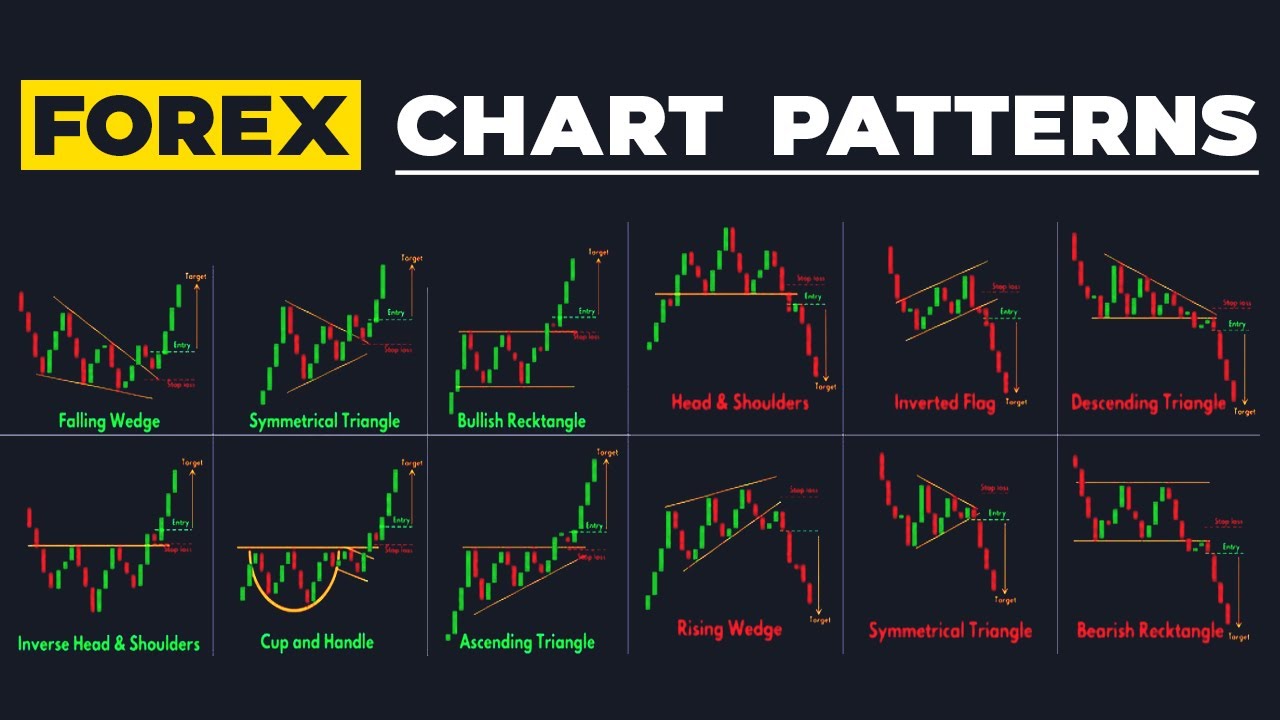

- Continuation Patterns: These patterns recommend that the prevailing pattern will proceed after a short lived pause or consolidation. Examples embrace triangles, flags, pennants, and wedges.

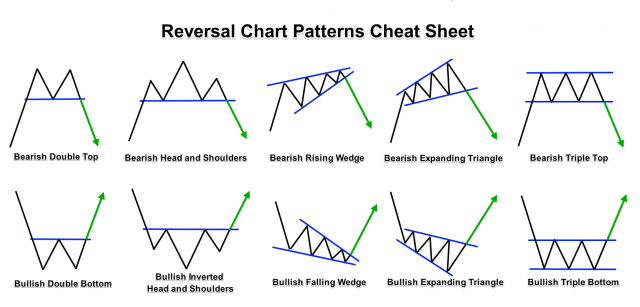

- Reversal Patterns: These patterns point out a possible change within the prevailing pattern. Head and shoulders, double tops/bottoms, and triple tops/bottoms are frequent examples.

Key Foreign exchange Chart Patterns and their Interpretations:

Let’s delve into a number of the most prevalent and dependable foreign exchange chart patterns:

1. Head and Shoulders (Reversal Sample):

It is a traditional reversal sample indicating a possible shift from an uptrend to a downtrend (head and shoulders high) or vice versa (head and shoulders backside). It consists of three peaks (or troughs), with the center peak (the "head") being considerably larger (or decrease) than the opposite two ("shoulders"). A neckline, a trendline connecting the troughs of the shoulders, is essential for confirming the sample’s validity. A break under (or above) the neckline confirms the reversal sign.

