gl vs chart of accounts

Associated Articles: gl vs chart of accounts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to gl vs chart of accounts. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

The Basic Ledger (GL) vs. the Chart of Accounts: A Deep Dive into Monetary Document-Holding

Correct and environment friendly monetary record-keeping is the spine of any profitable group, no matter measurement or {industry}. Two elementary parts underpin this course of: the Basic Ledger (GL) and the Chart of Accounts (COA). Whereas typically used interchangeably, they’re distinct but interconnected entities that work collectively to supply a complete view of a company’s monetary well being. This text will delve into the intricacies of each the GL and COA, exploring their particular person features, their relationship, and the significance of their efficient implementation.

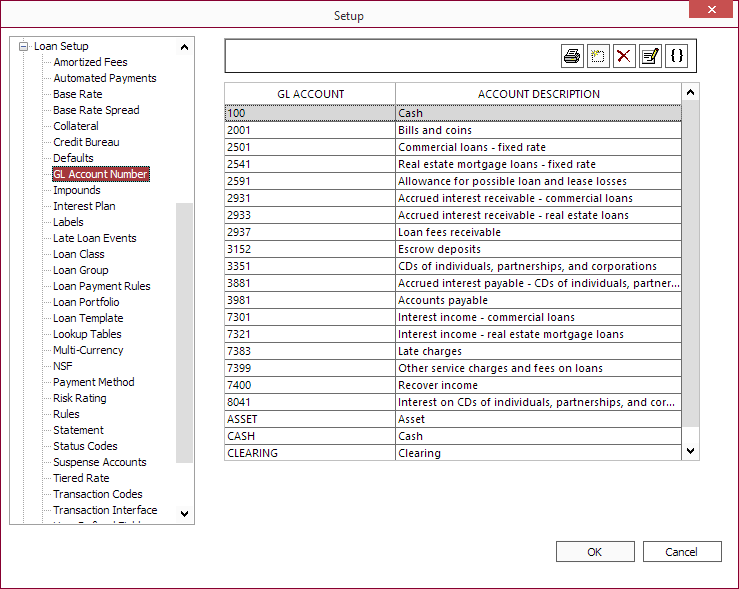

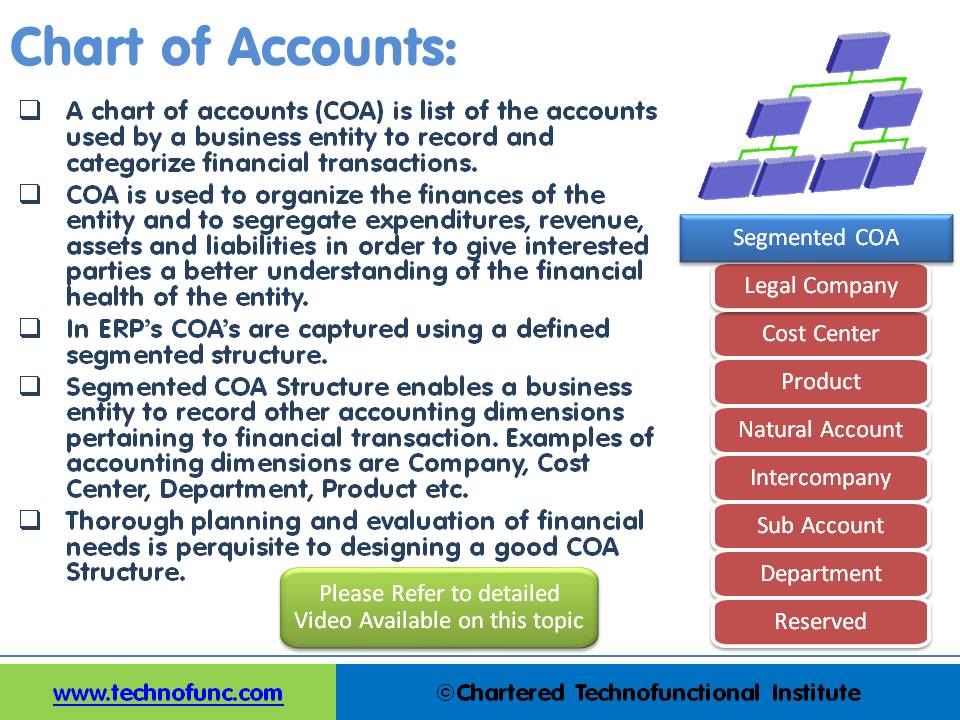

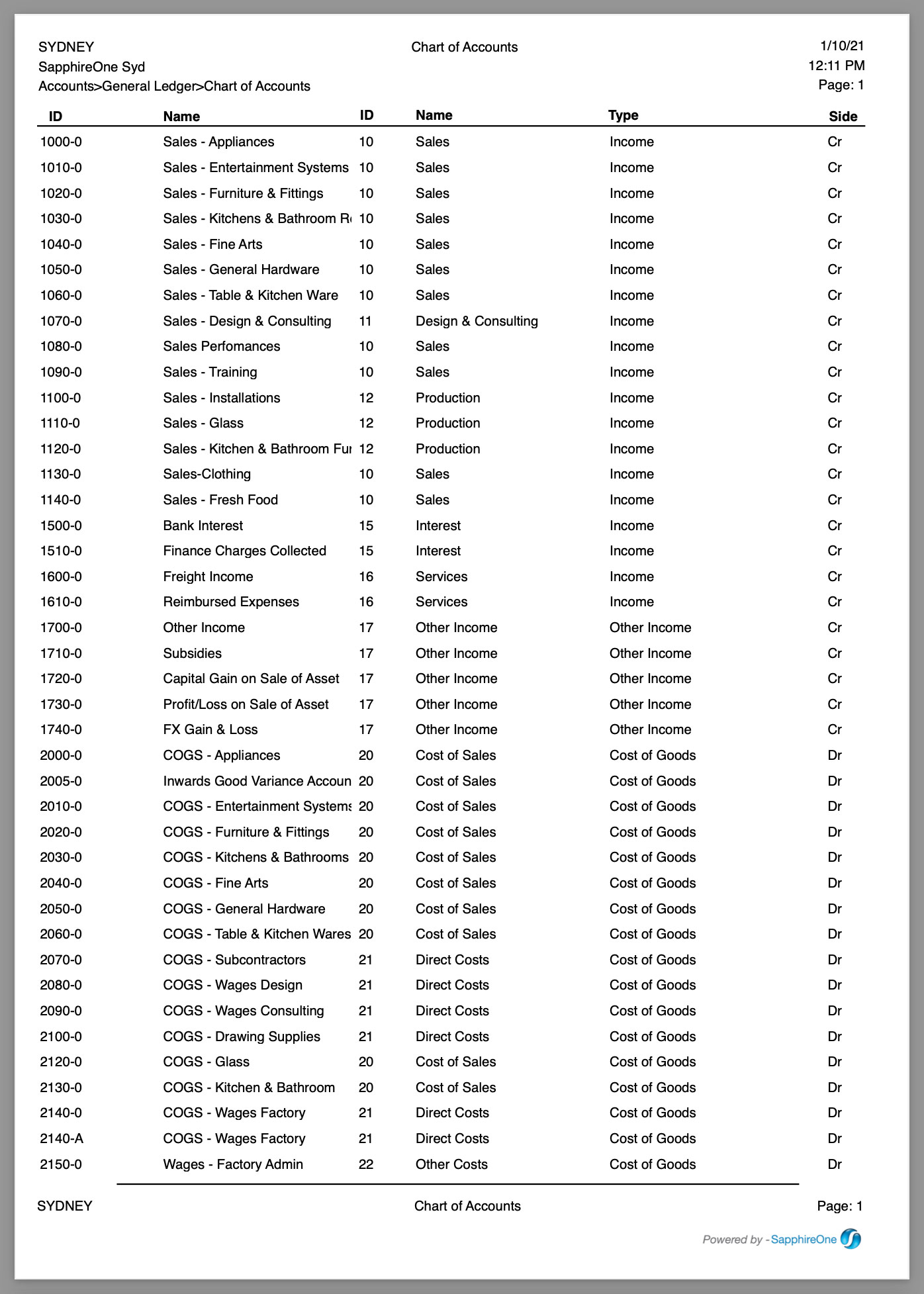

Understanding the Chart of Accounts (COA): The Basis of Monetary Group

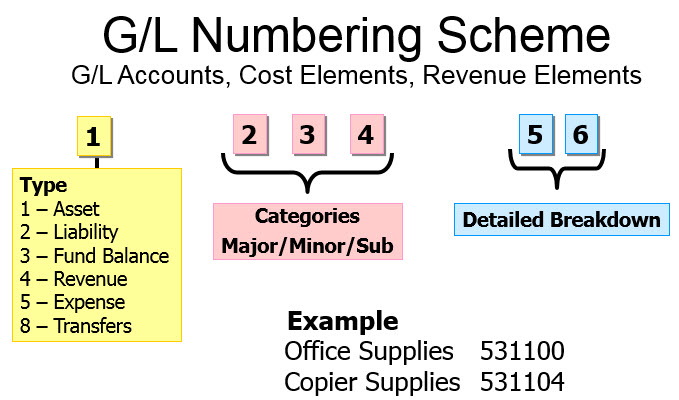

