gold vs silver value chart india

Associated Articles: gold vs silver value chart india

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to gold vs silver value chart india. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Gold vs. Silver Value Chart India: A Comparative Evaluation

India, a land steeped in custom and a major international participant in treasured metals, boasts a vibrant marketplace for each gold and silver. These metals, deeply intertwined with cultural practices and funding methods, have seen their costs fluctuate dramatically through the years. Understanding the dynamics of their value actions, as mirrored within the gold vs. silver value chart for India, is essential for buyers, customers, and anybody within the Indian financial system. This text delves right into a complete evaluation of this relationship, exploring historic tendencies, influencing elements, and future prospects.

Historic Perspective: A Take a look at the Indian Gold and Silver Value Charts

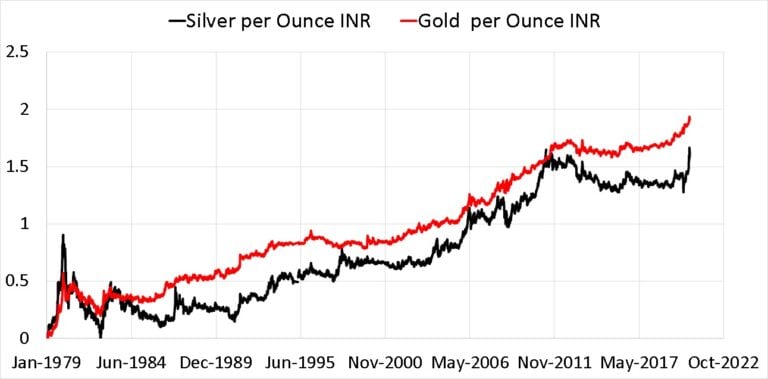

Inspecting historic value charts of gold and silver in India reveals a fancy interaction of things. Whereas each metals typically transfer in tandem, reflecting broader macroeconomic tendencies, their correlation is not at all times excellent. Over the previous 20 years, for example, we have witnessed intervals of sturdy constructive correlation, the place each gold and silver costs rose or fell concurrently, and intervals of weaker correlation, and even destructive correlation, the place one steel outperformed the opposite.

The early 2000s noticed a comparatively regular rise in each gold and silver costs, fueled by international financial uncertainty and rising investor demand. The 2008 international monetary disaster considerably boosted demand for each metals as safe-haven belongings, resulting in a pointy surge in costs. Nonetheless, the following restoration and quantitative easing measures by central banks led to some value volatility, with intervals of each features and losses for each gold and silver.

Extra not too long ago, the COVID-19 pandemic triggered one other important value rally for each metals. The pandemic-induced financial uncertainty and large authorities stimulus packages fueled inflation fears, driving buyers in the direction of treasured metals as a hedge towards inflation. Nonetheless, the following financial restoration and rising rates of interest have impacted costs, resulting in a interval of relative consolidation and even decline in some intervals.

Analyzing particular value factors and tendencies on the Indian gold vs. silver value chart requires contemplating the affect of assorted elements together with:

-

Rupee fluctuations: The Indian Rupee’s trade charge towards the US greenback considerably impacts the worth of gold and silver, as these metals are primarily traded in US {dollars} internationally. A weaker rupee usually results in increased costs in Indian Rupees.

-

Import duties and taxes: India levies import duties and taxes on gold and silver, influencing home costs. Modifications in these duties could cause quick value changes.

-

Home demand: India’s substantial demand for gold, pushed by cultural and funding causes, performs a major function in value dedication. Competition seasons and auspicious events typically witness a surge in demand, main to cost will increase.

-

International provide and demand: International macroeconomic elements, geopolitical occasions, and industrial demand for each metals affect costs worldwide, impacting the Indian market.

-

Funding sentiment: Investor notion and hypothesis play an important function in value fluctuations. Constructive sentiment can result in elevated shopping for, driving costs increased, whereas destructive sentiment can set off promoting stress and value declines.

Analyzing the Correlation: When Do Gold and Silver Transfer Collectively, and When Do They Diverge?