(Downloadable PDF Useful resource: [Link to a PDF focusing on Head and Shoulders patterns, including examples and trading strategies])

2. Double Tops/Bottoms (Reversal Sample):

These patterns encompass two related worth highs (double high) or lows (double backside), adopted by a break under (double high) or above (double backside) the neckline connecting the 2 highs or lows. The neckline acts as assist (double backside) or resistance (double high). A break confirms the reversal sign. The space between the highs/lows and the neckline usually offers a worth goal for the potential transfer.

(Downloadable PDF Useful resource: [Link to a PDF focusing on Double Tops/Bottoms patterns, including examples and risk management strategies])

3. Triple Tops/Bottoms (Reversal Sample):

Much like double tops/bottoms, however with three related worth highs (triple high) or lows (triple backside). The affirmation and interpretation are related, however the sign is mostly thought of stronger as a result of elevated affirmation.

(Downloadable PDF Useful resource: [Link to a PDF comparing Double and Triple Tops/Bottoms, highlighting their similarities and differences])

4. Triangles (Continuation or Reversal Sample):

Triangles are consolidation patterns shaped by converging trendlines. They are often symmetrical, ascending, or descending. Symmetrical triangles usually result in continuation strikes, whereas ascending triangles favor upward breaks and descending triangles favor downward breaks. The breakout path usually determines the long run pattern.

(Downloadable PDF Useful resource: [Link to a PDF explaining the different types of triangles and their implications for trading])

5. Flags and Pennants (Continuation Patterns):

These are short-term consolidation patterns that normally seem throughout robust tendencies. Flags are characterised by parallel trendlines, whereas pennants have converging trendlines, resembling a triangle however shorter in length. Breakouts from these patterns sometimes proceed the prevailing pattern.

(Downloadable PDF Useful resource: [Link to a PDF differentiating between Flags and Pennants and providing examples of successful trades])

6. Wedges (Continuation or Reversal Sample):

Wedges are characterised by converging trendlines, much like triangles. Ascending wedges are typically bearish, suggesting a possible pattern reversal, whereas descending wedges are typically bullish, suggesting a continuation or reversal to the upside.

(Downloadable PDF Useful resource: [Link to a PDF focusing on Wedge patterns and their use in identifying potential trend reversals])

7. Rectangles (Continuation Sample):

Rectangles are characterised by two parallel horizontal traces, representing assist and resistance ranges. The value consolidates inside these ranges earlier than ultimately breaking out in both path. The breakout path usually determines the long run pattern.

(Downloadable PDF Useful resource: [Link to a PDF demonstrating the use of Rectangles in identifying support and resistance levels and potential breakouts])

Utilizing Chart Patterns Successfully:

Whereas chart patterns can present precious insights, it is essential to keep in mind that they aren’t foolproof indicators. A number of components must be thought of:

- Affirmation: At all times verify sample indicators with different technical indicators, corresponding to shifting averages, RSI, MACD, or quantity evaluation.

- Danger Administration: Implement correct threat administration methods, together with stop-loss orders, to restrict potential losses.

- Context: Contemplate the broader market context and financial components earlier than making buying and selling selections primarily based solely on chart patterns.

- Apply: Mastering chart sample recognition requires follow and expertise. Begin with simulated buying and selling to realize confidence earlier than risking actual capital.

Conclusion:

Foreign exchange chart patterns are highly effective instruments for technical evaluation, providing precious insights into potential worth actions. By understanding the traits of various patterns and mixing them with different analytical strategies and threat administration methods, merchants can considerably improve their buying and selling selections. Do not forget that constant studying and follow are key to mastering the artwork of chart sample recognition and reaching success within the foreign exchange market. Make the most of the downloadable PDF sources linked all through this text to deepen your understanding and refine your buying and selling strategy. Keep in mind to at all times commerce responsibly and handle your threat successfully. Good luck!

(Be aware: The bracketed hyperlinks above are placeholders. To create a whole article, you would want to create precise PDF paperwork specializing in every chart sample and hyperlink them appropriately.)

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-02-f9a2aa69cf4f4546b2ed3857797e8be8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg)

Closure

Thus, we hope this text has supplied precious insights into Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable Assets Included). We recognize your consideration to our article. See you in our subsequent article!