The Chart of Accounts is basically a structured listing of all of the accounts utilized by a company to document its monetary transactions. Consider it as an in depth define or blueprint for a way monetary knowledge will probably be categorized and tracked. Every account represents a particular side of the enterprise’s monetary actions, resembling belongings, liabilities, fairness, revenues, and bills. The COA supplies a standardized framework for classifying transactions, guaranteeing consistency and facilitating correct reporting.

A well-designed COA is essential for a number of causes:

- Group: It systematically organizes monetary knowledge, making it simpler to find and analyze particular info. With out a COA, transactions could be a chaotic jumble, rendering monetary evaluation just about unimaginable.

- Consistency: It ensures that each one transactions are recorded utilizing the identical terminology and classification, minimizing errors and enhancing the reliability of economic statements.

- Reporting: It facilitates the era of correct and significant monetary reviews, together with the stability sheet, revenue assertion, and money move assertion. The COA supplies the construction wanted to combination knowledge and current it in a transparent and concise method.

- Auditing: A well-structured COA simplifies the auditing course of, as auditors can simply hint transactions and confirm their accuracy. That is significantly necessary for regulatory compliance.

- Evaluation: The detailed categorization of accounts permits for in-depth monetary evaluation. By analyzing particular person accounts, companies can establish traits, pinpoint areas of power and weak point, and make knowledgeable choices.

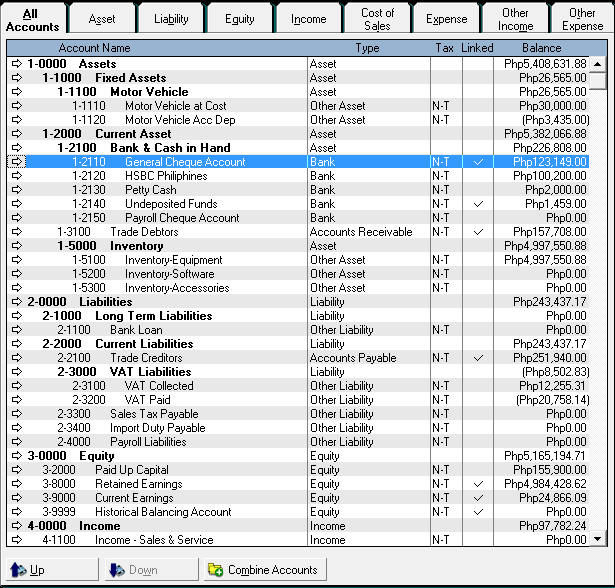

The construction of a COA can fluctuate relying on the dimensions and complexity of the group, in addition to industry-specific necessities. Nevertheless, most COAs observe a standardized format based mostly on typically accepted accounting rules (GAAP) or Worldwide Monetary Reporting Requirements (IFRS). Frequent account classes embrace:

- Belongings: Sources owned by the group, resembling money, accounts receivable, stock, and property, plant, and tools (PP&E).