Whereas gold and silver typically exhibit a constructive correlation, their relationship is not at all times easy. A number of elements can result in divergence:

-

Industrial demand for silver: Silver’s industrial functions are much more intensive than gold’s. Fluctuations in industrial demand, notably in sectors like electronics and photo voltaic power, can considerably affect silver costs independently of gold. A surge in industrial demand can drive silver costs increased even when gold costs stay comparatively steady.

-

Funding methods: Traders might select to allocate their funds in a different way between gold and silver based mostly on their perceived risk-reward profiles. This may result in intervals the place one steel outperforms the opposite.

-

Speculative buying and selling: Speculative buying and selling exercise can amplify value actions in each metals, resulting in intervals of divergence. Quick-term speculative buying and selling typically does not replicate the underlying fundamentals of provide and demand.

-

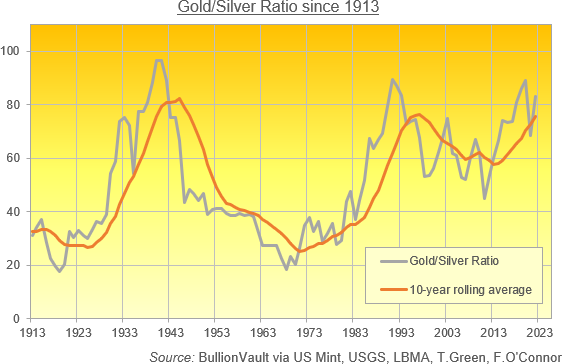

Relative valuations: The worth ratio between gold and silver (typically expressed because the gold-silver ratio) can fluctuate considerably. A excessive gold-silver ratio means that gold is comparatively dearer than silver, probably presenting a sexy shopping for alternative for silver.

The Gold-Silver Ratio: A Key Indicator

The gold-silver ratio is a vital metric for buyers assessing the relative worth of those two treasured metals. It represents the variety of ounces of silver wanted to purchase one ounce of gold. Traditionally, this ratio has fluctuated significantly, starting from lows of round 16 to highs exceeding 100. Analyzing historic tendencies within the gold-silver ratio can present worthwhile insights into potential funding alternatives. A excessive ratio might sign that silver is undervalued relative to gold, whereas a low ratio might point out the other.

Future Prospects: Predicting the Gold vs. Silver Value Chart in India

Predicting future value actions for gold and silver is inherently difficult, given the complexity of influencing elements. Nonetheless, a number of elements might form the long run gold vs. silver value chart in India:

-

International financial outlook: International financial progress, inflation charges, and rate of interest insurance policies will considerably affect demand for each metals. A interval of sustained inflation may enhance demand for each gold and silver as inflation hedges.

-

Geopolitical dangers: Geopolitical instability and uncertainty typically result in elevated demand for safe-haven belongings like gold and silver.

-

Technological developments: Technological developments impacting industrial demand for silver, notably in renewable power and electronics, will affect its value trajectory.

-

Authorities insurance policies: Modifications in import duties, taxes, and laws in India will affect home costs.

-

Sustainable investing tendencies: Rising curiosity in sustainable and accountable investments might affect the demand for ethically sourced gold and silver.

Conclusion:

The gold vs. silver value chart for India displays a fancy interaction of world and home elements. Whereas each metals typically transfer in tandem, their correlation is not at all times excellent. Understanding the historic tendencies, influencing elements, and potential future eventualities is essential for buyers and customers alike. Analyzing the gold-silver ratio, monitoring macroeconomic indicators, and conserving abreast of geopolitical developments are key to navigating the dynamic world of treasured steel investments in India. It is important to keep in mind that investing in treasured metals carries inherent dangers, and diversification is essential for a strong funding technique. Seek the advice of with a monetary advisor earlier than making any funding selections.

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

.png)

Closure

Thus, we hope this text has offered worthwhile insights into gold vs silver value chart india. We hope you discover this text informative and useful. See you in our subsequent article!