- Liabilities: Obligations owed by the group to others, resembling accounts payable, loans payable, and salaries payable.

- Fairness: The homeowners’ stake within the group, representing the distinction between belongings and liabilities.

- Revenues: Revenue generated from the group’s main operations, resembling gross sales income, service income, and curiosity income.

- Bills: Prices incurred in producing income, resembling value of products offered, salaries expense, lease expense, and utilities expense.

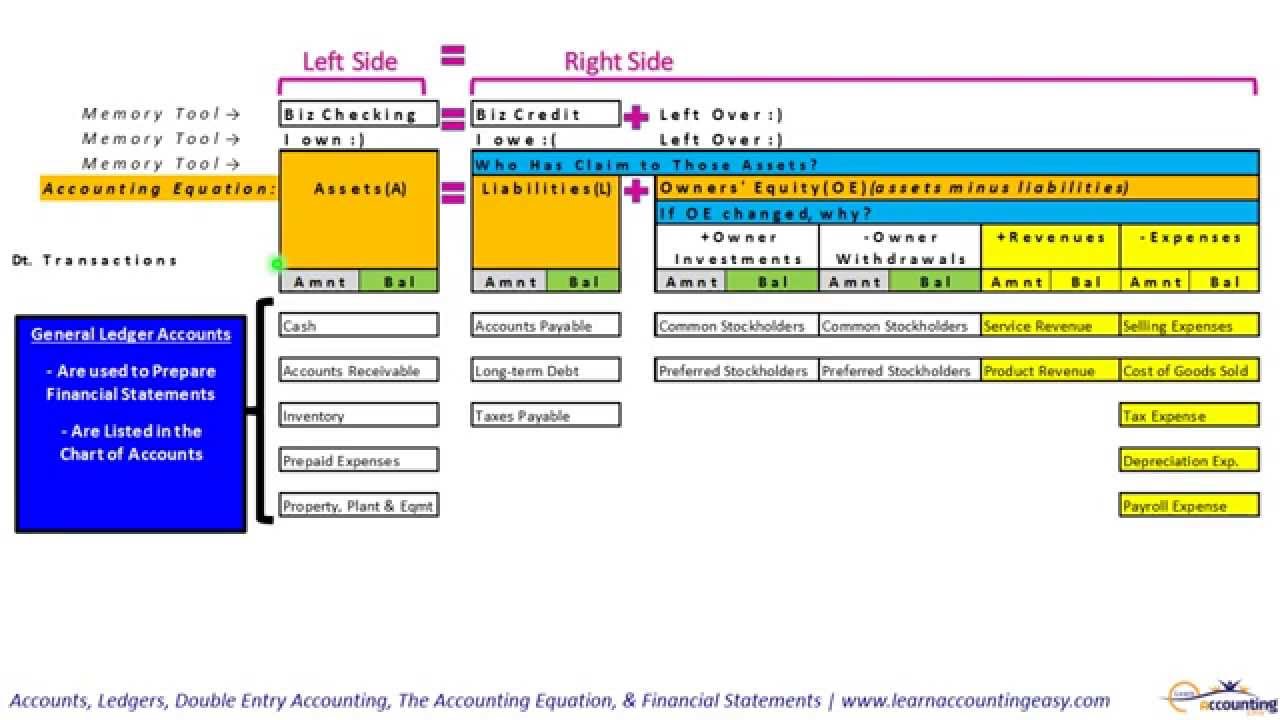

The Basic Ledger (GL): The Coronary heart of Monetary Recording

The Basic Ledger is the central repository for all monetary transactions recorded by a company. It is a complete document of each debit and credit score entry made all through the accounting interval. The GL acts as an in depth historical past of all monetary exercise, offering a whole and auditable path. Every transaction recorded within the GL is linked to a particular account inside the COA, guaranteeing that the info is correctly categorized and summarized.

The GL’s main features embrace:

- Transaction Recording: It meticulously data each monetary transaction, offering a whole and correct document of all debits and credit.

- Account Balancing: It ensures that the debits and credit for every account are balanced, sustaining the basic accounting equation (Belongings = Liabilities + Fairness). Any imbalance signifies an error that must be rectified.

- Summarization: It summarizes the exercise inside every account, offering a transparent image of the balances at any given cut-off date.

- Reporting: It serves as the first supply of information for producing monetary reviews. The GL knowledge is used to create the stability sheet, revenue assertion, and money move assertion.

- Auditing: It supplies an auditable path of all monetary transactions, permitting for verification of the accuracy and completeness of the monetary data.

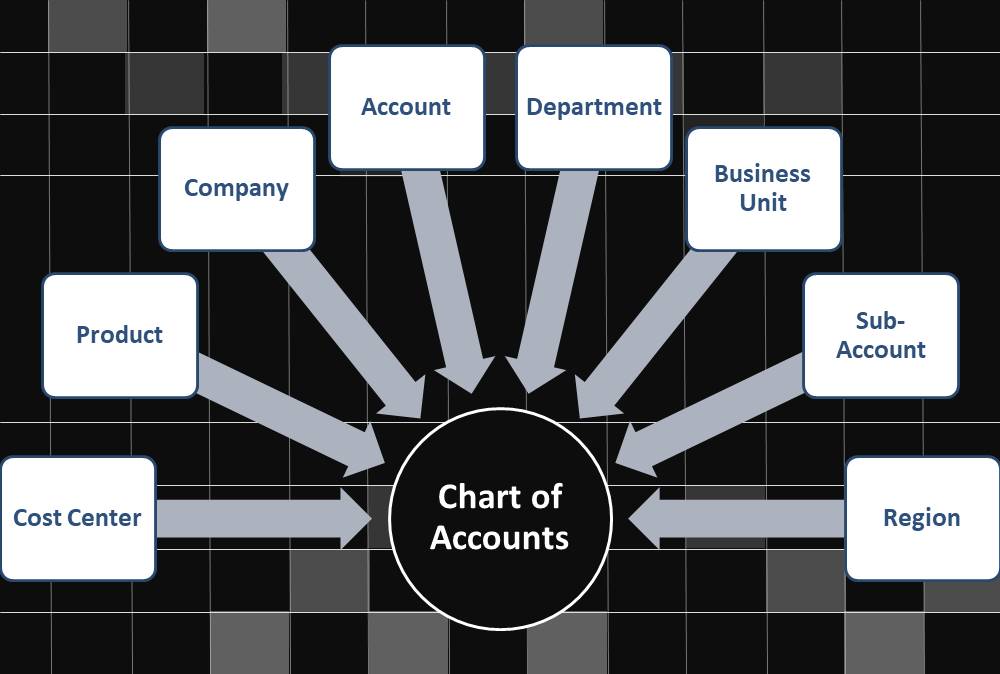

The Interaction between the COA and the GL

The COA and the GL are intrinsically linked. The COA supplies the framework for organizing and classifying monetary knowledge, whereas the GL serves because the repository for that knowledge. Each transaction recorded within the GL is classed in keeping with the COA, guaranteeing that the data is constantly categorized and readily accessible for evaluation and reporting.

Consider the COA as a library’s catalog and the GL because the library itself. The catalog (COA) supplies a structured listing of all of the books (accounts) obtainable, whereas the library (GL) homes the precise books and supplies entry to them. With out the catalog, discovering a particular e-book could be extraordinarily tough. Equally, with out the COA, finding and analyzing particular monetary knowledge inside the GL could be a frightening job.

The Significance of a Nicely-Maintained COA and GL

Sustaining a well-structured COA and a meticulously saved GL is essential for a number of causes:

- Correct Monetary Reporting: Correct monetary statements are important for making knowledgeable enterprise choices, attracting buyers, and complying with regulatory necessities.

- Improved Choice-Making: Detailed monetary knowledge permits for in-depth evaluation, enabling companies to establish traits, pinpoint areas of enchancment, and make strategic choices.

- Enhanced Operational Effectivity: A well-organized system streamlines monetary processes, lowering the effort and time required for record-keeping and reporting.

- Regulatory Compliance: Correct monetary data are essential for complying with tax rules and different authorized necessities.

- Fraud Prevention: A well-maintained system makes it tougher to hide fraudulent actions.

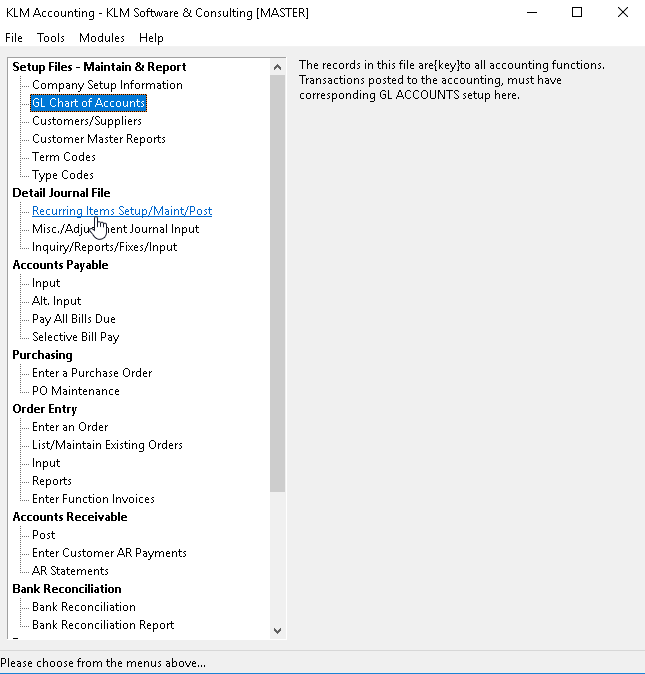

Trendy GL and COA Methods: Know-how’s Function

Trendy accounting software program performs a significant function in managing each the COA and the GL. These techniques automate most of the handbook processes, enhancing effectivity and lowering the danger of errors. Superior options embrace:

- Automated Transaction Posting: Transactions are robotically posted to the proper accounts based mostly on the COA.

- Actual-time Reporting: Monetary reviews could be generated in real-time, offering up-to-the-minute insights into the group’s monetary efficiency.

- Information Integration: The GL could be built-in with different techniques, resembling CRM and ERP techniques, offering a holistic view of the group’s operations.

- Information Analytics: Superior analytics instruments can be utilized to establish traits, patterns, and anomalies in monetary knowledge.

Conclusion:

The Basic Ledger and the Chart of Accounts are indispensable instruments for efficient monetary administration. The COA supplies the framework for organizing monetary knowledge, whereas the GL serves because the central repository for all monetary transactions. Their mixed use ensures correct monetary reporting, knowledgeable decision-making, and regulatory compliance. Investing in a well-structured COA and using trendy accounting software program to handle the GL are essential for the success of any group. Understanding the connection between these two parts is crucial for anybody concerned in monetary administration, from small enterprise homeowners to massive company CFOs. A well-maintained system interprets to higher management, improved insights, and in the end, a more healthy monetary future.

Closure

Thus, we hope this text has supplied precious insights into gl vs chart of accounts. We recognize your consideration to our article. See you in our subsequent article!